The @FT is kicking off its #RunawayMarkets series today. We'll be examining the frothy conditions in many corners of the global financial market. I'll be rounding-up the stories in this thread, or you can follow along at http://ft.com/runawaymarkets (1/x)

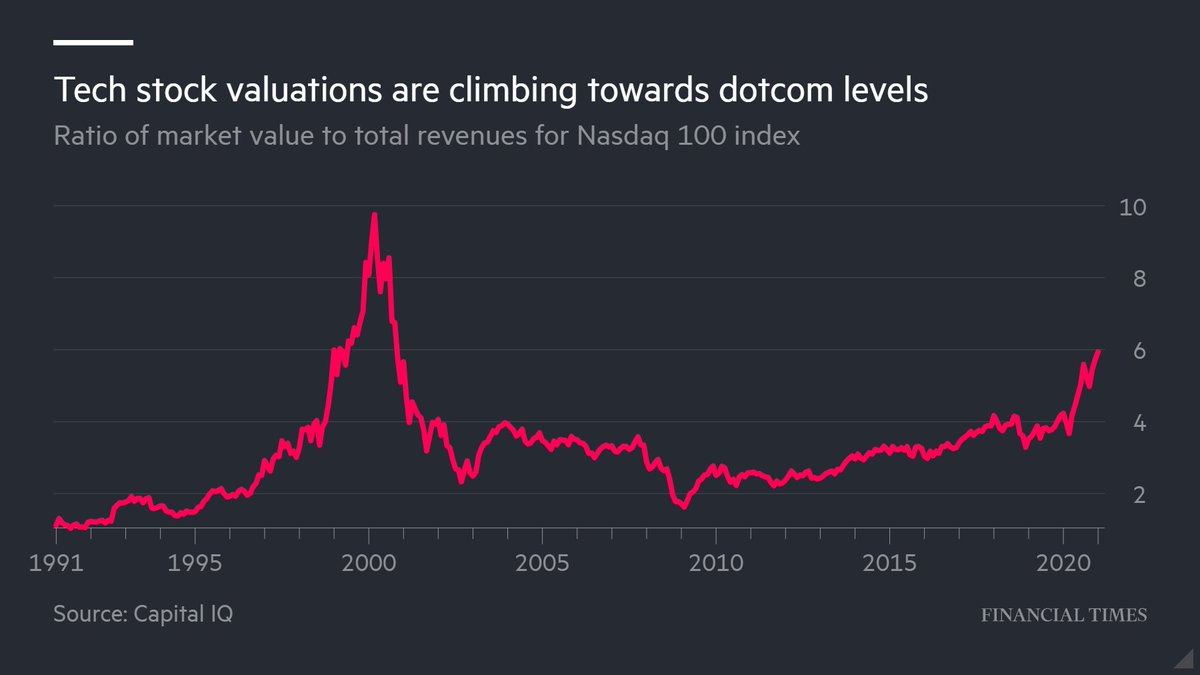

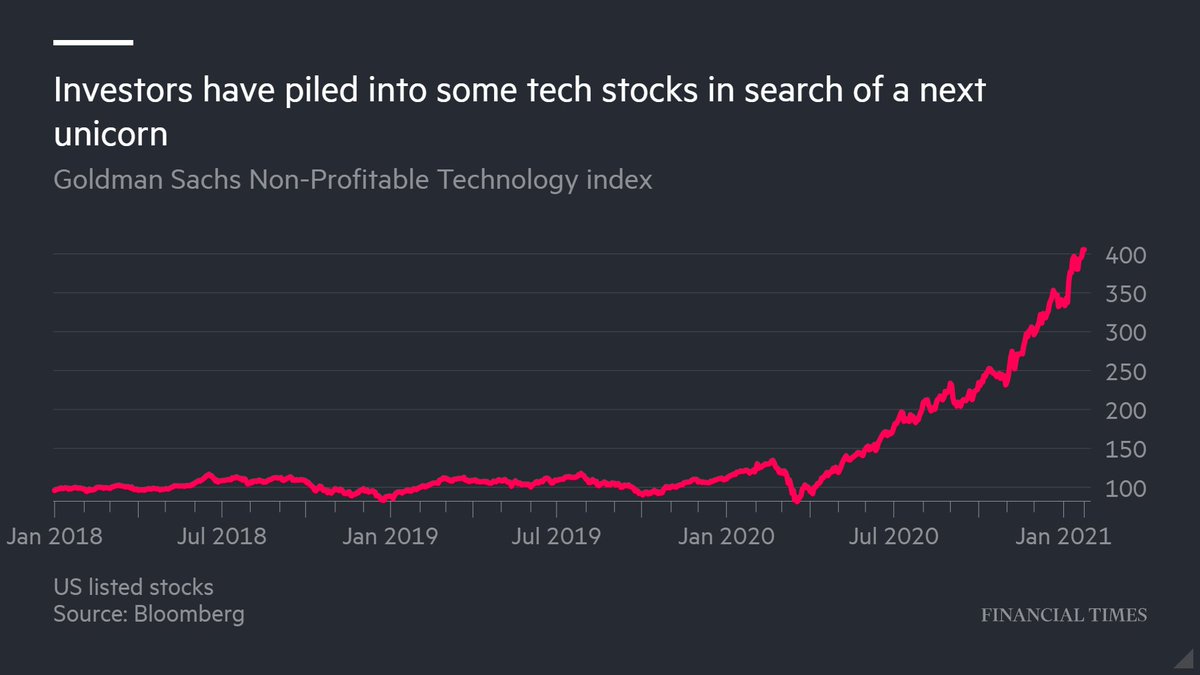

First up is @katie_martin_fx, with a look at how some veteran fund managers are growing increasingly anxious over the prospect of a stock market 'bubble'. (h/t to @iankmsmith for the cool chart). https://www.ft.com/content/a790c796-f0c4-4cf9-8c7a-3b52daff89e4 (2/x)

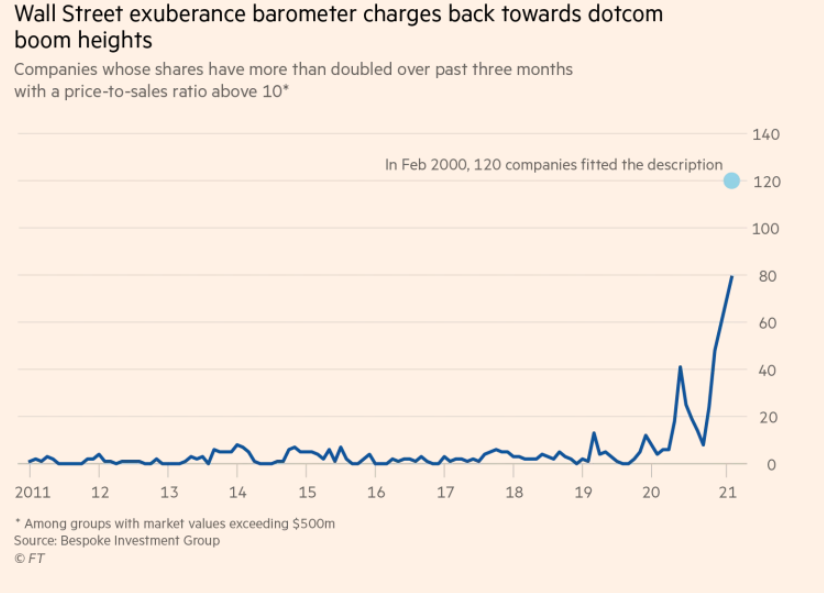

A measure of Wall St exuberance called the 'ludicrous index' has shot up towards dotcom era heights, @EricGPlatt reports. Goldman notes one of the q's it is getting from clients is whether US stocks are trading in “bubble” territory. https://www.ft.com/content/856c7e84-dd8b-4b6b-8e39-21826ebc15b6 #RunawayMarkets (3/x)

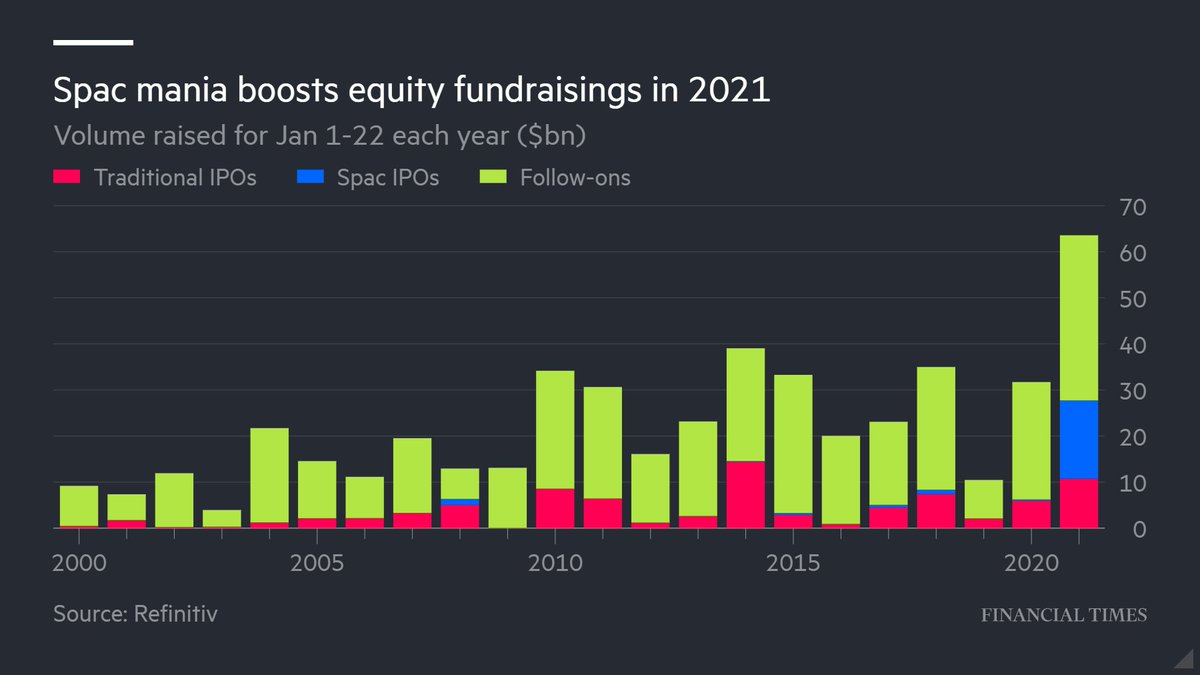

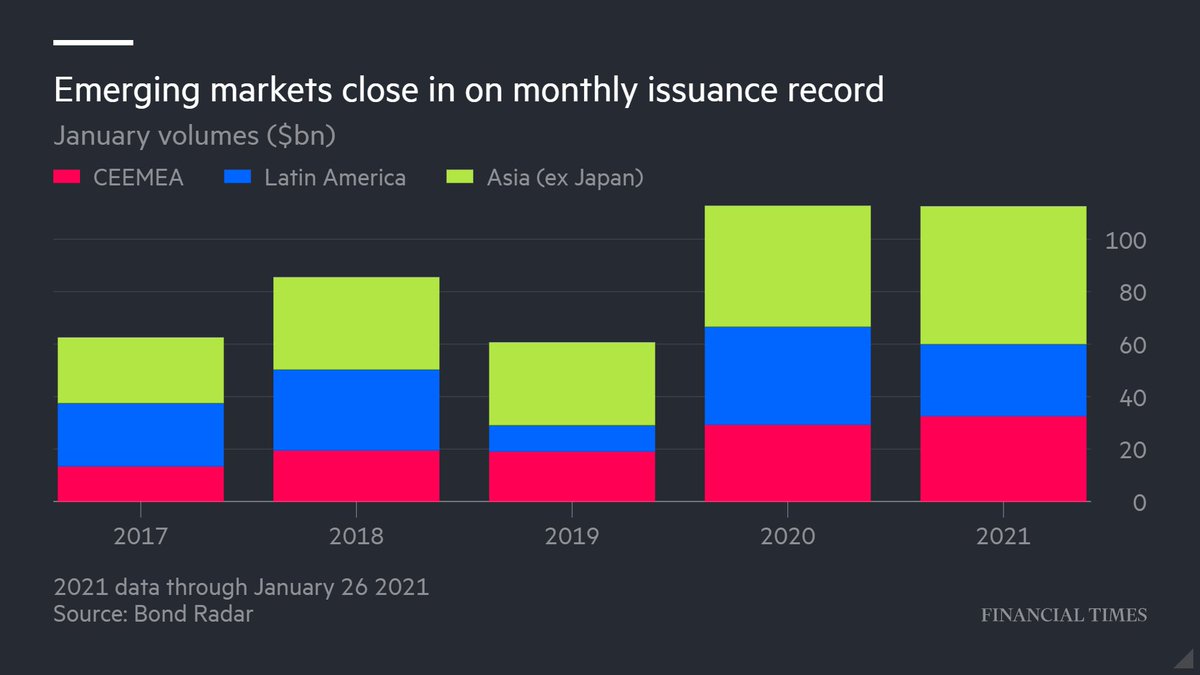

Companies have raised $400bn in a blistering start to 2021. “The only thing that matters is global fiscal and monetary policy ... Markets are priced as though coronavirus doesn’t matter any more.” https://www.ft.com/content/45770ddb-29e0-41c2-a97a-60ce13810ff2 @nikasgari @staffordphilip @JARennison @KangHexin (4/x)

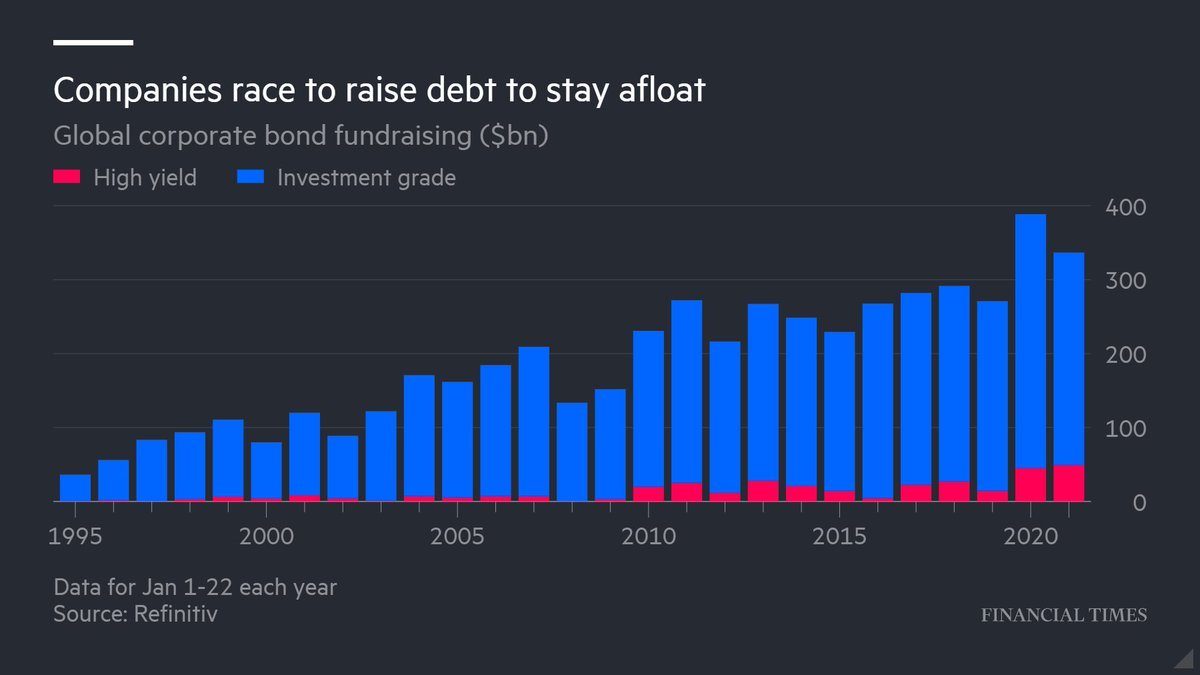

Debt issuance is also off to a brisk start, particularly junk bonds which are being sold at the quickest pace on records going back to the mid-1990s (red columns in the chart below) -> (6/x)

. @biancoresearch argues in @ftopinion that there are "unmistakable" signs retail investors are beginning to chase individual stocks -- especially groups that have yet to make any profits. https://www.ft.com/content/2833bb81-10f1-4869-8648-02ffb68b2f99 (7/x)

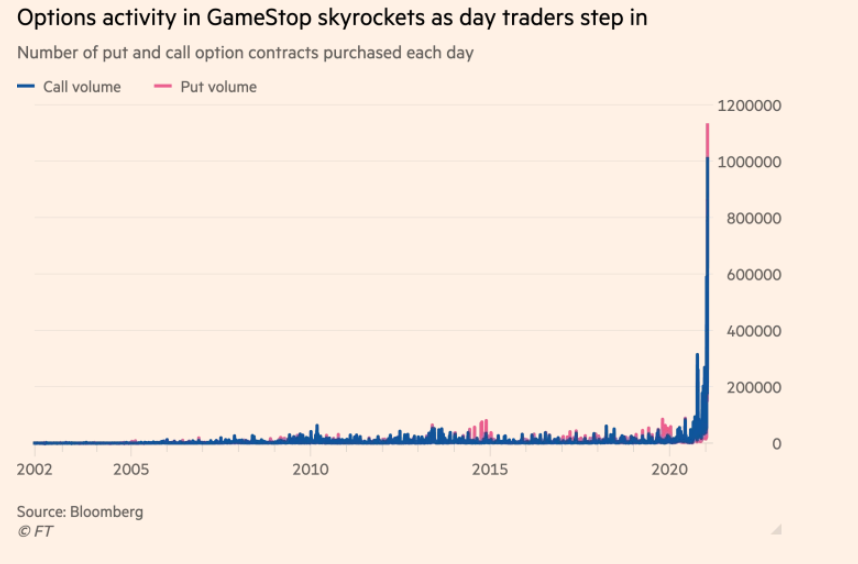

Reddit traders wage battle against Wall Street: An army of amateur traders has launched a siege that has shaken up markets and left seasoned hedge funds reeling.

https://www.ft.com/content/56e8b33a-d9b6-4f74-998b-327ef54c4d5a @EricGPlatt

@colbyLsmith

(8/x)

https://www.ft.com/content/56e8b33a-d9b6-4f74-998b-327ef54c4d5a @EricGPlatt

@colbyLsmith

(8/x)

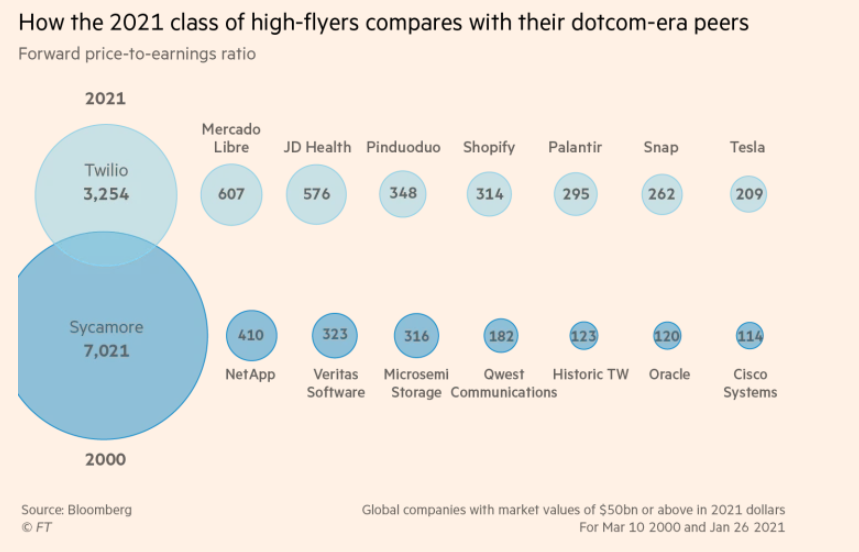

The rising number of companies trading at sky-high valuations has divided Wall St between those warning of a 'bubble' and others who say traditional metrics just don't work anymore in the 'new economy' (and partic. b/c of low rates). https://www.ft.com/content/0158a15b-52e7-4270-9ab3-4f6934b931c3 @journofletcher (9/x)

This quote reminded me of the 'eyeballs' of the dotcom era:

“The best companies right now are investing in human capital ... This investment is conventionally treated as cost, but in reality, they are getting exceptional returns on these investments" (10/x)

“The best companies right now are investing in human capital ... This investment is conventionally treated as cost, but in reality, they are getting exceptional returns on these investments" (10/x)

Speaking of the dotcom boom, @AliceKantor put together this cool chart comparing the p/e ratios of high-fliers now with those when the bubble peaked in 2000. (11/x)

Robert Buckland at Citi writes in @ftopinion that bubbles 'don’t burst on the first hint of tightening from central banks. Instead, they are runaway trains that misallocate capital, distort the asset management industry and end investment careers'.

https://www.ft.com/content/329a50d0-399b-4b69-847a-01aee41960e8 (12/x)

https://www.ft.com/content/329a50d0-399b-4b69-847a-01aee41960e8 (12/x)

GameStop ($GME) has embarked on a dizzying rally in recent days. @RobinWigg digs into how day traders have 'weaponised' options trading and are causing big fluctuations in stock prices. https://www.ft.com/content/ae1ecff4-9019-4a2a-97ea-55a3cd15c36a (13/x)

Emerging market borrowers are tapping debt markets at what will likely be a record monthly pace as cash-strapped governments seek to plug holes in their public finances while the going is good. https://www.ft.com/content/1a7e3490-be2d-4630-8999-59316db02b22 @colbyLsmith @TomStub (14/x)

. @katie_martin_fx writes for @ftopinion on how the new class of day traders has become a 'destabilising force in global markets' as they lever up their power with options trading and organise on Reddit. https://www.ft.com/content/bcfb2252-f752-4177-a860-07dc66b0b9e8 (15/x)

Read on Twitter

Read on Twitter