Key takeaways from 'The Future of TV Report' by $TTD

2 surveys conducted:

a) Advertiser study: ~150 marketers (agencies & brand direct advertisers) w/ Advertiser Perceptions

b) Consumer study: ~2000 adult 18+ TV viewers w/ YouGov

My thoughts on overall AdTech at the end

2 surveys conducted:

a) Advertiser study: ~150 marketers (agencies & brand direct advertisers) w/ Advertiser Perceptions

b) Consumer study: ~2000 adult 18+ TV viewers w/ YouGov

My thoughts on overall AdTech at the end

Start of 2021

- 78MM cable TV households

- 84MM connected TV households

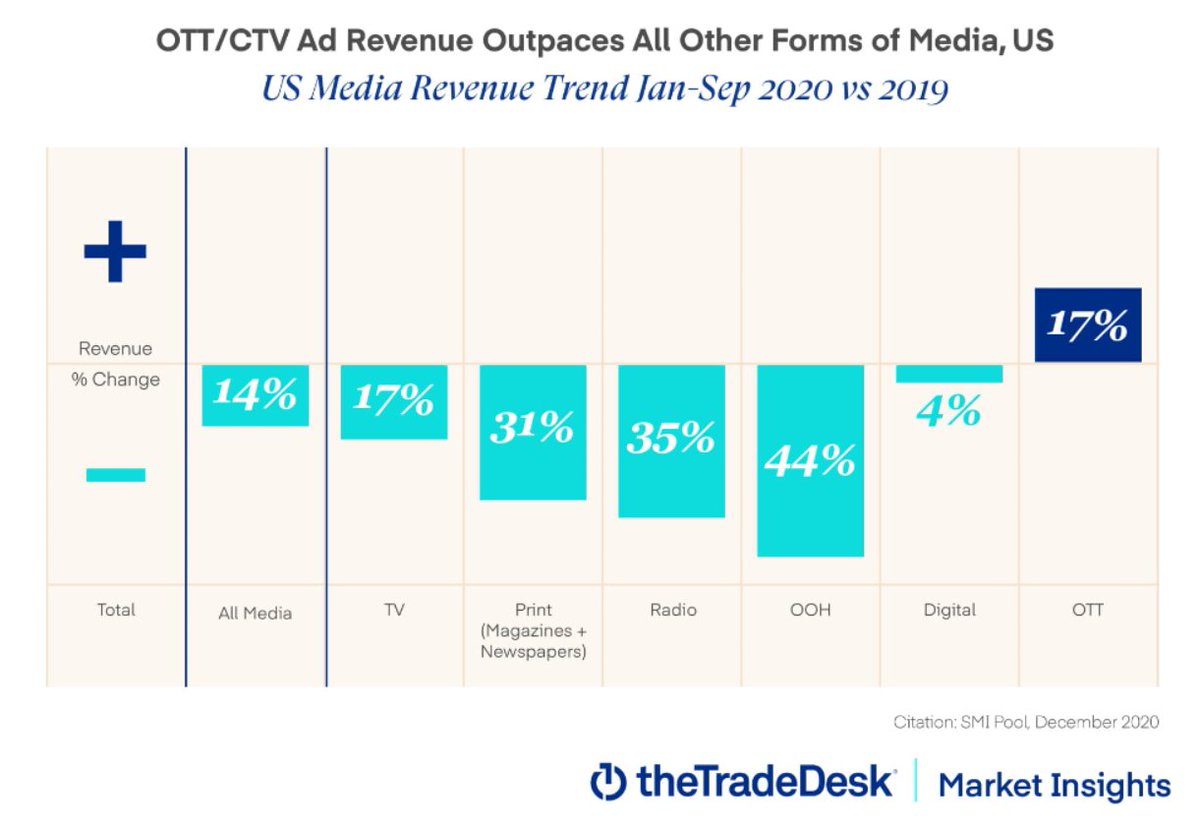

Overall ad revenues down 14% for Q1-Q3 2020, CTV revenues up 17% for the same period

- 78MM cable TV households

- 84MM connected TV households

Overall ad revenues down 14% for Q1-Q3 2020, CTV revenues up 17% for the same period

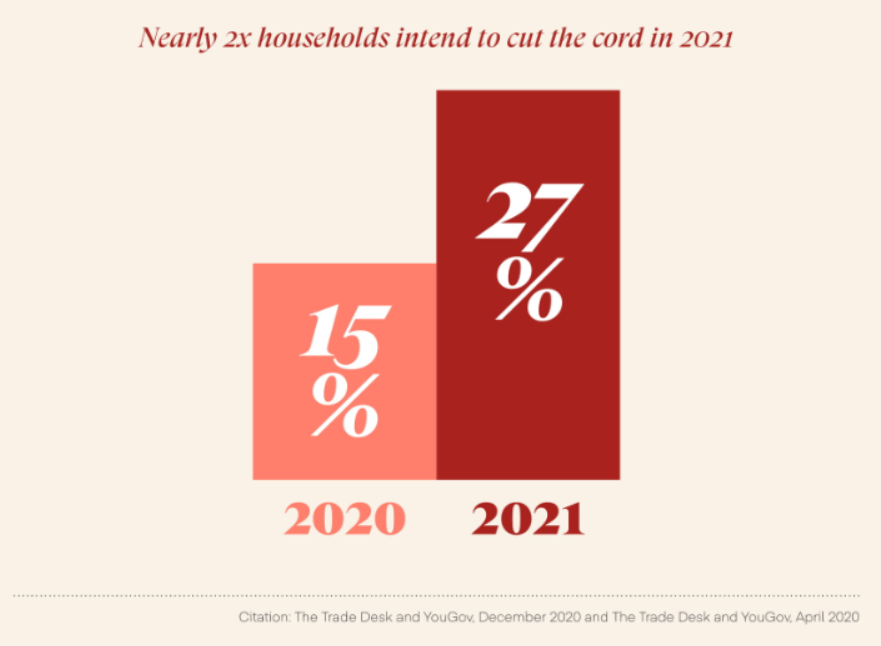

- No. of consumers intending to move from cable TV to CTV in 2021 is going to be approx. 27%, up from 15% in 2020

- 38% of respondents said they were attracted to streaming services because of the better viewing experience

- 38% of respondents said they were attracted to streaming services because of the better viewing experience

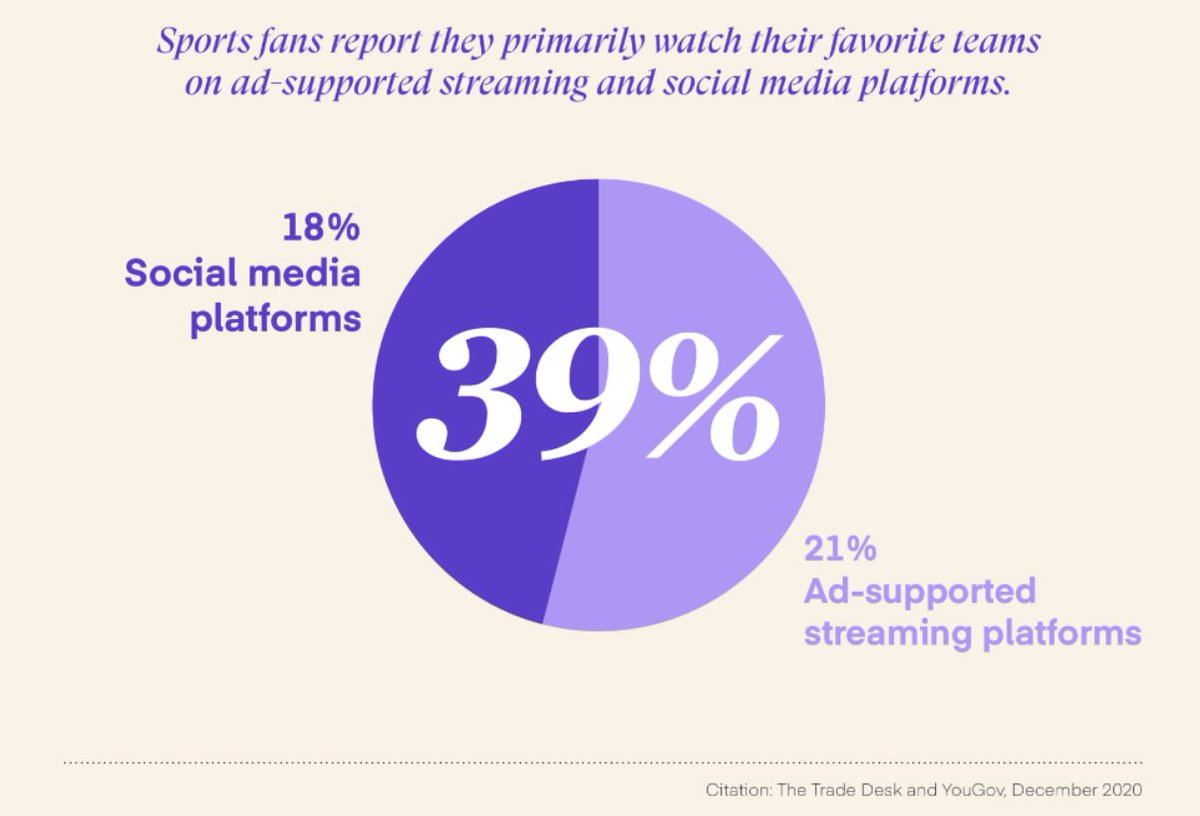

A major driver of shifting attitudes for advertisers and consumers is the evolving perspective on live sports.

Due to pandemic when live sports was halted, ~39% of the sports viewers watch sports via ad-supported streaming platforms like Hulu, Fubo or social media like Youtube

Due to pandemic when live sports was halted, ~39% of the sports viewers watch sports via ad-supported streaming platforms like Hulu, Fubo or social media like Youtube

- Only 14% of TV viewers were willing to pay a premium for an ad-free experience

- 72% opted for free (32%) or lower cost ad-supported model (40%)

We can see where the consumer is going, ad dollars are starting to follow

- 72% opted for free (32%) or lower cost ad-supported model (40%)

We can see where the consumer is going, ad dollars are starting to follow

Agency and Brand TV buyers

- 60% are making fewer upfront commitments in 2021.

- 43% responded with CTV as the #1 channel for brand storytelling

- 89% report CTV is more (or just as) effective than linear TV

Buyers need flexibility, precision & attribution

- 60% are making fewer upfront commitments in 2021.

- 43% responded with CTV as the #1 channel for brand storytelling

- 89% report CTV is more (or just as) effective than linear TV

Buyers need flexibility, precision & attribution

My Thoughts

This report reinforced my conviction in companies that are benefitting from this trend.

The biggest beneficiaries are $ROKU $TTD and $MGNI given they have a strong CTV offering both on the demand and the supply side.

Own: $ROKU $TTD

Watchlist: $MGNI

This report reinforced my conviction in companies that are benefitting from this trend.

The biggest beneficiaries are $ROKU $TTD and $MGNI given they have a strong CTV offering both on the demand and the supply side.

Own: $ROKU $TTD

Watchlist: $MGNI

Some other thoughts on companies like $ACUIF and $ADCOF

I've looked into these companies and though they look compelling to own because of the space they're in, they're not for me because I like to invest in leaders, and they are nowhere close yet. I don't have any clarity ...

I've looked into these companies and though they look compelling to own because of the space they're in, they're not for me because I like to invest in leaders, and they are nowhere close yet. I don't have any clarity ...

... of them being the main beneficiaries of the shift to CTV and hence I'm not investing in them, though I'll keep a close eye on how they execute in the next few quarters.

On $PUBM vs. $MGNI

I think $PUBM is also going to be a beneficiary of the CTV shift, but Magnite is the bigger (better) player here while PubMatic is catching up. We still don't have enough data for $PUBM as a public company, so I'll be keeping a close eye on how they show up.

I think $PUBM is also going to be a beneficiary of the CTV shift, but Magnite is the bigger (better) player here while PubMatic is catching up. We still don't have enough data for $PUBM as a public company, so I'll be keeping a close eye on how they show up.

There's one name that hasn't still caught any attention on FinTwit is Viant Technologies $DSP

They dropped their S1 last week.

Revenue growth -4%, but 75% CTV growth (YoY Q1-Q3 2020).

I don't invest in IPO's, but this one is worth keeping a tab

(end)

They dropped their S1 last week.

Revenue growth -4%, but 75% CTV growth (YoY Q1-Q3 2020).

I don't invest in IPO's, but this one is worth keeping a tab

(end)

Read on Twitter

Read on Twitter