1- $GBTC premium is not good or bad, it just is. If you think the premium is bad, but want easy #bitcoin  exposure in your IRA, it is oldest and most liquid play. The premium exists because it is a closed end fund and the only redemption is for Private Placement holders to sell

exposure in your IRA, it is oldest and most liquid play. The premium exists because it is a closed end fund and the only redemption is for Private Placement holders to sell

exposure in your IRA, it is oldest and most liquid play. The premium exists because it is a closed end fund and the only redemption is for Private Placement holders to sell

exposure in your IRA, it is oldest and most liquid play. The premium exists because it is a closed end fund and the only redemption is for Private Placement holders to sell

1a- I was an accredited investor with for $GBTC, but now only hold because the premium was arbitraged away. @BarrySilbert @Ray_scale @keeganrt https://medium.com/@keegan.toci/gbtc-arbitraging-regulators-and-retail-investors-since-2015-3740c323e35f

2- the shares, after the 6 month lockup, on the open market. Stock to Flow works for stocks similar to commodities. While this term is typically not used, stock buy backs(decrease outstanding supply, price up) and additional offerings (raise cash, increase supply, price down)

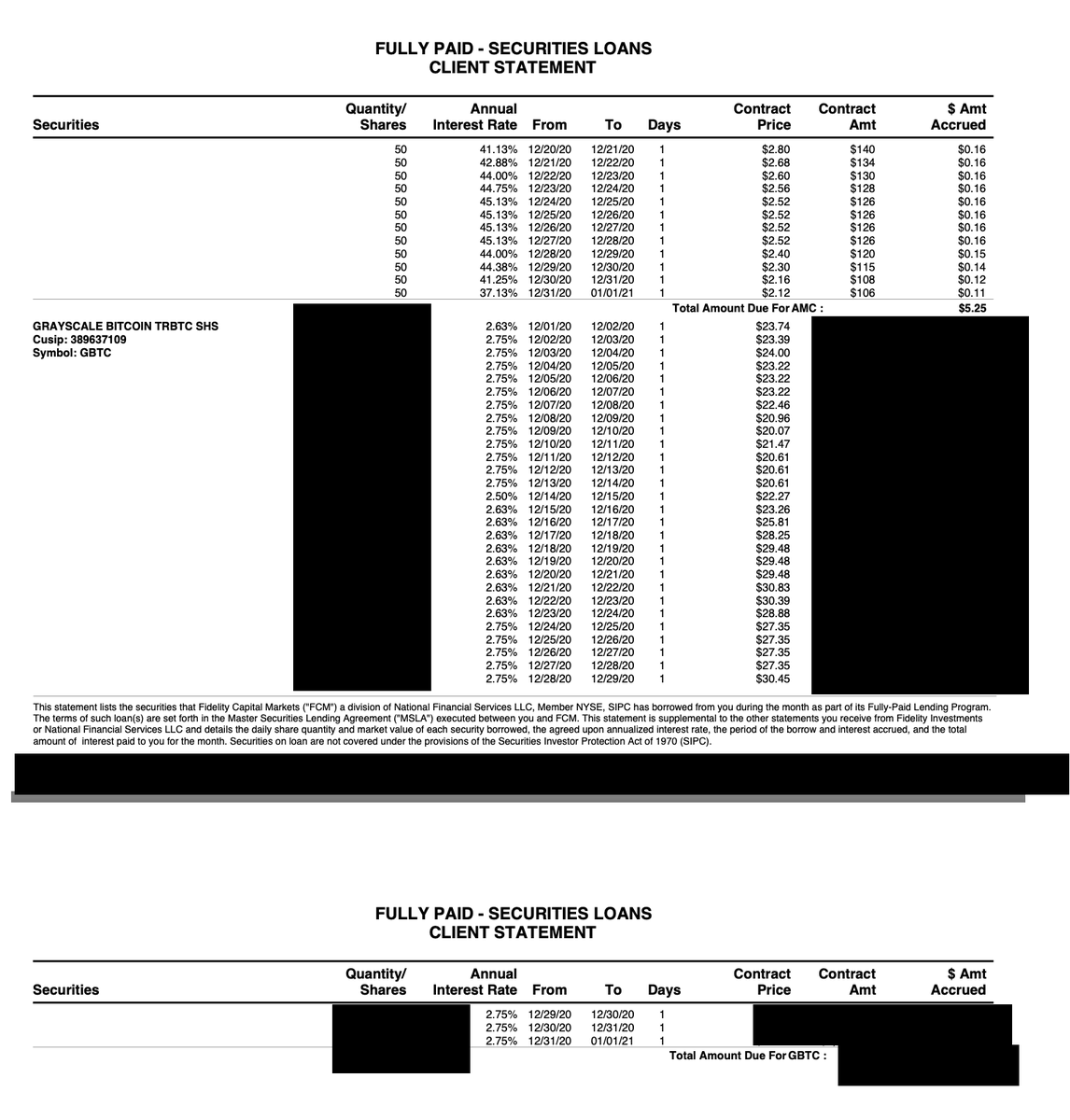

3- is simple supply and demand. Stock splits and Reverse stock splits do not change the outstanding supply. However, a stock split tends to create a positive herd mentality, and price tends to rise in many cases.

4-$GBTC net new shares(after the 6 month holding period) would tend to drive the price and premium of GBTC down. It is important to note that the shares take a couple days to go from Grayscale's custodian to your custodian (DTCC eligible) for you to trade.

5- I manually made these charts sourcing the information from @Grayscale(newly created shares, offset by six months), @DigitalAssets (lending rate) and @Gemini (Bitcoin 4pm price) and @ycharts for premium.

6-To do the arbitrage (carry trade) hedge funds short GBTC and go long spot Bitcoin. Since they don't own GBTC they need to borrow shares. Fidelity, Etrade allow you to re-hypothecate your shares and you split loaned interest with the brokerage house. https://www.fidelity.com/trading/fully-paid-lending

7-Currently, Fidelity is paying 2.75% on GBTC. This rate can vary daily, and it is fixed Friday through Sunday. Blank spots in the chart are when my shares were not loaned. Premium is not calculated on the weekends.

8- The loaned rate(green line) has dropped because the amount of available shares has increased. The premium(purple line)

has dropped because the amount of available shares has increased. The premium(purple line) has bounced around, but is decreasing. But what about price(orange)? see below.

has bounced around, but is decreasing. But what about price(orange)? see below.

has dropped because the amount of available shares has increased. The premium(purple line)

has dropped because the amount of available shares has increased. The premium(purple line) has bounced around, but is decreasing. But what about price(orange)? see below.

has bounced around, but is decreasing. But what about price(orange)? see below.

9-TL;DR - In summary, GBTC goes up with Bitcoin, and the premium will bounce around. The lending rate will probably go away. 3 Arrows has no incentive to dump GBTC at a loss because any rational person would buy GBTC at discount to NAV and Bitcoin. https://twitter.com/CoinDesk/status/1271093604241608706?s=20

10- The wildcard. The reddit/TikTok generation decides to run up GBTC. GBTC trades at half the % to 200DMA as $TSLA (667%, $800B market cap) and $GBTC (328%, $22B Market cap) has plenty of room to run.

11- These people have commented a lot about $GBTC premium. @EricBalchunas @JSeyff @gaborgurbacs @JoshKernan @CarpeNoctom @GoingParabolic @std_dev @harfangcap @GrayscaleTrust @PrincipiaTradin @Max_Colbert @brett_colbert @VetteVector @ejazc @ShardiB2 @maxxrpbtc @lopp @hansthered

12- GBTC will continue to trade at a premium and this is my prediction.

@ChartsBtc @ecoinometrics @michaelsaylor @stephenLweiss @CaitlinLong_ https://twitter.com/Z06Z07/status/1347702290610749440?s=20

@ChartsBtc @ecoinometrics @michaelsaylor @stephenLweiss @CaitlinLong_ https://twitter.com/Z06Z07/status/1347702290610749440?s=20

@ChartsBtc @ecoinometrics @michaelsaylor @stephenLweiss @CaitlinLong_ https://twitter.com/Z06Z07/status/1347702290610749440?s=20

@ChartsBtc @ecoinometrics @michaelsaylor @stephenLweiss @CaitlinLong_ https://twitter.com/Z06Z07/status/1347702290610749440?s=20

Read on Twitter

Read on Twitter