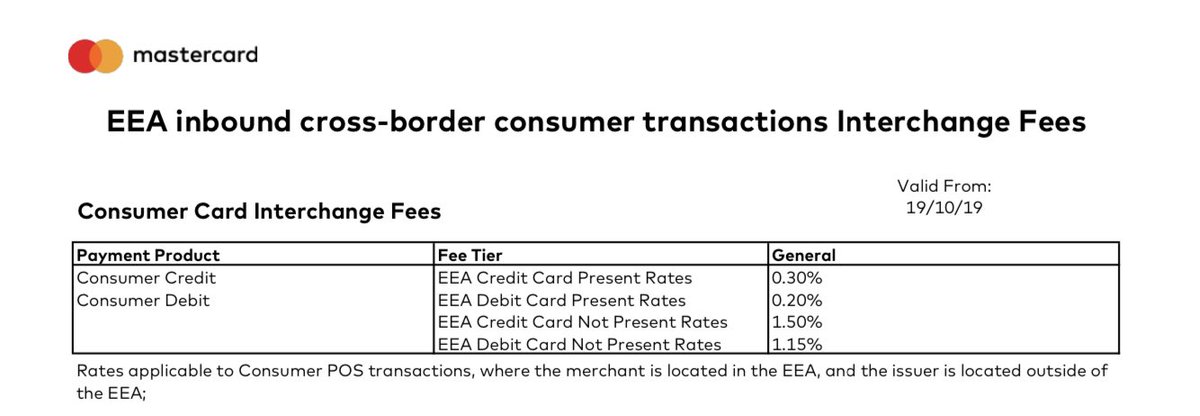

Mastercard is raising its fees on EU purchases made by holders of UK credit cards from 0.3% to 1.5%.

Another Brexit dividend, because we no longer fall under the EU-wide Interchange Fee Regulation that used to cap the fee at 0.3%. https://on.ft.com/2KIM3rE

Another Brexit dividend, because we no longer fall under the EU-wide Interchange Fee Regulation that used to cap the fee at 0.3%. https://on.ft.com/2KIM3rE

The amazing thing is, we have the EU to thank for it rising only to 1.5%, because they negotiated a lower cap for non-EU credit cards used in the EU.

Without that EU-brokered cap (which lasts 5 years and 6 months) we would face paying even more again. https://ec.europa.eu/commission/presscorner/detail/en/IP_19_2311

Without that EU-brokered cap (which lasts 5 years and 6 months) we would face paying even more again. https://ec.europa.eu/commission/presscorner/detail/en/IP_19_2311

It's a known Brexit issue that was explicitly acknowledged by the UK Government in November 2018 when it set out the new law "Interchange Fee (Amendment) (EU Exit) Regulations 2018"

They talk about it in the notes accompanying the statutory instrument. https://www.gov.uk/government/publications/draft-interchange-fee-amendment-eu-exit-regulations-2018/interchange-fee-amendment-eu-exit-regulations-2018-explanatory-information

They talk about it in the notes accompanying the statutory instrument. https://www.gov.uk/government/publications/draft-interchange-fee-amendment-eu-exit-regulations-2018/interchange-fee-amendment-eu-exit-regulations-2018-explanatory-information

So it's:

- an issue that's been anticipated for over 2 years

- clearly and explicitly Brexit-related

- openly acknowledged by the UK government

- not something imposed by the EU

Treat all current news stories accordingly. The only "new" aspect is the actual fee rise.

- an issue that's been anticipated for over 2 years

- clearly and explicitly Brexit-related

- openly acknowledged by the UK government

- not something imposed by the EU

Treat all current news stories accordingly. The only "new" aspect is the actual fee rise.

It's also worth noting that Mastercard haven't invented a specific fee schedule for the UK.

They've simply applied to the UK their existing EEA inbound cross-border fee, which was last updated in 2019, and which applies to all non-EEA countries (ie us).

https://www.mastercard.co.uk/en-gb/vision/terms-of-use/Interchange/European-interchange-country-rates.html

They've simply applied to the UK their existing EEA inbound cross-border fee, which was last updated in 2019, and which applies to all non-EEA countries (ie us).

https://www.mastercard.co.uk/en-gb/vision/terms-of-use/Interchange/European-interchange-country-rates.html

How much money are we talking about?

Credit card figures are hard to come by.

People spend about £3 billion a month overseas on UK debit cards (not necessarily all EU) and the fee's rising from 0.2% to 1.15%. So up to £28.4 million a month in extra fees!

https://www.ukfinance.org.uk/sites/default/files/uploads/Data%20(XLS%20and%20PDF)/Card-Spending-Update-October-2020-final.pdf

Credit card figures are hard to come by.

People spend about £3 billion a month overseas on UK debit cards (not necessarily all EU) and the fee's rising from 0.2% to 1.15%. So up to £28.4 million a month in extra fees!

https://www.ukfinance.org.uk/sites/default/files/uploads/Data%20(XLS%20and%20PDF)/Card-Spending-Update-October-2020-final.pdf

Read on Twitter

Read on Twitter