Thread

I'm going to go through a few things, I've learned about rare earths and how I plan to play them as a result.

I've changed my views and positioning significantly since writing https://traderferg.com/rare-opportunity/ in September last year.

I'll refer to rare earth elements as REEs

I'm going to go through a few things, I've learned about rare earths and how I plan to play them as a result.

I've changed my views and positioning significantly since writing https://traderferg.com/rare-opportunity/ in September last year.

I'll refer to rare earth elements as REEs

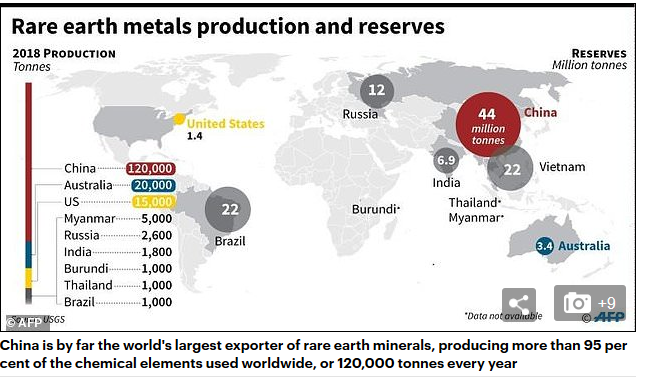

REEs are a China story

China mines >70% of REEs

China refines >80% of worlds mixed oxides

China separates >90% of worlds elemental oxides

China produces or controls 100% of new REE base metals where 95% of the value is

Chinese base material is dirt cheap & highly subsidized

China mines >70% of REEs

China refines >80% of worlds mixed oxides

China separates >90% of worlds elemental oxides

China produces or controls 100% of new REE base metals where 95% of the value is

Chinese base material is dirt cheap & highly subsidized

Take Baotou's monster Bayan Obo mine produces iron ore & REE base material as a by-product

It produces 73,000tonnes vs 132,000tonnes total

Any company mining REEs directly are at a huge disadvantage to this byproduct

But this isn't even the stage which the Chinese monopolize

It produces 73,000tonnes vs 132,000tonnes total

Any company mining REEs directly are at a huge disadvantage to this byproduct

But this isn't even the stage which the Chinese monopolize

The production of new REE based metals is so heavily subsidized it's near impossible to compete with on economic terms

An example of this is the value add component

Iron ore to steel value add is ~400%

Some of the high-value REEs value add is 10% !!(below even the energy cost)

An example of this is the value add component

Iron ore to steel value add is ~400%

Some of the high-value REEs value add is 10% !!(below even the energy cost)

Now consider international REE companies disadvantages

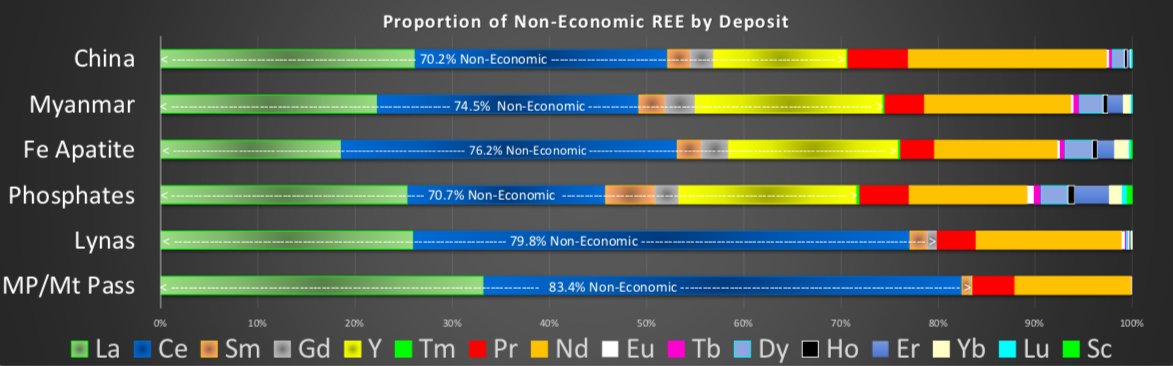

Radioactive material is highly regulated in western countries so $MP & $LYC.ax target low actinide deposits to avoid this issue

The problem is REE economics is a function of geochemistry & low actinide has poor mix of REEs

Radioactive material is highly regulated in western countries so $MP & $LYC.ax target low actinide deposits to avoid this issue

The problem is REE economics is a function of geochemistry & low actinide has poor mix of REEs

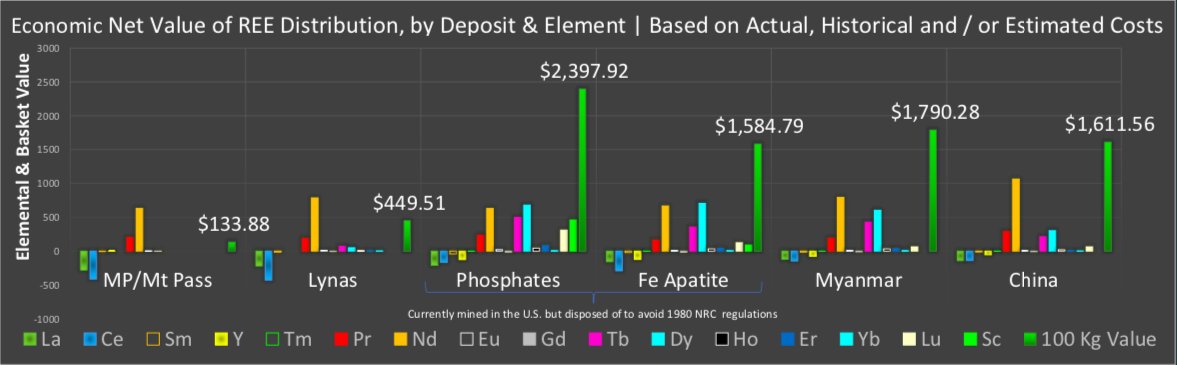

What does poor geochemistry mean?

There are 17 REEs

7 of them fetch above $1000/kg

The likes of Cerium & Lanthanum fetch a few $ a kg

So the REE mix of the deposit really matters for a mines economics

This is where $MP & $LYC.ax run into trouble

Chart source: James Kennedy

There are 17 REEs

7 of them fetch above $1000/kg

The likes of Cerium & Lanthanum fetch a few $ a kg

So the REE mix of the deposit really matters for a mines economics

This is where $MP & $LYC.ax run into trouble

Chart source: James Kennedy

Issues with $MP & $LYC.ax

-Both have too much cerium & lanthanum

-Lack Terbium & dysprosium (critical for military magnets)

-$MP only has 10% of the comparative economic value of China REEs while $LYC.ax is 30%

They are wildly uneconomic vs China

Chart source: James Kennedy

-Both have too much cerium & lanthanum

-Lack Terbium & dysprosium (critical for military magnets)

-$MP only has 10% of the comparative economic value of China REEs while $LYC.ax is 30%

They are wildly uneconomic vs China

Chart source: James Kennedy

Investment implications?

I'm obviously not a fan of $MP or $LYC.ax for long term success

I've decided to scale out of http://GGG.ax due to there being no plan for the thorium by-product & questions over the scalability of extraction https://www.rcinet.ca/eye-on-the-arctic/2021/01/08/canadian-geologist-raises-questions-about-controversial-greenland-mining-project/

I'm obviously not a fan of $MP or $LYC.ax for long term success

I've decided to scale out of http://GGG.ax due to there being no plan for the thorium by-product & questions over the scalability of extraction https://www.rcinet.ca/eye-on-the-arctic/2021/01/08/canadian-geologist-raises-questions-about-controversial-greenland-mining-project/

How do I plan to maintain exposure to REE theme?

Via one company $UUUU as I believe it is the only one to stand a real chance of being competitive against China.

$UUUU overcomes many of the issues outlined above and is also a first mover in #uranium

Via one company $UUUU as I believe it is the only one to stand a real chance of being competitive against China.

$UUUU overcomes many of the issues outlined above and is also a first mover in #uranium

$UUUU is now processing monazite which has very good geochemistry (refer to previous charts as monazite= phosphates)

Better yet monazite is a by-product of chemical plants so will be very cheap (similar to China)

$UUUU has permits to process thorium

https://www.mining-technology.com/news/energy-fuels-rare-earths-processing/

Better yet monazite is a by-product of chemical plants so will be very cheap (similar to China)

$UUUU has permits to process thorium

https://www.mining-technology.com/news/energy-fuels-rare-earths-processing/

So add these all together and you have quite something

-Great geochemistry (mix of high $ REEs)

-Access to low-cost base material that don't need to mine

-White Mesa mill and all the permits to process the REEs and dispose of thorium which is near impossible to get otherwise

-Great geochemistry (mix of high $ REEs)

-Access to low-cost base material that don't need to mine

-White Mesa mill and all the permits to process the REEs and dispose of thorium which is near impossible to get otherwise

Opportunity to create a complete REE chain outside of China with partnering with. http://NEO.to to provide REEs to Silment plant in Estonia.

US government will surely understand the strategic value of this sooner rather than later and incentivize/subsidize the process.

US government will surely understand the strategic value of this sooner rather than later and incentivize/subsidize the process.

Takeaway

If $UUUU executes I see no reason why they can't trade at a similar or larger market cap than $MP or $LYC.ax and this is without valuing their #uranium assets.

I continue to add on weakness.

If $UUUU executes I see no reason why they can't trade at a similar or larger market cap than $MP or $LYC.ax and this is without valuing their #uranium assets.

I continue to add on weakness.

Read on Twitter

Read on Twitter