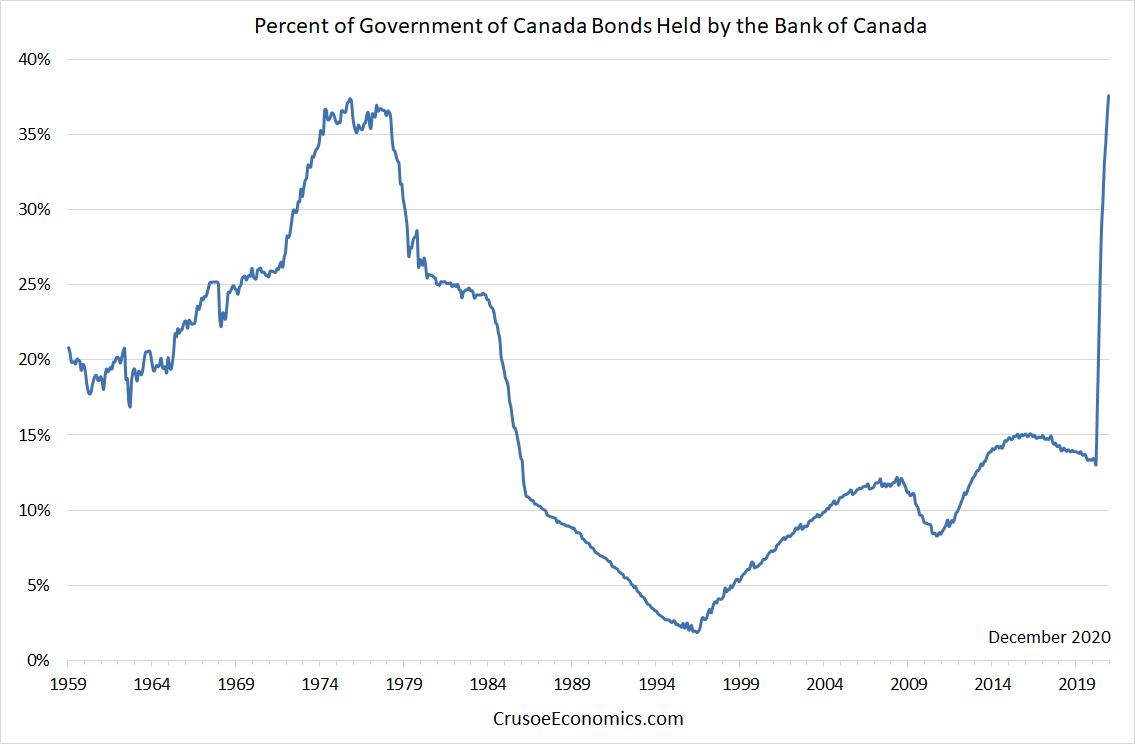

1/ How much potential QE is left in the barrel? The BoC seems to believe that they can own up to 50% of the bond market before it becomes impaired. Current ownership rate as of December is ~37%

2/ Given current GoC bonds outstanding, the BoC can theoretically purchase another $102B before they reach that threshold. If deficits for the coming year come in on the high side of projections, net bond issuance will be ~$167B (gross will be $263B to account for $96B maturing)

3/ This will allow for the BoC upper threshold to be approximately $186B ($102B+($167B/2)) in new QE for 2021. At a buying pace of $4B/week they would reach this threshold in ~46 weeks. So the BoC does have significant QE room left, to the extent you think 46 weeks is significant

4/ Keep in mind that this is just an approximate theoretical upper limit. The BoC doesn't have to hit their upper bound, and probably doesn't want to. If they don't consider it useful they could instead taper their buying further to push out the purchases over a longer time frame

Read on Twitter

Read on Twitter