Hashrate DeFi tokens, $BTCST & $pBTC35A have been fascinating to watch. There is a massive mispricing here.

pBTC35A represents 1TH of mining power vs BTCST is only 0.1TH of mining power. Holding all else equal pBTC35A should trade at 10x BTCST. Yet they are almost the same price.

pBTC35A also has a better value on a per hash basis. It has an all-in cost of $0.0477/TH/Day vs BTCST's of $0.0928/TH/Day

pBTC35A has an electricity fee of $0.0583/kWh, efficiency of 35W/T, and pool fee of 2.5% FPPS. While BTCST has an electricity fee of $0.058/kWh, efficiency of 60W/T, power usage efficiency loss of 3%, and an annual downtime of 10%.

By staking your BTCST you get Bitcoin, whereas by staking pBTC35A you get wBTC and MARS (their governance token).

pBTC35A utilizes Uniswap, a great way to bootstrap liquidity. In the first week of trading, it already reached $6mm+ in daily volume  @bit_kevin @qian9207

@bit_kevin @qian9207

@bit_kevin @qian9207

@bit_kevin @qian9207

BTCST took a different approach where the project team serves as the market maker.

Expecting pBTC35A to trade at ~12x of BTCST given hashrate output and better cost economics.

CC @dcarmitage

CC @dcarmitage

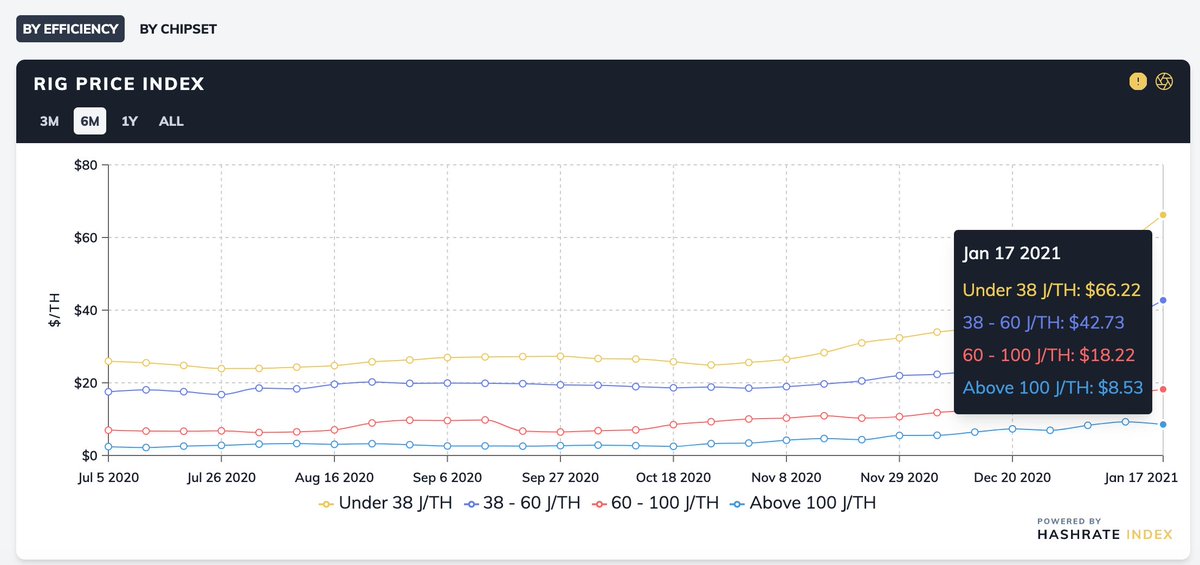

Also b/c these are bridges to the real world it's important to compare to ASIC prices. You can buy one TH of the latest-gen equipment for around $66/TH right now. Hashrate token markets should trade at a slight premium to ASICs given their liquidity

https://hashrateindex.com/machines/sha256-rig-index

https://hashrateindex.com/machines/sha256-rig-index

Read on Twitter

Read on Twitter