1. Let's compare EV refineries and why I think $QPM is seriously under valued when compared to some of its peers.

2. $NVX current market cap $981m Au. Current plant(Capex 20m) producing 2k TPA of synthetic graphite for revenue of $20mil. Future plant upgrades to 25k TPA with Capex around $300mil+

3. $TLG market cap $442mil.

Just raised 30mil to build a pilot plant(200 TPA) for natural graphite

Now TLG plans to build a 19k TPA plant($174mil us)selling its Talnode for $11k(EBITDA 147mil us) on one slide but on the other it says $2.5k($45mil.us similar to other nat spheric)

Just raised 30mil to build a pilot plant(200 TPA) for natural graphite

Now TLG plans to build a 19k TPA plant($174mil us)selling its Talnode for $11k(EBITDA 147mil us) on one slide but on the other it says $2.5k($45mil.us similar to other nat spheric)

4. $EGR current market cap $141mil planning to build a 20k TPA natural spherical plant for $70mil+ us with an EBITDA of $35mil us.

5. So out of these 3, $NVX is infront generating $20m and aiming to have an upgraded plant by 2022-2025. Next $EGR already has a pilot and and is looking for funding for its production plant. Lastly $TLG just starting to build pilot plant with production plant sometime in 2023/25

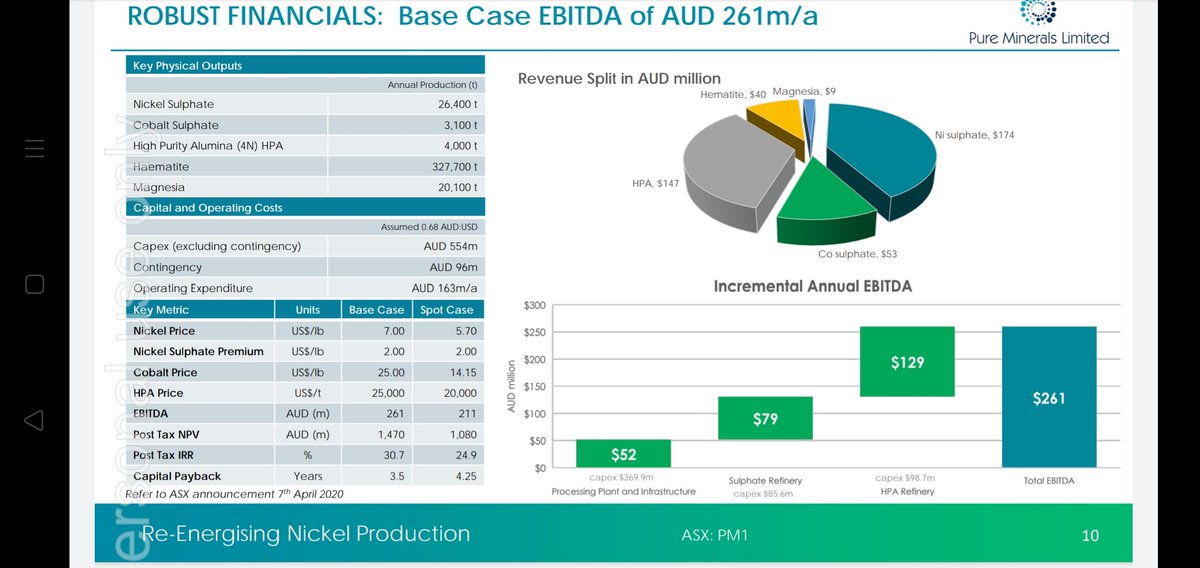

6. $QPM current market cap $60mil. Already has a pilot plant and production plant(Capex $554mil AU) and would only take 12months to build with EBITDA $261 mil AU

7. Keep in mind $QPM DNI refinery process in a cleaner alternative to traditional methods and similar in concept to NVX DPMG. The main difference is DNI has been piloted for the past 8/10yrs and is commercially viable and ready today

Read on Twitter

Read on Twitter