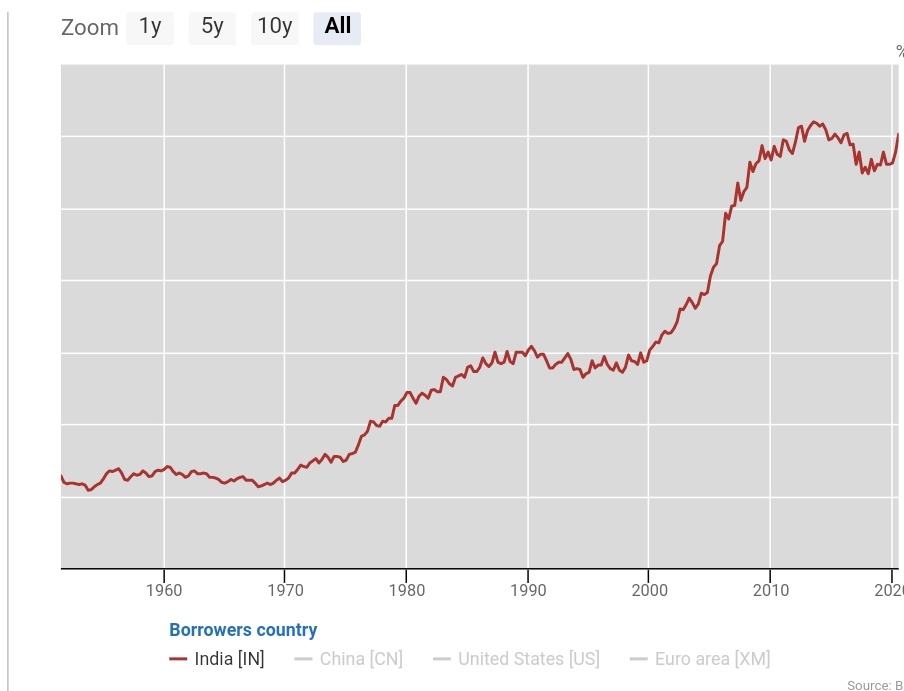

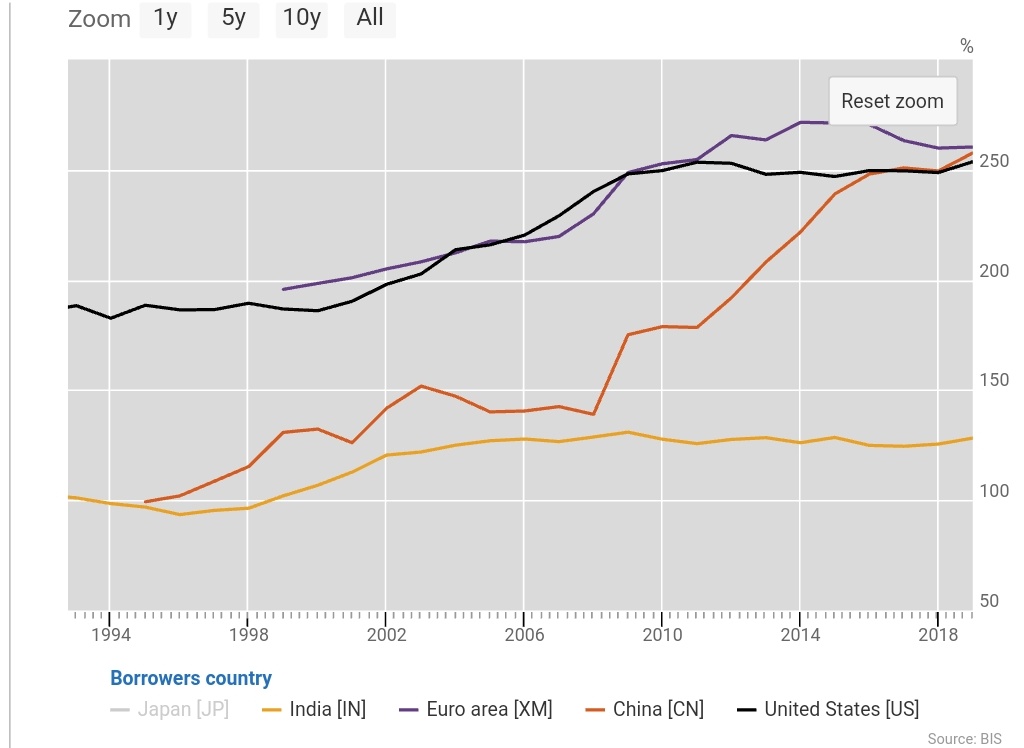

Plotted private sector corporate indebtedness as % of GDP across India, China, US, EU zone to give a perspective. Low interest rates for developed world hasn't spurred corporate investment by taking on debt in last decade.

For India - post the early 90s exuberance, saw deleveraging (from 30% to 27%) & then took off around the turn of 21 century till GFC. The last decade, corp indebtedness has seen dip from 62% to 57%, pre covid-an evidence of deleveraging.

Till 70s,Pvt credit was hovering around 10% of GDP n then 70s n 80s saw it take off till 30.Consolidation & mild deleveraging in 90s,before taking off to 60% in first decade of century & consolidating & deleveraging between 2010-2020. Can the coming decades see a take-off?

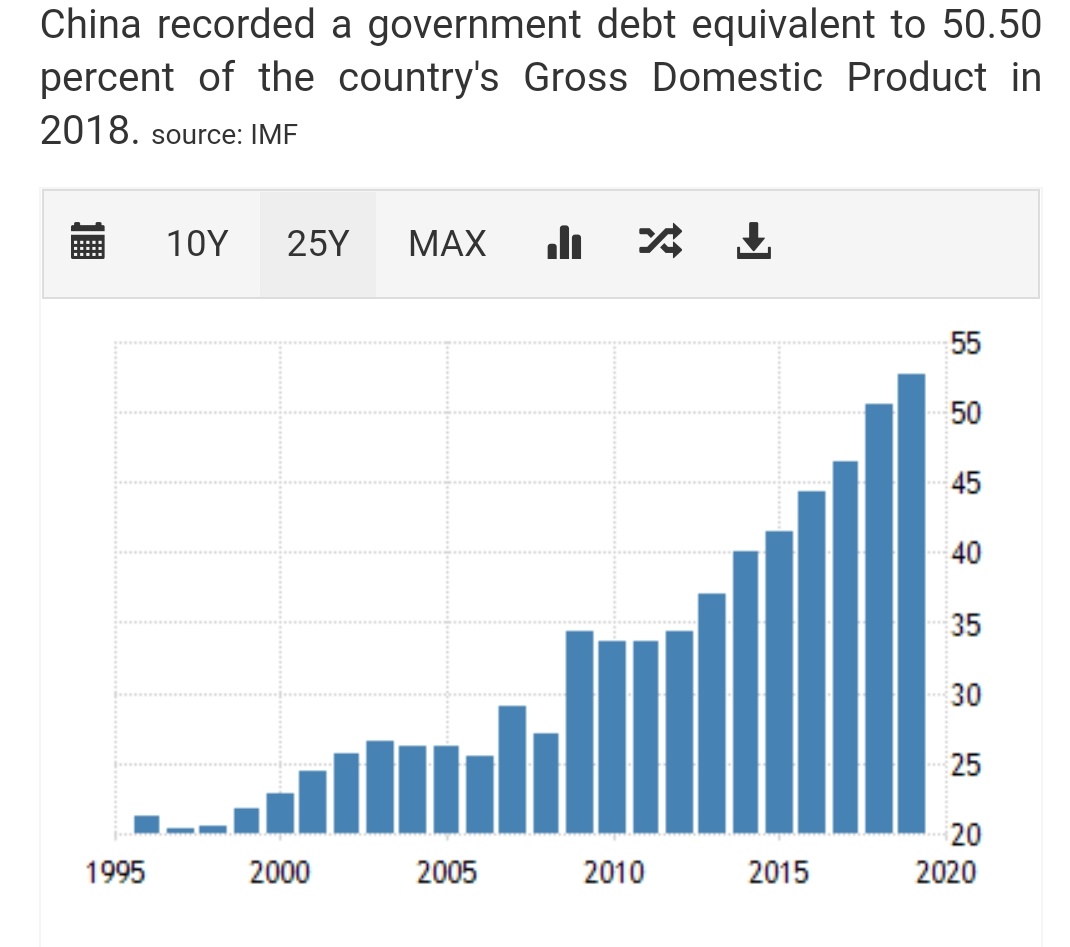

China - saw rapid rise in Pvt indebtedness in 1990s (in contrast to India)& then broadly consolidated in first decade (in contrast wrt rest of world). & Contrast continues when rest of world has seen stagnation, china debt has zoomed in 2010-20

Chinese households have also piled on debt, a contrast of household leverage in US, China, India here https://twitter.com/hktg13/status/1244282543009968128?s=19

Finally,a look at total non-finanancial indebtedness to GDP (private + govt) across these 4 blocs. China is a contrast where private corp indebtedness is significantly more than it's govt indebtedness, even as their government debt is also been growing

Will the next decade be more of the same or will there be animal spirits leading to investment in the real economy,across the world? Will Covid drive change or will populist fiscal stimulus bring forth investment in real economy?Can India begin a decade of re-leveraging?

Raw data sourced from Bank for International Settlements (BIS), data till June qtr 2020, due to which there is Covid induced lockdown spike at the end as GDP contracted across all major economies

Read on Twitter

Read on Twitter