As the US grapples with the economic fallout of #COVID19 + a long-simmering #ClimateCrisis, ambitious investment to build a net-zero carbon economy could provide a big share of the economic stimulus needed to power America out of the COVID era. Here's how: https://thehill.com/opinion/energy-environment/535365-climate-solutions-and-the-covid-19-employment-cliff

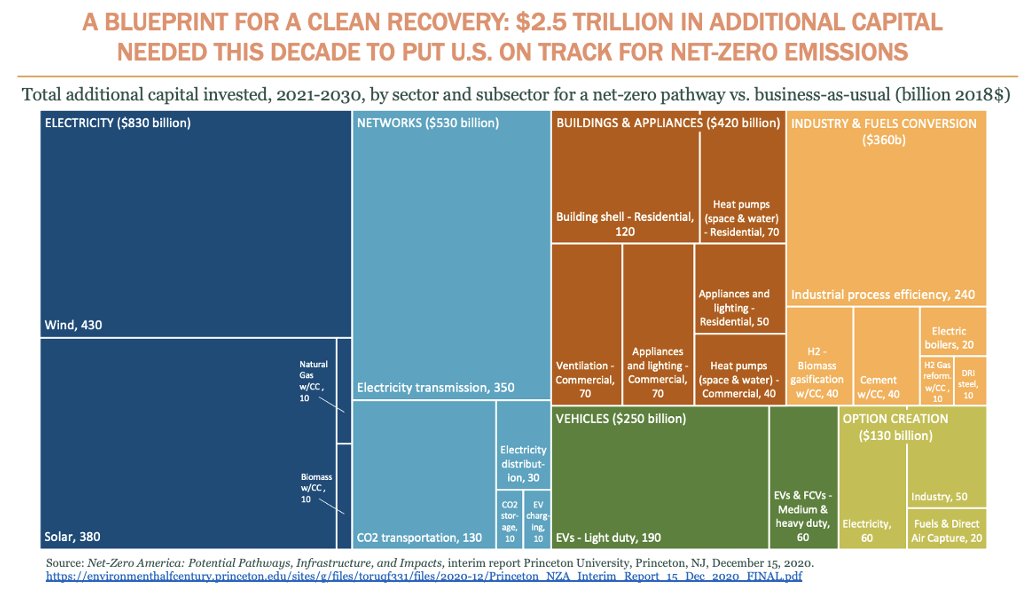

The @Princeton NET-ZERO AMERICA study also provides a blueprint for an additional $2.5 trillion in capital investment in clean energy infrastructure needed this decade to put America on a path to net zero emissions by 2050. https://www.princeton.edu/news/2020/12/15/big-affordable-effort-needed-america-reach-net-zero-emissions-2050-princeton-study

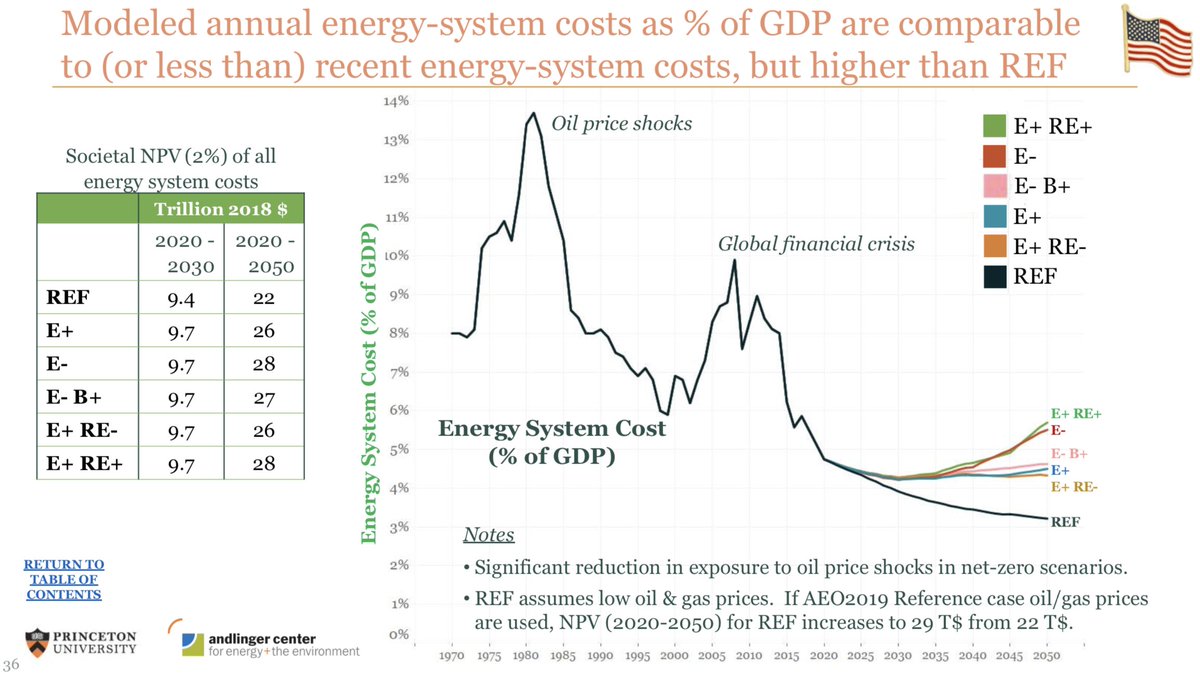

To be clear: these are investments, NOT costs. Energy consumers will pay back these investments over many decades, keeping net annual US spending on energy near its historic low as a percentage of GDP. And near-term investment is exactly what's needed to power economic recovery.

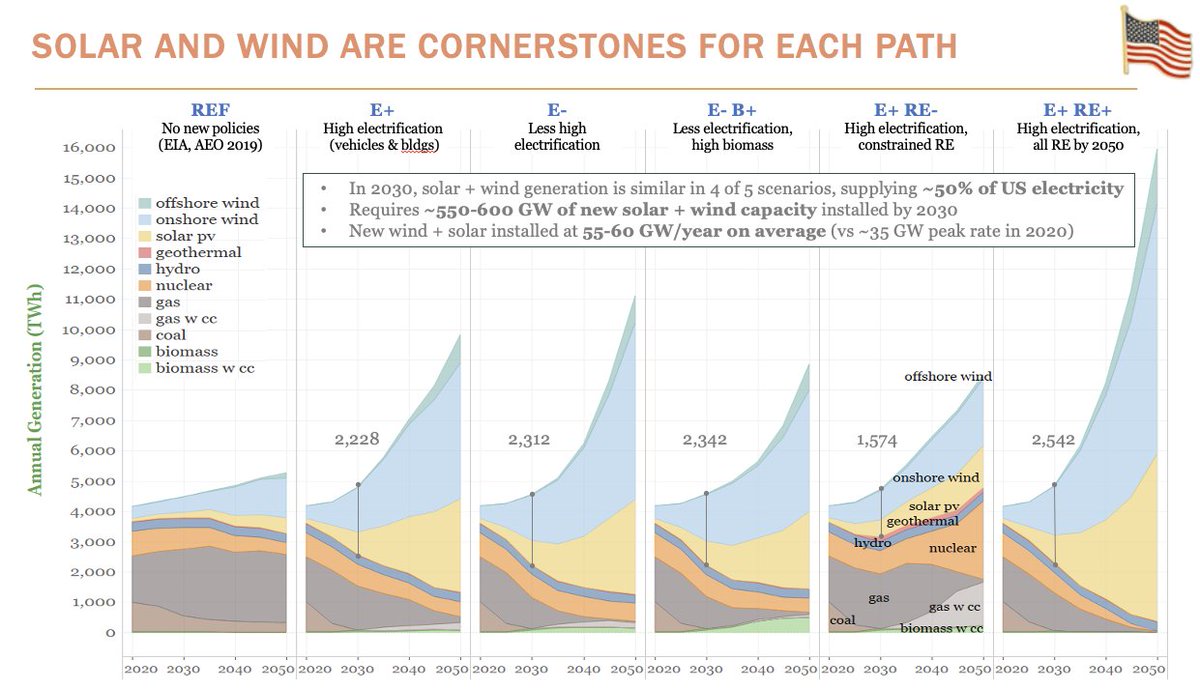

The Net-Zero America analysis shows that the first requirement will be to more than double the total electricity generation from carbon-free sources, including wind, solar, hydropower and nuclear energy by 2030. Most of that growth will come from wind and solar power...

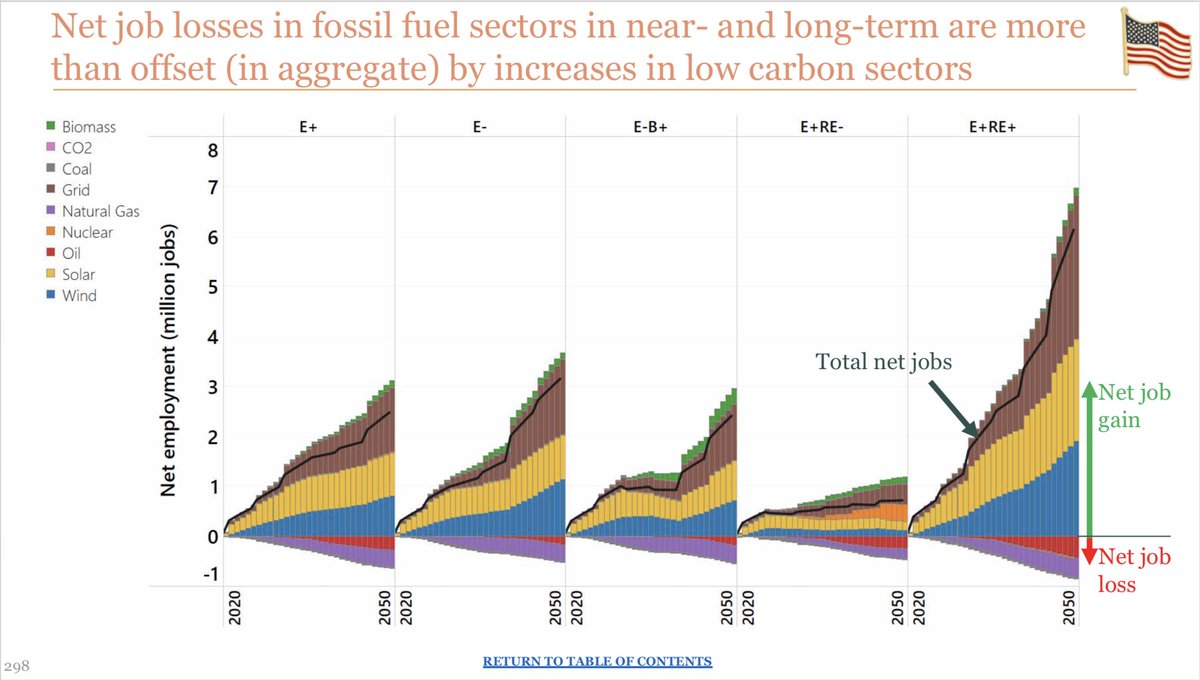

The wind and solar industries already employed >360,000 Americans in 2019. By 2030, over 1.2 million Americans could be employed in the wind and solar industries, with 700,000 more skilled workers employed constructing high voltage transmission lines.

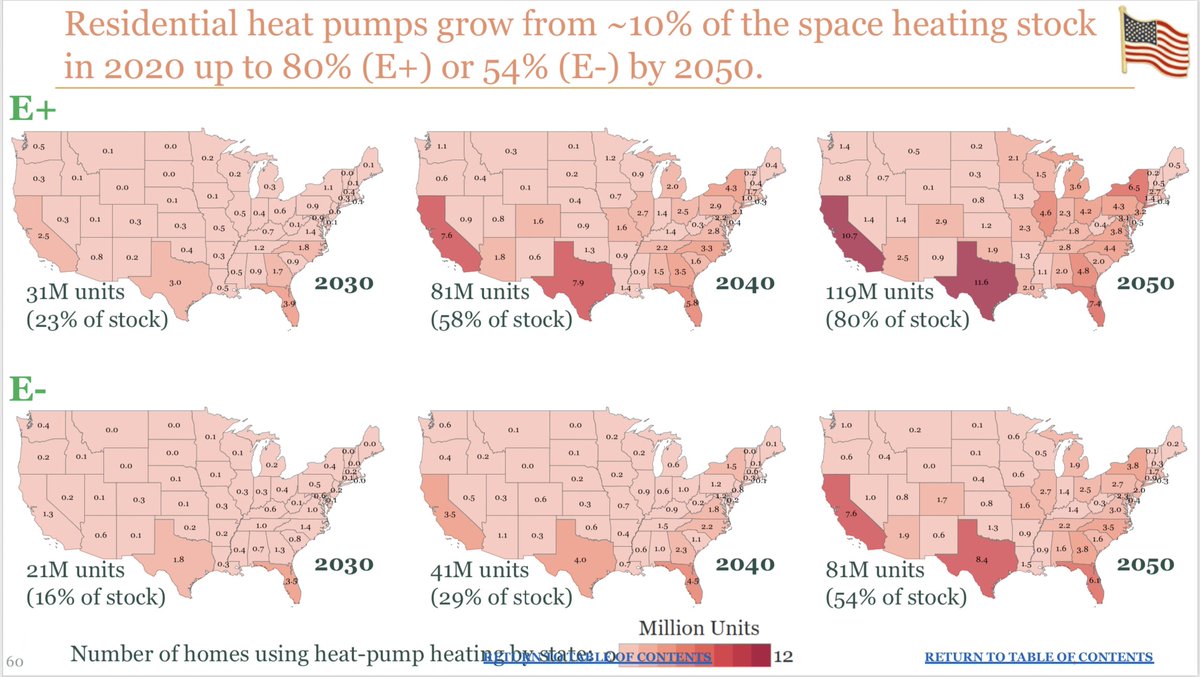

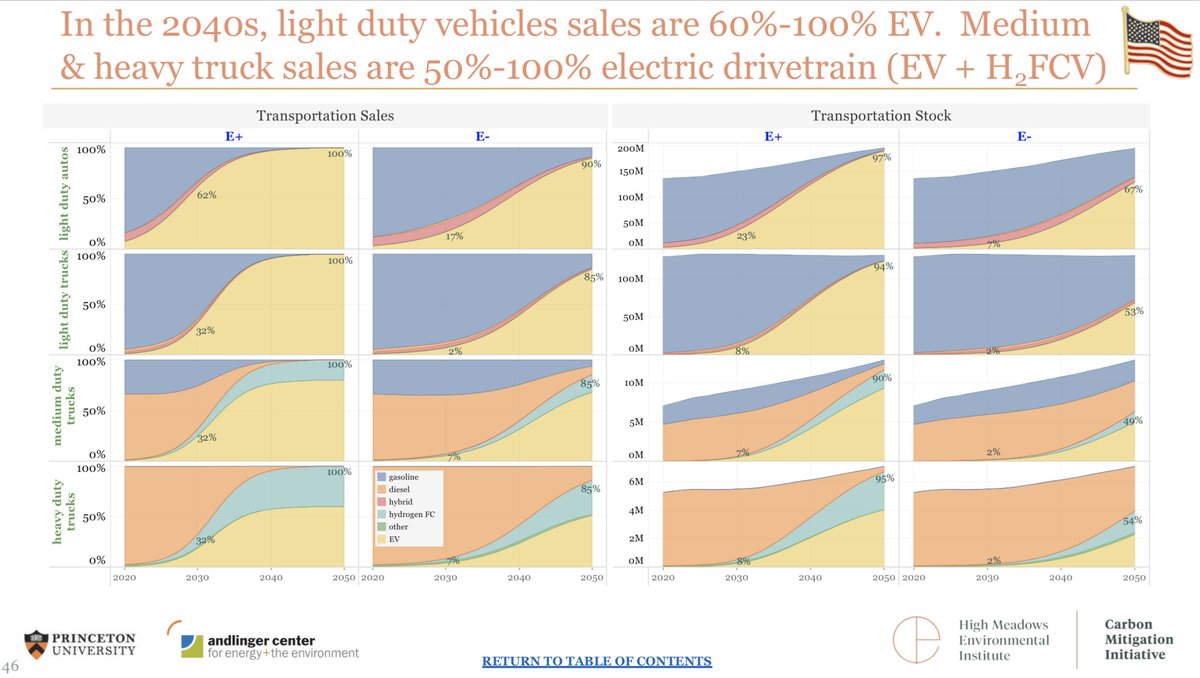

Second, electrifying vehicles & heating will enable new clean electricity to displace oil & natural gas. The US could leverage today’s zero-interest environment to provide low-cost capital to retool and repower US manufacturing to produce globally competitive EVs and heat pumps.

With many of the world’s largest auto markets, from China to California, already planning to phase out sales of internal combustion engine vehicles, the future for American automakers is clearly electric. It's time to invest in that future.

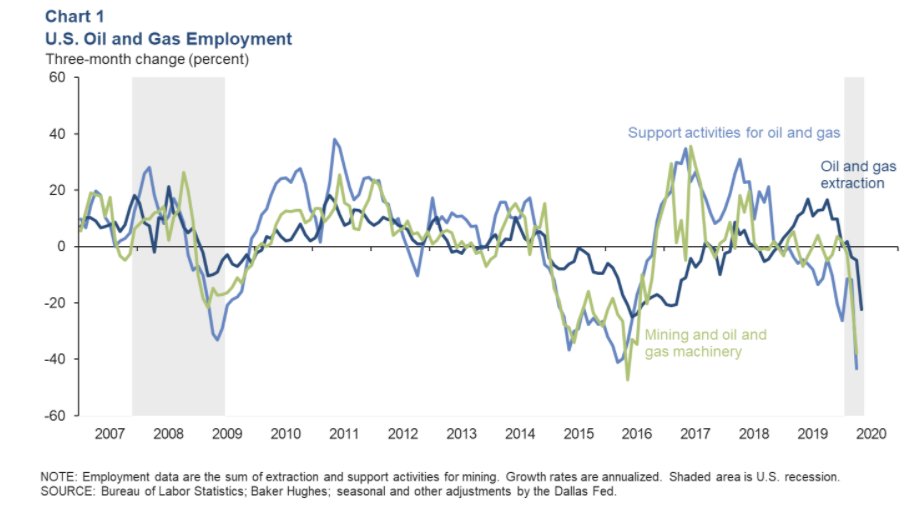

Additional steps for reaching net zero could help to employ skilled workers in the U.S. oil and gas sectors, which are reeling as COVID-19 has crushed short-term energy demand. (see https://dallasfed.frswebservices.org/research/energy/indicators/2020/en2006.aspx)

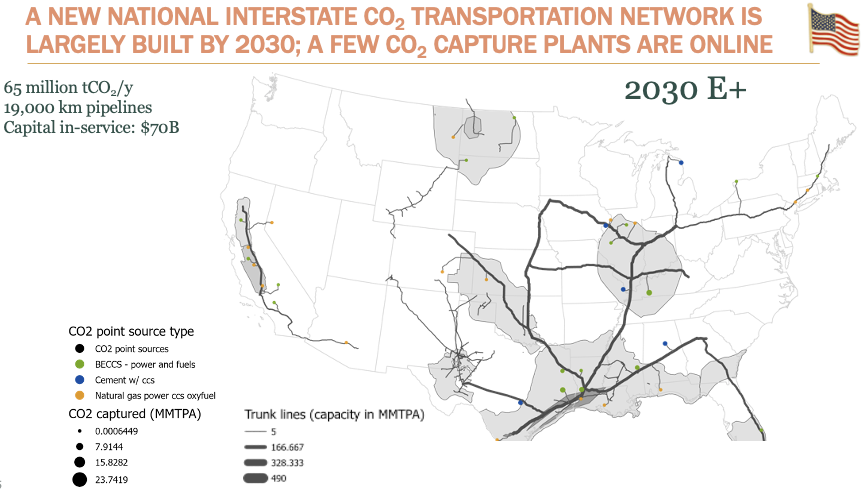

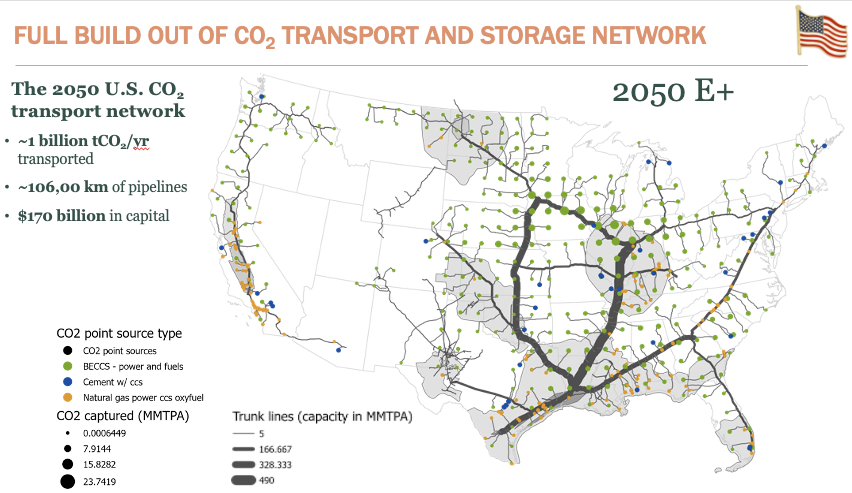

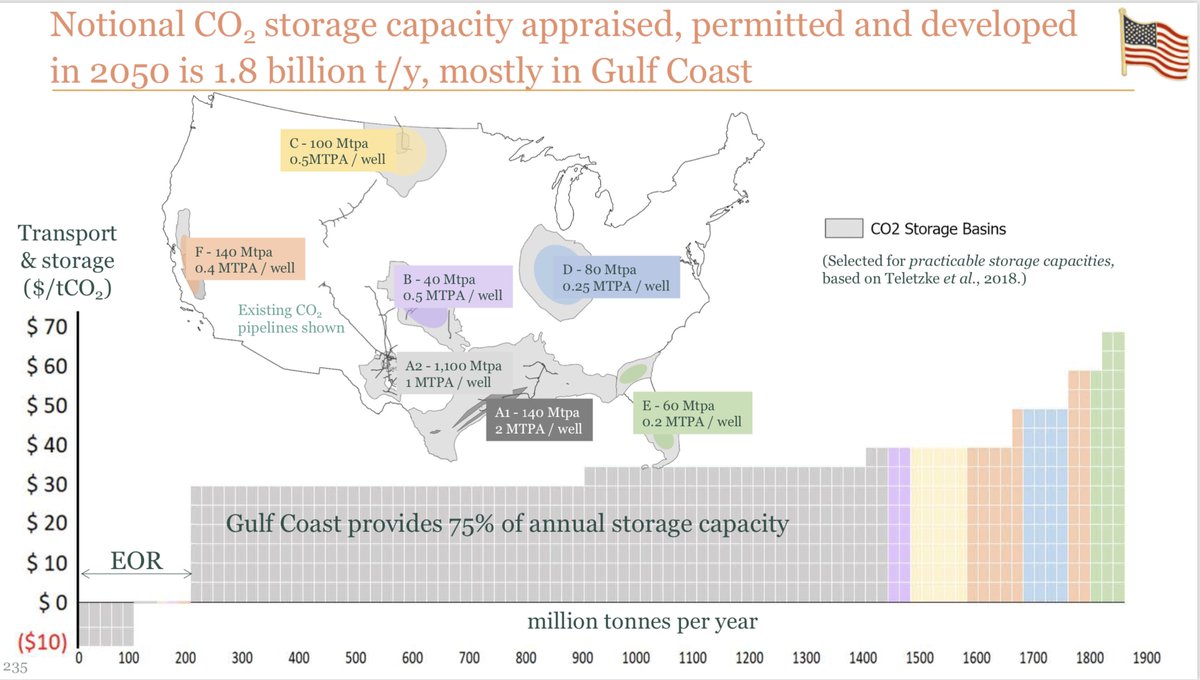

Pipeline workers could start building a new “carbon dioxide superhighway,” a national network of pipelines that can transport carbon dioxide captured at power plants and industrial processes across the country to storage locations in the Gulf Coast, West Texas and the Dakotas.

To make the project work best, the government could fund a program to characterize the best specific locations in the country to inject carbon dioxide deep underground for permanent and safe storage. That’s an opportunity to put now-idled drill rigs and crews back to work.

Further investment in advanced geothermal techs could also employ workers w/oil & gas expertise--e.g. enhanced geothermal energy, which applies horizontal drilling and hydraulic fracturing to dramatically expand the nation’s renewable energy potential. See

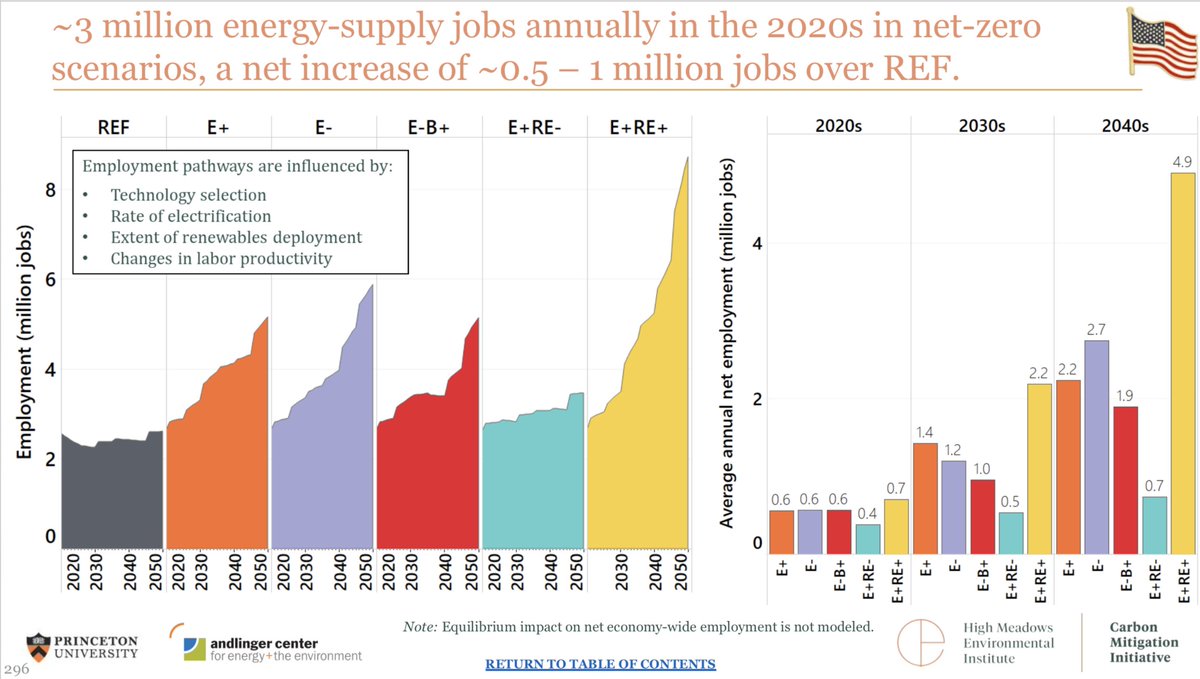

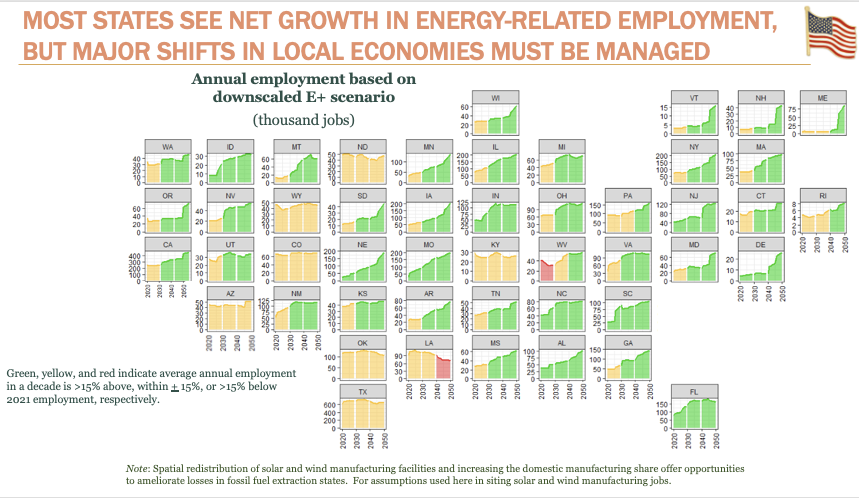

Overall, growth in clean energy would more than offset employment declines in fossil energy sectors, resulting in a net increase of 0.5-1 million jobs in energy supply sectors by 2030, estimates @ErinNMayfield. More would be employed in energy efficiency and vehicle/appliance mfg

Almost all states will win; those with the biggest projected boosts this decade include Florida, the Carolinas, Missouri, Indiana, Idaho and Nebraska.

The coronavirus has caused a profound economic shock. Clean energy alone cannot put America back to work. Nor will near-term stimulus measures be sufficient to fund the decades-long effort to build a net zero carbon economy.

That said, it is clear that ambitious and timely investment in clean energy today can help confront both the #climatecrisis and the economic fallout wrought by the COVID-19 pandemic at once, and point our nation toward a cleaner and more resilient future.

For more, read the op ed by @ben_strauss and I in @theHill here (and please share with your friends): https://thehill.com/opinion/energy-environment/535365-climate-solutions-and-the-covid-19-employment-cliff

And see the full Net-Zero America study here: https://environmenthalfcentury.princeton.edu/sites/g/files/toruqf331/files/2020-12/Princeton_NZA_Interim_Report_15_Dec_2020_FINAL.pdf

Or summary here: https://www.princeton.edu/news/2020/12/15/big-affordable-effort-needed-america-reach-net-zero-emissions-2050-princeton-study

</The end>

And see the full Net-Zero America study here: https://environmenthalfcentury.princeton.edu/sites/g/files/toruqf331/files/2020-12/Princeton_NZA_Interim_Report_15_Dec_2020_FINAL.pdf

Or summary here: https://www.princeton.edu/news/2020/12/15/big-affordable-effort-needed-america-reach-net-zero-emissions-2050-princeton-study

</The end>

Read on Twitter

Read on Twitter