Finally got around to reading Costco's FY2020 Annual Report. I remain bullish as ever. Some takeaways, incredible facts & chicken puns from the 3rd largest global retailer & one of my favorite businesses on this planet

Finally got around to reading Costco's FY2020 Annual Report. I remain bullish as ever. Some takeaways, incredible facts & chicken puns from the 3rd largest global retailer & one of my favorite businesses on this planet  (1/23) :

(1/23) :

First off, Costco as a wholesale membership retailer runs a pretty different business from most of its practical competitors in almost every category it competes in, from packaged food to produce to gasoline to flatscreen TVs to rotisserie chicken

Unlike Target, Costco doesn't try to aggressively mark-up individual items it sells

Unlike Exxon, Costco doesn't seek to make much profit on gasoline (on avg 21 cents cheaper than market)

Unlike Walmart, Costco has a very limited selection--only has ~4,000 SKUs in TOTAL

Why?

Unlike Exxon, Costco doesn't seek to make much profit on gasoline (on avg 21 cents cheaper than market)

Unlike Walmart, Costco has a very limited selection--only has ~4,000 SKUs in TOTAL

Why?

Membership Model: With limited exceptions by law (alc and pharmacy), you *need* a membership to shop at Costco. While this appears to limit the appeal of Costco vs the AMZN/Prime model, the opposite is actually true...

The base membership is only $60 dollars a year (of almost pure profit ) and forces casual to prolific Costco users to sign up and take full advantage of all their membership has to offer. Once you pay the membership as *59M* households already do, you get keys to the kingdom.

) and forces casual to prolific Costco users to sign up and take full advantage of all their membership has to offer. Once you pay the membership as *59M* households already do, you get keys to the kingdom.

) and forces casual to prolific Costco users to sign up and take full advantage of all their membership has to offer. Once you pay the membership as *59M* households already do, you get keys to the kingdom.

) and forces casual to prolific Costco users to sign up and take full advantage of all their membership has to offer. Once you pay the membership as *59M* households already do, you get keys to the kingdom.

In 2020 Costco made ~$3.5B in membership fees; and $5.4 billion in total operating income -- the membership model clearly drives a significant component of the profit, and like Netflix, there's definitely room to grow it and upsell on memberships

It's Win-Win: Costco is incentivized to do everything in its power to keep prices low and quality high so you keep paying that membership (91% of USA members renew every year) and never question their product selection. Here's what that looks like in practice:

4,000 SKUs: Costco negotiates ruthlessly with suppliers to get you the lowest price, and pits competitors against each other for ONE, maybe TWO spots on its shelf. If you don't make the cut, it's an incredible loss. E.g: everyone who needs coconut water will buy Vita Coco.

To put this in perspective:

Walmart has 140,000 SKUs.

Not even fair to play this game with Amazon's long-tail (millions?)

Streamlining the product offering (+ bulk!) has immense implications on reducing operational costs & complexity in supply chain

Walmart has 140,000 SKUs.

Not even fair to play this game with Amazon's long-tail (millions?)

Streamlining the product offering (+ bulk!) has immense implications on reducing operational costs & complexity in supply chain

Kirkland Signature: Kirkland is one of the largest private-market brands, represents incredible quality at incredible prices, and you can't get it anywhere else. Costco again has massive leverage with suppliers. If you win, Costco's order volume is *huge* and no mkting required

Private label used to be a value-maximizing strategy, but now its a loyalty strategy too- Costco members love Kirkland, they don't know the real brand behind it, and as one of the most loved private labels, makes it even harder for Costco members to quit their memberships

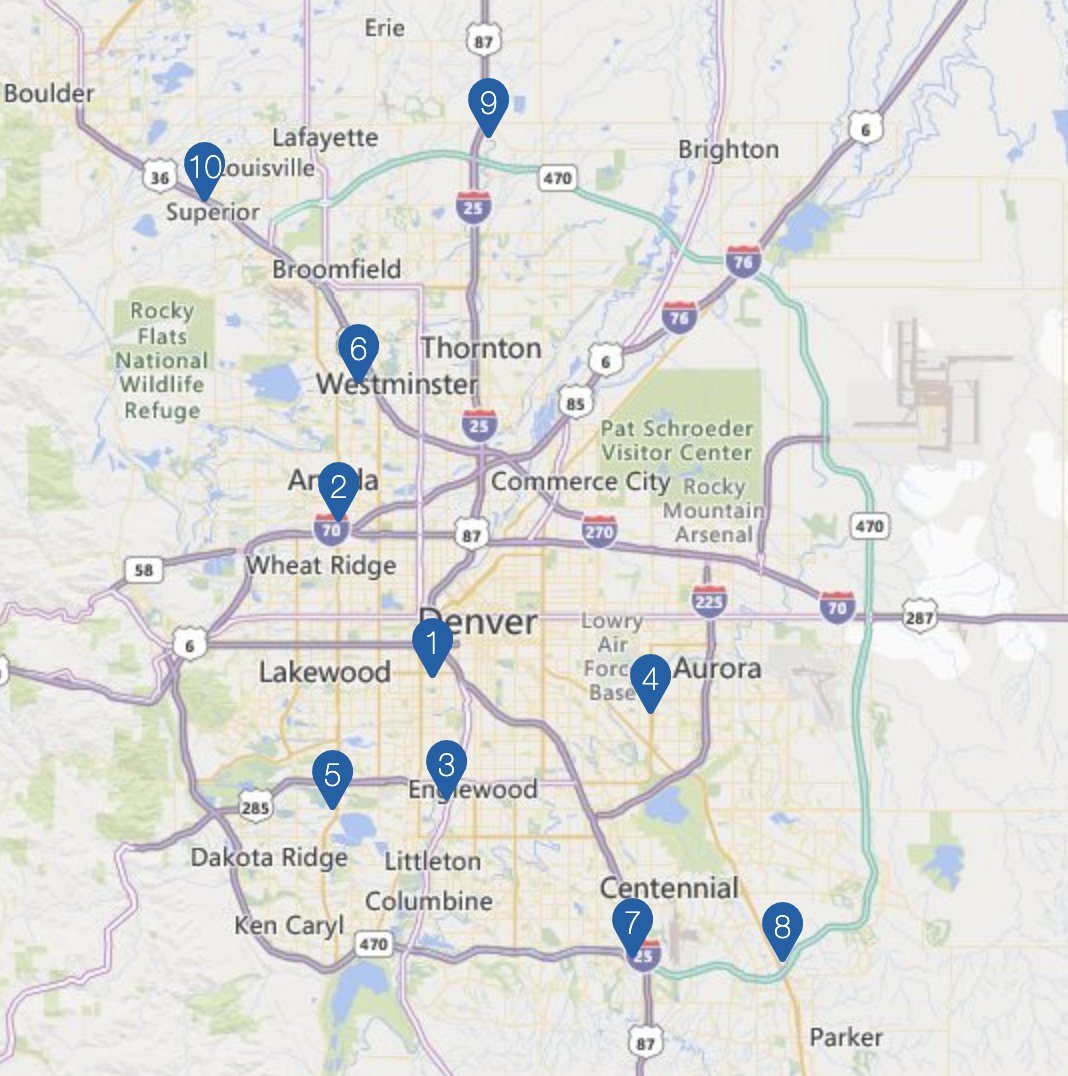

Gasoline: at ~21c per gallon less than market, gas is almost a loss-leader for Costco. Why do it.. given the cost, handling of flammables, regulations and space required? Answer: Location, Location Location

When they can help it, Costco doesn't place its warehouses in the center of cities but instead in the outer suburbs where land is cheap. The gas is near at-cost to incentivize customers to make the trek to the exurbs to pick up gas and visit the warehouses on a regular cadence

The big loss-leader for Costco is the Rotisserie Chicken  (While this doesn't appeal to me as a vegetarian, I still salivate at the strategy). Costco has gone to great lengths breaking their beaks for this EGGcellent deal: $4.99 for a 3lb chicken https://www.cnn.com/2019/10/11/business/costco-5-dollar-chicken/index.html

(While this doesn't appeal to me as a vegetarian, I still salivate at the strategy). Costco has gone to great lengths breaking their beaks for this EGGcellent deal: $4.99 for a 3lb chicken https://www.cnn.com/2019/10/11/business/costco-5-dollar-chicken/index.html

(While this doesn't appeal to me as a vegetarian, I still salivate at the strategy). Costco has gone to great lengths breaking their beaks for this EGGcellent deal: $4.99 for a 3lb chicken https://www.cnn.com/2019/10/11/business/costco-5-dollar-chicken/index.html

(While this doesn't appeal to me as a vegetarian, I still salivate at the strategy). Costco has gone to great lengths breaking their beaks for this EGGcellent deal: $4.99 for a 3lb chicken https://www.cnn.com/2019/10/11/business/costco-5-dollar-chicken/index.html

To get most of your membership value, you must show up and go all the way to the back of the store-- good luck leaving with ONLY Foghorn Leghorn since you made the trip. Costco sold 101m chickens last year globally-- at their scale everything makes a difference.

Fun Fact: Costco built a 452acre chicken farm in Nebraska to better count their chickens before they hatch (2 million per week!) and vertically integrate their chicken supply chain to save 35 cents per chicken. Don't worry-- I'm done with the chicken puns. https://www.mashed.com/314771/how-costcos-enormous-chicken-farm-has-changed-nebraska/

I could go on and on covering Costco's insane pricing power (AMEX stock fell 6% and 1 of 10 cards in circulation when they lost their Costco cobrand in 2016, or just think about TP negotiation) but Costco's growth amidst the challenges of COVID was also quite impressive:

In 2020--

Opened 9 new warehouses during COVID

Opened 9 new warehouses during COVID

Net sales grew almost 10% from 2019

Net sales grew almost 10% from 2019

e-Commerce up 50%!!

e-Commerce up 50%!!

Membership revenue grew 6%

Membership revenue grew 6%

Costco bought an equity share in a PBM to compete with CVS & Walgreens on drugs

Costco bought an equity share in a PBM to compete with CVS & Walgreens on drugs

Costco acquired a last-mile delivery provider

Costco acquired a last-mile delivery provider

Opened 9 new warehouses during COVID

Opened 9 new warehouses during COVID Net sales grew almost 10% from 2019

Net sales grew almost 10% from 2019 e-Commerce up 50%!!

e-Commerce up 50%!! Membership revenue grew 6%

Membership revenue grew 6%

Costco bought an equity share in a PBM to compete with CVS & Walgreens on drugs

Costco bought an equity share in a PBM to compete with CVS & Walgreens on drugs

Costco acquired a last-mile delivery provider

Costco acquired a last-mile delivery provider

Is Costco perfect? Almost, but I cannot wish it true-- they've got a long way to go on melding their digital and in-store experiences with neither coming at the expense of the other. Offer too much online-- the cart-size and "one-more-item" effect in-store declines.

Reserve too much value for in-store and you'll lose during COVID when every other business is trying to deliver more online, incl bulk. I remain super bullish as with 59M households, they're super well positioned to move into any new market that plays on their strengths

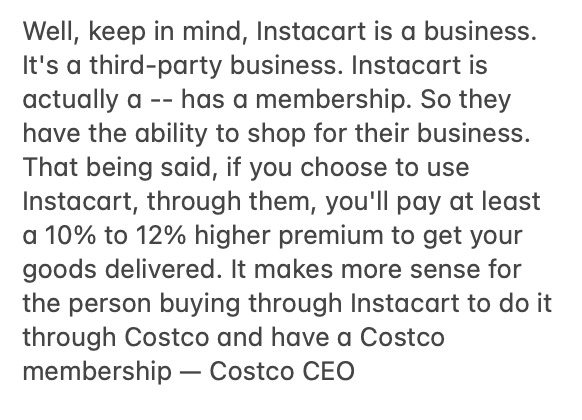

And what's up with the Instacart partnership? You don't need a Costco membership to shop the warehouse with Instacart... in a reply to this the Costco CEO plays it cool, but I imagine this changing in the next 1-2 years given investments in delivery

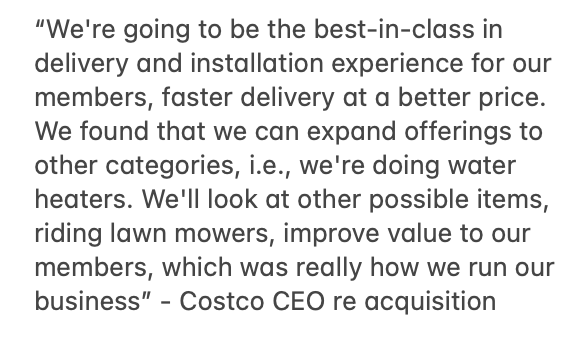

What's 'in-store' for 2021? Costco acquired a last-mile provider from Sears bankruptcy that did all Sears' appliance and large-item deliveries. Big & Bulk is Costco's middle name.

If you're curious to read more from more eloquent Costco-stans than I, this deck written in 2018 is one of my favorites on the topic (23/23) https://issuu.com/slowappreciation/docs/costco_deck

Read on Twitter

Read on Twitter