Last week ALEC & others tried to salvage support for eliminating the personal income tax in West Virginia by cherry picking a quote from an interview where I mentioned Kansas' tax experiment disaster as a cautionary tale for WV lawmaker.

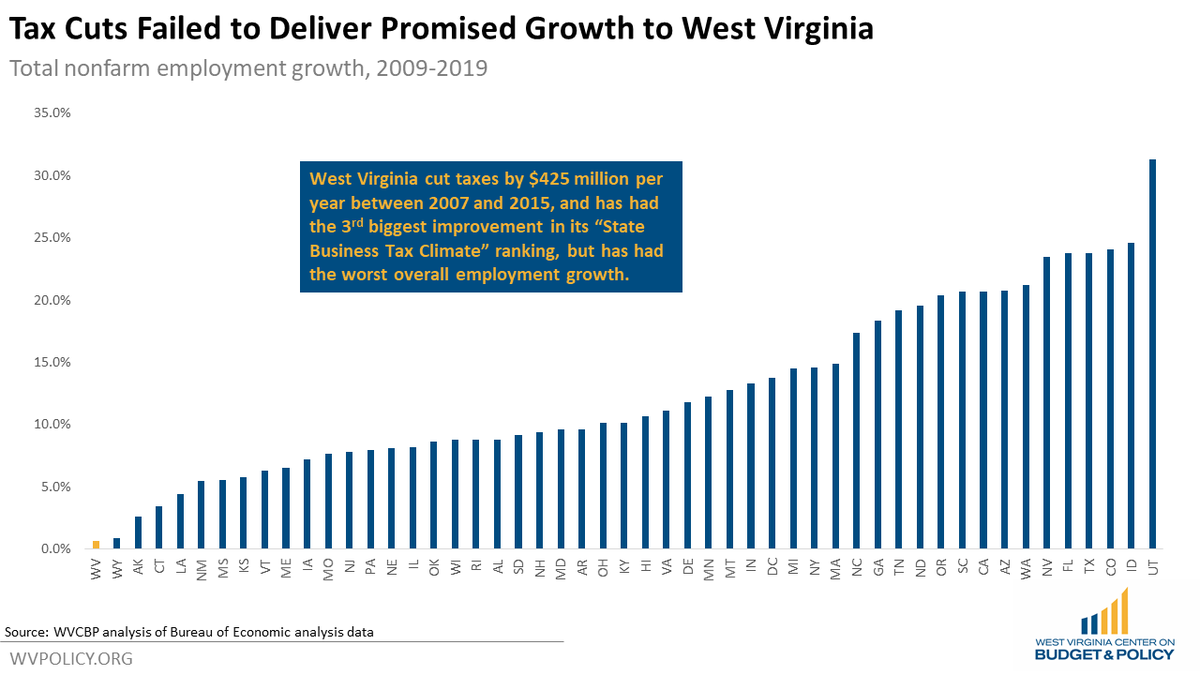

During the same interview I also highlighted that one needn't look outside WV to see the impact tax cuts have on job growth/economic activity. WV cut taxes by $425 million/year from 2007-15. What followed- the worst jobs growth in the US.

But there were major impacts on the state's ability to provide necessary public services. WV cut public health funding by 30%, something we should learn from as we consider that cutting the PIT would force additional cuts in the wake of a pandemic. https://wvpolicy.org/funding-cuts-to-local-health-departments-harmful-for-public-health/

Similarly, WV's walk down this path before has forced huge cuts to higher ed, another likely target if the personal income tax is eliminated- ultimately shifting more costs to families and making it harder for the state to enhance equity and its workforce. https://wvpolicy.org/higher-education-funding-cuts-have-hurt-students-and-the-states-future/

Eliminating the income tax will necessarily mean: increasing other taxes, eliminating huge swaths of public services, or (likely) some combo of both. Huge benefits for the wealthy while the rest of us are left w/ degraded public services and a bleaker future.

As we emerge from the pandemic, we should invest in programs and services that will help us recover and ensure a better state for us today & for our kids and grandkids tomorrow- quality public ed, health care, infrastructure, & communities. Let's not double down on our mistakes.

Read on Twitter

Read on Twitter