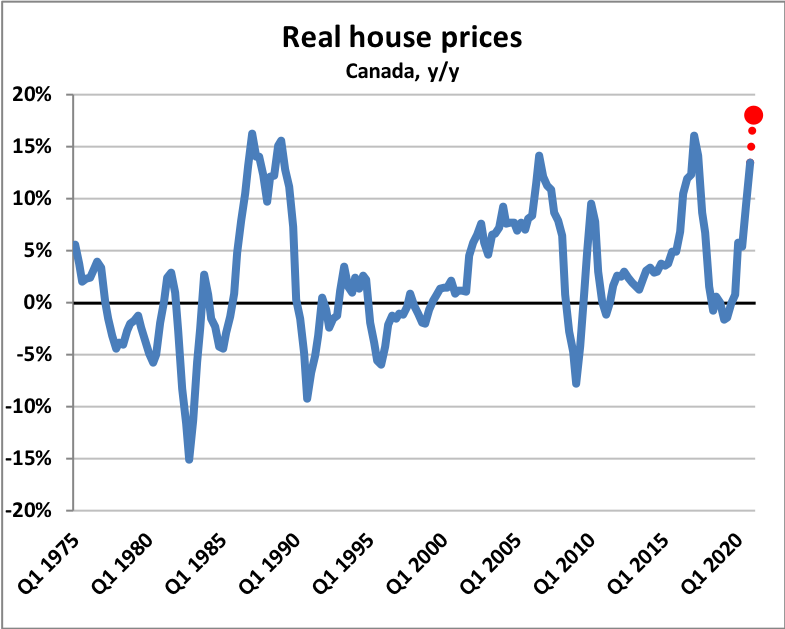

1/ A thread here on where I think housing is going as we head into the spring. As I said in a prev tweet, I think we'll see 20% y/y in the MLS HPI by the summer which would put us at 50-yr highs in terms of REAL house price appreciation

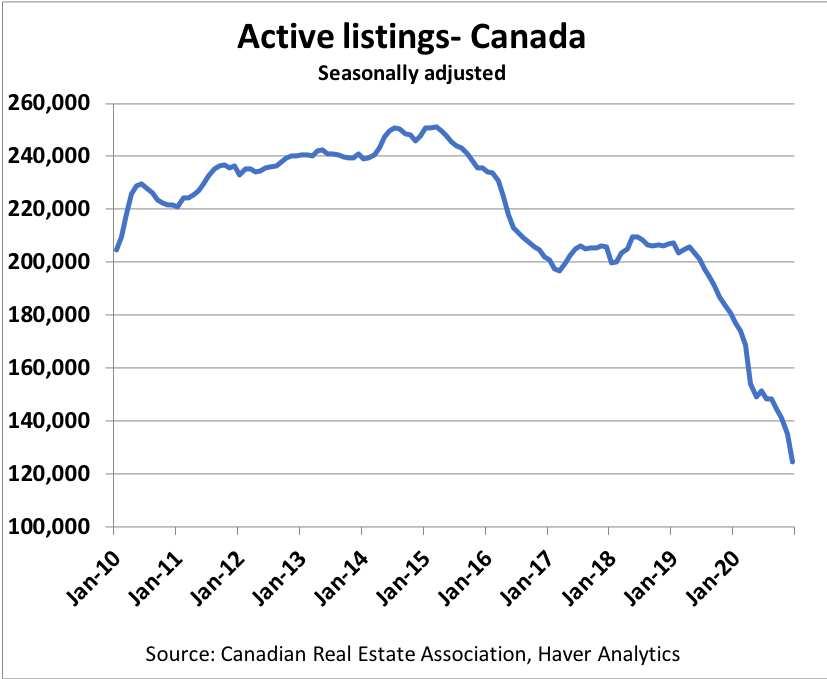

2/ The reality is that inventory is remarkably low right now...at least at 30-yr lows. Lots of theories about what's causing this, but note that it's not a new phenomenon. It's been trending down sharply since 2019.

3/ This lends credence to the view that we have a supply problem as well as potentially a demand problem, and solutions that address only one side may fall short. Of note, starts are now at 230k SAAR over the past 6 months which is way above hhld formations, so that's good.

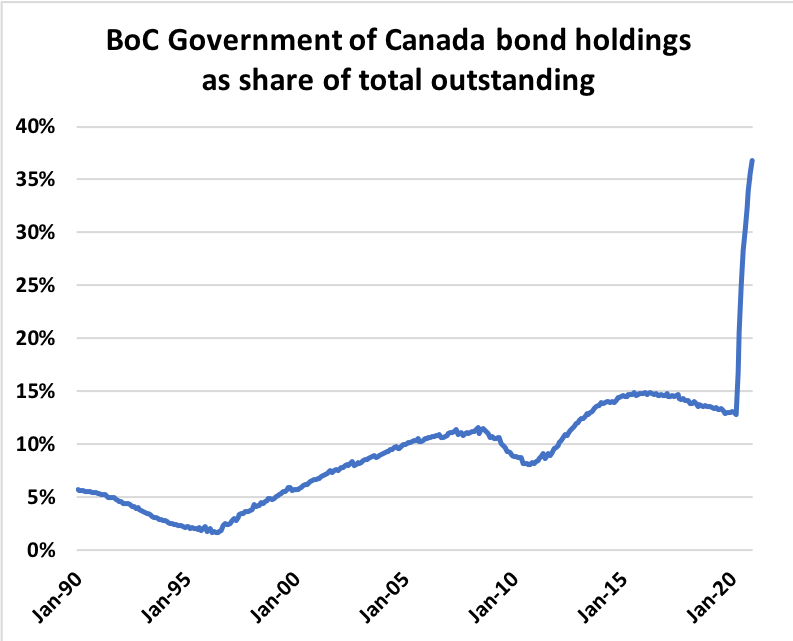

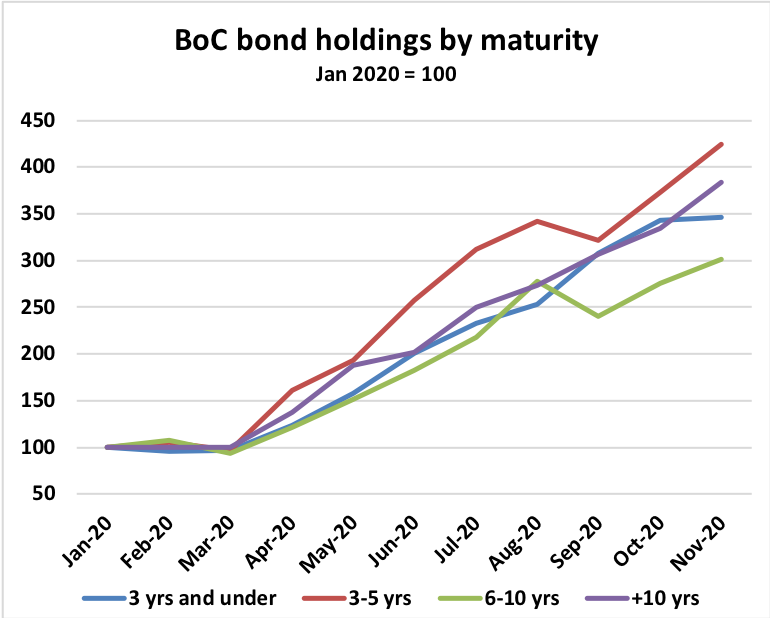

5/ I think we can reasonably expect rates to stay low for a long time. It's telling that not only is the BoC aggressively buying bonds but they are targeting the part of the curve that most directly affects mortgages.

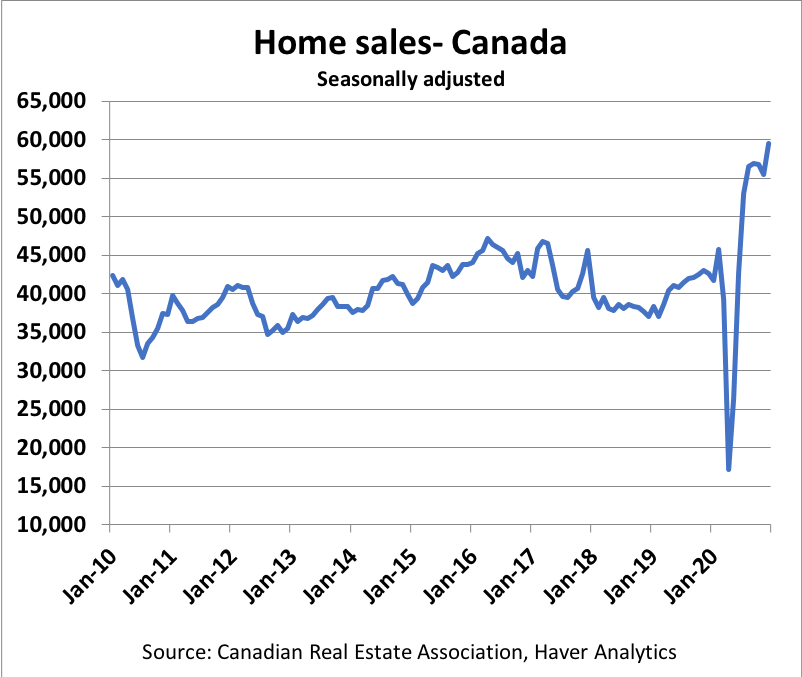

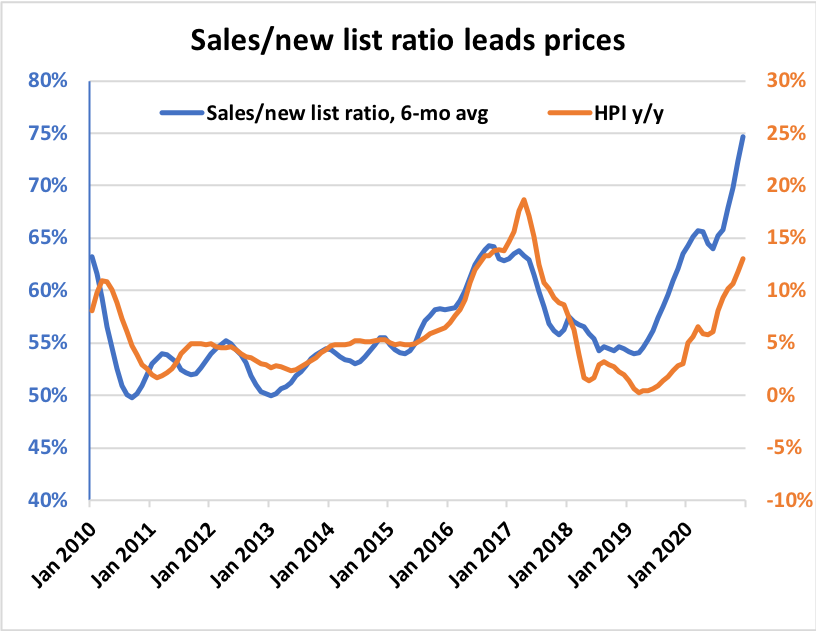

6/ The market balance as we head into the spring is incredibly tight. Months of inventory is at record lows, sales to new listings ratio at or near record highs. Prices have a ways to go to catch up.

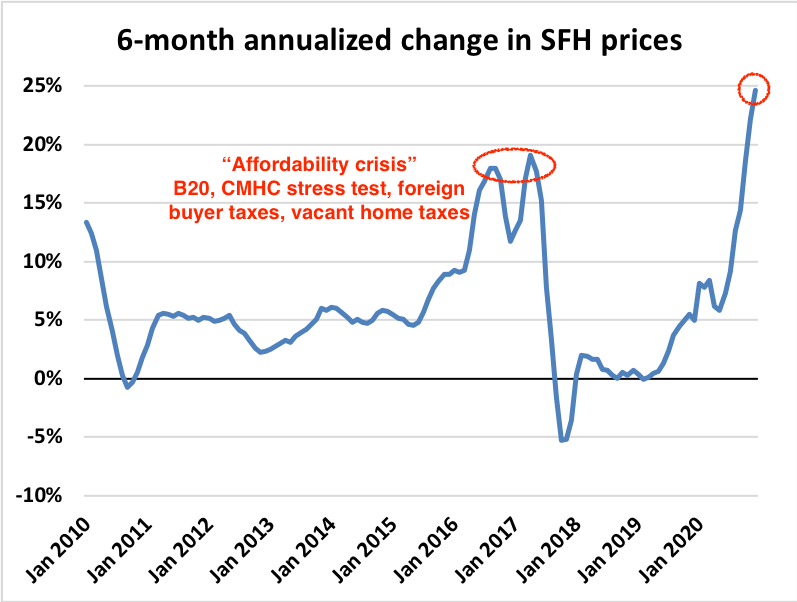

7/ Already, prices for SFH are accelerating above where they were in 16-17, but unlike then, policy makers will be wary of curbing demand given how reliant we'll be on resi investment and consumption to drive growth coming out of this recession. They'll let this burn for a while

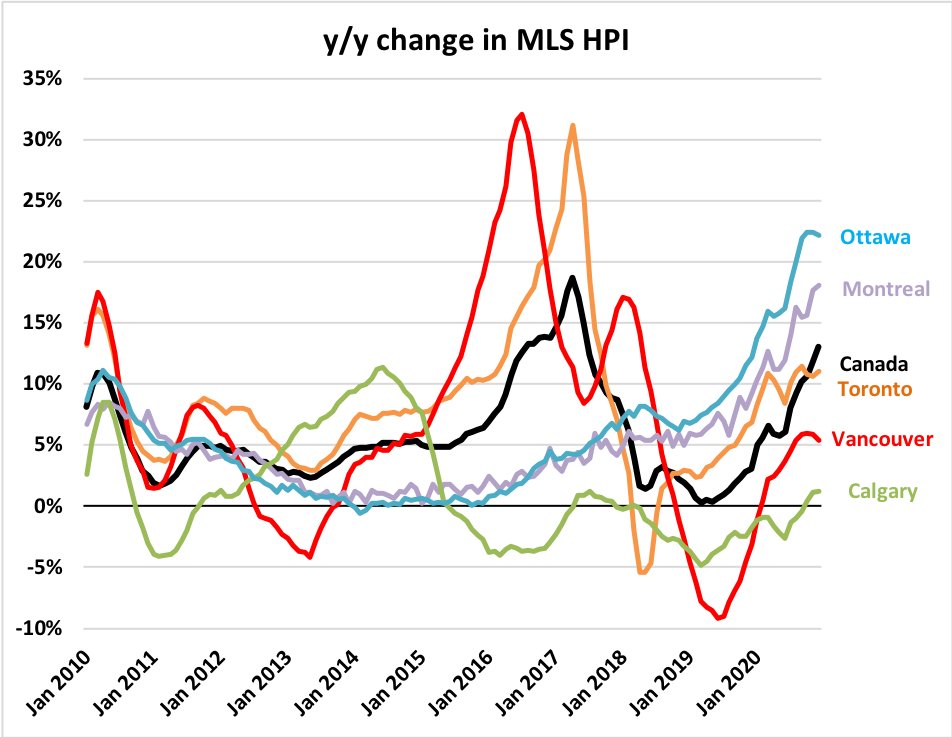

8/ Even if they wanted to tame this, which I don't think they do, there are no easy measures to take froth out of the market given current dynamics. Prev peaks were driven by TO and Vancouver, but this time the gains are widespread and those markets are LAGGING the national HPI.

9/ In fact, of the 16 regional boards that reported house price increases excess of 20% y/y last month, only 2 were top-10 metros. EVERYWHERE is hot right now, so regional measures like foreign buyer taxes, etc just won't work.

10/ And let's keep in mind that all of this is happening with an OSFI stress test rate at 4.79%, a policy that is getting increasingly difficult to justify. They were in the process of changing to a floating rate of contract +200bps when COVID hit. That may still be in the works

11/ I've got lots of thoughts on what may help bring market back into balance in back half of 2021 and beyond, but I think an insane spring selling season is pretty much baked in....and policy makers will frankly be quite happy to see that.

Read on Twitter

Read on Twitter