The Battle of The Crown - DraftKings & Penn Gaming

Unless you have been living under a rock, you know about @stoolpresidente. The electrifying founder of @barstoolsports & his new Barstool Sportsbook App are changing the online gambling scene. A competitor? DraftKings

Thread...

Unless you have been living under a rock, you know about @stoolpresidente. The electrifying founder of @barstoolsports & his new Barstool Sportsbook App are changing the online gambling scene. A competitor? DraftKings

Thread...

1/ FLASHBACK - $PENN

Penn National Gaming bought a 36% stake in Barstool for $163 M in cash & stock — valuing Barstool at $450 M. In 3 years Penn will pay another $62 M to amp its stake to 50%. Penn is listed as $PENN on the NYSE and hope to continue their content success.

Penn National Gaming bought a 36% stake in Barstool for $163 M in cash & stock — valuing Barstool at $450 M. In 3 years Penn will pay another $62 M to amp its stake to 50%. Penn is listed as $PENN on the NYSE and hope to continue their content success.

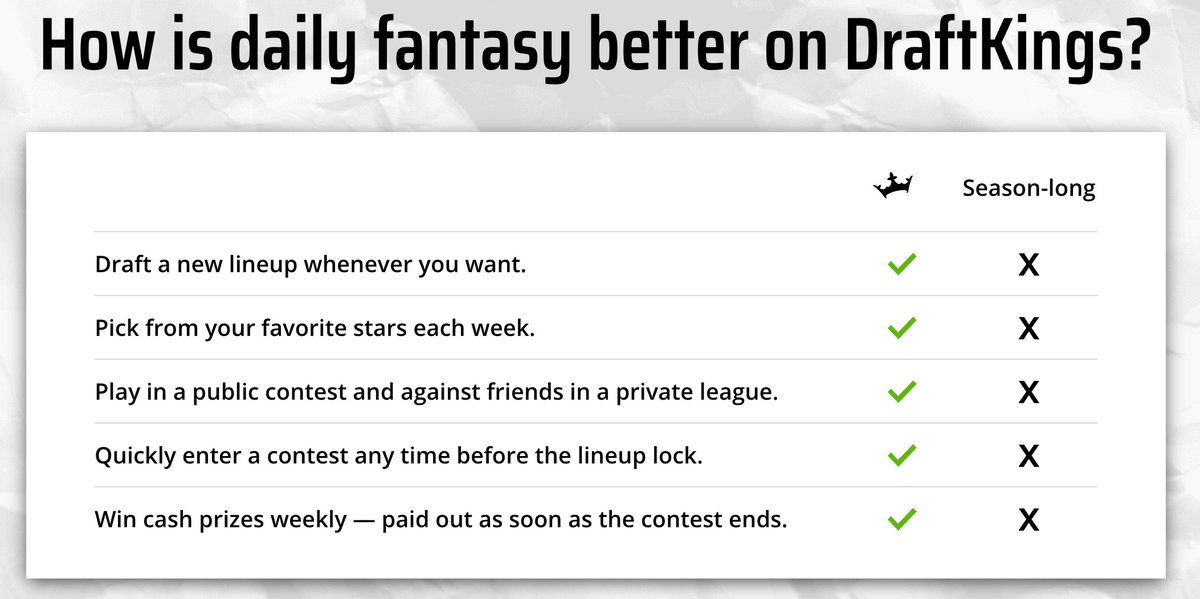

2/ DRAFTKINGS

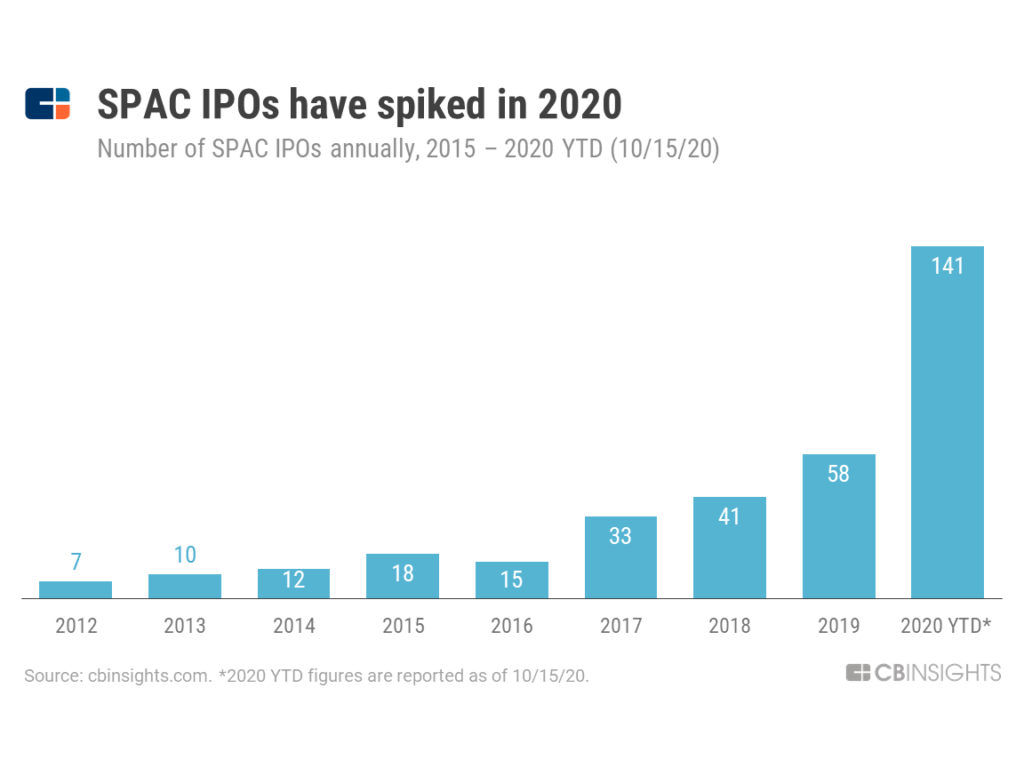

There is A LOT of competition in the online gambling app space. One of the many is Draft Kings ($DKNG), an online fantasy sports/betting app company that had a SPAC merger in late 2019. Finance twitter often bickered which was a better investment $DKNG or $PENN.

There is A LOT of competition in the online gambling app space. One of the many is Draft Kings ($DKNG), an online fantasy sports/betting app company that had a SPAC merger in late 2019. Finance twitter often bickered which was a better investment $DKNG or $PENN.

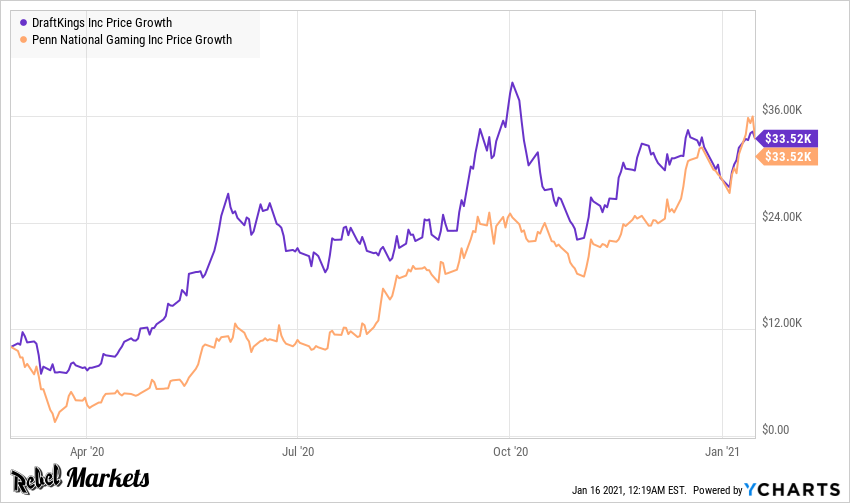

3/ SHARE PRICE BOOM

Incredibly, if you invested $10,000 on 3/1/20 into either $PENN or $DKNG you would be sitting at around $33,520 as of 1/16/21.

These two companies truly had incredible runs in 2020.

Source: @ycharts

Incredibly, if you invested $10,000 on 3/1/20 into either $PENN or $DKNG you would be sitting at around $33,520 as of 1/16/21.

These two companies truly had incredible runs in 2020.

Source: @ycharts

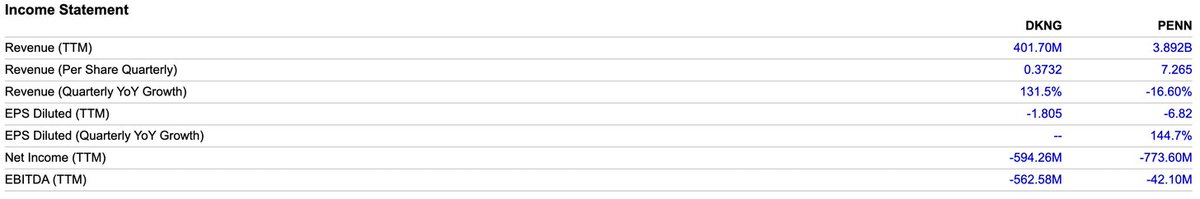

4/ $PENN vs. $DKNG

$DKNG had SIGNIFICANTLY less rev in a TTM period than $PENN. Interesting, $PENN’s mcap is $15.3B vs. $DKNG’s $20.9B mcap. A company w/ $401M in rev shouldn't have a larger mcap than a company w/ $3.9B rev. $DKNG is too focused on growth & not being profitable.

$DKNG had SIGNIFICANTLY less rev in a TTM period than $PENN. Interesting, $PENN’s mcap is $15.3B vs. $DKNG’s $20.9B mcap. A company w/ $401M in rev shouldn't have a larger mcap than a company w/ $3.9B rev. $DKNG is too focused on growth & not being profitable.

5/ Digging Deeper

The metric that pops out to me is the price to sales ratio. $DKNG’s P/S Ratio is currently 42.39 where $PENN’s P/S Ratio is 3.273. Generally speaking, low P/S ratios are more appealing because they suggest that a company is undervalued.

The metric that pops out to me is the price to sales ratio. $DKNG’s P/S Ratio is currently 42.39 where $PENN’s P/S Ratio is 3.273. Generally speaking, low P/S ratios are more appealing because they suggest that a company is undervalued.

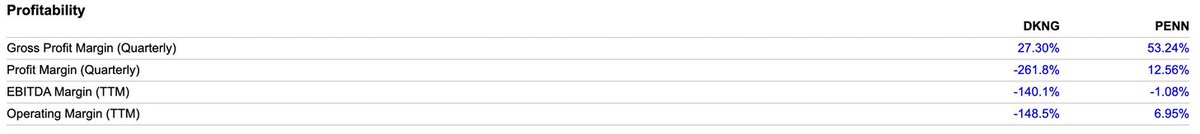

6/ Gross Profit Margin

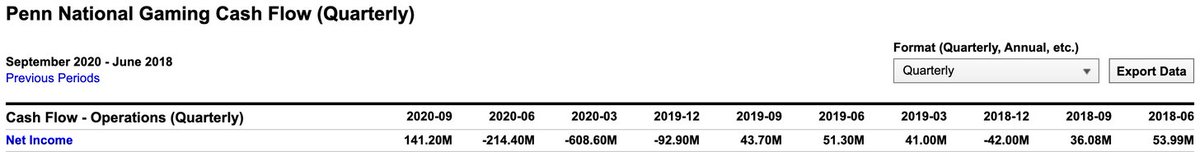

Gross profit represents the % of each dollar of a company's revenue available after accounting for COGS. Both companies currently have a negative TTM net income ($DKNG: -594M; $PENN: -773M), but the GPM shows how $PENN appears to be a better investment.

Gross profit represents the % of each dollar of a company's revenue available after accounting for COGS. Both companies currently have a negative TTM net income ($DKNG: -594M; $PENN: -773M), but the GPM shows how $PENN appears to be a better investment.

7/ Financials Cont.

$DKNG is exponentially increasing their (negative) net income. So why is $DKNG been up in share price as much as $PENN? It could be a combination of factors - recent IPO via SPAC madness, legalization of sports gambling in states, hype in the industry, etc.

$DKNG is exponentially increasing their (negative) net income. So why is $DKNG been up in share price as much as $PENN? It could be a combination of factors - recent IPO via SPAC madness, legalization of sports gambling in states, hype in the industry, etc.

8/ INTANGIBLES

I could bore you w/ #s all day about how $PENN (although definitely shaken up by the pandemic) is on paper fundamentally a significantly better investment than $DKNG currently, but I truly think the reason why $PENN is in a better position is their intangibles.

I could bore you w/ #s all day about how $PENN (although definitely shaken up by the pandemic) is on paper fundamentally a significantly better investment than $DKNG currently, but I truly think the reason why $PENN is in a better position is their intangibles.

9/ INTANGIBLE #1

Dave Portnoy - Has an incredible knack for keeping his audience engaged whether it be doing pizza reviews, day trading millions, starting impromptu podcasts w/ Tiktok stars, or raising millions of $ for small biz throughout this time. https://www.barstoolsports.com/the-barstool-fund

Dave Portnoy - Has an incredible knack for keeping his audience engaged whether it be doing pizza reviews, day trading millions, starting impromptu podcasts w/ Tiktok stars, or raising millions of $ for small biz throughout this time. https://www.barstoolsports.com/the-barstool-fund

10/ INTANGIBLE #2

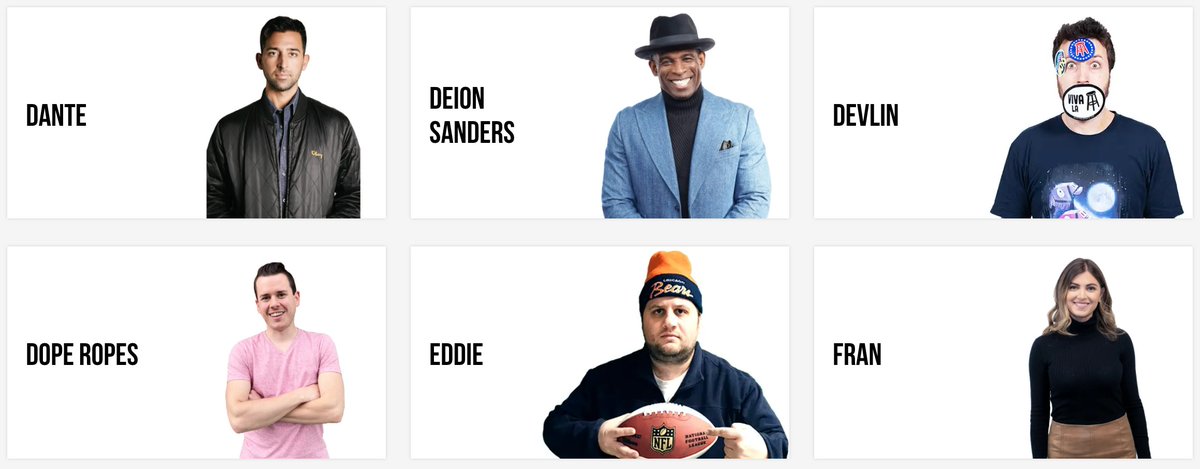

Marketing - Barstool employs tons of media personalities w/ their own blogs, podcasts, instagrams, twitters, shows etc. At any moment they can shift their focus to SELLING. Their own employees are walking living advertisements. 102 listed on their website.

Marketing - Barstool employs tons of media personalities w/ their own blogs, podcasts, instagrams, twitters, shows etc. At any moment they can shift their focus to SELLING. Their own employees are walking living advertisements. 102 listed on their website.

11/ INTANGIBLE #3

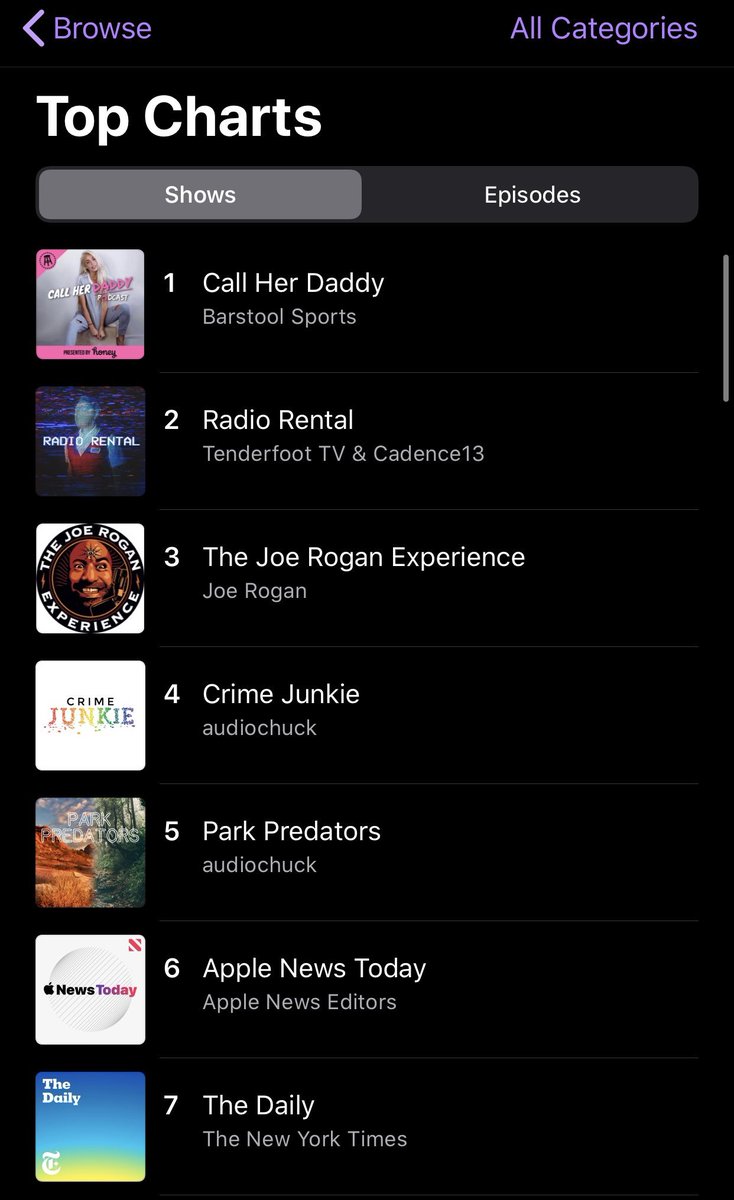

Celeb Status - What makes Barstool Sports employees unique is they themselves can become mini celebs. The Podcast @callherdaddy by @alexandracooper has catapulted her into internet fame. Her podcast blew up unlike any other podcast I have seen in history.

Celeb Status - What makes Barstool Sports employees unique is they themselves can become mini celebs. The Podcast @callherdaddy by @alexandracooper has catapulted her into internet fame. Her podcast blew up unlike any other podcast I have seen in history.

12/ INTANGIBLE #4

Drama - There's no shortage of drama at Barstool. Portnoy masterfully stirs the pot alongside his other media personality employees. The result = more eyeballs & ears on their content. Portnoy is a master marketer & content MACHINE. Latest beef is w/ @BryceHall

Drama - There's no shortage of drama at Barstool. Portnoy masterfully stirs the pot alongside his other media personality employees. The result = more eyeballs & ears on their content. Portnoy is a master marketer & content MACHINE. Latest beef is w/ @BryceHall

13/

This bullet point is solely used to ponder why they haven’t hired a finance personality (me) since it’s one of the few spaces they don’t have media personalities for. If any of you are Barstool see this you know where to find me. @large @stoolpresidente

This bullet point is solely used to ponder why they haven’t hired a finance personality (me) since it’s one of the few spaces they don’t have media personalities for. If any of you are Barstool see this you know where to find me. @large @stoolpresidente

14/

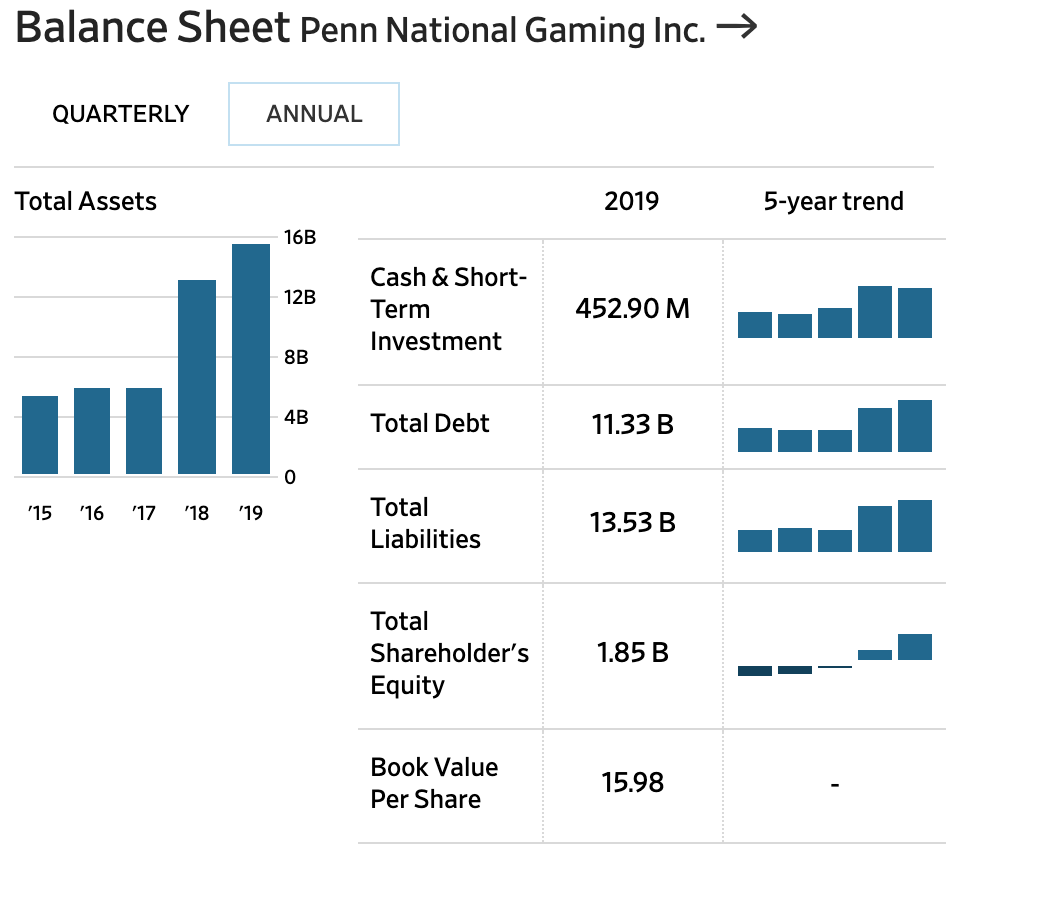

One thing that I would like to see in $PENN is lower their total debt. Luckily with their revenue/gross profit margin and expansion I think they can accomplish this fairly quick alongside rising some money through selling stock possibly. This NEEDs to be taken care of.

One thing that I would like to see in $PENN is lower their total debt. Luckily with their revenue/gross profit margin and expansion I think they can accomplish this fairly quick alongside rising some money through selling stock possibly. This NEEDs to be taken care of.

15/ CONCLUSION

I don’t own $DKNG or $PENN. We could dream all day about how we should’ve bought $PENN at $4 (now $99). Unlike Conor Mcgregor, we can’t “pretick dez tings”. @EKANardini , the CEO has done an incredible job navigating these waters - the future is bright.

I don’t own $DKNG or $PENN. We could dream all day about how we should’ve bought $PENN at $4 (now $99). Unlike Conor Mcgregor, we can’t “pretick dez tings”. @EKANardini , the CEO has done an incredible job navigating these waters - the future is bright.

16/

This is my opinion & not professional financial advice. Do your DD.

On @joincommonstock I am " @gannon" & post memos/trades

Thanks to @ycharts for the data/charts

Please give it a like/RT for the effort!

Check out my other write ups below https://rebelmarkets.substack.com/

https://rebelmarkets.substack.com/

This is my opinion & not professional financial advice. Do your DD.

On @joincommonstock I am " @gannon" & post memos/trades

Thanks to @ycharts for the data/charts

Please give it a like/RT for the effort!

Check out my other write ups below

https://rebelmarkets.substack.com/

https://rebelmarkets.substack.com/

Read on Twitter

Read on Twitter