1/ I've been though several periods when stocks rose very quickly and then "repriced down" very quickly. I didn't read about these periods in a book or papers. The best explanation that fits with my experience is Per Bak's self-organised criticality. https://www.guydcutting.com/media/SOC-ScientificAmerican-Bak-Chen.pdf

2/ If you want to understand more about how complex adaptive systems and self organized criticality impact markets I suggest you read this paper by Michael Mauboussin: "THE STOCK MARKET AS A COMPLEX ADAPTIVE SYSTEM." http://www.capatcolumbia.com/Articles/Mauboussin%20-%20CAS.pdf The paper includes this paragraph:

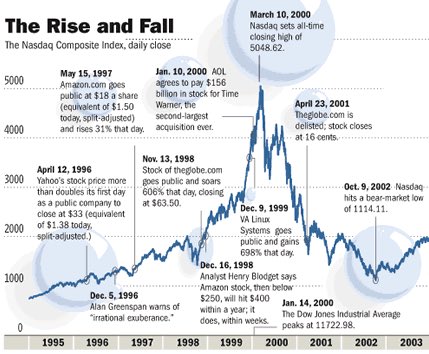

3/ My take away from my experience during periods like this one is that they fit with Per Bak's sand pile model. What this means is: I deal with the risk of possible "swift downward repricing" via asset allocation. Rather than trying to time markets I calibrate my allocations.

4/ "Once a pile of sand is of sufficient size little disturbances can cause full-fledged avalanches. We cannot understand these large changes by studying the individual grains. The system itself gains properties that we must consider separately from the individual pieces." MM

5/ How do you operationalize the ideas of Per Bak?

"You can't predict but you can prepare... There are two things I would never say when referring to the market: 'get out' and 'it’s time.' I’m not that smart, and I’m never that sure." Howard Marks. https://www.google.com/amp/s/25iq.com/2018/10/06/lessons-from-howard-marks-new-book-mastering-the-market-cycle-getting-the-odds-on-your-side/amp/

"You can't predict but you can prepare... There are two things I would never say when referring to the market: 'get out' and 'it’s time.' I’m not that smart, and I’m never that sure." Howard Marks. https://www.google.com/amp/s/25iq.com/2018/10/06/lessons-from-howard-marks-new-book-mastering-the-market-cycle-getting-the-odds-on-your-side/amp/

Read on Twitter

Read on Twitter