1/ @ArmorFi is releasing its token, $ARMOR within two hours (6PM UTC).

Source: https://armorfi.gitbook.io/armor/

The implications will be huge for $wNXM and $NXM.

Why? A thread below.

Source: https://armorfi.gitbook.io/armor/

The implications will be huge for $wNXM and $NXM.

Why? A thread below.

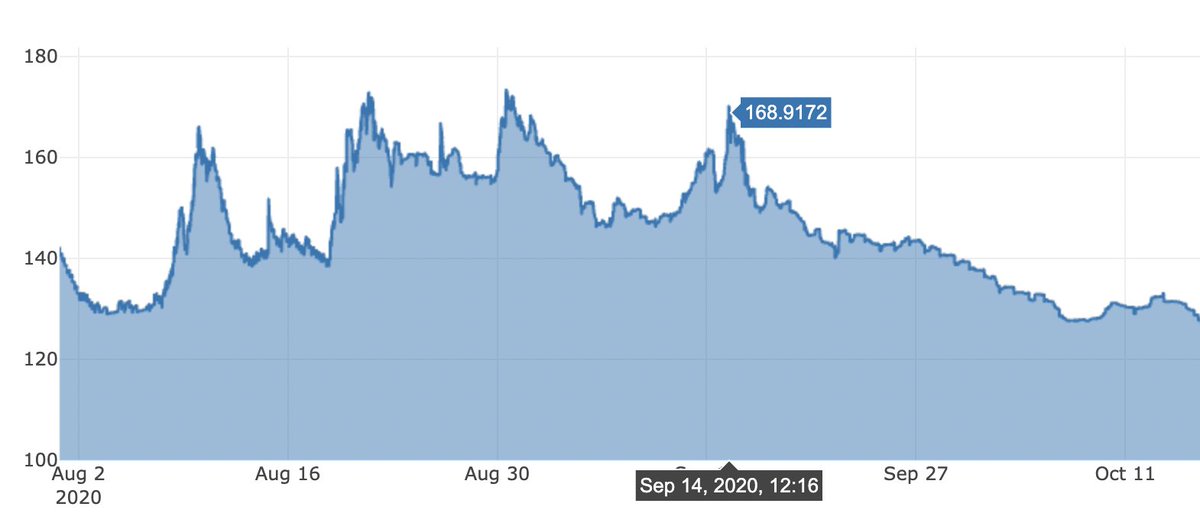

2/ Remember the $SAFE mining back then? The MCR % of $NXM hit a high of 169%, with today's capital of 162,425 ETH, that will make $NXM worth 0.239 ETH, 6x the price now.

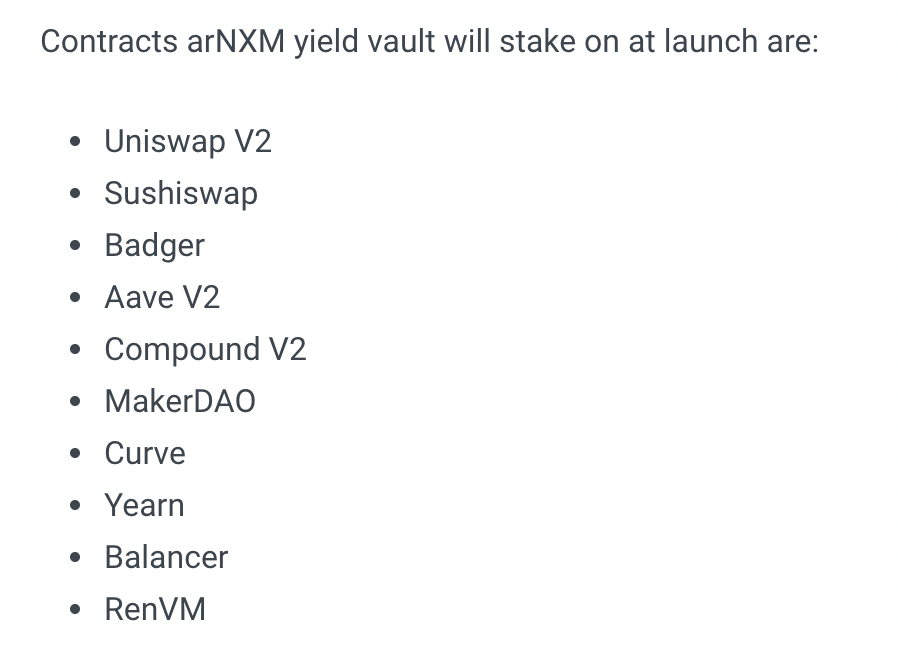

3/ Let's see what @ArmorFi is really offering. yInsure will be rebranded as arNFT, and this time, other than just being a KYC-less insurance token, it will be powering new products, namely arCORE and arSHIELD. Plus, there is a $wNXM vault named arNXM.

4/ arCORE is a pay-as-you-go insurance product, where @ArmorFi tracks the exact amounts of user funds as they dynamically move across various protocols, and bills by the second using a streamed payment system.

5/ The underlying of arCORE is basically just pooled arNFTs that are broken down and being sold at a premium. This allows much more innovative product design and really showcase the great composability of DeFi ecosystem.

6/ arSHIELD in the meantime covers LP tokens where the insurance premiums are subtracted directly from the LP's pool fees, essentially creating an insured LP token. So no payments upfront!

7/ $wNXM is a great tool for allowing people having an exposure on $NXM without the needs of KYC. But at the same time it is not the most capital efficient solution as now they are absent from the mutual's operation of staking, claim and governance voting.

8/ With arNXM, wNXM staked on @ArmorFi can be unwrapped and staked on protocols, opening up more covers. Plus all the cost of staking and claiming rewards will now be socialised across the pool. This is the $wNXM vault that we all are waiting for.

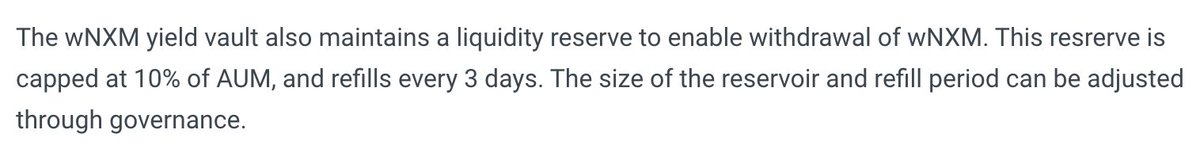

10/ arNXM stakers should be aware about the exit liquidity as only 10% of the pool will be available for withdrawal, it will only be refilled every 3 days.

11/ The liquidity programme is launching soon at https://armor.fi/arnxm-vault .

arNFT Pool Stakers: 35% of allocated LP tokens

arNXM Vault Stakers: 3% of allocated LP tokens

arNXM:ETH LP Stakers: 12% of allocated LP tokens

Governance ARMOR:ETH LP Pools: 50% of allocated LP tokens

arNFT Pool Stakers: 35% of allocated LP tokens

arNXM Vault Stakers: 3% of allocated LP tokens

arNXM:ETH LP Stakers: 12% of allocated LP tokens

Governance ARMOR:ETH LP Pools: 50% of allocated LP tokens

Read on Twitter

Read on Twitter