Easy to follow DD on $PRCH

A unique business model (a play on vertical SaaS). We see 2X potential with continued execution and large TAM ahead.

@JonahLupton @Fintech_IBank @saxena_puru @WallStJesus @MatthewMcCall @BSchulz33868165 @sunriverflow @LFGBOOM @IrnestKaplan

A unique business model (a play on vertical SaaS). We see 2X potential with continued execution and large TAM ahead.

@JonahLupton @Fintech_IBank @saxena_puru @WallStJesus @MatthewMcCall @BSchulz33868165 @sunriverflow @LFGBOOM @IrnestKaplan

1/ Business Model

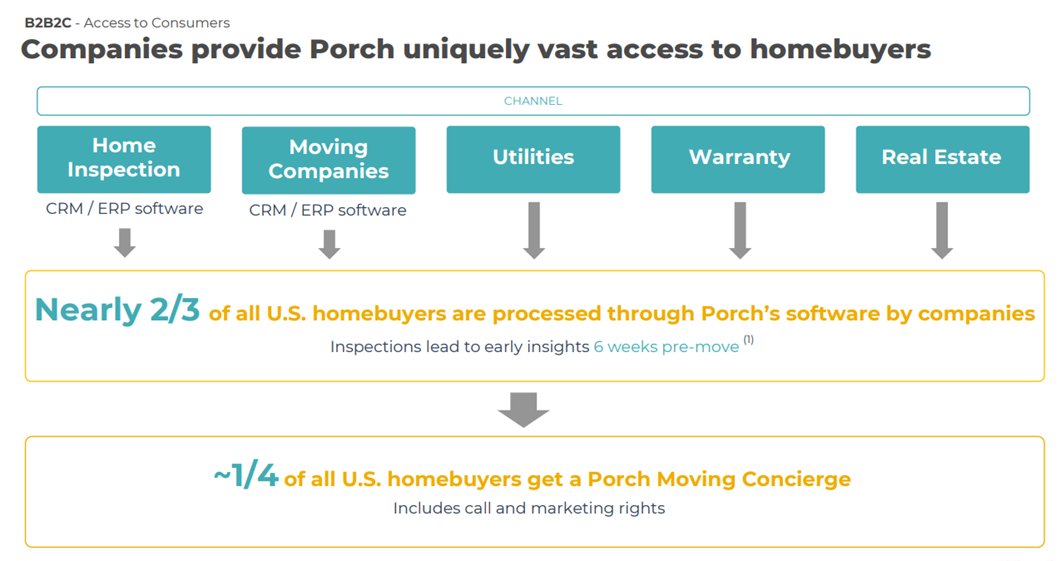

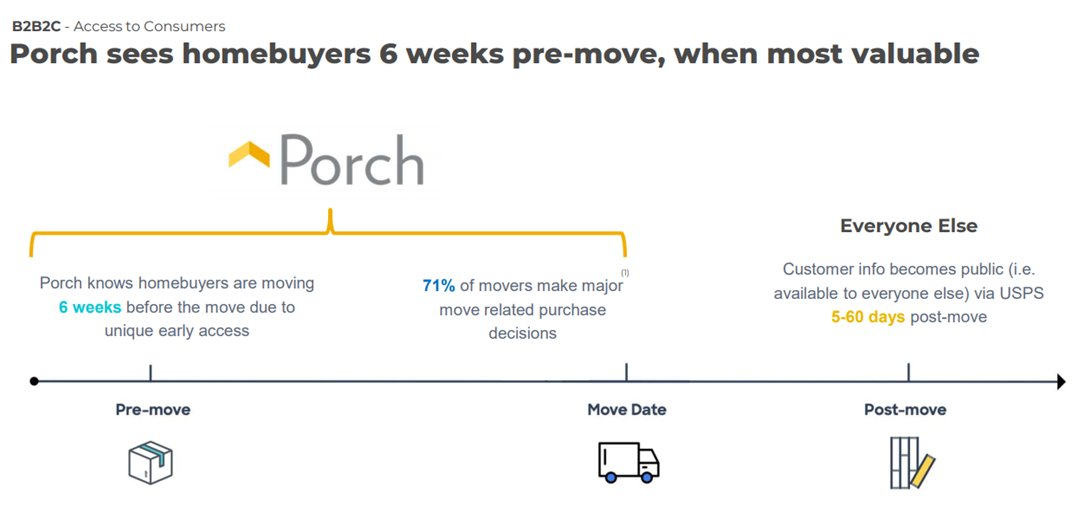

They provide CRM and ERM software to home inspectors and moving companies. These companies, in turn, can pay PRCH in SaaS fees or customer access. When they give the customer access, magic happens as 71% of home movers make big-ticket purchases before moving.

They provide CRM and ERM software to home inspectors and moving companies. These companies, in turn, can pay PRCH in SaaS fees or customer access. When they give the customer access, magic happens as 71% of home movers make big-ticket purchases before moving.

2/

PRCH unique early access (6 weeks prior to the move) allows them to act as white-glove concierge for home service across the vertical.

They provide some of these services themselves, in other cases, serve as a platform for others to do so but charge commissions

PRCH unique early access (6 weeks prior to the move) allows them to act as white-glove concierge for home service across the vertical.

They provide some of these services themselves, in other cases, serve as a platform for others to do so but charge commissions

Attractive Unit Economics

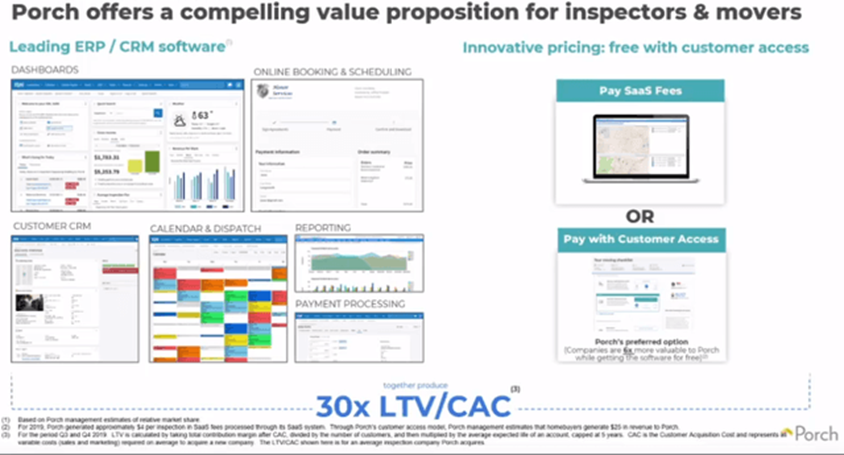

30x LTV/CAC by bundling ERP/CRM software with a customer access freemium pricing model

30x LTV/CAC by bundling ERP/CRM software with a customer access freemium pricing model

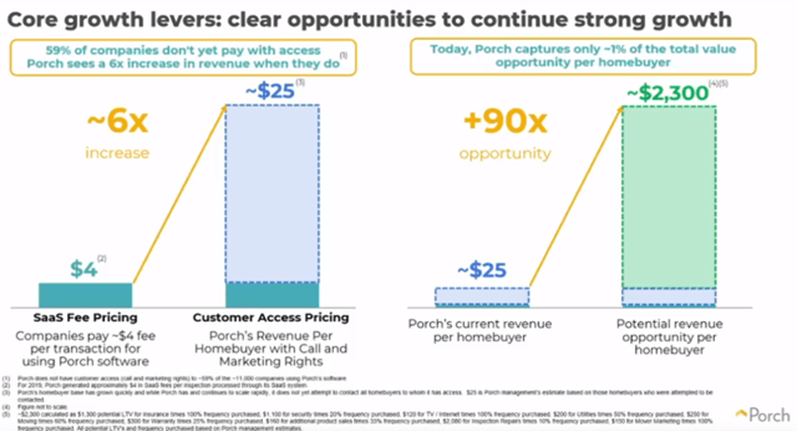

Transaction pricing model company pay either $4 or $25. 59% of companies pay via SaaS fees and 41% pay via transaction

Transaction pricing model company pay either $4 or $25. 59% of companies pay via SaaS fees and 41% pay via transaction

30x LTV/CAC by bundling ERP/CRM software with a customer access freemium pricing model

30x LTV/CAC by bundling ERP/CRM software with a customer access freemium pricing model Transaction pricing model company pay either $4 or $25. 59% of companies pay via SaaS fees and 41% pay via transaction

Transaction pricing model company pay either $4 or $25. 59% of companies pay via SaaS fees and 41% pay via transaction

The company recently made 4 acquisition

The company recently made 4 acquisitionHome of America – this acquisition will allow them to infiltrate deeper into the insurance valuee chain. They will now become both insurance brokers and underwriters. (Continued)

As they already have access to user data from home inspectors, they know about issues within new homes (walls are broken, roof leaking, etc ). Hence they can churn a lot of profit through this integration.

As they already have access to user data from home inspectors, they know about issues within new homes (walls are broken, roof leaking, etc ). Hence they can churn a lot of profit through this integration. Also, bundle the insurance - let's say home insurance with car

V12 will help them expand into mover marketing. I.e companies that want to do marketing - appliances, fumigation, etc

V12 will help them expand into mover marketing. I.e companies that want to do marketing - appliances, fumigation, etc Palm tech – Inspection report writing software. This will improve their already existing CRM for inspectors.

Palm tech – Inspection report writing software. This will improve their already existing CRM for inspectors.  IRoofing – Saas application for roofing

IRoofing – Saas application for roofing

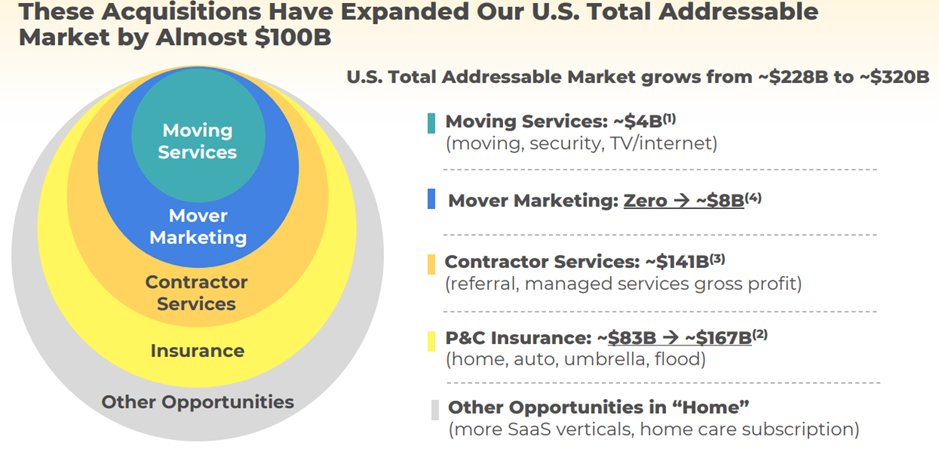

They already had a huge TAM of 230bn. Now these services have expanded that by $100bn (See below)

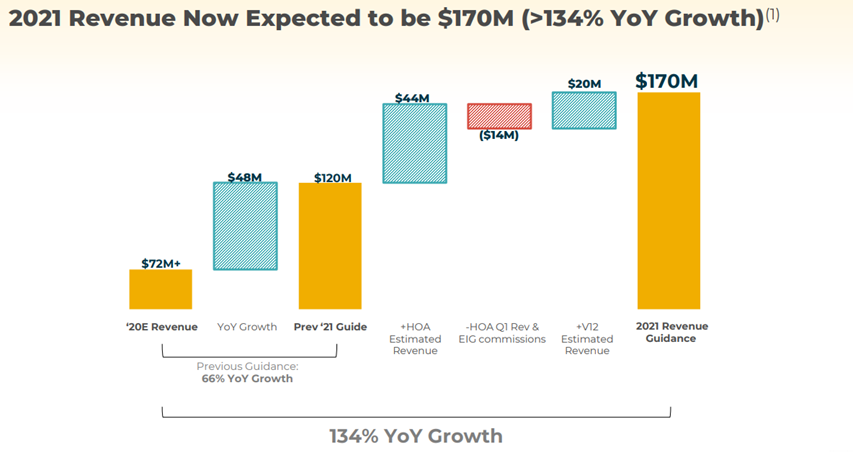

They already had a huge TAM of 230bn. Now these services have expanded that by $100bn (See below) Management has also updated their revenue guidance to $170M after these acquisitions from $120M earlier (See below)

Management has also updated their revenue guidance to $170M after these acquisitions from $120M earlier (See below)

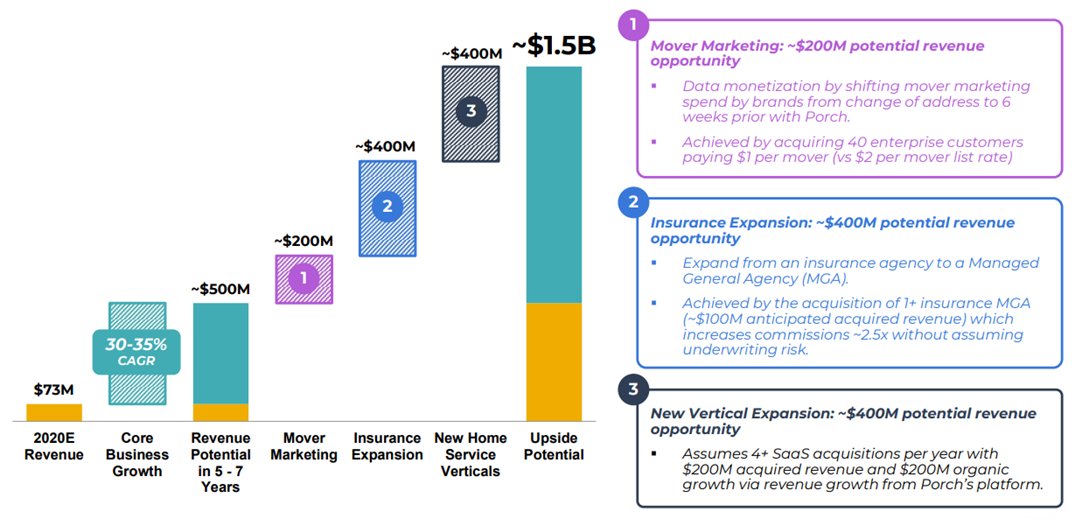

Their Long run revenue expectation is a whopping 1.5B. Given the large TAM and the aggressive acquisition strategy, we feel it's doable.

Their Long run revenue expectation is a whopping 1.5B. Given the large TAM and the aggressive acquisition strategy, we feel it's doable. 80%+ Gross margin and EBITDA margin Long Term is expected to be 25%

80%+ Gross margin and EBITDA margin Long Term is expected to be 25%

Can they Deliver and unlock value?

Before becoming publicly listed $PRCH promised 4 acquisitions this year – they delivered. Good sign

Before becoming publicly listed $PRCH promised 4 acquisitions this year – they delivered. Good sign

ISN their previous acquisition has grown 5x in revenues and Hire a Helper 3x in revenue

ISN their previous acquisition has grown 5x in revenues and Hire a Helper 3x in revenue

(Continued)

Before becoming publicly listed $PRCH promised 4 acquisitions this year – they delivered. Good sign

Before becoming publicly listed $PRCH promised 4 acquisitions this year – they delivered. Good sign ISN their previous acquisition has grown 5x in revenues and Hire a Helper 3x in revenue

ISN their previous acquisition has grown 5x in revenues and Hire a Helper 3x in revenue(Continued)

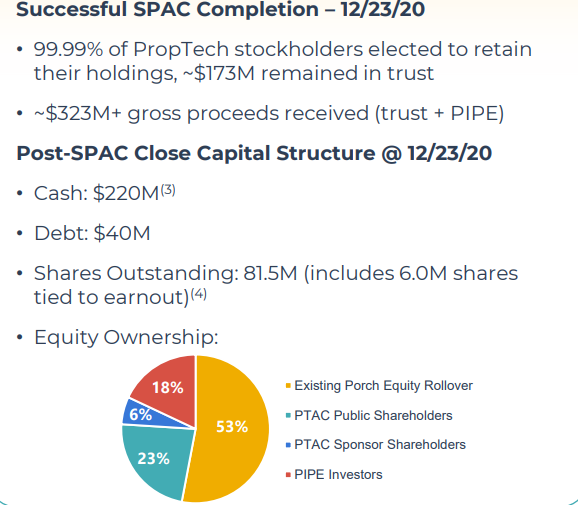

The reason for the SPAC was to add liquidity and recognition, so they could do more acquisitions - quickly

The reason for the SPAC was to add liquidity and recognition, so they could do more acquisitions - quickly 99% of shareholders retained their holding after the SPAC, including a VC firm. This means they have confidence in $PRCH and their growth is in the early innings atm.

99% of shareholders retained their holding after the SPAC, including a VC firm. This means they have confidence in $PRCH and their growth is in the early innings atm.

Risks

Open Door and other competitors might able to front-run Porch. Is this the reason why PRCH is moving so fast?

Open Door and other competitors might able to front-run Porch. Is this the reason why PRCH is moving so fast?

Can they repeatedly service the same homeowner, or is it just during the initial moving journey? It isn't easy to do the later

Can they repeatedly service the same homeowner, or is it just during the initial moving journey? It isn't easy to do the later

(Continued)

Open Door and other competitors might able to front-run Porch. Is this the reason why PRCH is moving so fast?

Open Door and other competitors might able to front-run Porch. Is this the reason why PRCH is moving so fast? Can they repeatedly service the same homeowner, or is it just during the initial moving journey? It isn't easy to do the later

Can they repeatedly service the same homeowner, or is it just during the initial moving journey? It isn't easy to do the later(Continued)

Data Privacy? They obtain data from their SaaS products which home inspector ane other service provider use

Data Privacy? They obtain data from their SaaS products which home inspector ane other service provider use Execution risk as the company has forecasted aggressive TAM and Revenue growth?

Execution risk as the company has forecasted aggressive TAM and Revenue growth?

Valuation

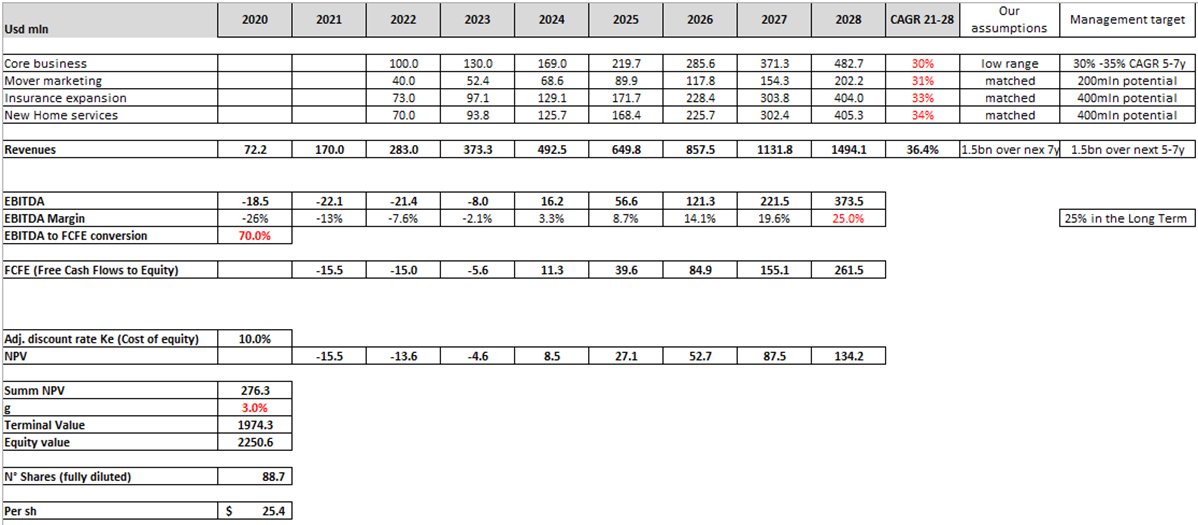

Based on our DCF model, we obtain a target price of $25.4. Representing 50% upside from current prices.

Based on our DCF model, we obtain a target price of $25.4. Representing 50% upside from current prices.

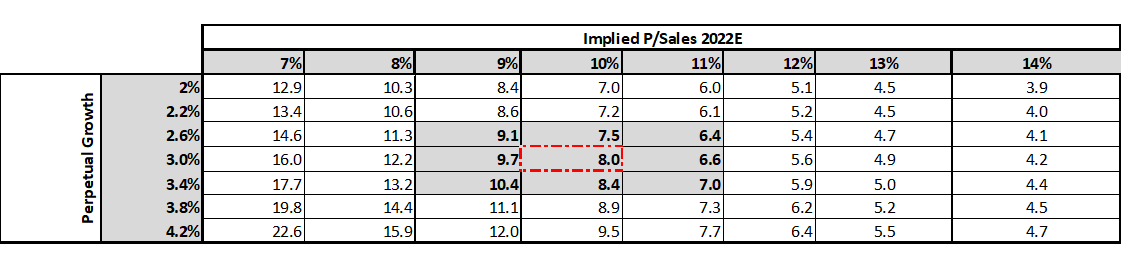

With Implied P/Sales (2022E) at multiple of 8, sounds yummy given large TAM untapped with massive growth still lying ahead

With Implied P/Sales (2022E) at multiple of 8, sounds yummy given large TAM untapped with massive growth still lying ahead

Based on our DCF model, we obtain a target price of $25.4. Representing 50% upside from current prices.

Based on our DCF model, we obtain a target price of $25.4. Representing 50% upside from current prices. With Implied P/Sales (2022E) at multiple of 8, sounds yummy given large TAM untapped with massive growth still lying ahead

With Implied P/Sales (2022E) at multiple of 8, sounds yummy given large TAM untapped with massive growth still lying ahead

However, our sensitivity analysis shows if the assumption is conservative, at current prices PRCH is fairly valued. I.e 13% discount rate

However, our sensitivity analysis shows if the assumption is conservative, at current prices PRCH is fairly valued. I.e 13% discount rate

Conclusion

PRCH is trying to make a fragmented market of Home Services into a complete market in the US. I.e What Amazon did vs retailers.

PRCH is trying to make a fragmented market of Home Services into a complete market in the US. I.e What Amazon did vs retailers.

Early access of the client.High-Quality data. Variety of services will create moats - economy of scale and barriers of entry.

Early access of the client.High-Quality data. Variety of services will create moats - economy of scale and barriers of entry.

PRCH is trying to make a fragmented market of Home Services into a complete market in the US. I.e What Amazon did vs retailers.

PRCH is trying to make a fragmented market of Home Services into a complete market in the US. I.e What Amazon did vs retailers. Early access of the client.High-Quality data. Variety of services will create moats - economy of scale and barriers of entry.

Early access of the client.High-Quality data. Variety of services will create moats - economy of scale and barriers of entry.

Feel free to join our Telegram chat for investment/trade ideas: https://t.me/joinchat/J90VAhuJOZsEBhm

Follow us on seeking alpha https://seekingalpha.com/author/moat-investing/followers

Follow us on seeking alpha https://seekingalpha.com/author/moat-investing/followers

Read on Twitter

Read on Twitter