Today we have published 'Building a Living Pension' - supported by @AvivaUK - which examines how much is needed for an adequate income in retirement, the level of savings required to reach that target, and how it could delivered through a 'Living Pension'. A short thread...

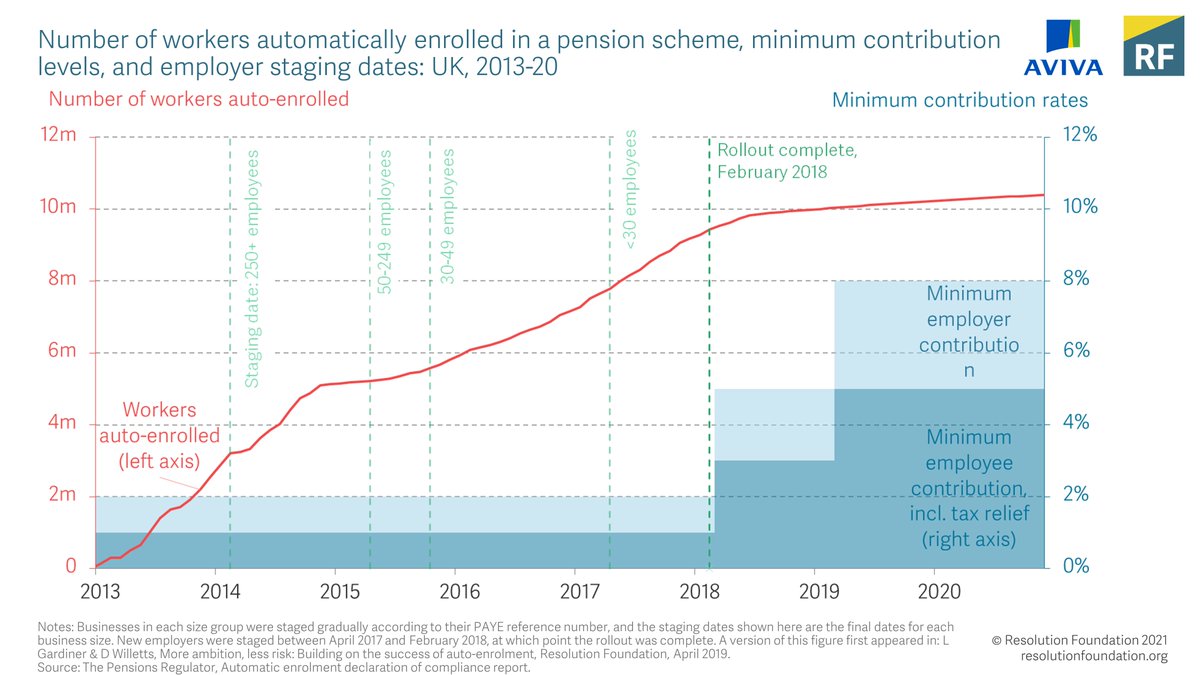

The welcome context to this report is auto-enrolment, which has has led to a significant increase in those saving into a private pension since its introduction in 2012.

However, despite this progress, pension savings remain low for many groups – with around 42 per cent of employees in the bottom half of the income distribution (with no significant Defined Benefit pension entitlement) reporting no pension wealth.

There has been a gradual rise in the numbers of lower-income employees reporting pension saving since the introduction of auto-enrolment, but savings remain low.

A Living Pension, providing a clear target for an adequate income in retirement could help to rectify this – and this report sets out a methodology based on the steps below.

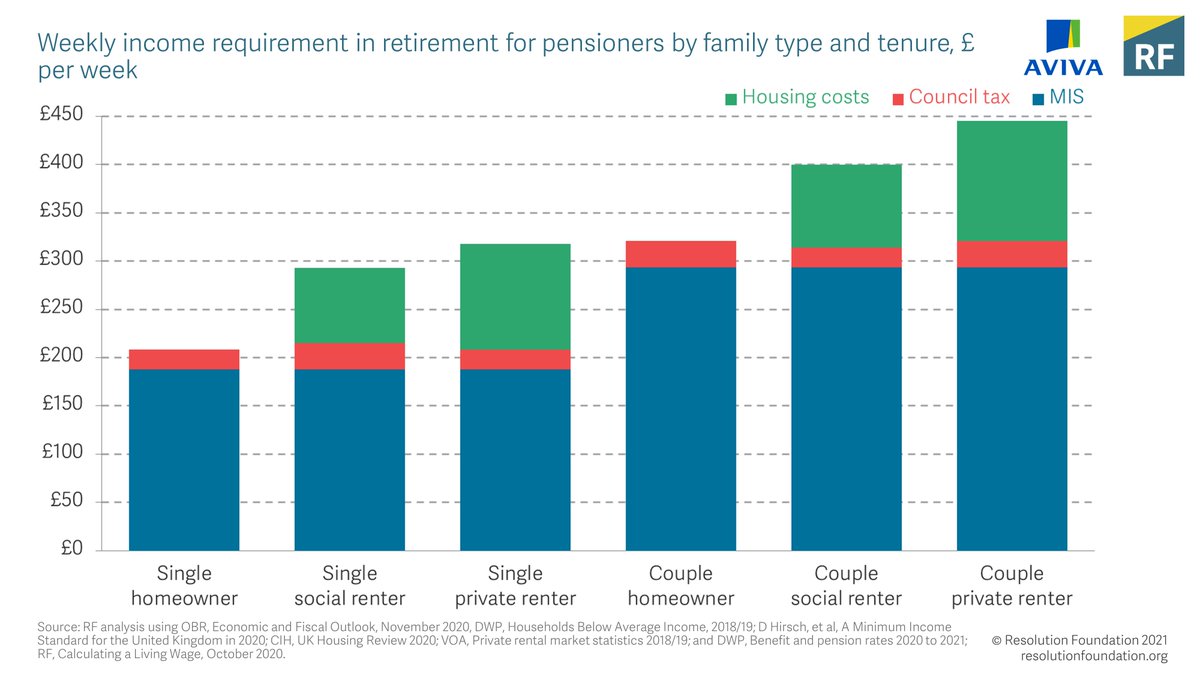

A key figure is the target income needed to achieve an adequate level of living standards in retirement, which can be based on calculations of an adequate income, including the likely housing costs future pensioners might face.

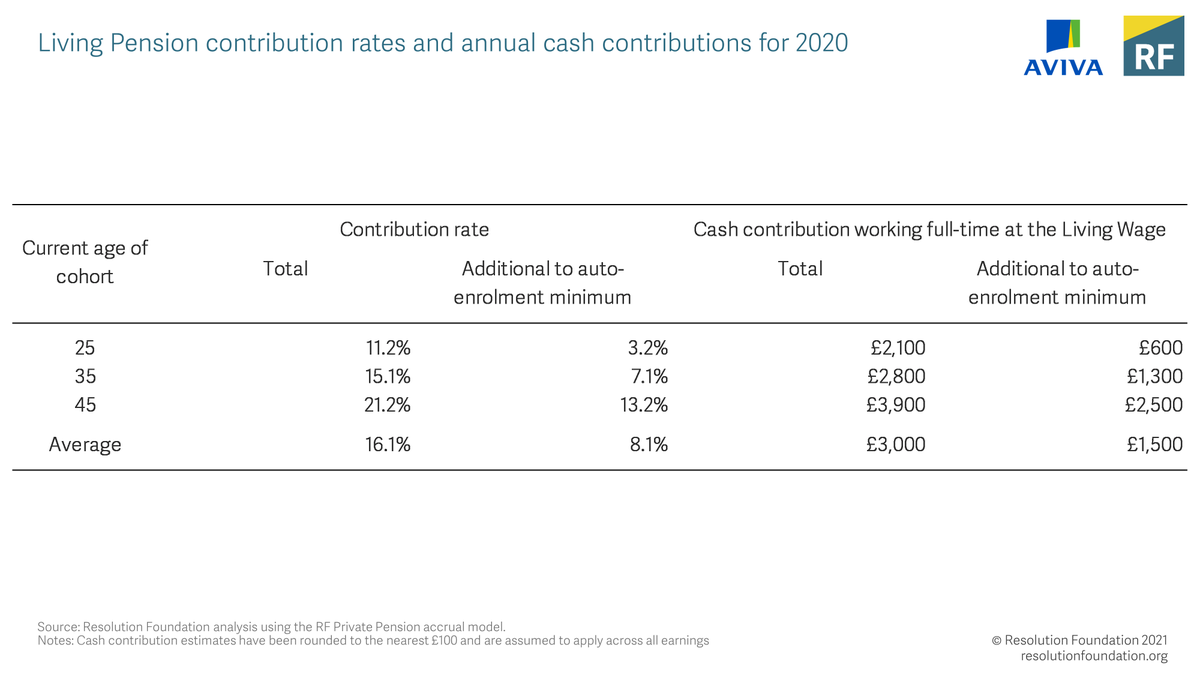

Taking this together with a range of assumptions, including earning trajectories through life, would suggest an average employee would need to save £3000 a year to reach the Living Pension target – or an extra £1500 above auto-enrolment requirements.

Where next for our 'Living Pension' proposal? The @LivingWageUK will explore the proposal with employers, in a project supported by @standardlifefdn - using the expertise they've amassed from the hugely successful Living Wage campaign,

And we'll be discussing the idea with Pensions Minister @GuyOpperman @FT Global pensions correspondent @JosephineCumbo and Lord Willetts in a webinar at 11am on Monday (25th). Register to watch and submit questions here https://www.resolutionfoundation.org/events/a-living-pension/

Read on Twitter

Read on Twitter