0/ Following is my current market outlook viewed through the lens of how I would identify a good entry point if I were currently out of the market but looking to buy (back) in.

1/ First things first: one day, a trend does not make. While I’m certainly relieved to see the correction relent, I’m not convinced we’re out of the woods just yet. We need to see reduced volatility on decent volume across several consecutive days first, IMO.

2/ To add insult to injury, we’re rolling into a weekend, where retail still dominates (though no longer exclusively) and volume is typically lower than weekdays. For this reason, I don’t think the upcoming weekend will tell us much of anything about the longer-term trend.

3/ I therefore wouldn’t buy based on this weekend’s PA, regardless of what happens. Instead, I would take my cues from moving averages.

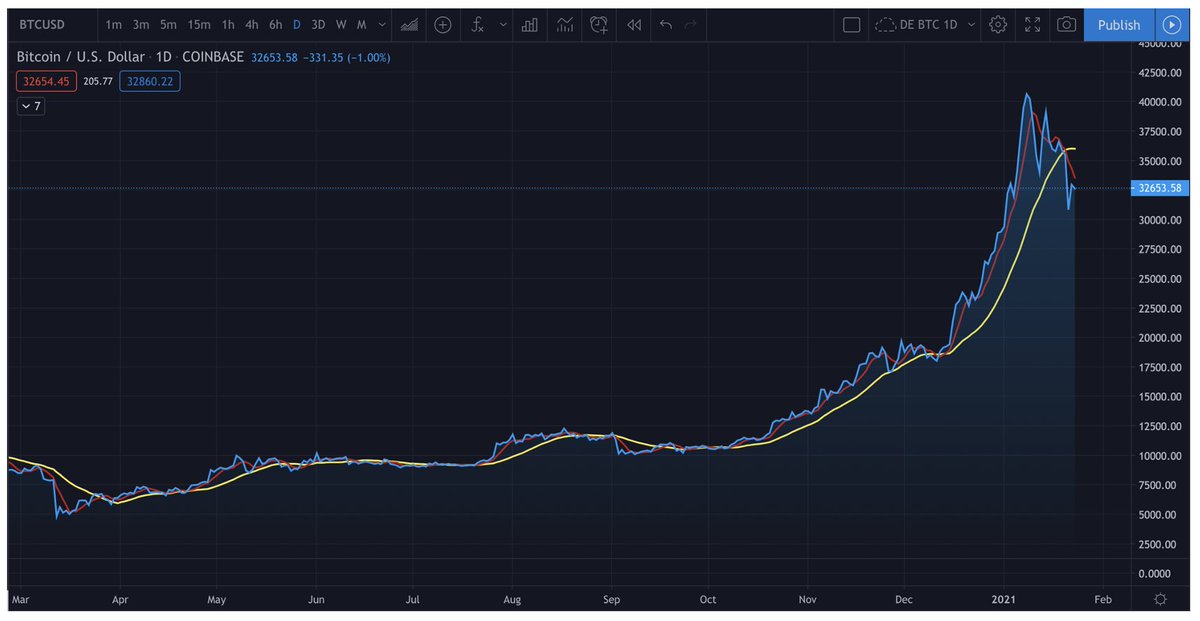

4/ See the attached chart. The red line is the 5DMA; the yellow line is the 20DMA. If I were looking to buy (back) in, there are two approaches I would consider. The more aggressive approach would be to buy after the 5DMA and 20DMA both resume an upward trend.

5/ The more conservative approach would be to buy not only after they both resume an upward trend, but also after the 5DMA closes above the 20DMA. Although this latter approach means I would buy even higher, I would have greater confirmation of the trend reversal.

6/ As shown in the attached chart, the 5DMA is clearly trending down and the 20DMA is rolling over to boot. For this reason, despite today’s bounce and other bullish indicators (increased whale accumulation, negative funding rates, etc.), now is NOT a safe entry point, IMO.

7/ In other words, I personally wouldn’t buy back in until I see both the 5DMA and 20DMA resume their upward trend. In the attached chart, red squares show where corrections started and green squares show where the 5DMA closed above the 20DMA (i.e., good entry points).

8/ Long and short, while I’m relieved by today’s bounce, the current micro-trend is still a series of lower highs and lower lows, so until that trend reverses, further corrections are completely plausible (I know, an unsavory prospect, but still a possibility unfortunately).

9/ Looking ahead, I also think we’ll face considerable resistance at $37.5K and at the current ATH ~$42K (FWIW, I don’t think $40K will actually provide that much resistance). It would take too long to explain my rationale for these price targets, but the larger point is this…

10/ Even if we have indeed stanched the bleeding now and are beginning to resume our climb north, I think we’ll have some bumps along the way until we finally push through $42K once and for all. In other words…

11/ We are no longer in a price discovery phase. We have clear price points that serve as psychological anchors for both bulls and bears. As such, I think we’ll have some chop over the coming weeks until/unless a meaningful catalyst emerges.

12/ For example:

a. A big position ($100M+) taken by a lesser-known corporate entity (like MicroStrategy).

b. A position of any size initiated by a conservative institution (like MassMutual).

c. A position of any size initiated by a popular corporate entity (e.g., Big Tech).

a. A big position ($100M+) taken by a lesser-known corporate entity (like MicroStrategy).

b. A position of any size initiated by a conservative institution (like MassMutual).

c. A position of any size initiated by a popular corporate entity (e.g., Big Tech).

13/ What I do NOT think would necessarily catalyze the market sufficiently is, e.g., the announcement of another potential future investment (e.g., like the BlackRock SEC filing) or yet another billionaire stating that they think #BTC  is not the black plague after all.

is not the black plague after all.

is not the black plague after all.

is not the black plague after all.

14/ Therefore, in the absence of a meaningful catalyst, I think we’re potentially entering an extended period of consolidation, which frankly is a good thing long-term if not particularly fun in the short term. And we might yet still see further slides before finding bedrock.

15/ i.e., While I certainly hope the slide has run its course for our collective mental health, even if not, I unflinchingly believe we are still in the early stages of an epic macro bull run despite the short-term roller coaster we are on.

16/ I realize the charts I posted are too zoomed out to be fully illustrative, so I’ll post a zoomed in chart when we’re getting closer to what I consider to be a safe (re)entry point. But again, that time is not now, IMO. But hopefully it will be soon.

Go #BTC

.

.

Go #BTC

.

.

Read on Twitter

Read on Twitter