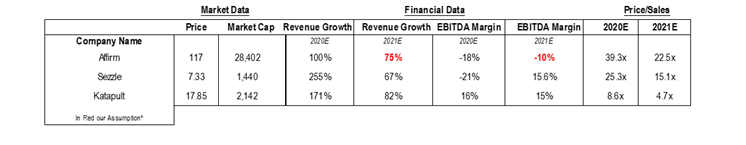

1) We feel the discount against comparables partly reflects $FSRV risk, unable to acquire Katapult. Once the acquisition closes, we think the valuation will expand and converge to a level seen by its peers.

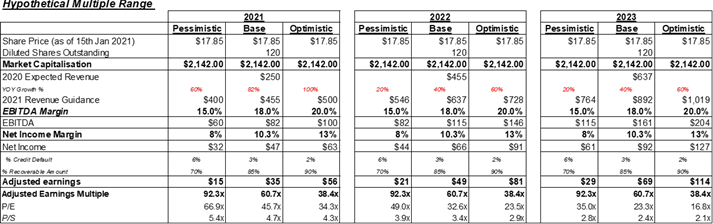

2)Even under our pessimistic scenario analysis, where we accounted for credit risk and execution risk (on hyper-growth estimates), stock still turned out to be cheaper relative to its peers. We feel that at the current price level, $FSRV is a buy

3) Credit risk is still an issue. One can understand it by looking at it from a risk to reward perspective. If they generate a 7% default rate (more than 2X their estimate), if they compensate this through profit earned from the rest of the 93% sales, risk-reward remains

4) Also new fiscal stimulus in the US will allow the non-prime customers to duly make their payment. After that, COVID recovery will also prove to be a nice tailwind.

You can read our full analysis below: https://seekingalpha.com/article/4400407-finserv-acquisition-katapult-good-bad-and-unknown

Read on Twitter

Read on Twitter