Companies with exposure to federal land (e.g. $DVN / $OXY / $EOG / $MUR) are expectedly reacting quite negatively to this 60-day freeze...

But is the reaction justified? https://twitter.com/josh_young_1/status/1352325636640157699

But is the reaction justified? https://twitter.com/josh_young_1/status/1352325636640157699

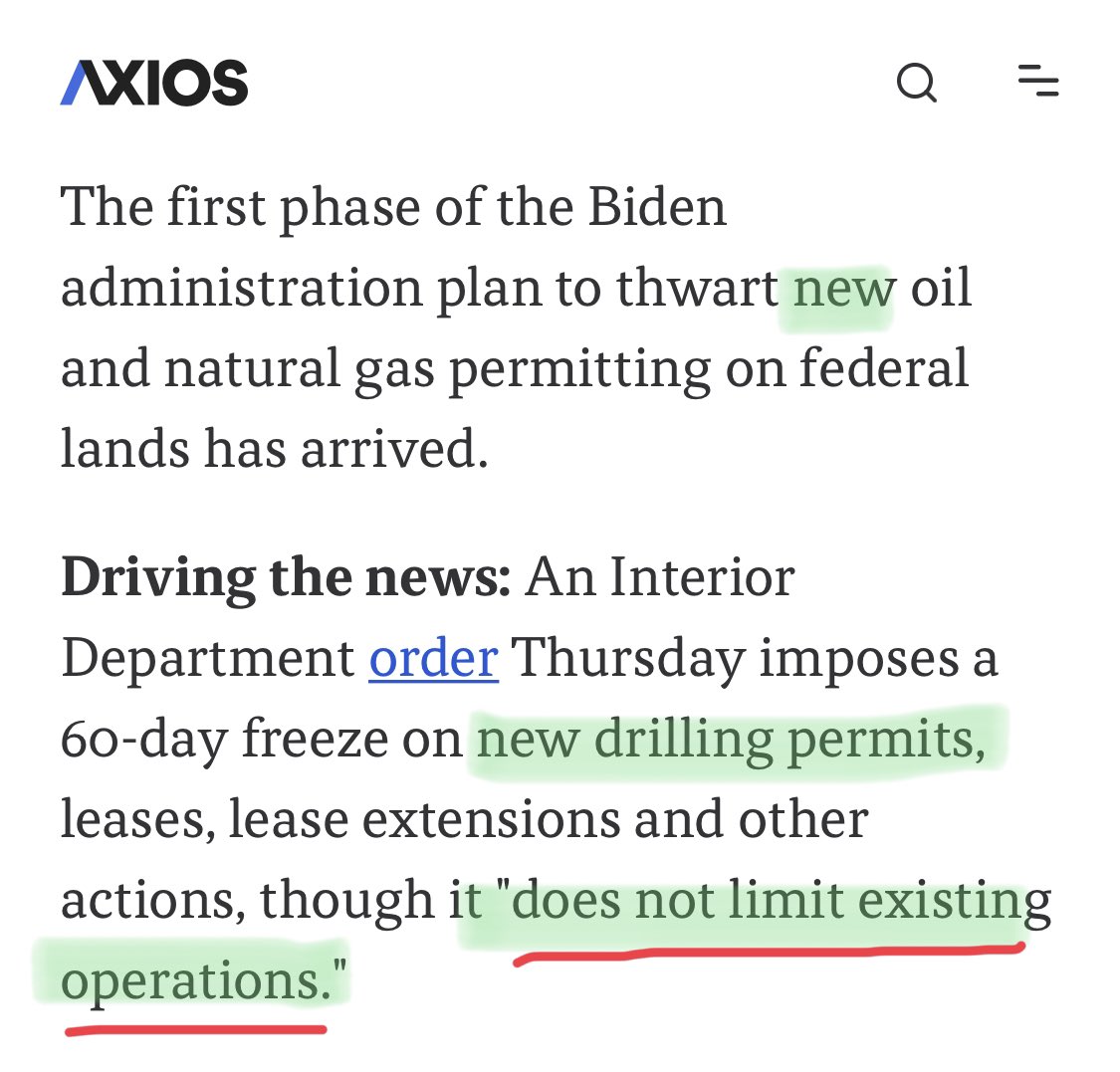

1- Importantly, the freeze does not apply to existing permits, and most of these companies have already secured years of drilling permits on federal land in advance of the freeze. They also have lots of private acreage and can pretty easily pivot production toward those areas.

2- For exposed players, the time ahead might be choppy, at least until greater clarity is reached on the specifics of Biden’s energy policy.

Will he extend the 60-day freeze and/or expand its scope? This perception of uncertainty in the space, some say, may hurt multiples.

Will he extend the 60-day freeze and/or expand its scope? This perception of uncertainty in the space, some say, may hurt multiples.

3- Then again, it’s not hard to imagine how the uncertainty could instead prove to be a boon; that is, if it serves to discourage producers from ramping up production (and instead paying down debt, or doing buybacks and dividends) as prices rise.

@contrarian8888 says it well. https://twitter.com/contrarian8888/status/1352390341823930369

https://twitter.com/contrarian8888/status/1352390341823930369

@contrarian8888 says it well.

https://twitter.com/contrarian8888/status/1352390341823930369

https://twitter.com/contrarian8888/status/1352390341823930369

4- And prices will rise, because, well, that’s what happens when you place restrictions on production. On that, we all agree. https://twitter.com/hfi_research/status/1352681437950996480

Read on Twitter

Read on Twitter