So here's some thought for your Friday. It's been doing the rounds on social media... talking Survivorship Bias and how we view data. Thread below:

#investments #strategy

#investments #strategy

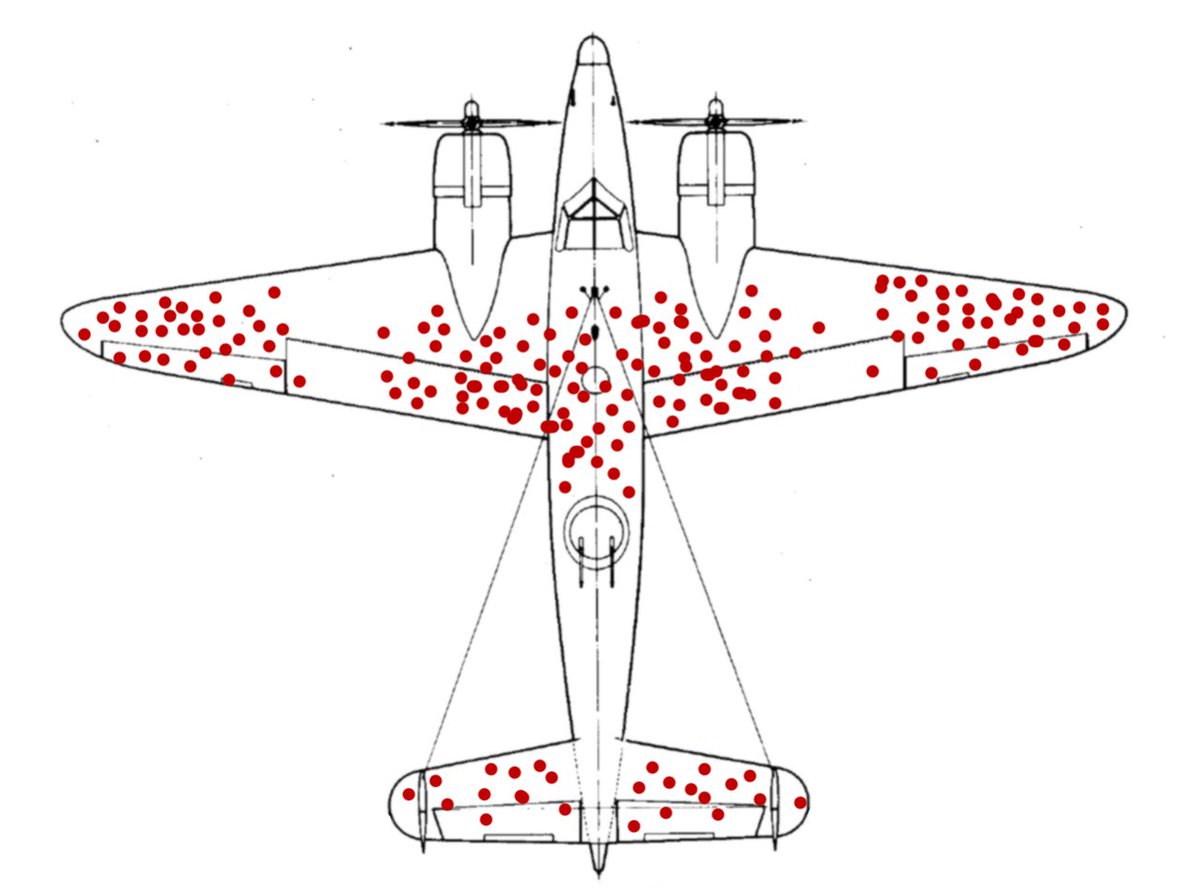

In WW2, the US had this schematic of damage done to bombers after they returned from missions. They recommended adding armor to the areas most hit to bolster the planes ability to withstand fire...

However, a statistician called Abraham Wald advised that they actually increase armor in the areas least hit. The reason was that survivorship bias meant they were only looking at the aircraft that survived.

As such, the planes that were hit in the areas where the data showed the 'least' hits were likely 'taken down' by fire in those areas... the counterintuitive was vital in this instance in that it was the data they WERENT seeing that was key!

It is important to consider contrary points of view and to consider problems from all angles , even with regards to our #investments. #behavioural finance is an important field in this regard.

This is why on my blog, I like to consider pro's and cons to themes I am looking at. I dont have all the answers and want to hear your views too! That way we all learn and create a richer investment universe! Subscribe to my free newsletter and blog here: https://moe-knows.com/blog/

Read on Twitter

Read on Twitter