What’s the reasoning behind $JD and $BABA to have approximately equal revenue, but much different valuations?

In Q3 2020, JD recorded a revenue of 25.7 billion USD whereas Alibaba recorded 22.8 billion USD. Meanwhile, JD is valued at P/S = 1.3 with Alibaba at 7.3. How come?

In Q3 2020, JD recorded a revenue of 25.7 billion USD whereas Alibaba recorded 22.8 billion USD. Meanwhile, JD is valued at P/S = 1.3 with Alibaba at 7.3. How come?

Well, $JD does not generated the same amounts of profits. For Q3 2020, $BABA had an EBIT margin at 38% of revenue for ecommerce. Contrary to this, JD were at 4%.

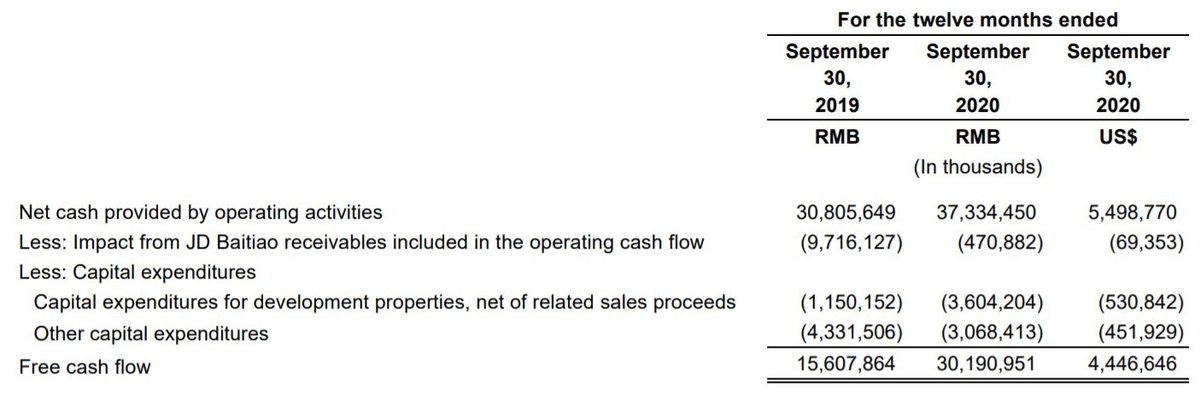

But.. the profitability of JD is growing rapidly, doubling their FCF on YoY basis

But.. the profitability of JD is growing rapidly, doubling their FCF on YoY basis

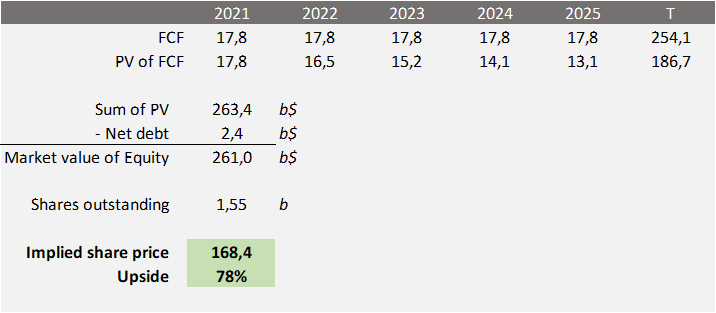

If we assume that $JD has a FCF of 4.4 billion USD, as in Q3 2020, for each quarter in eternity, a simple DCF valuation would argue an upside of +78%.

In my view, this is quite conservative

Assumptions: WACC = 8%, g = 1%

In my view, this is quite conservative

Assumptions: WACC = 8%, g = 1%

Conclusion: I see much more than a 78% upside

The path of profitability has just begun for $JD. It is already significantly undervalued. They're increasing revenue at around 30% YoY, meanwhile their margins are improving greatly. Great low-risk/high-reward case

The path of profitability has just begun for $JD. It is already significantly undervalued. They're increasing revenue at around 30% YoY, meanwhile their margins are improving greatly. Great low-risk/high-reward case

What do you think, @FromValue?

Read on Twitter

Read on Twitter