1/ The customer bank.

How did Starbucks get a $1.269B loan at a negative 10% interest rate from its customers?

Here's how:

How did Starbucks get a $1.269B loan at a negative 10% interest rate from its customers?

Here's how:

2/ Every day we wake up 64% of Americans drink at least one cup of coffee.

As a result, Starbucks goes through on average 8,070,428 cups per day.

But how do their customers pay for the coffee and sous vide egg bites?

As a result, Starbucks goes through on average 8,070,428 cups per day.

But how do their customers pay for the coffee and sous vide egg bites?

3/ Launched in 2008, the Starbucks Reward Loyalty Program had 16 million active members (as of March 2019)...and damn are these users loyal

Starbucks attributes 40% of its total sales to the Rewards Program and has seen same-store sales rise by 7%

But why does this matter?

Starbucks attributes 40% of its total sales to the Rewards Program and has seen same-store sales rise by 7%

But why does this matter?

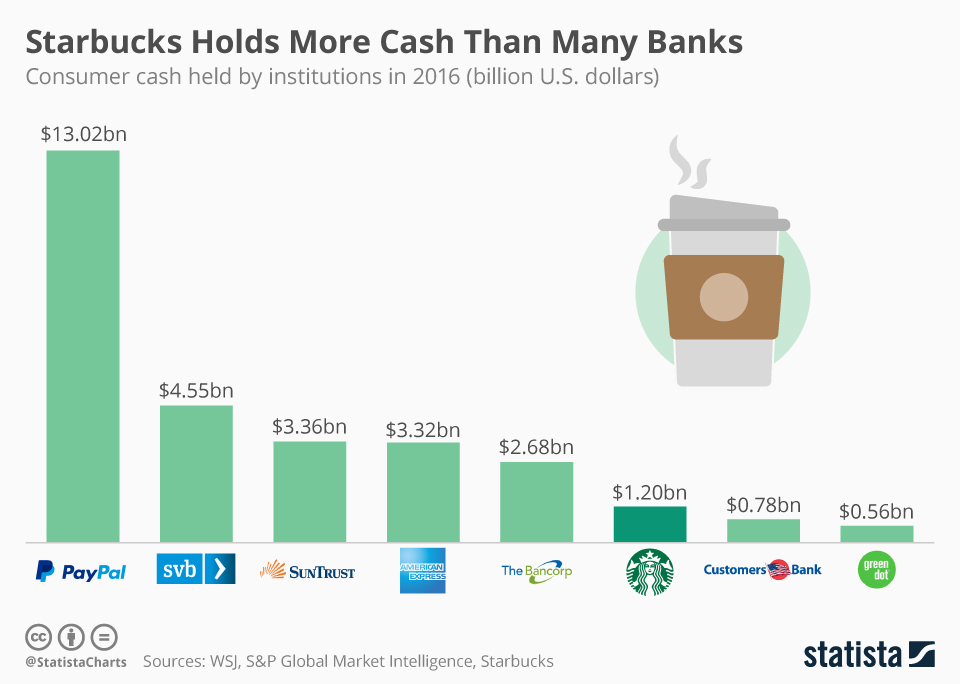

4/ Well, not only does the Starbucks app make you load it up with the money to pay, but according to wallet hub they're also the #5 most popular gift card in the world

As a result, Starbucks had $1.6B from its customer's money sitting in "stored value card liabilities"

And...

As a result, Starbucks had $1.6B from its customer's money sitting in "stored value card liabilities"

And...

5/ They know that the only thing you can buy with that card is stuff from Starbucks.

So, they're able to use that cash to fund operations and investments.

But why -10%?

So, they're able to use that cash to fund operations and investments.

But why -10%?

6/ Well, remember how many times you've lost a gift card, forgot to download an app again on your new phone or left the card in your jeans and now can't read that code after they went through the washer?

You're not alone.

You're not alone.

Read on Twitter

Read on Twitter