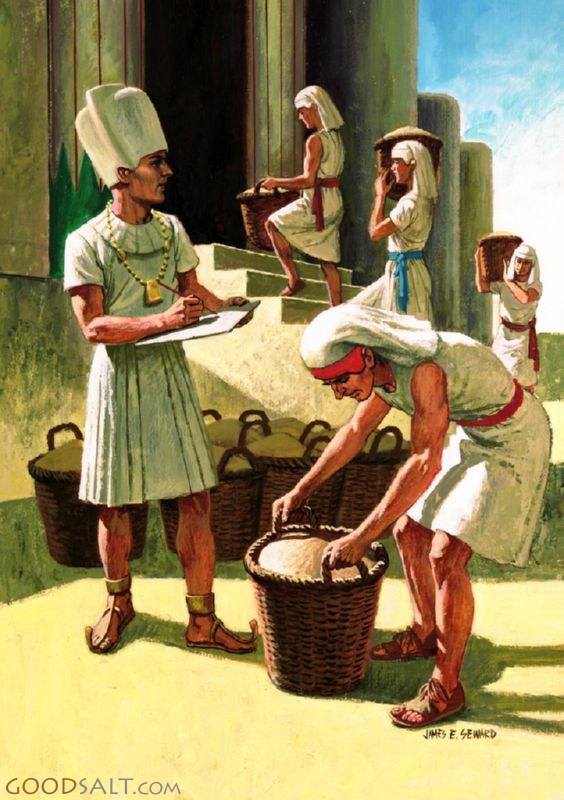

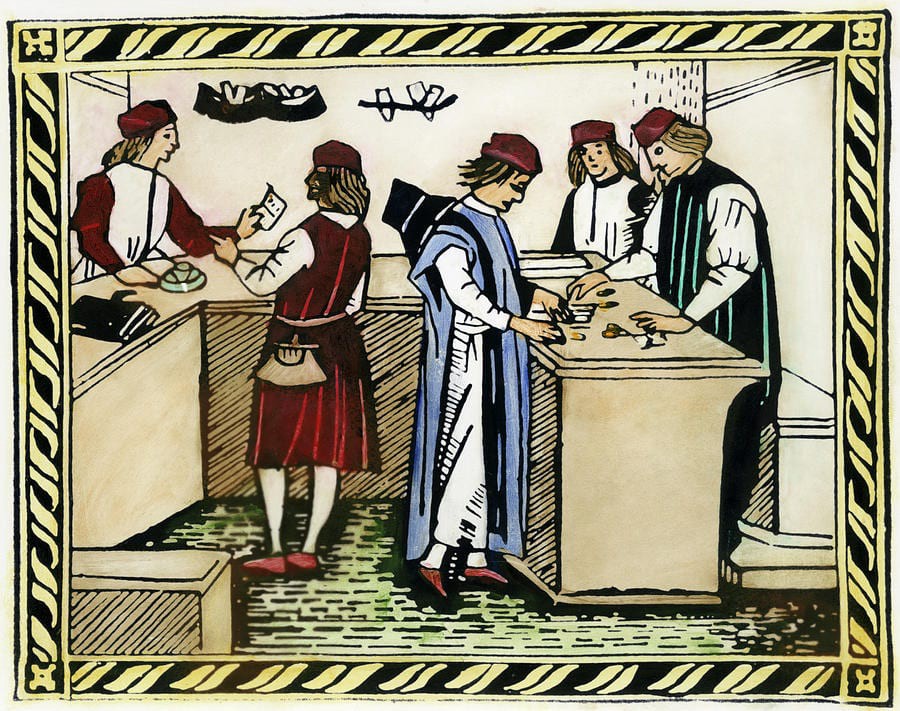

Banking began with the first prototype banks which were the merchants of the world, who gave grain loans to farmers and traders who carried goods between cities.

Around 2000 BC in Assyria, India and Sumeria and later in ancient Greece and during the Roman Empire, lenders based in temples gave loans, while accepting deposits and performing the change of money.

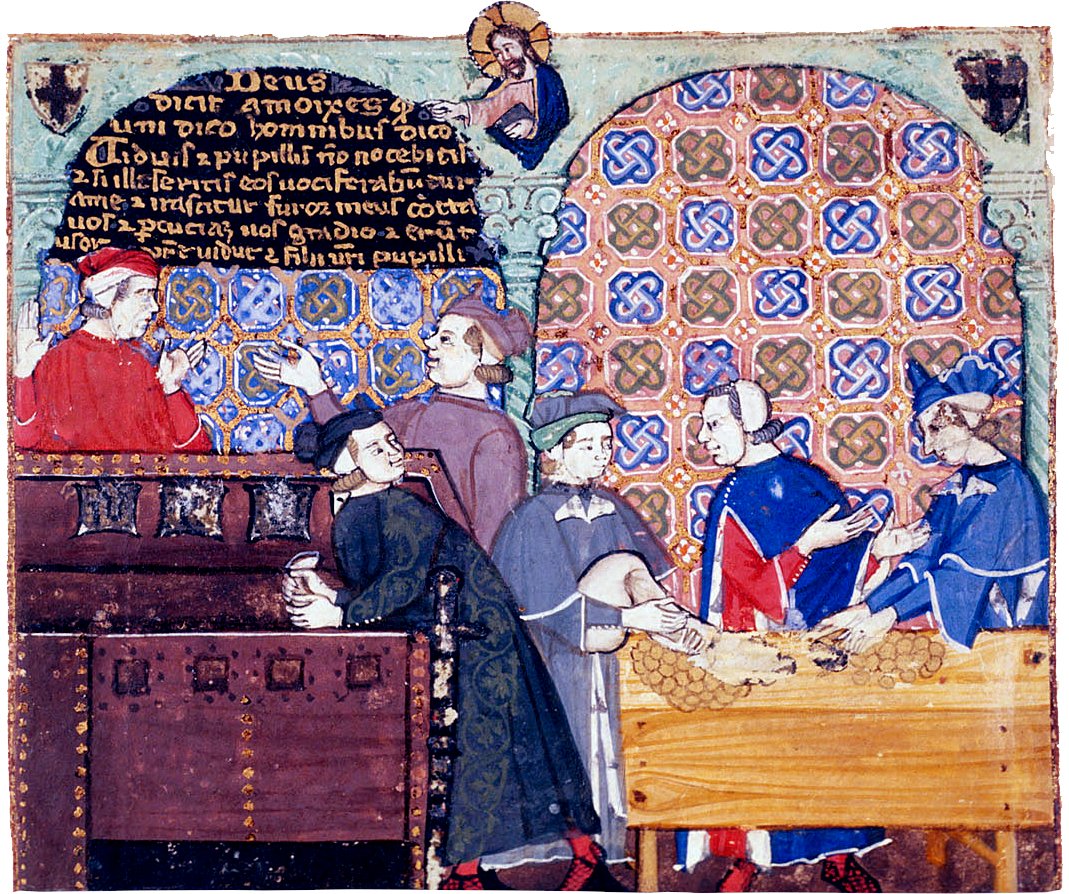

History positions the historical development of banking to medieval and Renaissance Italy and the cities of Florence, Venice and Genoa.

The Bardi and Peruzzi Families dominated banking in 14th century Florence, establishing branches in many other parts of Europe.

The Bardi and Peruzzi Families dominated banking in 14th century Florence, establishing branches in many other parts of Europe.

From 1342 to 1345 members of both companies were arrested for bankruptcy and released only on renunciation of all claims to interest, and the English crown canceled massive debts to the Peruzzi.

The oldest bank still in existence is Banca Monte dei Paschi di Siena, headquartered in Siena, Italy, which has been operating continuously since 1472.

Development of banking spread from northern Italy throughout the Holy Roman Empire, and in the 15th and 16th century to northern Europe.

During the 20th century, developments in telecommunications and computing caused major changes to banks' operations and let banks dramatically increase in size and geographic spread.

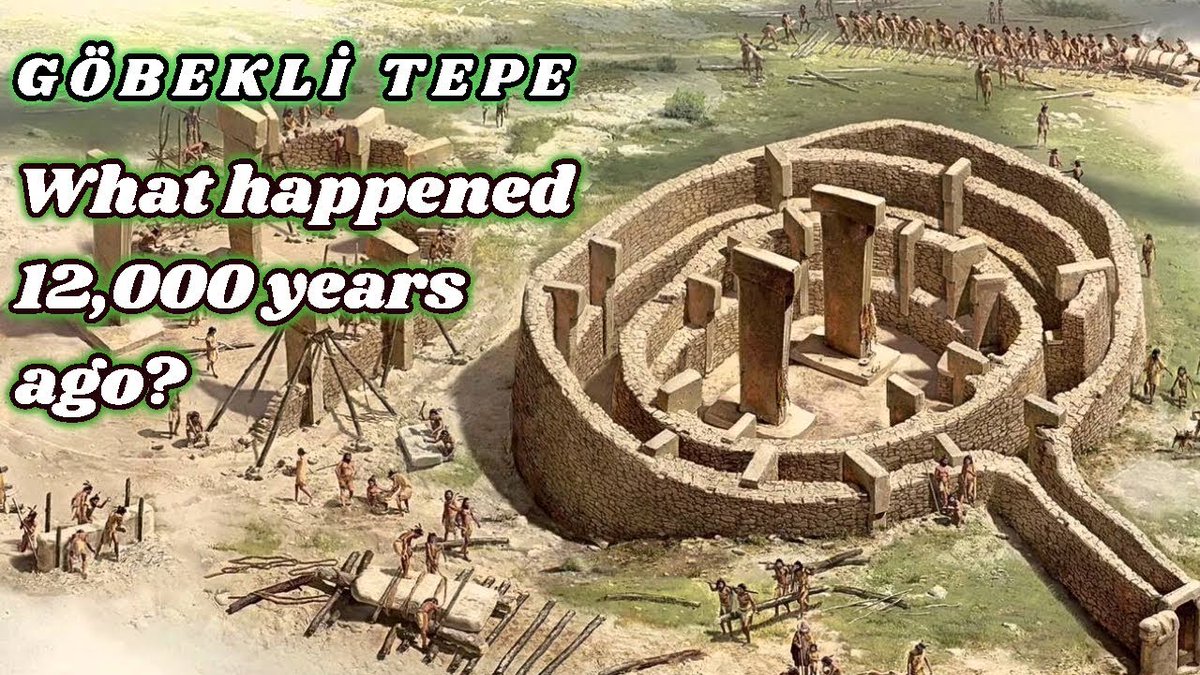

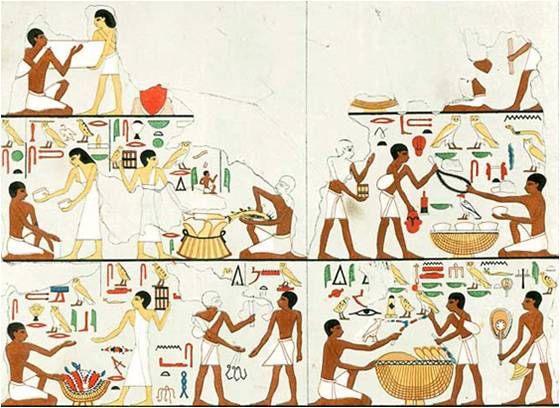

Stable economic relations were brought about with a change in socio-economic conditions from a reliance on hunting and gathering of foods to agricultural practice, during periods beginning sometime after 12,000 BC, at approximately 10,000 years ago in the Fertile Crescent.

In northern China about 9,500 years ago, about 5,500 years ago in Mexico and approximately 4,500 years ago in the eastern parts of the United States.

Surplus grain functioned as an early 'reserve currency'

Surplus grain functioned as an early 'reserve currency'

The history of banking is intertwined with the history of money.

Ancient types of money known as grain-money and food cattle-money were used from a time of around at least 9000 BC, as two of the earliest things that could be used for the purposes of barter.

Ancient types of money known as grain-money and food cattle-money were used from a time of around at least 9000 BC, as two of the earliest things that could be used for the purposes of barter.

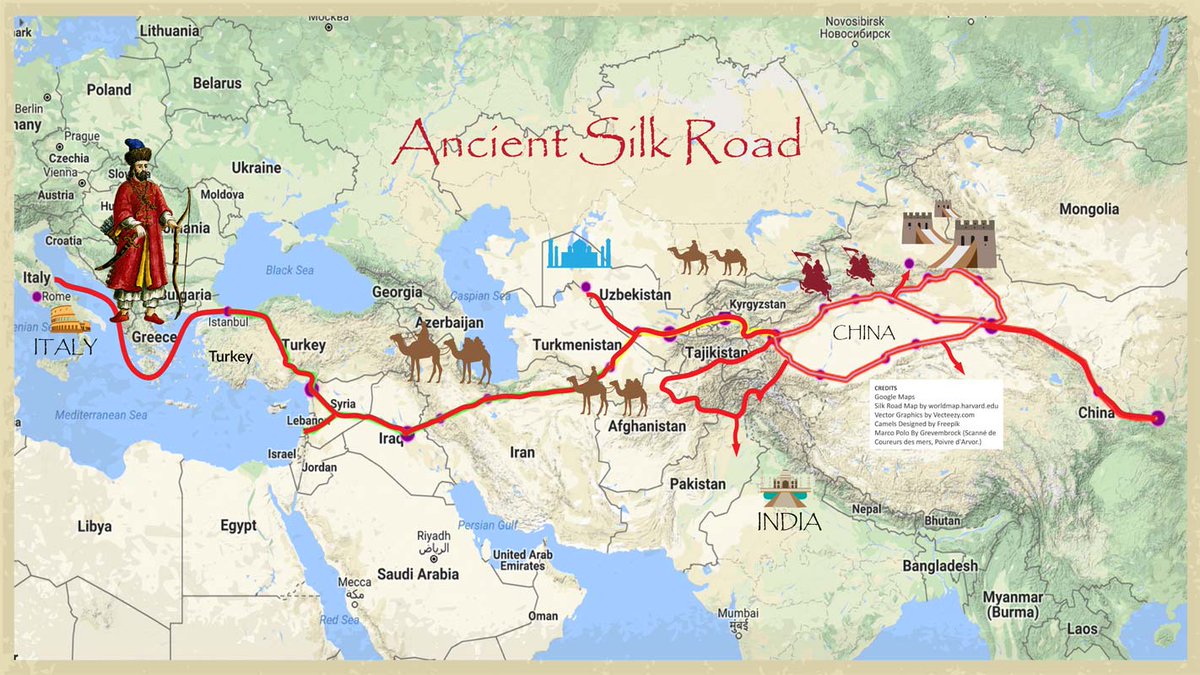

Anatolian obsidian as a raw material for Stone Age tools was being distributed from as early as about 12,500 BCE.

The occurrence of an organized trade was current during the 9th millennium.

Sardinia was the location of one of the four main sites for sourcing the deposits of obsidian within the Mediterranean.

Obsidian was replaced during the 3rd millennia by trade of copper and silver.

Sardinia was the location of one of the four main sites for sourcing the deposits of obsidian within the Mediterranean.

Obsidian was replaced during the 3rd millennia by trade of copper and silver.

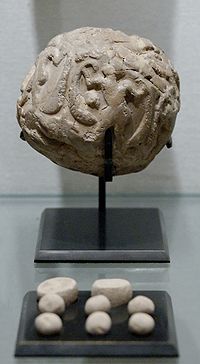

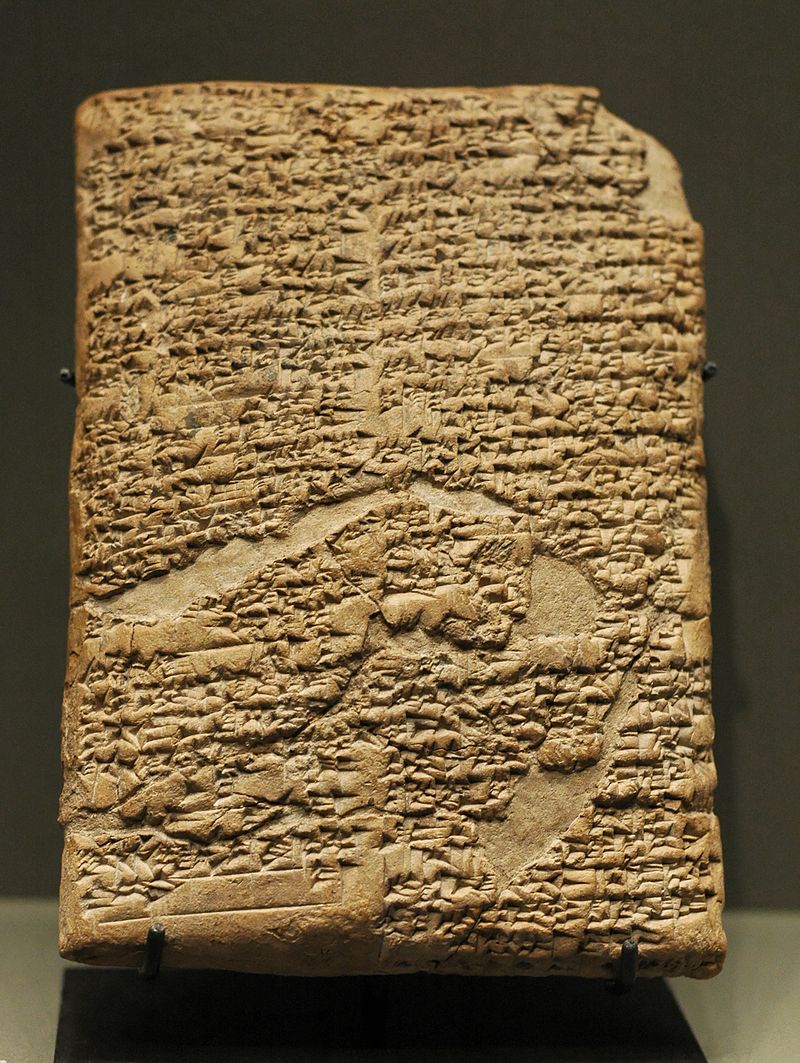

Objects used for record keeping, "bulla" and tokens, have been recovered from within Near East excavations, dated to a period beginning 8000 BCE and ending 1500 BCE, as records of the counting of agricultural produce.

A bulla (or clay envelope) and its contents on display

A bulla (or clay envelope) and its contents on display

Later, tokens transitioned into cylinders. Around the sixth century BCE, cylinders were used in international exchanges between empires.

A famous one discovered is the Cyrus Cylinder.

A famous one discovered is the Cyrus Cylinder.

In the late fourth millennia mnemonic symbols were in use by members of temples and palaces to serve to record stocks of produce.

Types of records accounting for trade exchanges of payments were being made firstly about 3200.

Types of records accounting for trade exchanges of payments were being made firstly about 3200.

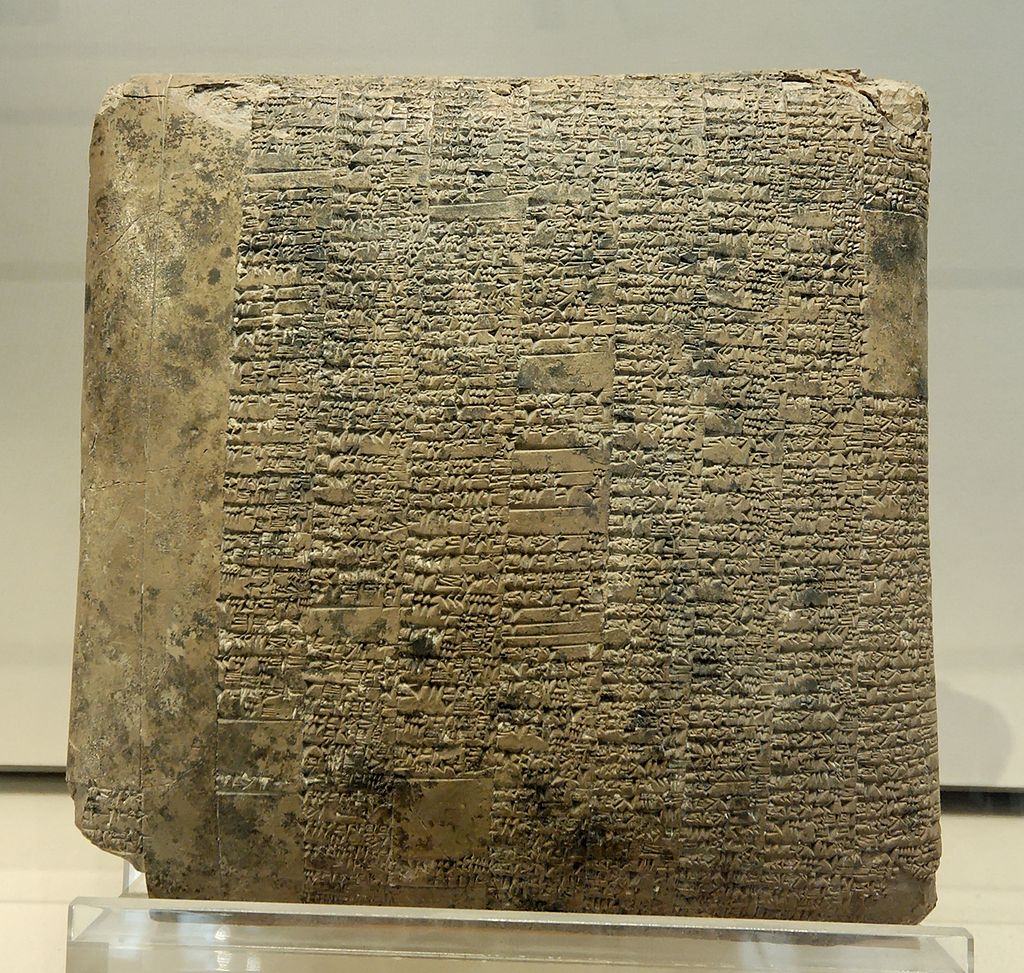

A very early writing on clay tablet called the Code of Hammurabi, refers to the regulation of a banking activity of sorts within the civilization (Armstrong) of an era which dates to ca. 1700 BCE, banking was well enough developed to justify laws governing banking operations.

Later during the Achaemenid Empire, also called the First Persian Empire, or just 'the Empire', after 646 BCE further evidence is found of banking practices in the Mesopotamia region.

Iran - Gate of all nations pictured below.

Iran - Gate of all nations pictured below.

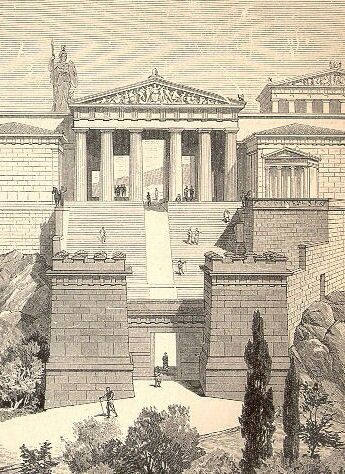

By the 5th millennium BCE, the settlements of Sumer were formed around a central temple (or bank).

People began to build and live in the civilization of cities, providing a structure for the construction of institutions and establishments.

People began to build and live in the civilization of cities, providing a structure for the construction of institutions and establishments.

Prior to the reign of Sargon of Akkad (2335–2280 BC) the occurrence of trade was limited to the internal boundaries of each city-state of Babylon and the temple located at the centre of economic activity therein.

Trade at the time for citizens external to the city was forbidden

Trade at the time for citizens external to the city was forbidden

In Babylonia of 2000 BCE, people depositing gold were required to pay amounts as much as one sixtieth of the total deposited.

Both the palaces and temple are known to have provided lending and issuing from the wealth they held - the palaces to a lesser extent.

Such loans typically involved issuing seed-grain, with re-payment from the harvest.

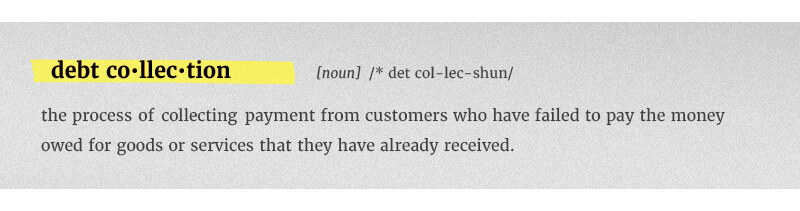

These basic social agreements were documented in clay tablets, with an agreement on interest accrual.

These basic social agreements were documented in clay tablets, with an agreement on interest accrual.

The habit of depositing and storing of wealth in temples continued at least until 209 BCE, as evidenced by Antioch having ransacked or pillaged the temple of Aine in Ecbatana (Media) of gold and silver. https://www.britannica.com/place/Ecbatana

The temple of Artemis at Ephesus was the largest depository of Asia.

A pot-hoard dated to 600 BCE was found in excavations by The British Museum during the year after 1904.

A pot-hoard dated to 600 BCE was found in excavations by The British Museum during the year after 1904.

This is a model of the Temple of Artemis. In its final form was one of the Seven Wonders of the Ancient World.

During the time at the cessation of the first Mithridatic war the entire debt record at the time being held, was annulled by the council.

During the time at the cessation of the first Mithridatic war the entire debt record at the time being held, was annulled by the council.

Mark Anthony is recorded to have stolen from the deposits on an occasion.

The temple served as a depository for Aristotle, Caesar, Dio Chrysostomus, Plautus, Plutarch, Strabo and Xenophon.

The temple served as a depository for Aristotle, Caesar, Dio Chrysostomus, Plautus, Plutarch, Strabo and Xenophon.

The temple to Apollo in Didyma was constructed sometime in the 6th century.

A large sum of gold was deposited within the treasury at the time by king Croesus.

A large sum of gold was deposited within the treasury at the time by king Croesus.

Later during the Maurya dynasty (321 to 185 BC), an instrument called adesha was in use, which was an order on a banker desiring him to pay the money of the note to a third person, which corresponds to the definition of a bill of exchange as we understand it today.

During the Buddhist period, there was considerable use of these instruments.

Merchants in large towns gave letters of credit to one another.

Merchants in large towns gave letters of credit to one another.

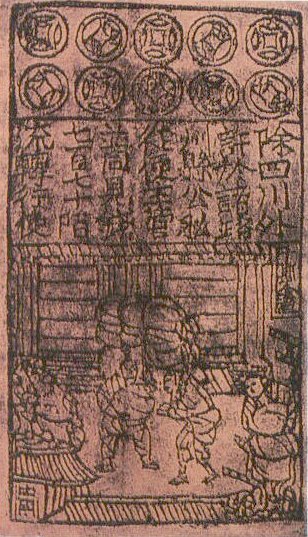

In ancient China, starting in the Qin Dynasty (221 to 206 BC), Chinese currency developed with the introduction of standardized coins that allowed easier trade across China, and led to development of letters of credit.

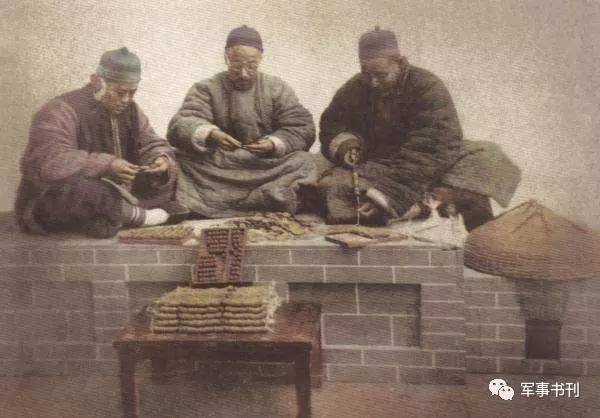

Qiánpù stringing cash coins, which was a typical service offered by the qianzhuang "money shops" in imperial China.

In Egypt some scholars suggest that the grain-banking system became so well-developed that it was comparable to major modern banks, both in terms of its number of branches and employees, and in terms of the total volume of transactions.

During the rule of the Greek Ptolemies, the granaries were transformed into a network of banks centered in Alexandria, where the main accounts from all of the Egyptian regional grain-banks were recorded.

This became the site of one of the earliest known government central banks, and may have reached its peak with the assistance of Greek bankers.

In Greece the Trapezitica is the first source documenting banking.

The speeches of Demosthenes contain numerous references to the issuing of credit.

The speeches of Demosthenes contain numerous references to the issuing of credit.

Xenophon is credited to have made the first suggestion of the creation of an organization known in the modern definition as a joint-stock bank in On Revenues written circa 353 BCE

The city-states of Greece after the Persian Wars produced a government and culture sufficiently organized for the birth of a private citizenship and therefore a capitalist society, allowing the separation of wealth from state ownership to the ownership by the individual.

The earliest forms of storage utilized were the rudimentary money-boxes (θΗΣΑΥΡΌΣ) which were made similar in form to the construction of a bee-hive, and were found for example in the Mycenae tombs of 1550–1500 BC.

Private and civic entities within ancient Grecian society, especially Greek temples, performed financial transactions.

The temples were the places where treasure was deposited for safe-keeping.

It's interesting the Temple is literally where the 'power' or wealth was stored.

The temples were the places where treasure was deposited for safe-keeping.

It's interesting the Temple is literally where the 'power' or wealth was stored.

Many loans are recorded in writings from the classical age, although a very small proportion were provided by banks.

Provision of these were likely an occurrence of Athens, with loans known to have been provided at some time at an annual interest of 12%.

Provision of these were likely an occurrence of Athens, with loans known to have been provided at some time at an annual interest of 12%.

Banks sometimes made loans available confidentially, which is, they provided funds without being publicly and openly known to have done so, in addition also, to act as intermediaries for persons to loan their own monies without this being known to others.

A loan was made by a Temple of Athens to the state during 433–427 BCE.

Roman banking had a crucial presence within temples.

The minting of coins occurred within temples, like the Juno Moneta temple, though during the time of the Empire, public deposits gradually ceased to be held in temples, and instead were held in privately.

The minting of coins occurred within temples, like the Juno Moneta temple, though during the time of the Empire, public deposits gradually ceased to be held in temples, and instead were held in privately.

During 352 BCE a rudimentary public bank was formed, with the passing of consul directive to form a commission of mensarii to deal with debt in the impoverished lower classes.

Another source shows practices during 325 BCE when, on account of being in debt, the Plebeians were required to borrow money, so newly appointed bankers were commissioned to provide services to those who had security to provide, in exchange for money from the public treasury.

Cassius Dio advocated the establishment of a state bank, funded by the sale of all the properties owned at the time by the state.

The Roman empire at some time formalized the administrative aspect of banking and instituted greater regulation of financial institutions and financial practices.

Charging interest on loans and paying interest on deposits became more highly developed and competitive. The development of Roman banks was limited, however, by the Roman preference for cash transactions.

During the reign of the Roman emperor Gallienus (260–268 CE), there was a temporary breakdown of the Roman banking system after the banks rejected the flakes of copper produced by his mints.

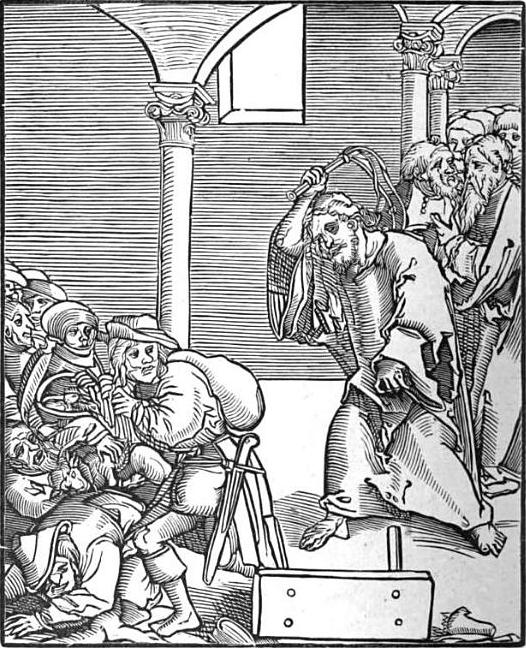

With the ascent of Christianity, banking became subject to additional restrictions, as the charging of interest was seen as immoral.

After the fall of Rome, banking temporarily ended in Europe and was not revived until the time of the crusades.

After the fall of Rome, banking temporarily ended in Europe and was not revived until the time of the crusades.

Throughout history there as been numerous religious restrictions on interest paid on loans.

Most early religious systems in the ancient Near East, and the secular codes arising from them, did not forbid usury.

Most early religious systems in the ancient Near East, and the secular codes arising from them, did not forbid usury.

These societies regarded inanimate matter as alive, like plants, animals and people, and capable of reproducing itself.

Hence if you lent 'food money', or monetary tokens of any kind, it was legitimate to charge interest.

Hence if you lent 'food money', or monetary tokens of any kind, it was legitimate to charge interest.

Food money in the shape of olives, dates, seeds or animals was lent out as early as c. 5000 BCE, if not earlier.

The Torah and later sections of the Hebrew Bible criticize interest-taking, but interpretations vary.

One common understanding is that Jews are forbidden to charge interest upon loans made to other Jews, but obliged to charge interest on transactions with non-Jews, or Gentiles.

One common understanding is that Jews are forbidden to charge interest upon loans made to other Jews, but obliged to charge interest on transactions with non-Jews, or Gentiles.

Deuteronomy 23:19

Thou shalt not lend upon interest to thy brother: interest of money, interest of victuals, interest of any thing that is lent upon interest.

Thou shalt not lend upon interest to thy brother: interest of money, interest of victuals, interest of any thing that is lent upon interest.

Deuteronomy 23:20

Unto a foreigner thou mayest lend upon interest; but unto thy brother thou shalt not lend upon interest; that the LORD thy God may bless thee in all that thou puttest thy hand unto, in the land whither thou goest in to possess it.

Unto a foreigner thou mayest lend upon interest; but unto thy brother thou shalt not lend upon interest; that the LORD thy God may bless thee in all that thou puttest thy hand unto, in the land whither thou goest in to possess it.

Israelites were forbidden to charge interest on loans made to other Israelites, but allowed to charge interest on transactions with non-Israelites, as the latter were often amongst the Israelites for the purpose of business anyway.

It was the interpretation that interest could be charged to non-Israelites that would be used in the 14th century for Jews living within Christian societies in Europe to justify lending money for profit.

Originally, the charging of interest, known as usury, was banned by Christian churches.

This included charging a fee for the use of money, such as at a bureau de change. (forex)

This included charging a fee for the use of money, such as at a bureau de change. (forex)

However over time the charging of interest became acceptable due to the changing nature of money, the term came to be used for interest above the rate allowed by law.

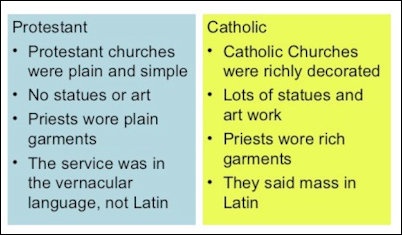

The rise of Protestantism in the 16th century weakened Rome's influence, and its dictates against usury became irrelevant in some areas.

That would free up the development of banking in Northern Europe.

That would free up the development of banking in Northern Europe.

In Islam it is strictly prohibited to take interest; the Quran strictly prohibits lending money on Interest.

"O you who have believed, do not consume usury, doubled and multiplied, but fear Allah that you may be successful"

(3:130)

(3:130)

"and Allah has permitted trade and has forbidden interest"

(2:275)

(2:275)

The Quran states that taking of interest and making money through unethical means is not prohibited for Muslims only but were prohibited for earlier communities as well.

Riba is forbidden in Islamic economic jurisprudence (fiqh).

Islamic jurists discuss two types of riba: an increase in capital with no services provided, which the Qur'an prohibits—and commodity exchanges in unequal quantities, which the Sunnah prohibits; trade in promissory notes (e.g. fiat money and derivatives) is forbidden.

Despite the prohibition of charging interest, during the 20th century a number of developments took place that would lead to an Islamic banking model where no interest is charged but banks would still operate for profit.

This would be done through charging for loans in different ways such as through fees and using method of risk sharing and different ownership models such as leasing.

As Lombardy merchants and bankers grew in stature based on the strength of the Lombard plains cereal crops, many displaced Jews fleeing Spanish persecution were attracted to the trade. https://www.history.com/this-day-in-history/spain-announces-it-will-expel-all-jews

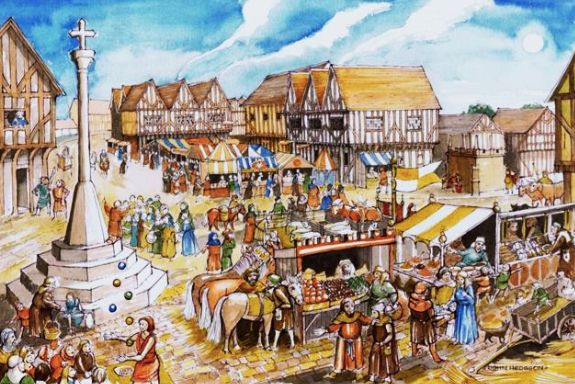

Jews could not hold land in Italy, so they entered the great trading piazzas and halls of Lombardy, alongside local traders, and set up their benches to trade in crops.

They had one great advantage over the locals. Christians were strictly forbidden the sin of usury, defined as lending at interest (Islam makes similar condemnations of usury).

The Jewish newcomers, on the other hand, could lend to farmers against crops in the field, a high-risk loan at what would have been considered usurious rates by the Church; but the Jews were not subject to the Church's dictates.

They then began to advance payment against the future delivery of grain shipped to distant ports. In both cases they made their profit from the present discount against the future price.

This two-handed trade was time-consuming and soon there arose a class of merchants who were trading grain debt instead of grain.

It's interesting to consider of "merchant of debt"

It's interesting to consider of "merchant of debt"

Merchant's "benches" (bank is derived from the Italian for bench, banca, as in a counter) in the great grain markets became centres for holding money against a bill (billette, a note, a letter of formal exchange, later a bill of exchange and later still a cheque).

The term bankrupt is a corruption of the Italian banca rotta, or broken bench, which is what happened when someone lost his traders' deposits.

Being "broke" has the same connotation.

Being "broke" has the same connotation.

In the 12th century, the need to transfer large sums of money to finance the Crusades stimulated the re-emergence of banking in western Europe.

In 1162, Henry II of England levied a tax to support the crusades - the first of a series of taxes levied by Henry over the years with the same objective.

The Templars and Hospitallers acted as Henry's bankers in the Holy Land.

The Templars and Hospitallers acted as Henry's bankers in the Holy Land.

The Templars' land holdings across Europe also emerged in the 1100–1300 time frame as the beginning of European banking.

They would take in local currency, for which a demand note would be given that would be good at any of their castles across Europe, allowing movement of money without the usual risk of robbery while traveling.

Medieval trade fairs, such as the one in Hamburg, contributed to the growth of banking in a curious way: moneychangers issued documents redeemable at other fairs, in exchange for hard currency.

These documents could be cashed at another fair in a different country or at a future fair in the same location.

If redeemable at a future date, they would often be discounted by an amount comparable to a rate of interest.

If redeemable at a future date, they would often be discounted by an amount comparable to a rate of interest.

Eventually, these documents evolved into bills of exchange, which could be redeemed at any office of the issuing banker.

The bills made it possible to transfer large sums of money without hauling large chests of gold and hiring armed guards to protect the gold from thieves.

The bills made it possible to transfer large sums of money without hauling large chests of gold and hiring armed guards to protect the gold from thieves.

In 1156, in Genoa, occurred the earliest known foreign exchange contract.

Two brothers borrowed 115 Genoese pounds and agreed to reimburse the bank's agents in Constantinople the sum of 460 bezants one month after their arrival in that city.

Two brothers borrowed 115 Genoese pounds and agreed to reimburse the bank's agents in Constantinople the sum of 460 bezants one month after their arrival in that city.

In the following century the use of such contracts grew rapidly, particularly since profits from time differences were seen as not infringing canon laws against usury.

The first bank was established in Venice with guarantee from the State in 1157.

This was due to the commercial agency of the Venetians, acting in the interest of the Crusaders of Pope Urban II.

This was due to the commercial agency of the Venetians, acting in the interest of the Crusaders of Pope Urban II.

Banking practice proper began in the mid-parts of the 12th century, and continued until the bank was caused to cease to operate during the French invasion of 1797.

Italian Christians, particularly the Cahorsins and Lombards, invented legal fictions to get around the ban on Christian usury.

The Christians effecting these legal fictions became known as the pope's usurers, and reduced the importance of the Jews to European monarchs.

The Christians effecting these legal fictions became known as the pope's usurers, and reduced the importance of the Jews to European monarchs.

The most famous Italian bank was the Medici bank, set up by Giovanni di Bicci de' Medici in 1397 and continuing until 1494.

By the later Middle Ages, Christian Merchants who lent money with interest were without opposition, and the Jews lost their privileged position as money-lenders.

In 1401 the magistrates of Barcelona, established in the city the first replication of the Venetian model of exchange and deposit, Taula de Canvi – the Table of Exchange, considered to be the first public bank of Europe. https://www.britannica.com/topic/Taula-de-Canvi

In the 16th century, Marrano Jews (Doña Gracia from House of Mendes) fleeing from Iberia introduced the techniques of European capitalism, banking and even the mercantilist concept of state economy to the Ottoman Empire.

In the 16th century, the leading financiers in Istanbul were Greeks and Jews.

Many of the Jewish financiers were Marranos who had fled from Iberia during the period leading up to the expulsion of Jews from Spain.

Some of these families brought great fortunes with them.

Many of the Jewish financiers were Marranos who had fled from Iberia during the period leading up to the expulsion of Jews from Spain.

Some of these families brought great fortunes with them.

The most notable of the Jewish banking families in the 16th-century Ottoman Empire was the Marrano banking house of Mendes, which moved to Istanbul in 1552, under the protection of Sultan Suleyman the Magnificent.

When Alvaro Mendes arrived in Istanbul in 1588, he is reported to have brought with him 85,000 gold ducats.

The Mendès family soon acquired a dominating position in the state finances of the Ottoman Empire and in commerce with Europe.

The Mendès family soon acquired a dominating position in the state finances of the Ottoman Empire and in commerce with Europe.

They thrived in Baghdad during the 18th and 19th centuries under Ottoman rule, performing critical commercial functions such as moneylending and banking.

Like the Armenians, the Jews could engage in necessary commercial activities, such as moneylending and banking, that were proscribed for Muslims under Islamic law.

Court Jews were Jewish bankers or businessmen who lent money and handled the finances of some of the Christian European noble houses, primarily in the 17th and 18th centuries.

Court Jews were precursors to the modern financier or Secretary of the Treasury.

Their jobs included raising revenues by tax farming, negotiating loans, master of the mint, creating new sources for revenue, floating debentures, devising new taxes. and supplying the military.

Their jobs included raising revenues by tax farming, negotiating loans, master of the mint, creating new sources for revenue, floating debentures, devising new taxes. and supplying the military.

In addition, the Court Jew acted as personal bankers for nobility: he raised money to cover the noble's personal diplomacy and his extravagances.

Court Jews were skilled administrators and businessmen who received privileges in return for their services.

They were most commonly found in Germany, Holland, and Austria, but also in Denmark, England, Hungary, Italy, Poland, Lithuania, Portugal, and Spain.

They were most commonly found in Germany, Holland, and Austria, but also in Denmark, England, Hungary, Italy, Poland, Lithuania, Portugal, and Spain.

Virtually every duchy, principality, and palatinate in the Holy Roman Empire had a Court Jew.

Dutch bankers played a central role in banks in the Northern German city states.

Berenberg is the oldest bank in Germany and the world's second oldest, established in 1590 by brothers Hans and Paul Berenberg in Hamburg.

The bank is still owned by the Berenberg dynasty.

Berenberg is the oldest bank in Germany and the world's second oldest, established in 1590 by brothers Hans and Paul Berenberg in Hamburg.

The bank is still owned by the Berenberg dynasty.

Throughout the 17th century, precious metals from the New World, Japan and other locales were being channeled into Europe, with corresponding price increases.

Thanks to the free coinage, the Bank of Amsterdam, and the heightened trade and commerce, the Netherlands attracted even more coin and bullion to be deposited in their banks.

These concepts of Fractional-reserve banking and payment systems were further developed and spread to England and elsewhere. https://www.investopedia.com/terms/f/fractionalreservebanking.asp

In the City of London there were not any banking houses operating in a manner recognized as so today until the 17th century, although the London Royal Exchange was established in 1565.

By the end of the 16th century and during the 17th, the traditional banking functions of accepting deposits, moneylending, money changing, and transferring funds were combined with the issuance of bank debt that served as a substitute for gold and silver coins.

The success of the new banking techniques and practices in Amsterdam and London helped spread the concepts and ideas elsewhere in Europe.

Modern banking practice, including fractional reserve banking and the issue of banknotes, emerged in the 17th century.

At the time, wealthy merchants began to store their gold with the goldsmiths of London, who possessed private vaults and charged a fee for their service.

At the time, wealthy merchants began to store their gold with the goldsmiths of London, who possessed private vaults and charged a fee for their service.

In exchange for each deposit of precious metal, the goldsmiths issued receipts certifying the quantity and purity of the metal they held as a bailee; these receipts could not be assigned, only the original depositor could collect the stored goods.

Gradually the goldsmiths began to lend the money out on behalf of the depositor, which led to the development of modern banking practices; promissory notes (which evolved into banknotes) were issued for money deposited as a loan to the goldsmith.

These practices created a new kind of "money" that was actually debt, that is, goldsmiths' debt rather than silver or gold coin, a commodity that had been regulated and controlled by the monarchy.

This development required the acceptance in trade of the goldsmiths' promissory notes, payable on demand.

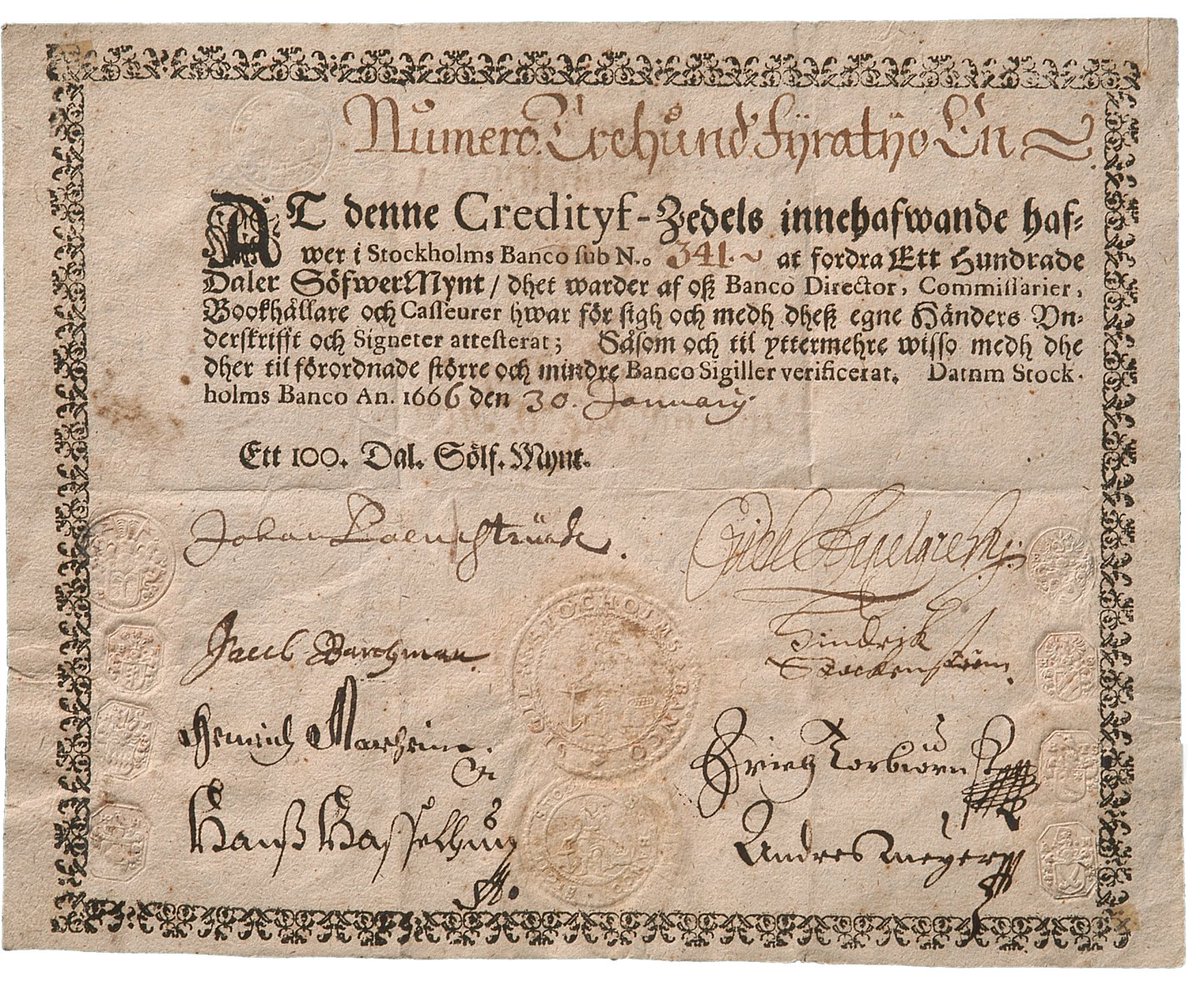

In 1695, the Bank of England became one of the first banks to issue banknotes, the first being the short-lived banknotes issued by Stockholms Banco in 1661.

Around 1770, they began meeting in a central location, and by the 1800s a dedicated space was established, known as a bankers' clearing house.

The number of banks increased during the Industrial Revolution and the growing international trade, especially in London.

The number of banks increased during the Industrial Revolution and the growing international trade, especially in London.

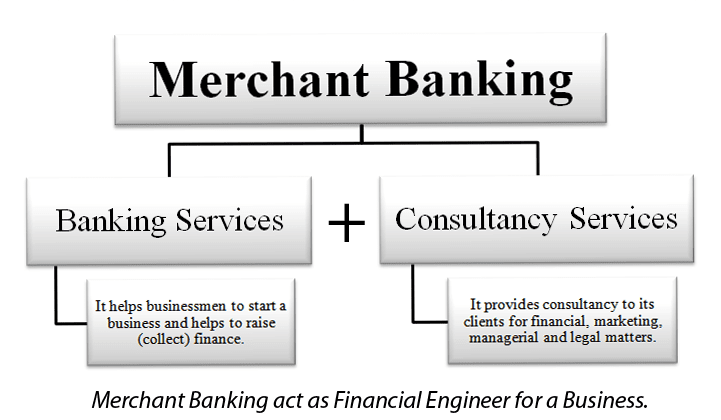

These new "merchant banks" facilitated trade growth, profiting from England's emerging dominance in seaborne shipping.

Two immigrant families, Rothschild and Baring, established merchant banking firms in London in the late 18th century and came to dominate world banking in the next century.

During the Qing dynasty, the private nationwide financial system in China was first developed by the Shanxi merchants, with the creation of so-called "draft banks".

Throughout the 19th century, the central Shanxi region became the de facto financial centre of Qing China.

Throughout the 19th century, the central Shanxi region became the de facto financial centre of Qing China.

With the fall of the Qing dynasty, the financial centers gradually shifted to Shanghai, with western-style modern banks flourishing. Today, the financial centres in China today are Hong Kong, Beijing, Shanghai and Shenzhen.

Read on Twitter

Read on Twitter