Inflation is here - it's just not evenly distributed.

This is my favorite framework for thinking about inflation risk. It simplifies an impossible debate.

Discussion below:

This is my favorite framework for thinking about inflation risk. It simplifies an impossible debate.

Discussion below:

The Fed says there is no inflation. That’s fine if you’re the government and want to keep social security increases low.

But what if you live in an expensive city and noticed your healthcare, education and housing costs are soaring?

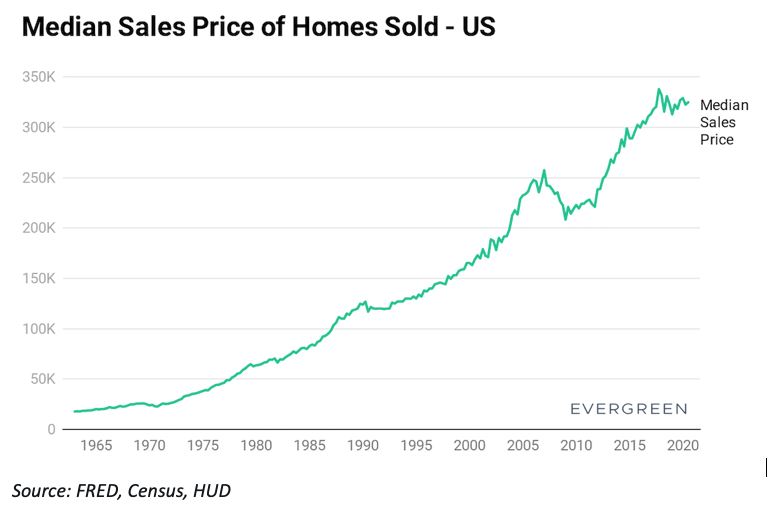

Median Sales Price of Homes Sold:

But what if you live in an expensive city and noticed your healthcare, education and housing costs are soaring?

Median Sales Price of Homes Sold:

And what about financial assets?

While investments don't factor into the CPI inflation calculation, the vast majority of assets are clearly ‘inflated’.

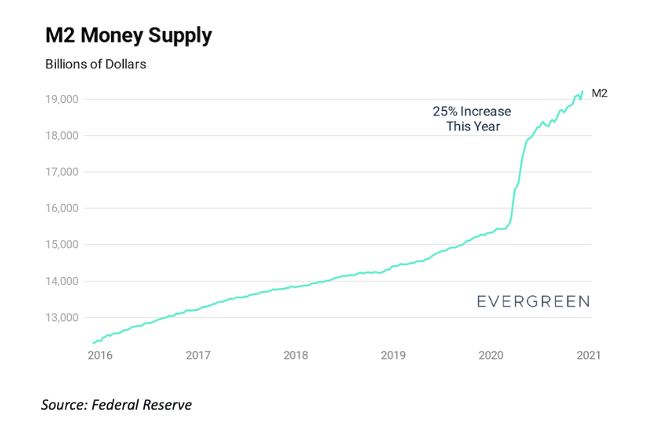

This is – partly – a function of the Fed’s aggressive money creation.

M2 Money Supply ($$$ Printing):

While investments don't factor into the CPI inflation calculation, the vast majority of assets are clearly ‘inflated’.

This is – partly – a function of the Fed’s aggressive money creation.

M2 Money Supply ($$$ Printing):

Yet, all this stimulus hasn’t resulted in CPI inflation.

What gives?

Well, the velocity of money today is glacial. It's a lot easier to save money when everything’s closed.

We also have deflationary forces. Tech advances and / offshoring labor are deflationary.

What gives?

Well, the velocity of money today is glacial. It's a lot easier to save money when everything’s closed.

We also have deflationary forces. Tech advances and / offshoring labor are deflationary.

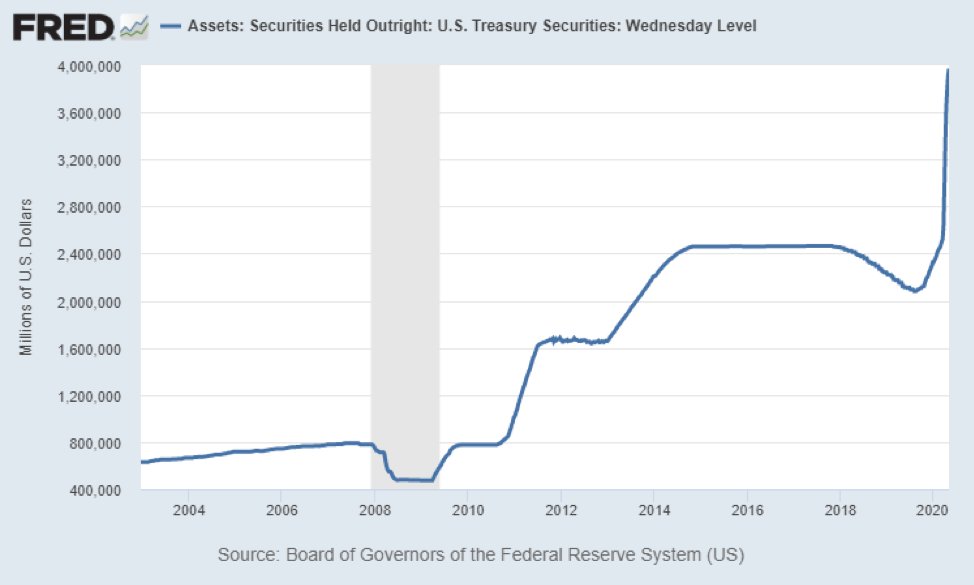

However, more rounds of stimulus checks and quantitative easing are coming.

How many trillions can we create from thin air without long term consequences?

It appears we’re going to find out.

How many trillions can we create from thin air without long term consequences?

It appears we’re going to find out.

There are too many variables at play to make a reliable forecast, which we don't do anyways. Your guess is as good as mine.

We do think deeply about risk and probabilities though.

It seems clear the risk of meaningful inflation this decade hasn’t been this high since the 1970s

We do think deeply about risk and probabilities though.

It seems clear the risk of meaningful inflation this decade hasn’t been this high since the 1970s

Regardless, you're probably better off thinking about inflation through your own personal spending lens.

What are your largest expenses? If your basket of products, services, and planned investments are skyrocketing in price, then today’s zero CPI rate isn’t your reality.

What are your largest expenses? If your basket of products, services, and planned investments are skyrocketing in price, then today’s zero CPI rate isn’t your reality.

If you want to mitigate that risk, get long hard assets.

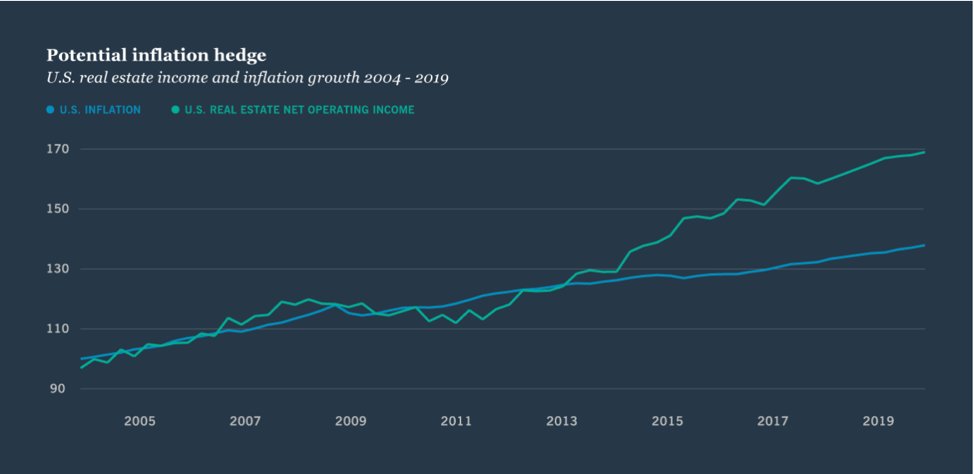

You might have guessed, but we prefer cash-flowing real estate / REITs.

As CPI increases, so does net operating income stemming from rent increases. This is true both of private and public real estate (REITs).

You might have guessed, but we prefer cash-flowing real estate / REITs.

As CPI increases, so does net operating income stemming from rent increases. This is true both of private and public real estate (REITs).

Rents and values increase with consumer prices.

This supports dividend growth and income that outpaces inflation.

RE has structural advantages as well. Inflation is a boon to fixed rate borrowers as you get to pay the lender back with “cheaper” cash.

This supports dividend growth and income that outpaces inflation.

RE has structural advantages as well. Inflation is a boon to fixed rate borrowers as you get to pay the lender back with “cheaper” cash.

America had a four-decade run of disinflation since 1980.

Today the risk of broadly higher inflation (over next decade) is on the table. The Fed clearly wants high CPI numbers to inflate away our unsustainable debt.

As @RayDalio says "cash is trash".

Don’t fight the Fed.

Today the risk of broadly higher inflation (over next decade) is on the table. The Fed clearly wants high CPI numbers to inflate away our unsustainable debt.

As @RayDalio says "cash is trash".

Don’t fight the Fed.

Evergreen Research Sign Up:

https://evergreenreits.ck.page/165fc809c2

https://evergreenreits.ck.page/165fc809c2

Read on Twitter

Read on Twitter