Today, the #JPMCInstitute released a new report examining the relationship between the stock market and household financial behavior. 1/6

https://www.jpmorganchase.com/institute/research/financial-markets/the-stock-market-and-household-financial-behavior/?jp_cmp=social_=fgtwitter_=stockwealth

https://www.jpmorganchase.com/institute/research/financial-markets/the-stock-market-and-household-financial-behavior/?jp_cmp=social_=fgtwitter_=stockwealth

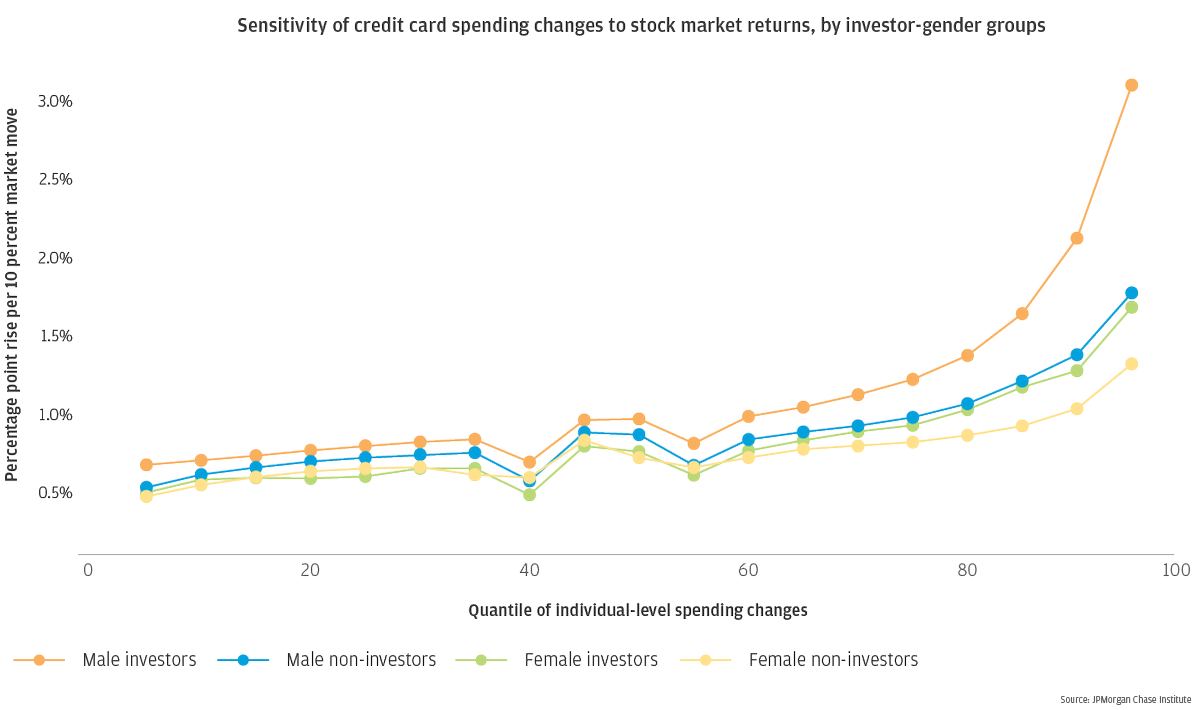

We find that some individuals respond to stock market rises with spending “splurges” on credit cards, changing their normal spending by 2-3x their normal spending in a given month following increases in stock prices. 2/6

While sensitivity to stock market changes for credit card spending are highest for male investors, middle- and low-income individuals were most sensitive within each subgroup we studied. 3/6

Transfers to investment accounts are also sensitive to the stock market—a 10% rise in stocks translates to a short-term increase in the magnitude of transfers of over 10% for both men and women—showing a pattern of returns chasing. 4/6

Our findings suggest that policies which aim to influence the real economy through the stock market are likely to be successful in stimulating the economy in the short-run, and even families who do not invest are subject to these impacts. 5/6

The stock market is not a perfect predictor for an improving labor market, however, which implies that lower wage individuals may be at greater risk of overusing credit after stock market gains, if not matched with subsequent earnings increases. 6/6

Read on Twitter

Read on Twitter