1/5

Let’s go back to Curve’s SynthSwap and use a real example to calculate the benefits of using it for large trades.

Due to the way Synthetix works, trades using Virtual Synths are divided into two transactions. Consequently, people using SynthSwap carry certain price risks.

Let’s go back to Curve’s SynthSwap and use a real example to calculate the benefits of using it for large trades.

Due to the way Synthetix works, trades using Virtual Synths are divided into two transactions. Consequently, people using SynthSwap carry certain price risks.

2/5

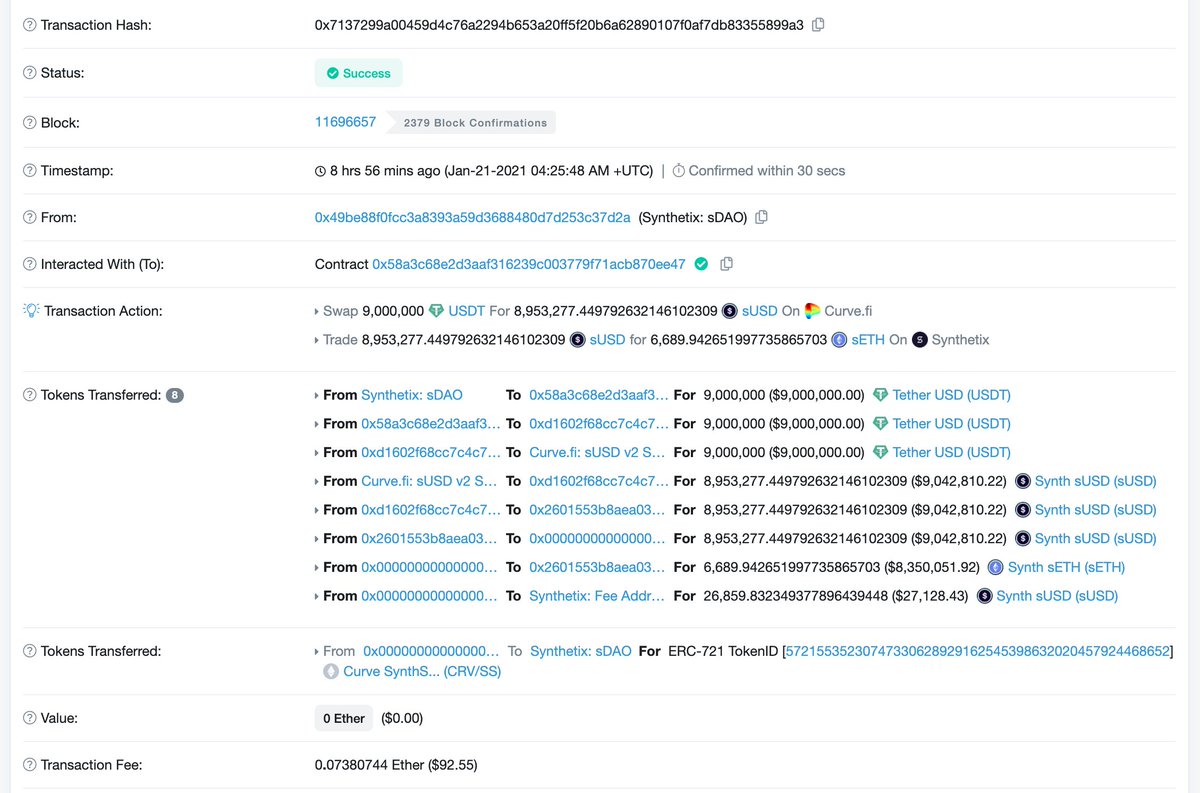

The first transaction:

1) 9M USDT swapped to 8.95M sUSD through Curve sUSD v2 pool (0.5% negative slippage)

2) 8.95M sUSD swapped to 6.69k sETH through Synthetix Exchange (0.3% fee)

The first transaction:

1) 9M USDT swapped to 8.95M sUSD through Curve sUSD v2 pool (0.5% negative slippage)

2) 8.95M sUSD swapped to 6.69k sETH through Synthetix Exchange (0.3% fee)

3/5

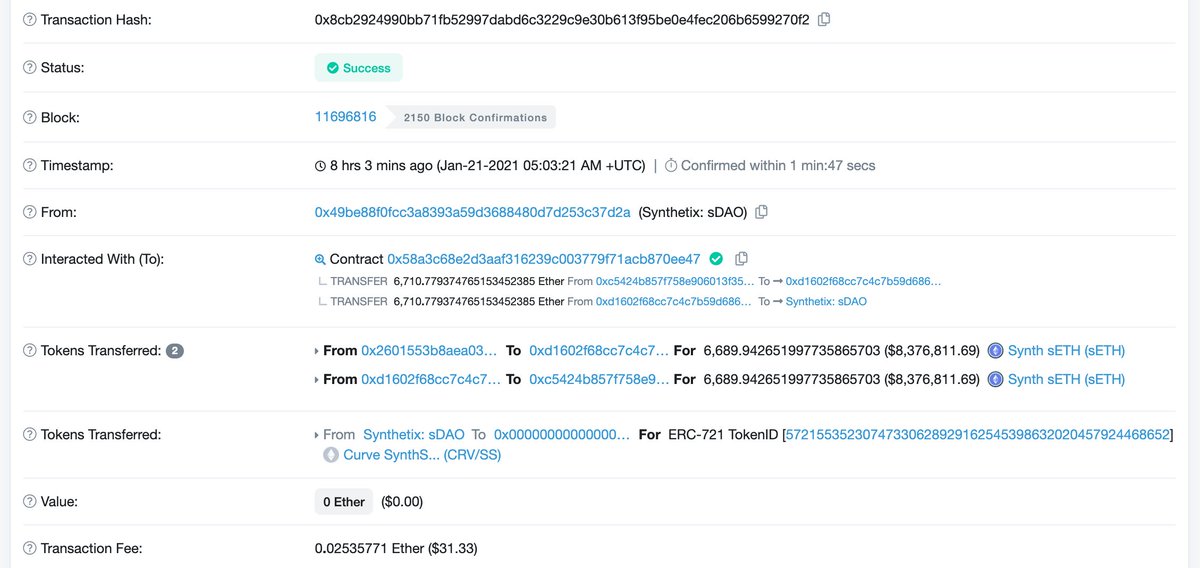

The second transaction took place 37 minutes after the first:

3) 6.69k sETH swapped to 6.71k ETH through Curve sETH pool (0.3% positive slippage)

So in this trade, ETH price was $1,341. For comparison, CoinGecko gives us $1,330.6 as ETH price, but what about the slippage?

The second transaction took place 37 minutes after the first:

3) 6.69k sETH swapped to 6.71k ETH through Curve sETH pool (0.3% positive slippage)

So in this trade, ETH price was $1,341. For comparison, CoinGecko gives us $1,330.6 as ETH price, but what about the slippage?

4/5

@KaikoData helped to calculate prices for this order, taking into account slippage at the time of the first transaction:

- Bitfinex, ETH/USD = $1,336.87 with 0.6% slippage

- Binance, ETH/USDT = $1,342.73 with 1%+ slippage

- Coinbase, ETH/USD = $1,366.92 with 2.9% slippage

@KaikoData helped to calculate prices for this order, taking into account slippage at the time of the first transaction:

- Bitfinex, ETH/USD = $1,336.87 with 0.6% slippage

- Binance, ETH/USDT = $1,342.73 with 1%+ slippage

- Coinbase, ETH/USD = $1,366.92 with 2.9% slippage

5/5

Earlier @lawmaster noticed that Bitfinex usually has the highest liquidity, so only on this exchange, the price ended up being better.

A fresh DeFi project already provides a better price for large trades than centralized exchanges with a long history.

Crazy

Earlier @lawmaster noticed that Bitfinex usually has the highest liquidity, so only on this exchange, the price ended up being better.

A fresh DeFi project already provides a better price for large trades than centralized exchanges with a long history.

Crazy

Read on Twitter

Read on Twitter