With stock markets all-time high, are we in a bubble?

The following chart suggests we might NOT be.

(a short thread explaining why)

The following chart suggests we might NOT be.

(a short thread explaining why)

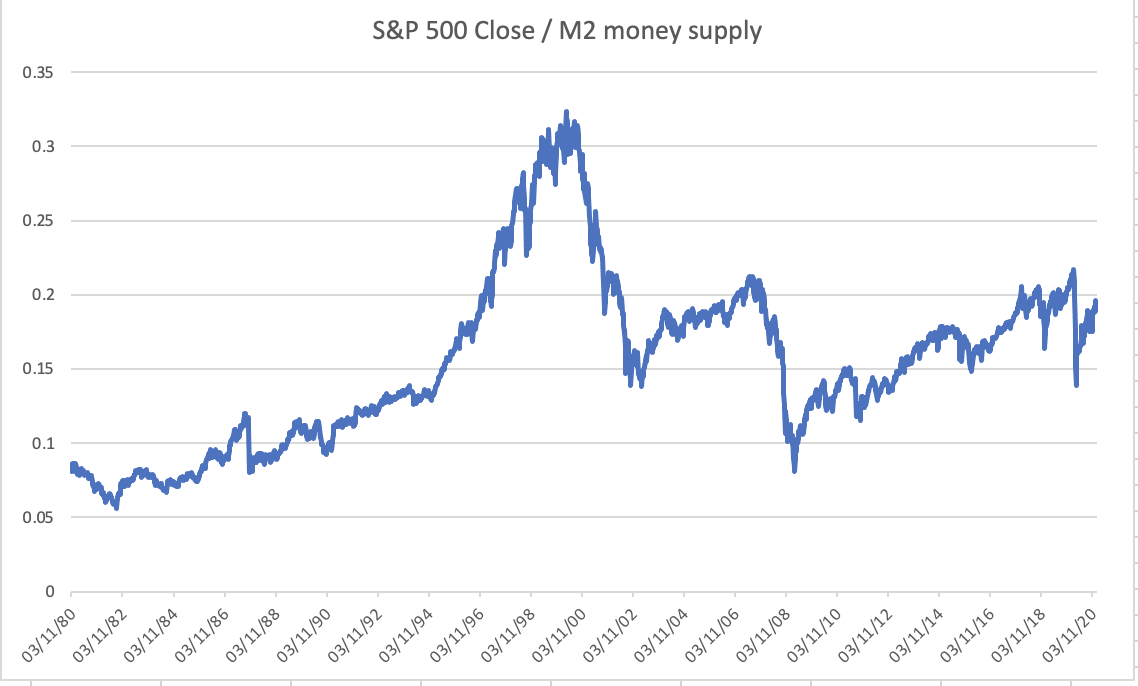

1/ What I did to investigate this was to compare S&P 500 with M2 Money supply.

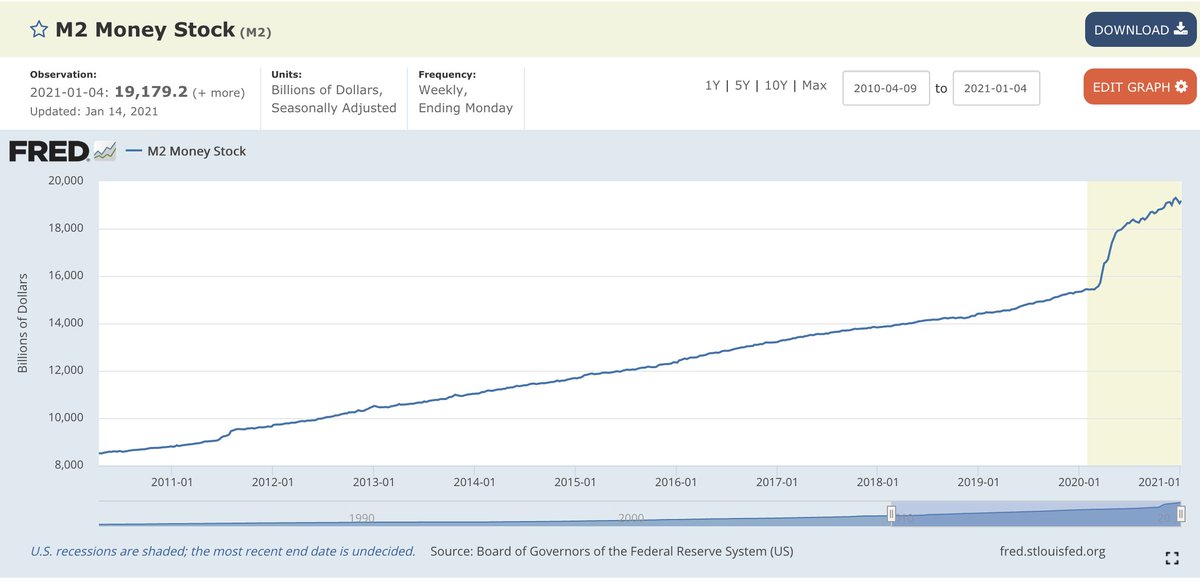

M2 is roughly representative of how many dollars are in the economy. As an economic stimulus for covid, unprecedented new money is being printed by the US Fed.

Is that causing rise of markets?

M2 is roughly representative of how many dollars are in the economy. As an economic stimulus for covid, unprecedented new money is being printed by the US Fed.

Is that causing rise of markets?

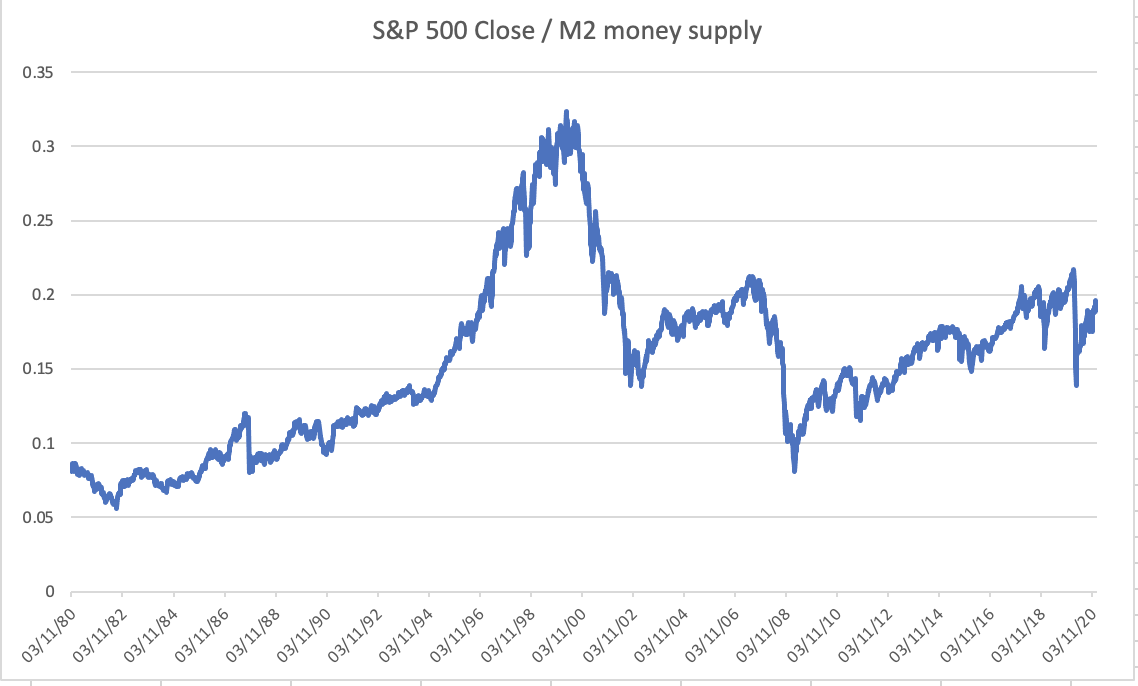

2/ If you divide S&P 500 (market index) with M2 money supply, you get the chart I attached.

Notice:

The ratio reached its peak during the 2000 dotcom bubble, and the current levels of the ratio are much below that (although they're reaching the 2008 levels)

Notice:

The ratio reached its peak during the 2000 dotcom bubble, and the current levels of the ratio are much below that (although they're reaching the 2008 levels)

3/ Also, since early 2020, M2 Money supply has roughly increased by 24% while S&P 500 has increased by 15%.

It means things are not totally out of whack.

I wouldn't be surprised if markets keep on rising simply because there are more dollars in the economy.

It means things are not totally out of whack.

I wouldn't be surprised if markets keep on rising simply because there are more dollars in the economy.

4/ It's also interesting to notice that the annual growth of this ratio over the last 40 years comes to be around 2% which is similar to the annual increase of US GDP (~2.5%).

5/ Another way to look at this:

The 8% annual returns of S&P 500 over the last 40 years can be broken down into two parts:

- 6% annual growth in money supply

- 2% annual growth in GDP

So, in some sense market's real growth has been simply tracking the GDP real growth.

The 8% annual returns of S&P 500 over the last 40 years can be broken down into two parts:

- 6% annual growth in money supply

- 2% annual growth in GDP

So, in some sense market's real growth has been simply tracking the GDP real growth.

6/ Which makes sense because assume no new money was printed and there were $100 in circulation 40 years ago.

If GDP grows at 2% annually, there are 2% more stuff available for consumption so today those $100 will fetch you more 2% annualized more stuff.

If GDP grows at 2% annually, there are 2% more stuff available for consumption so today those $100 will fetch you more 2% annualized more stuff.

7/ TLDR: my thesis is that if we have 25% more money in the system and markets have risen only 14% from their previous normal levels, we shouldn't be surprised if markets rise even further.

You can play with the data yourself: https://docs.google.com/spreadsheets/d/18S9anxRQAD6-865Mrdj6Xyr5DiFifSbef2AlFselWQc/edit#gid=618035938

You can play with the data yourself: https://docs.google.com/spreadsheets/d/18S9anxRQAD6-865Mrdj6Xyr5DiFifSbef2AlFselWQc/edit#gid=618035938

8/ By the way, I posted this on @reddit and it blew up.

Lots of interesting discussion on this r/investing https://www.reddit.com/r/investing/comments/l1upan/heres_the_evidence_that_were_not_in_a_bubble/

Would love to hear your views too!

Lots of interesting discussion on this r/investing https://www.reddit.com/r/investing/comments/l1upan/heres_the_evidence_that_were_not_in_a_bubble/

Would love to hear your views too!

9/ Simple mental model to think about this.

Imagine economy with only: $100, 100 apples and 100 shares in the apples company.

What happens if you double dollars but apples consumed remain the same? The per share dollar price doubles and now there’s 2x dollars chasing 1x shares.

Imagine economy with only: $100, 100 apples and 100 shares in the apples company.

What happens if you double dollars but apples consumed remain the same? The per share dollar price doubles and now there’s 2x dollars chasing 1x shares.

10/ What happens if you find a way to grow 100 apples into 102 apples through better tech?

Then since apples company cost is same, the extra 2 apples are profit that can be exchanged for more money and hence per share price in terms of dollars increases.

Then since apples company cost is same, the extra 2 apples are profit that can be exchanged for more money and hence per share price in terms of dollars increases.

11/ So stock markets benefit from both:

a) Economy growth, as it a claim on economic surplus

b) Monetary supply growth, as more money chases the same pie of economy via shares

a) Economy growth, as it a claim on economic surplus

b) Monetary supply growth, as more money chases the same pie of economy via shares

12/ The only case where increased money supply wouldn’t cause immediate increase in stock market value is if the extra money goes into consumption.

But that grows the economy, which eventually translates into growth of the market.

But that grows the economy, which eventually translates into growth of the market.

Read on Twitter

Read on Twitter