Some bubble thoughts

It's the season of calling bubbles. I don't claim to have any special insight on the market. I'm in this day and age, one of those endangered species who still believes that predicting things is hard.

It's the season of calling bubbles. I don't claim to have any special insight on the market. I'm in this day and age, one of those endangered species who still believes that predicting things is hard.

I've been reading whatever I can get my hands on about bubbles and peaks. So just collating all of them in this thread, if you find it useful.

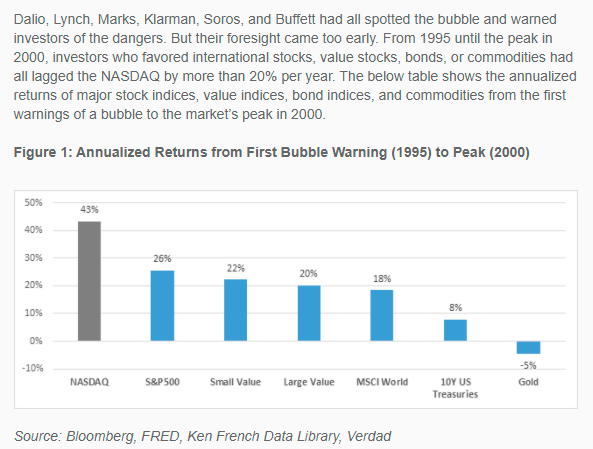

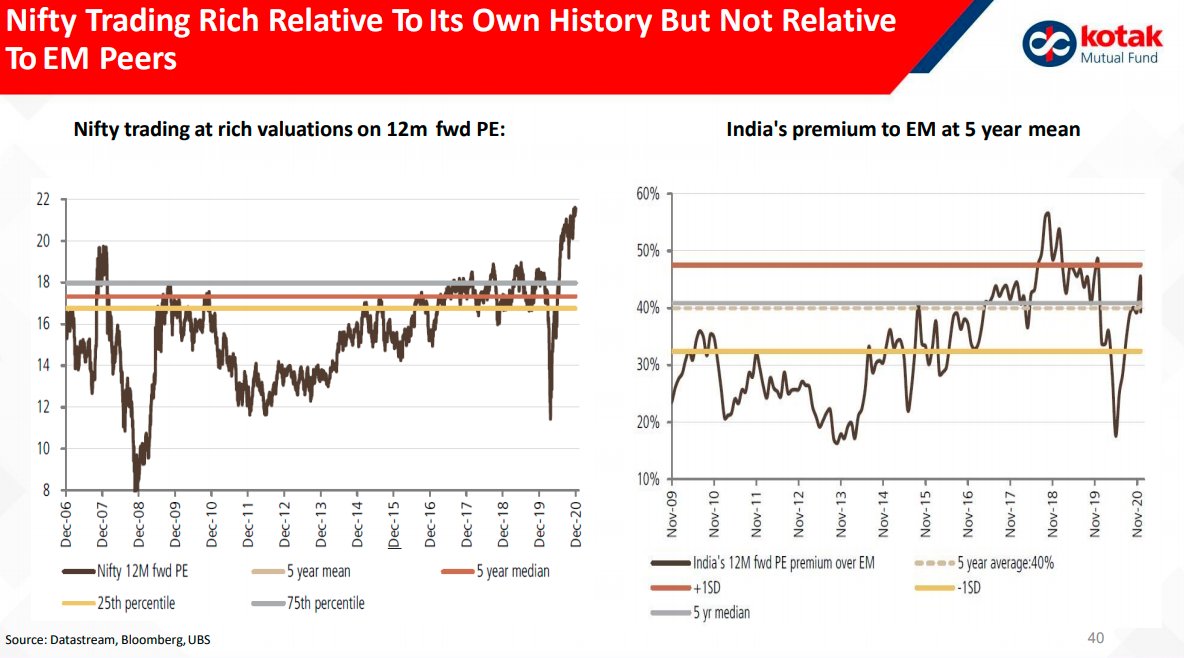

I was reading this brilliant piece by @verdadcap's colleagues and was struck by this chart

https://mailchi.mp/verdadcap/investing-in-a-bubble?e=b838bc224f

I was reading this brilliant piece by @verdadcap's colleagues and was struck by this chart

https://mailchi.mp/verdadcap/investing-in-a-bubble?e=b838bc224f

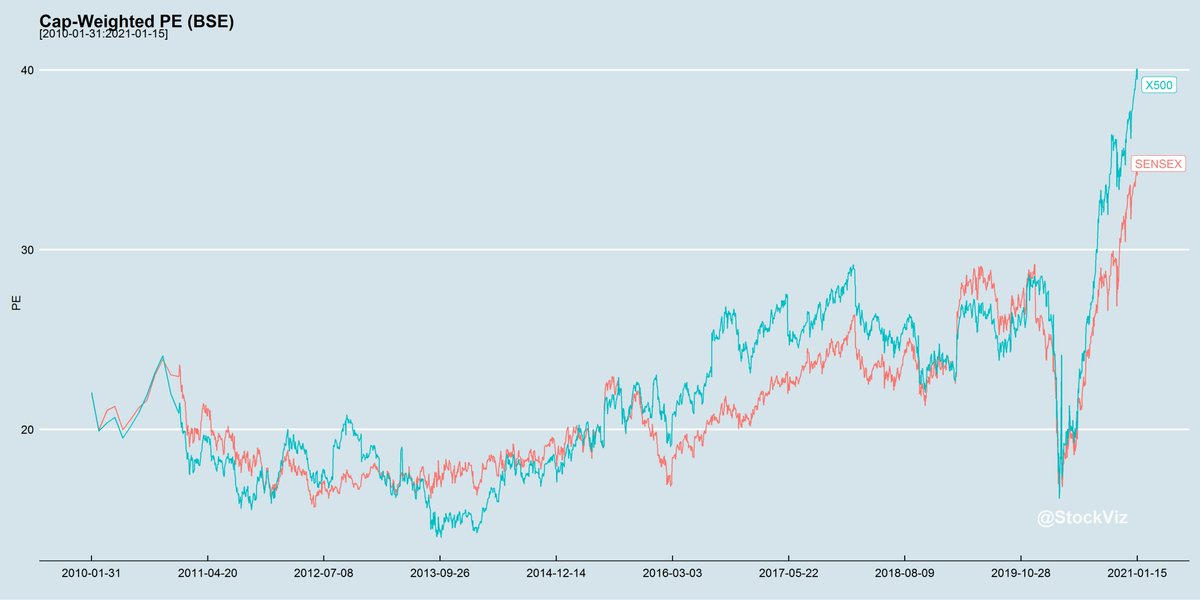

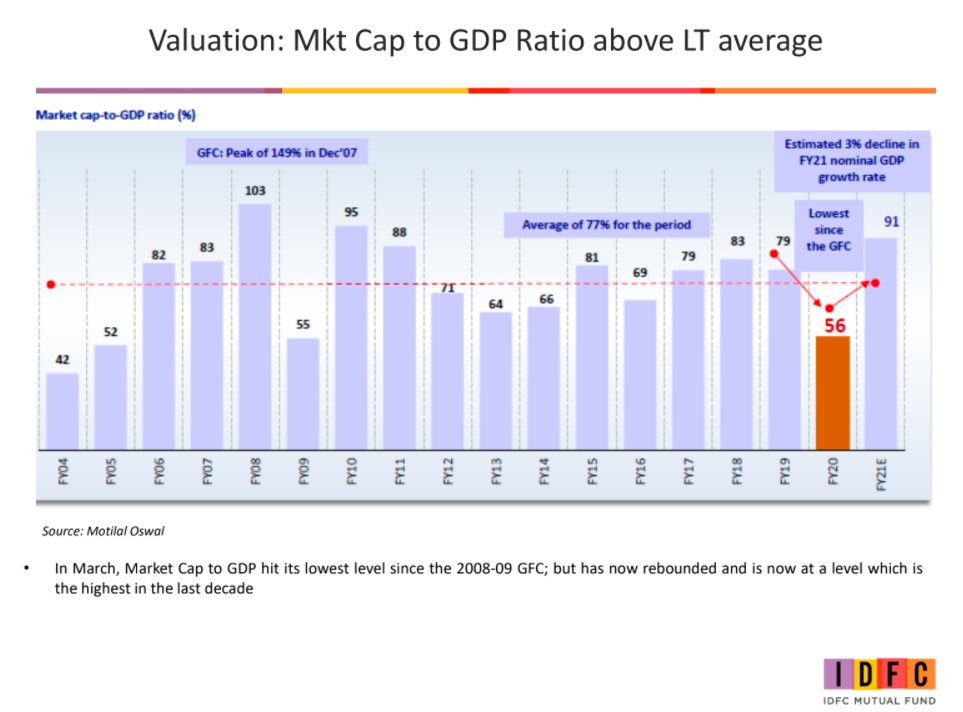

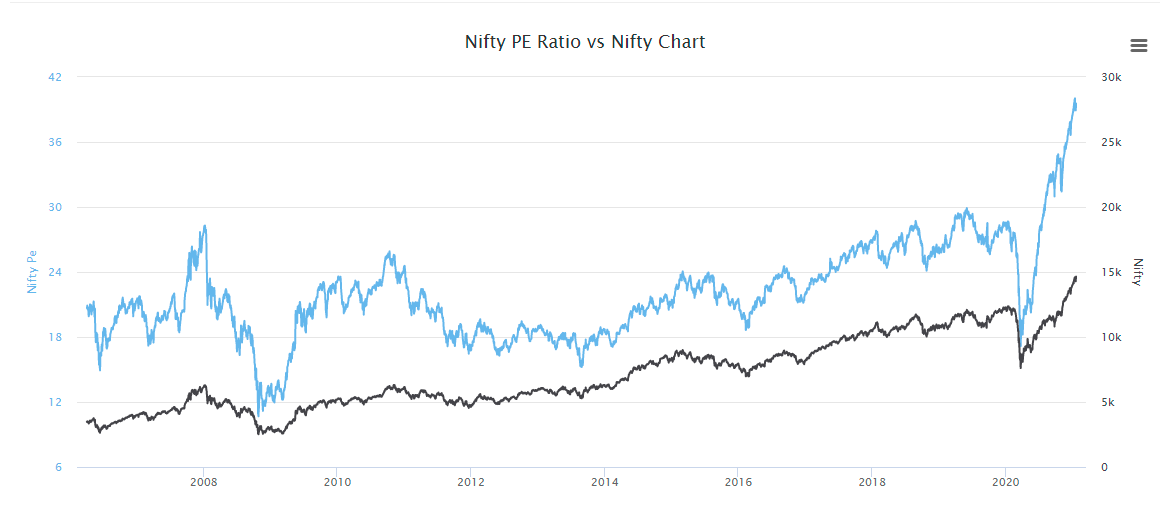

Calling a bubble early as good as being wrong. But are we in a bubble? Let's look at the most rudimentary valuation metric used - PE. Typically anything above 20-25 PE is considered overvalued. And we are at 40! But that's a standalone PE, the consolidated is a little lesser.

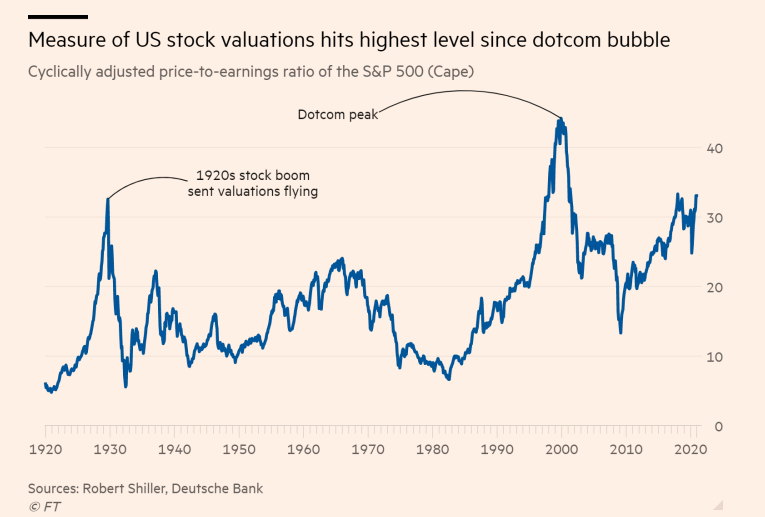

The US markets going by the Shiller CAPE have been only this exuberant once before - THE DOT COM BUBBLE

So, we are in a bubble right? Not so fast. Check this thread by @suru27. Headline PE numbers can be misleading. https://twitter.com/suru27/status/1350538634630365186

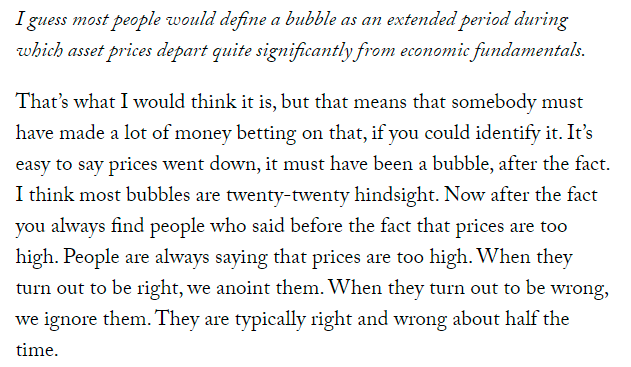

Now, what's a bubble? Eugene Fama, the father of the Efficient Markets hypothesis, doesn't believe in bubbles because you can predict them

" I don’t even know what a bubble means. These words have become popular. I don’t think they have any meaning."

https://www.newyorker.com/news/john-cassidy/interview-with-eugene-fama

https://www.newyorker.com/news/john-cassidy/interview-with-eugene-fama

Bubbles are apparent only after the fact, Fama contended. “The way I interpret it is: You must be able to predict the end of it,” he said. “A bubble has to be something with a predictable ending.” And he added: “What’s the testable proposition? https://www.ai-cio.com/news/cant-spot-bubble-dont-even-try-says-eugene-fama/

Recently, Jeremy Grantham penned a piece dramatically and perhaps aptly tiled "Waiting for the Last Dance".

https://www.gmo.com/asia/research-library/waiting-for-the-last-dance/

In the piece he wrote

https://www.gmo.com/asia/research-library/waiting-for-the-last-dance/

In the piece he wrote

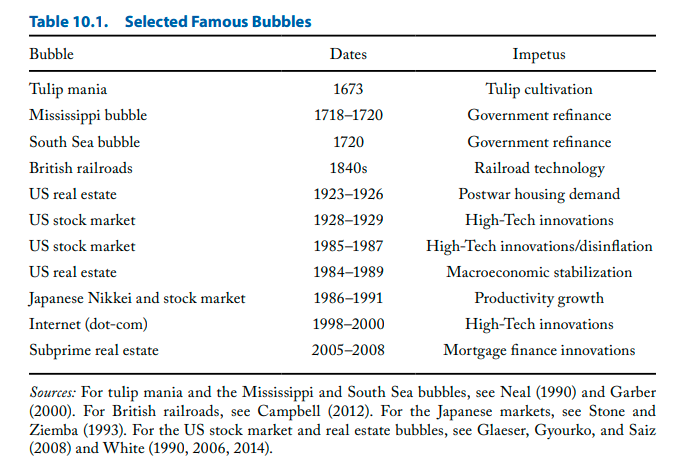

"The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior"

"I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000."

But why do people call bubbles? This piece by @TheStalwart is perhaps one that I keep reading every now and then. In the piece, here's what Joe wrote  https://www.bloomberg.com/news/articles/2019-09-19/seeing-bubbles-why-we-love-to-spot-other-investors-mistakes

https://www.bloomberg.com/news/articles/2019-09-19/seeing-bubbles-why-we-love-to-spot-other-investors-mistakes

https://www.bloomberg.com/news/articles/2019-09-19/seeing-bubbles-why-we-love-to-spot-other-investors-mistakes

https://www.bloomberg.com/news/articles/2019-09-19/seeing-bubbles-why-we-love-to-spot-other-investors-mistakes

"But why is making those calls so popular? Well, for one thing it allows you to feel sophisticated. You can furrow your brow, shake your head sagely, talk about how “history always repeats itself,” and then cite something you once read in Charles Mackay’s book"

So, is predicting bubbles and calling bubbles worth it? I'll use publicly available data, most of which is for the US markets.

Professor @WGoetzmann wrote, perhaps one of my favorite papers on bubbles.

"Using past crashes in this way is misleading to both investors and policy-makers. Particularly during periods of market booms, focusing attention on a few salient crashes in financial history ignores the base rate for bubbles."

"In simple terms, bubbles are booms that went bad but not all booms are bad."

"I define a bubble as a large price decline after a large price increase or, a crash after a boom. I find that the frequency of bubbles is quite small. The unconditional frequency of bubbles in the data is 0.3% to 1.4%"

"Crashes that gave back prior gains happened only 10% of the time. Market prices were more likely to double again following a 100% price boom."

"Placing a large weight on avoiding a bubble, or

misunderstanding the frequency of a crash following a boom, is dangerous for the long-term investor because it forgoes the equity risk premium."

misunderstanding the frequency of a crash following a boom, is dangerous for the long-term investor because it forgoes the equity risk premium."

"If investors in the shares of the Casa di San Giorgio had sold out in 1603, for example, they would have missed a 20-year boom in prices and would have had to wait 80 years to be proven right."

Waiting out bubbles can be costly:

"Even if you believe the probability of a correction is high, it’s far from certain. And when the correction doesn’t happen, the expected opportunity cost of having waited is much greater than the expected benefit." https://www.etf.com/sections/index-investor-corner/swedroe-better-face-correction?nopaging=1

"Even if you believe the probability of a correction is high, it’s far from certain. And when the correction doesn’t happen, the expected opportunity cost of having waited is much greater than the expected benefit." https://www.etf.com/sections/index-investor-corner/swedroe-better-face-correction?nopaging=1

And waiting out can real life consequences for simple uninformed investors like you and I. We don't have the ability to enter and exit these perceived or actual bubbles.

What you call a bubble might also bely profound technological, economic and demographic shits and the markets might be just reacting to them. https://www.cfainstitute.org/-/media/documents/book/rf-publication/2016/financial-market-history-full-book.ashx

"One man’s bubble is another’s wealth generating event."

@howardlindzon https://medium.com/@howardlindzon/one-mans-bubble-is-another-s-wealth-generating-event-372774440ff6

@howardlindzon https://medium.com/@howardlindzon/one-mans-bubble-is-another-s-wealth-generating-event-372774440ff6

"It’s very difficult to spot a bubble that is going to pop, because the bubble may continue and you’ll then lose out from having engaged in what’s still a variety of market timing." - Elroy Dimson https://blogs.cfainstitute.org/investor/2017/12/26/financial-market-history-can-help-todays-investors/

Calling bubble can extremely costly:

https://mailchi.mp/verdadcap/investing-in-a-bubble?e=b838bc224f

https://mailchi.mp/verdadcap/investing-in-a-bubble?e=b838bc224f

"George Soros had seen enough, persuaded by the same fact pattern Lynch, Dalio, Marks, and Klarman had all observed. He decided to put on a significant short trade against US technology stocks. By the end of 1998, Soros had lost $700m betting against internet firms"

Take piece which cites top investors like GMO, Research Affiliates, William Bernstein, Ray Dalio, Robert Shiller, Cliff Asness who predicted mute returns in 2015. https://awealthofcommonsense.com/2015/11/does-a-change-in-expectations-require-a-change-in-strategy/

Here's an excellent complication on the current season of bubble calling https://twitter.com/SandeepParekh/status/1338384619863822337

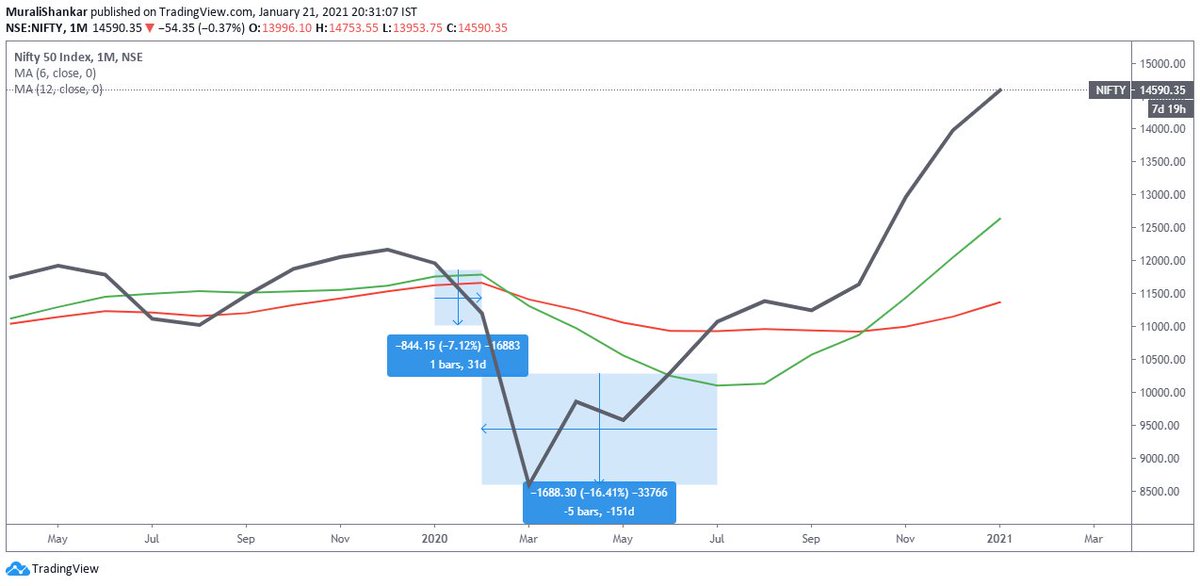

Can you protect yourself against bubbles? Not fully. Let's say, you implement a trend following strategy. Look at the chart closely. I've 6 months moving average as a proxy for 200 DMA and 12 months. Buy above and sell below a MA is the rule

In corona crash, you'd have gotten away with a 5-10% drawdown, but you'd have missed a good chunk of the recovery

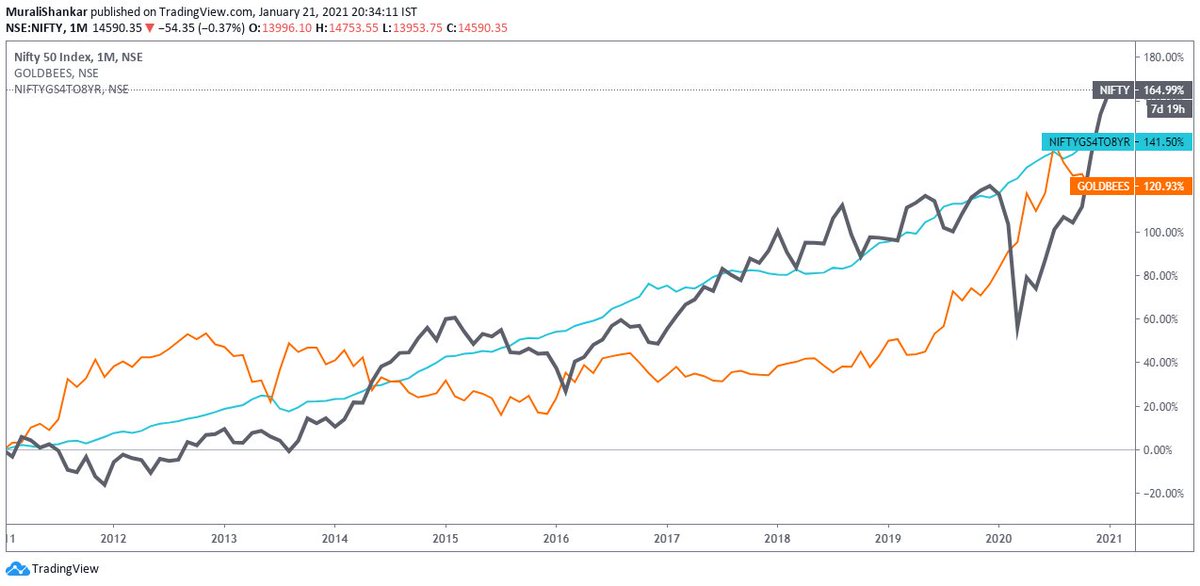

The other thing you can do is have a robust asset allocation. And that's not foolproof either. https://twitter.com/ShyamNation/status/1351773437396541441?s=20

Correlations are a moving target and during crises all assets may move together

https://twitter.com/ShyamNation/status/1345626228175167489

https://twitter.com/ShyamNation/status/1345626228175167489

To sum it up. Predicting bubbles, trying to ride them, trying to sit on cash is a horribly stupid idea. For mere mortals, the only real solution in my view is protection. It could be trend following to get in and out or asset allocation.

All in or out calls can go horribly bad. But the thing is they can have real rupee impacts on your goals.

Read on Twitter

Read on Twitter