Is Asymmetry investing something we should do some more? Let’s take the debate!

I use Asymmetry investing on portfolio-level, where I try to play the math to my advantage and use a lot of VC-mentality. The cross between stocks, Asymmetry investing, and VC is so beautiful.

I use Asymmetry investing on portfolio-level, where I try to play the math to my advantage and use a lot of VC-mentality. The cross between stocks, Asymmetry investing, and VC is so beautiful.

Definition

Symmetry: It’s when the parts of something have equal form and size (see picture).

An asymmetric investment is when the potential upside of a position is much more significant than its potential downside.

Symmetry: It’s when the parts of something have equal form and size (see picture).

An asymmetric investment is when the potential upside of a position is much more significant than its potential downside.

Example

If you invest $10,000 for the chance of making $10,000, you make a symmetrical investment

If you invest $10,000 for the chance of making $100,000, you make an asymmetrical investment

If you invest $10,000 for the chance of making $10,000, you make a symmetrical investment

If you invest $10,000 for the chance of making $100,000, you make an asymmetrical investment

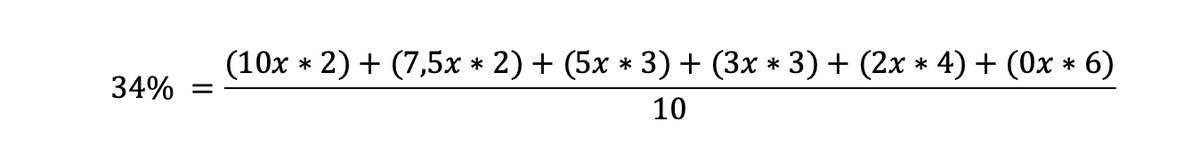

I show how you use it in a VC-fund in the next tweet, which returns 34% IRR.

“Rules”:

20 investments

20 investments

10y holding period

10y holding period

Every investment is placed in the inception

Every investment is placed in the inception

I have just simplified everything to make it more understandable.

“Rules”:

20 investments

20 investments  10y holding period

10y holding period  Every investment is placed in the inception

Every investment is placed in the inception I have just simplified everything to make it more understandable.

See this model I have created for fun to illustrate the math behind it. It is a VC-fund that delivers a return of 34% IIR and 340% in 10y

10x return: 2 companies

7,5x return: 2 companies

5x return: 3 companies

3x return: 3 companies

2x return: 4 companies

0x return: 6 companies

10x return: 2 companies

7,5x return: 2 companies

5x return: 3 companies

3x return: 3 companies

2x return: 4 companies

0x return: 6 companies

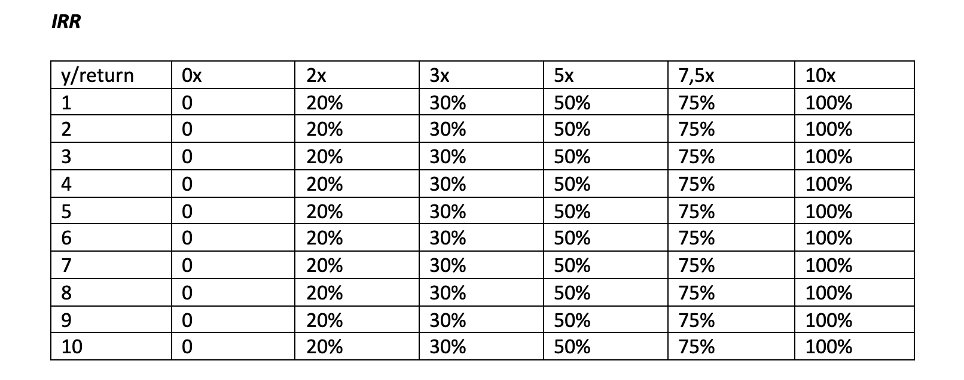

What is the return per y on each return (remember 10y holding):

10x return: 100% IIR

7,5x return: 75% IRR

5x return: 50% IRR

3x return: 30% IRR

2x return: 20% IRR

0x return: 0% IRR

20 companies divided into this (with the right segmentation) = 34% IRR.

10x return: 100% IIR

7,5x return: 75% IRR

5x return: 50% IRR

3x return: 30% IRR

2x return: 20% IRR

0x return: 0% IRR

20 companies divided into this (with the right segmentation) = 34% IRR.

The Asymmetry in VC-investing in real life:

They know (from historical data) that probably six companies will totally fail (100% downside), but if the rest make +100% of return, it is an asymmetry investment.

They know (from historical data) that probably six companies will totally fail (100% downside), but if the rest make +100% of return, it is an asymmetry investment.

Therefore VC always talks about the 10x – Every investment should have the potential of giving more than1000% again (with a downside of 100% = asymmetry).

What to be aware of:

This is a risk/reward play: volatility needs to be your friend. Maybe it 10x, perhaps it goes to the bottom, maybe it goes to the bottom and rises to 5x later. You need to look the other way.

And that is leading me to the next point:

This is a risk/reward play: volatility needs to be your friend. Maybe it 10x, perhaps it goes to the bottom, maybe it goes to the bottom and rises to 5x later. You need to look the other way.

And that is leading me to the next point:

You need to apply the same methods as VCs: Threat it as an illiquid asset. You really need to do your DD well and trust what you are doing ( =Know the case & the industry) because you will not touch it +5y. In the meantime, it can go up, down, sideways. Just trust for your work.

The difference between VC and stocks:

It is easy to find asymmetry opportunities in the VC-market than in the stock market. VCs have the option (especially early-stage VCs) to be on board from the start instead of after IPO.

It is easy to find asymmetry opportunities in the VC-market than in the stock market. VCs have the option (especially early-stage VCs) to be on board from the start instead of after IPO.

Before IPO, there is a lot greater risk the company will fail (100% downside). After IPO, the risk is a lot smaller, so instead of 0% in return, if maybe go sideways or down to 50%, etc.

How to find these stocks?

Just follow me Joke aside! You need to keep an open mind, understand that the world is changing, and you need to ride on megatrends. This one will be for another day.

Joke aside! You need to keep an open mind, understand that the world is changing, and you need to ride on megatrends. This one will be for another day.

Just follow me

Joke aside! You need to keep an open mind, understand that the world is changing, and you need to ride on megatrends. This one will be for another day.

Joke aside! You need to keep an open mind, understand that the world is changing, and you need to ride on megatrends. This one will be for another day.

Comments:

If you have 10 investments, if one becomes a 10x, the rest could totally fail, and you would still haven’t lost a dime. That’s how the math works.

If you have 10 investments, if one becomes a 10x, the rest could totally fail, and you would still haven’t lost a dime. That’s how the math works.

Comments:

It can be done: The VCs has attracted some of the smartest persons in the world because of the romance in Asymmetry investing. The same applies to stocks.

You cannot pick something “safe” to apply this model; you need companies with the most significant potential.

It can be done: The VCs has attracted some of the smartest persons in the world because of the romance in Asymmetry investing. The same applies to stocks.

You cannot pick something “safe” to apply this model; you need companies with the most significant potential.

Comments:

You are de-risking your portfolio if you do the math on this level instead of looking only at stock-by-stock in the portfolio. You need to look at the return overall.

You are de-risking your portfolio if you do the math on this level instead of looking only at stock-by-stock in the portfolio. You need to look at the return overall.

Comments:

You still need to evaluate your investment from time to time; Bad management, fraud accusations, the competitors are better, etc., should always make you think about cost opportunity.

You still need to evaluate your investment from time to time; Bad management, fraud accusations, the competitors are better, etc., should always make you think about cost opportunity.

Hope it was worth a read – It very complicated topic. I'm passionate about growth and VC, so I know this isn’t for anybody. And everything is a lot more nuanced.

Pick your own style.

Hope to get your retweet and your comment with your style. Would love that input!

Pick your own style.

Hope to get your retweet and your comment with your style. Would love that input!

Read on Twitter

Read on Twitter