What if I told you the next big play in clean/green energy was an oil and gas company? In my opinion, $FTI could be on the verge of producing a game-changer in energy storage technology. Don’t say an old dog can’t learn a new trick, because $FTI may just surprise us all.

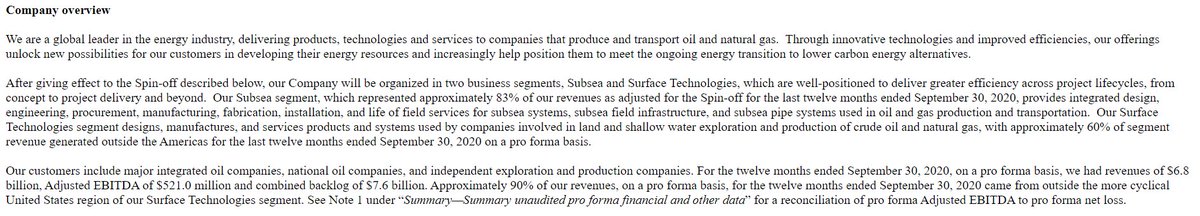

TechnipFMC $FTI is global leader in the energy industry, delivering projects, products, technologies, and services to clients around the world.

$FTI has 37,000 employees, their own supply chain (manufacturing plants worldwide), and experience running massive, complex projects.

$FTI has 37,000 employees, their own supply chain (manufacturing plants worldwide), and experience running massive, complex projects.

With much of the world looking to transition from fossil fuels to clean energy, players in the O&G space will have to adapt and explore new business opportunities. $FTI has begun this process with their Deep Purple project and their spin-off of Technip Energies.

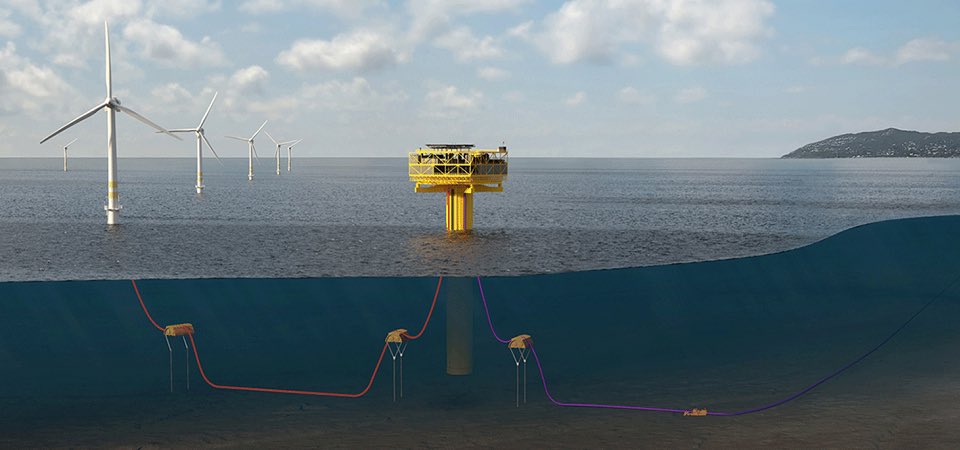

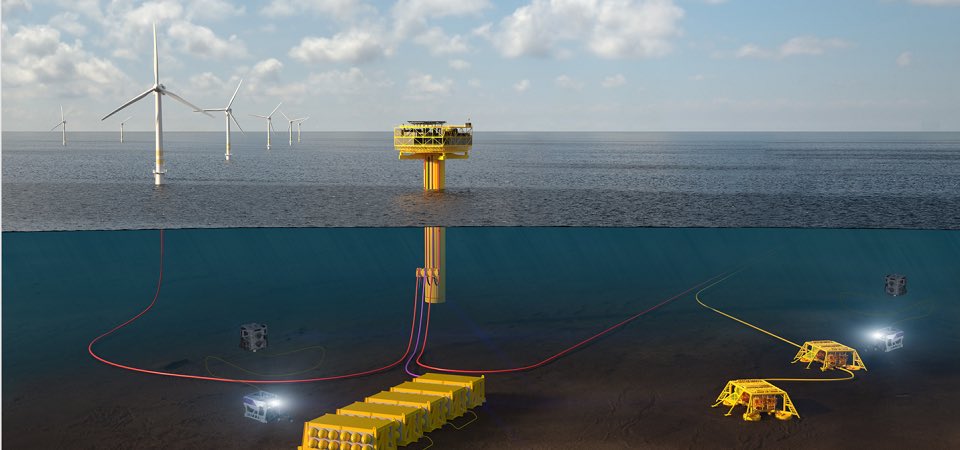

Deep Purple is a project to convert power from offshore wind to hydrogen and store it on the ocean seabed until needed. The project is currently underway in Norway, with an onshore pilot wind farm expected this year. https://www.maritime-executive.com/article/technipfmc-wins-support-for-offshore-hydrogen-generation-pilot

Deep Purple combines renewable energy with energy storage, making it a complete, sustainable energy solution. Wind turbines deliver power to consumers. When power isn’t needed, it’s used to split water into hydrogen and oxygen. The hydrogen is then stored in tanks on the seabed.

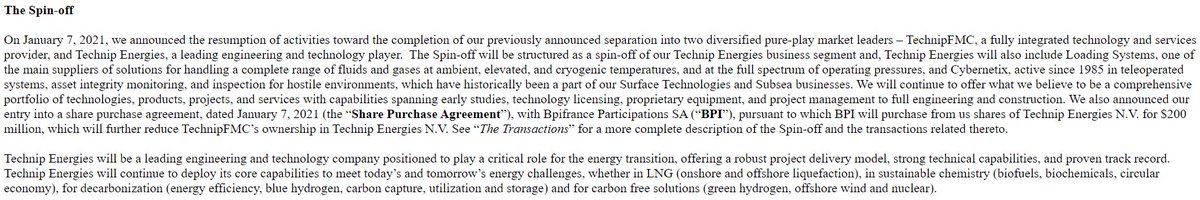

$FTI isn’t stopping there; to remain competitive in the changing energy landscape, they are spinning off Technip Energies. This will allow the new company to pursue tomorrow’s energy challenges (biofuels, decarbonization, hydrogen, wind, nuclear).

A single project and a spin-off company is no indicator of success, but here’s why I’m bullish. The transition from fossils fuels to clean energy will be a massive undertaking. $FTI has all the pieces to be successful - labor force, experience, manufacturing capabilities, etc.

You want a catalyst? You got it. On Jan. 28th, $FTI is hosting a Capital Markets Day dedicated to Technip Energies (spin-off). The presentation will highlight “Technip Energies long-term strategic vision and unique positioning in the energy transition.”

Last but not least, the chart. $FTI has been slowly grinding upwards but is currently pulling back to the trend line. This presents an entry opportunity for next weeks event. Hourly chart shows indicators starting to curl back up.

Full disclosure, I do have a position. Tweets are ideas/opinions. @yatesinvesting @Anonymoustocks @IncredibleTrade @MysteryMan_777 @SuperDuperInvst @Alexs_trades @notoriousalerts @Pharmdca @traderjon01 @ddandaneau @thedesertwolfe @LadeBackk @StockSwingAlert @TC_Investments

Read on Twitter

Read on Twitter