Thought I was going to finish 2020 empty handed, tough real estate market out here.

Managed to snag a great deal at the last minute and wanted to share the details.

Here’s how I analyze multifamily real estate investment opportunities

Managed to snag a great deal at the last minute and wanted to share the details.

Here’s how I analyze multifamily real estate investment opportunities

The property was a vacant 4plex, listed for $990k & after a few back and forths, the sellers accepted $950k with no finance condition.

Sellers were an elderly couple who neglected the property, it needed a lot of work. It was in a great neighbourhood/location.

(more pics later)

Sellers were an elderly couple who neglected the property, it needed a lot of work. It was in a great neighbourhood/location.

(more pics later)

I first calculated my total equity investment required to acquire and stabilize the property.

During the inspection, did a full walk through with a trusted contractor (worked with for years), receiving quotes unit-by-unit.

Estimated time to complete = 4-6 months.

During the inspection, did a full walk through with a trusted contractor (worked with for years), receiving quotes unit-by-unit.

Estimated time to complete = 4-6 months.

Next is the stabilized P&L.

Since I know the area very well, I can estimate rents and opex with great accuracy (I have another property within 15 mins walking distance).

Tenants are responsible for hydro/gas.

Since I know the area very well, I can estimate rents and opex with great accuracy (I have another property within 15 mins walking distance).

Tenants are responsible for hydro/gas.

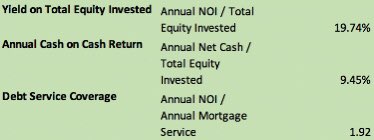

Finally, I put together the key metrics in evaluating the deal.

I look for yield above 15%, cash on cash above 7% and debt service above 1.5.

As you can see, the numbers check out.

I look for yield above 15%, cash on cash above 7% and debt service above 1.5.

As you can see, the numbers check out.

Bull case - I’m also looking into adding a 5th rental unit, which if feasible, should cost $50k to $75k to construct & generate $13k to $15k in annual gross rents.

This would improve all of my metrics. But even if it isn’t feasible, the base case is good enough for my criteria.

This would improve all of my metrics. But even if it isn’t feasible, the base case is good enough for my criteria.

I never speculate on either asset appreciation or future rent increases in my models or decision making criteria. I plan on holding very long term.

But if cap rates on stabilized properties remain around the current 3.5% to 4% range, the property could be worth $1.56m to $1.78m.

But if cap rates on stabilized properties remain around the current 3.5% to 4% range, the property could be worth $1.56m to $1.78m.

For more details on this deal, along with more pics and an explanation on how my real estate investing strategy has evolved, check out my blog post.

I also post free content on investing and personal finance, so be sure to subscribe! https://jayvas.com/my-latest-real-estate-deal-and-how-my-strategy-has-changed/

I also post free content on investing and personal finance, so be sure to subscribe! https://jayvas.com/my-latest-real-estate-deal-and-how-my-strategy-has-changed/

Regarding deal sourcing, it was sent to me by a local broker who I have a relationship with.

Regarding financing, no investors or LPs and mortgage is 1.8% with 30 year amortization.

Regarding financing, no investors or LPs and mortgage is 1.8% with 30 year amortization.

Read on Twitter

Read on Twitter