My yesterday's post about Grayscale and BlockFi got some interesting and valid criticism, and it's really worth taking a deeper dive into the GBTC premium arbitrage trade.

The main counter-argument is, "there's a premium for valid reasons, and people are taking advantage of it".

The main counter-argument is, "there's a premium for valid reasons, and people are taking advantage of it".

There are indeed good reasons for a premium. GBTC allows to get exposure to BTC while saving on taxes because you can put it into your IRA. It's much easier than buying Bitcoin on exchanges (although Paypal has changed that equation). So people accept to buy $BTC at 20% premium.

My exact argument was, you can't take advantage of the premium because there's no liquidity - the moment you try to cash out your shares witch you got by subscribing at NAV, the premium collapses. The counter-argument is, "really A LOT of people buying GBTC so there's liquidity".

Moreover, there's a 6 month lock-up period for people who subscribe at NAV, so it's not a quick trade, you can't milk the premium that easily.

Imagine you're an arbitrageur want to milk the premium. You buy 100 Bitcoins' worth of GBTC at NAV, and wait six months.

Imagine you're an arbitrageur want to milk the premium. You buy 100 Bitcoins' worth of GBTC at NAV, and wait six months.

You then manage to sell to retail investors your 100 Bitcoins' worth of GBTC at market value, i.e. with the premium. You made 20 BTC of profit. The trade worked, and you want to do it again, so you put the money to work again, buying 120 Bitcoins' worth of GBTC at NAV.

For the trade to work, Grayscale's AUM must go up. If retail investors don't buy GBTC shares, you can't cash out & take the premium. Mathematically, in X% of GBTC holders are arbitrageurs, GBTC AUM needs to go up by X% every 6 months. That's something called exponential growth.

Let's have a look at GBTC's AUM in Bitcoin terms:

24 months ago: 210K

18 months ago: 250K (+19%)

12 months ago: 270K (+8%)

6 months ago: 350K (+30%)

Today: 650K (+86%)

The trade could have clearly worked for the last year or so, based on these figures. BUT you'd still need people

24 months ago: 210K

18 months ago: 250K (+19%)

12 months ago: 270K (+8%)

6 months ago: 350K (+30%)

Today: 650K (+86%)

The trade could have clearly worked for the last year or so, based on these figures. BUT you'd still need people

to buy GBTC at market value, while the AUM growth might be due to sophisticated investors getting in at NAV:

1. Because it's cheaper and they understand what they're doing

2. Because there's a massive influx of arbitrageurs to milk the premium, and everyone has the same trade on.

1. Because it's cheaper and they understand what they're doing

2. Because there's a massive influx of arbitrageurs to milk the premium, and everyone has the same trade on.

Now if I were a sophisticated investor who's buying GBTC at NAV to get exposure to Bitcoin, I'd still want to milk the premium every six months by selling GBTC on the market and resubscribing at NAV. So every sophisticated investor who's holding GBTC is in fact an arbitrageur.

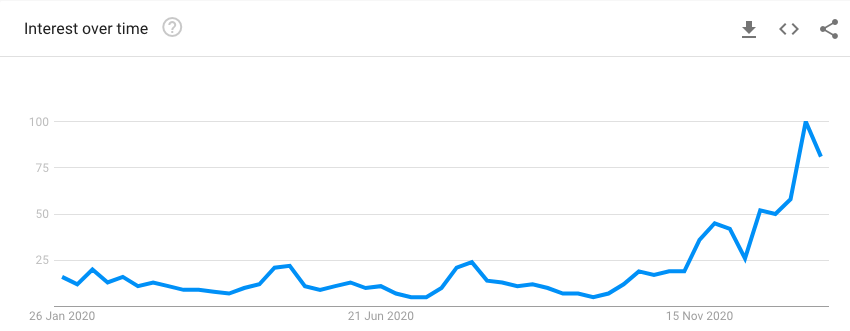

The persistence of the GBTC premium requires truly MASSIVE influx of retail money, to pay for the premium arbitrage. I have to admit it's possible: look at the Google trend for "GBTC". As everything Bitcoin related it's going to the moon.

The GBTC prospectus has a caveat though.

The GBTC prospectus has a caveat though.

Unlike most ETFs, you can't redeem your GBTC shares in Bitcoins - because that would be excruciatingly complicated to set up. You have to sell your GBTC shares on the market.

The GBTC arbitrage trade has itself grown exponentially over the last few months. It's becoming a risk.

The GBTC arbitrage trade has itself grown exponentially over the last few months. It's becoming a risk.

Given how much Bitcoin has been rising, and the negative carry cost of hedging your position against $BTC, it's unlikely most of these arbitrageurs are hedging their Bitcoin exposure.

Moreover, the 6 month lockup period means A LOT of people are currently waiting to cash out.

Moreover, the 6 month lockup period means A LOT of people are currently waiting to cash out.

Remember, this trade requires an EXPONENTIAL rise of GBTC holders, or it unravels. Everyone is on the same side of the boat.

So yes, the trade is possible and people are probably making money out of it - assuming an exponential influx of new investors. You know, like a Ponzi.

So yes, the trade is possible and people are probably making money out of it - assuming an exponential influx of new investors. You know, like a Ponzi.

But when the trade no longer works, a tsunami of traders will want out, and the only way out is a very stupid one - by selling GBTC on the market. This exit will become very illiquid in a heartbeat.

I'm sure Greyscale will enable holders of GBTC to redeem in Bitcoins somehow.

I'm sure Greyscale will enable holders of GBTC to redeem in Bitcoins somehow.

But that will create an army of Bitcoin bagholders who never wanted to hold Bitcoin in the first place, and who will try to get out.

The rise of Grayscale's AUM due to the premium arbitrage trade could have been responsible for Bitcoin's new ATHs. The way out will be messy.

The rise of Grayscale's AUM due to the premium arbitrage trade could have been responsible for Bitcoin's new ATHs. The way out will be messy.

Read on Twitter

Read on Twitter