*Mini-Thread*

I've been working through this rally by continually asking myself "How greedy do I want to be here?"

This question comes up on sell offs and allows me to balance the PA I'm seeing with spot buys.

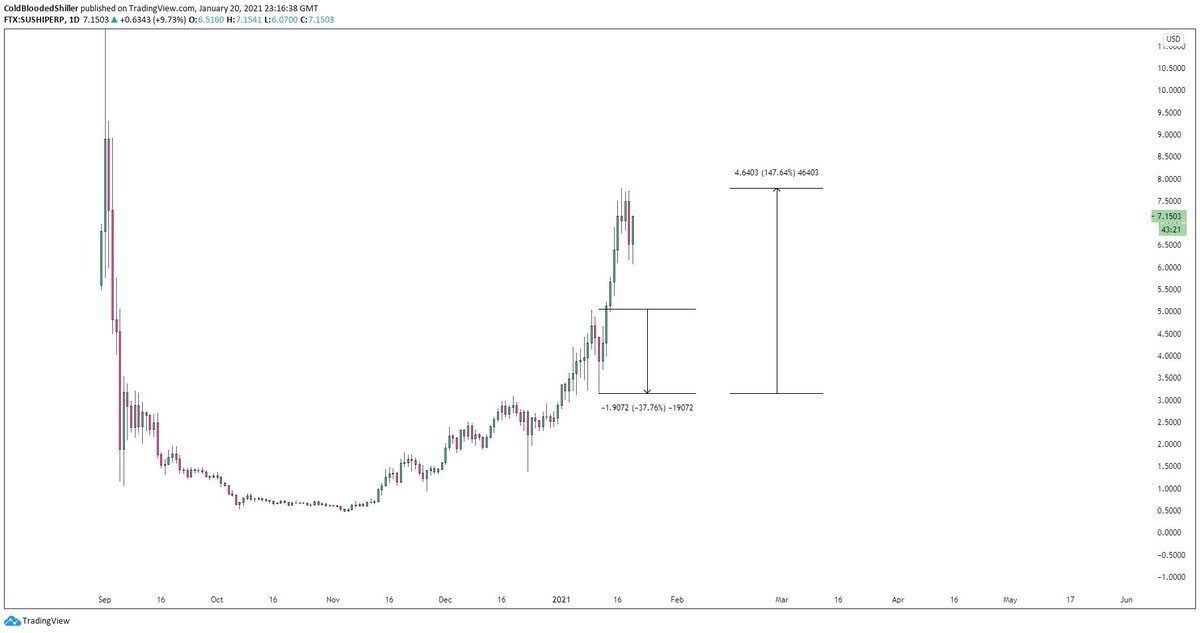

With 30 - 40% sell offs at times the question is always in my mind.

I've been working through this rally by continually asking myself "How greedy do I want to be here?"

This question comes up on sell offs and allows me to balance the PA I'm seeing with spot buys.

With 30 - 40% sell offs at times the question is always in my mind.

You'll have been conditioned by Twitter for weeks to expect 30% corrections in bull markets.

But when they are here they feel:

1. Too scary to long

2. That it could be a top and you want lower targets

This line of questioning around greed of entry has served me well so far.

But when they are here they feel:

1. Too scary to long

2. That it could be a top and you want lower targets

This line of questioning around greed of entry has served me well so far.

From the high, $LTC sold off 40%.

How greedy am I if I don't think about a spot opportunity here in the current conditions?

If we drop lower it's to $90. I'm able to take spot and exit if we invalidate as I believe the next leg is deep.

How greedy am I if I don't think about a spot opportunity here in the current conditions?

If we drop lower it's to $90. I'm able to take spot and exit if we invalidate as I believe the next leg is deep.

We have something similar on $ETC.

A 35% sell off - holding weekly support on top of a 10 months range.

Can I expect more? Or am I being greedy with fine-tuning an entry?

A 35% sell off - holding weekly support on top of a 10 months range.

Can I expect more? Or am I being greedy with fine-tuning an entry?

Now these are a couple of markets where the response hasn't been as strong as the best performers. But they show you my decision making at this time.

If you consider the same logic on these 30 - 40% drops across these alts perhaps the answer or the probabilities become clearer.

If you consider the same logic on these 30 - 40% drops across these alts perhaps the answer or the probabilities become clearer.

There are plenty more examples I can give but I'll stick with these for now. The idea here is to ask yourself when you see the sell offs "is it worth me being greedy for 1-2% more on a sell off?"

By facilitating the greed aspect to your entries you'll be unable to capitalise on the potential upside moves for alts in their V-reversals.

The majority of you are overleveraged and this will be your problem, you need to get the bottoms to survive.

Switch to spot and begin building entry in the fear we see around 30+% sell offs.

We are seeing exactly what was discussed, strong sell offs, stronger buy ups.

Switch to spot and begin building entry in the fear we see around 30+% sell offs.

We are seeing exactly what was discussed, strong sell offs, stronger buy ups.

So, ask yourself the question next time you see price selling off strongly and reaching these fabled 30-40% numbers.

Am I being greedy looking for more?

Am I overleveraged which means I can't enter?

Should I buy a small amount of spot to start a position?

Am I being greedy looking for more?

Am I overleveraged which means I can't enter?

Should I buy a small amount of spot to start a position?

If you can change your behaviour around the way you're viewing sell offs (as opportunity) you can begin to establish a strong portfolio of alts from a position of strength to ride rallies.

Low lev and spot will be your best friends.

Low lev and spot will be your best friends.

By shifting your risk management approach and ensuring you're being sensible you'll have less stop-outs and more exposure to great performing alts from better positions and for longer periods of time.

Is it truly worth holding on for that retest or eyeing up 1-2% lower while potentially missing out on the opportunity of some of the 100%+ gains we've seen across some markets?

For me, absolutely not. % sell offs has been a strong indicator of removing greed and entering spot.

For me, absolutely not. % sell offs has been a strong indicator of removing greed and entering spot.

Read on Twitter

Read on Twitter