1/  Time:

Time:

On Monday @SportsBizNick brought to my attention that @Sportico published their 2021 NBA valuations. @JoePompliano had a great summary in his newsletter @readhuddleup analyzing the valuation of the Warriors. One thing was clear from a valuation standpoint over time...

Time:

Time:On Monday @SportsBizNick brought to my attention that @Sportico published their 2021 NBA valuations. @JoePompliano had a great summary in his newsletter @readhuddleup analyzing the valuation of the Warriors. One thing was clear from a valuation standpoint over time...

2/ I thought it would be fun to take a look at just how much the NBA has grown from a valuation standpoint. I wanted to know what these valuations looked like with some historical context.

Let’s take a look

Let’s take a look

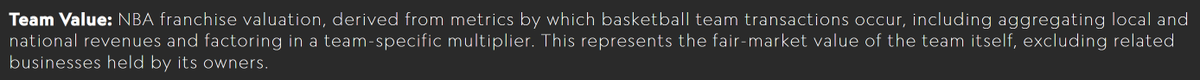

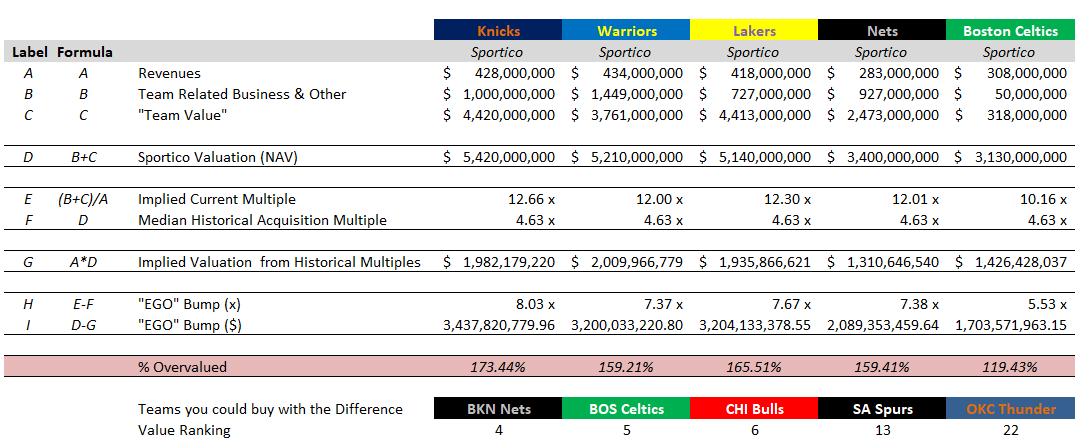

3/ First let’s take a look at how @Sportico determined their valuation numbers.

According to their methodology the valuations relied on two components:

-Team Related Business & Real-Estate

-“Team Value”

See below for a further breakdown of what this actually means:

According to their methodology the valuations relied on two components:

-Team Related Business & Real-Estate

-“Team Value”

See below for a further breakdown of what this actually means:

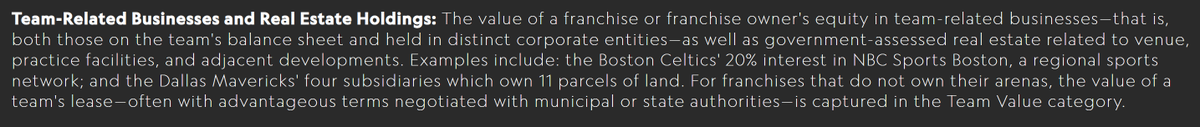

4/ @Sportico utilized what is known as a “Multiple Analysis” which is simply the use of a ratio to determine the overall value of an asset - in this case an NBA franchise. In their research @Sportico was able to generate a blended multiple with multiple inputs...

5/ For my analysis we will be using a simplified version of this multiple. While there are various types of multiple analysis utilized in financial valuation we will using a Price/Sales multiple which is further described below:

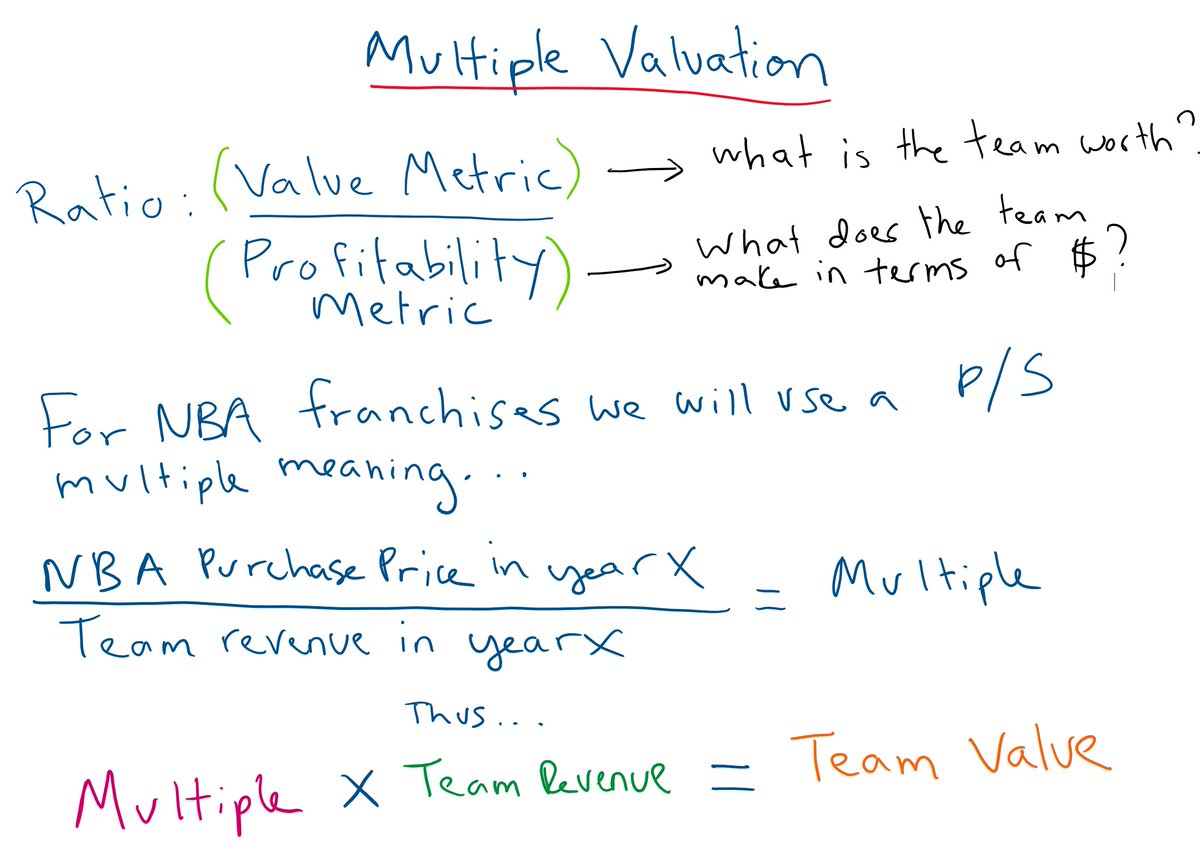

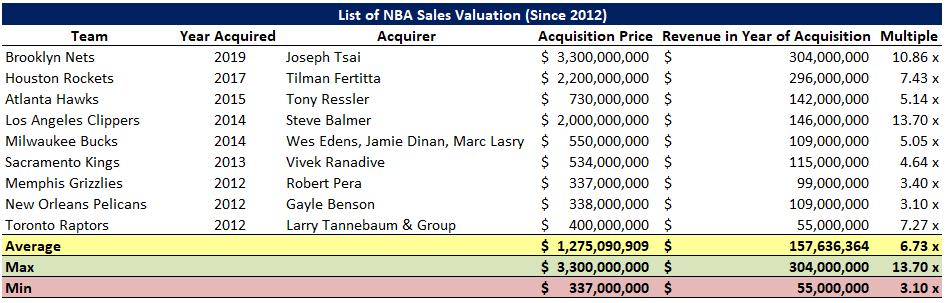

6/ Now that we have context on P/S multiple analysis let's dig into the data. Below is a list of the purchase prices and revenues for every current NBA team. Given this data we can generate a metric to apply to our 2021 NBA data:

(S/T @Forbes & @StatistaCharts )

(S/T @Forbes & @StatistaCharts )

7/ Notice that the average sale for NBA franchises has historically been 4.63x times the revenue in the given year they were sold. Therefore we should be able to come up with a proxy for a team’s value by multiplying (4.63 x 2020 revenue). Lets see the results...

8/ When applied to the top 5 teams on @Sportico’s list the results are surprising. Using historical multiples dating back to the 1970s - the valuations of the 5 highest valued teams would be over 100% more expensive than their historical multiples would indicate:

9/ According to the historical data the @nyknicks were 173% overvalued (by a $ amount of close to $3.5bn). To put this in context the Knicks could have bought the @BrooklynNets with the premium they paid! Sadly the data above does not necessarily paint a full picture...

10/ The previous graphic has definite flaws. Certain intangible assets and growth factors definitely make NBA franchises more valuable than they were even 10 years ago let alone 30. So let's look at valuation multiples from 2012 on for a more representative data set:

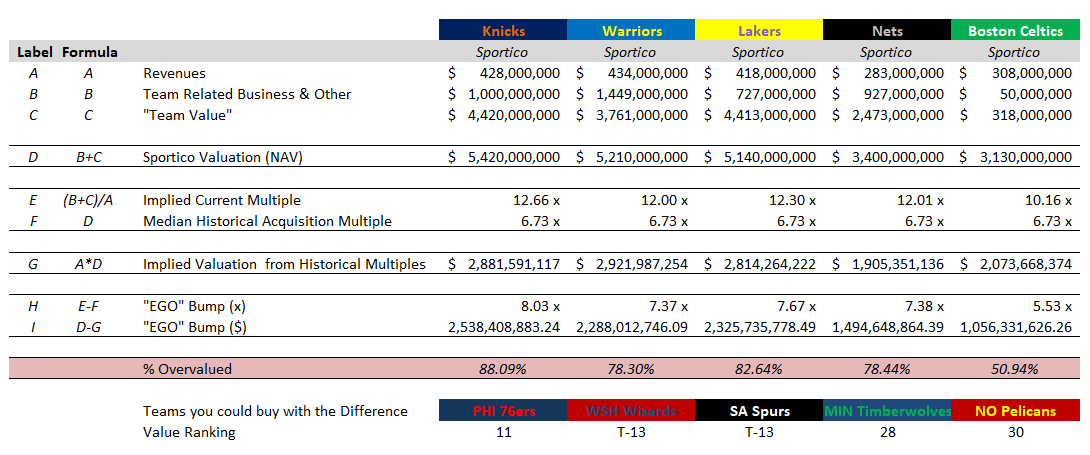

11/ Taking into account more recent transactions NBA franchises have been trading at ~7x price to revenue multiple. I reran the numbers and the results....still indicative of NBA owners being shopaholics:

12/ The recent franchise purchases show overvaluation ranges from 51% to 88%...Still pretty expensive IMO

While these multiples indicate a slight dislocation in value there are certainly arguments (agreed) that would indicate that NBA franchises are worth more than we think...

While these multiples indicate a slight dislocation in value there are certainly arguments (agreed) that would indicate that NBA franchises are worth more than we think...

13/ Why does this matter? To be perfectly honest I don't know if it does. But it sure is interesting that the CAGR for the @warriors has been 28% since their 2010 acquisition (shoutout @chamath)

14/ If there is one thing you take away from this thread it is this...

Golden State blew a 3-1 lead in the 2016 Finals

Golden State blew a 3-1 lead in the 2016 Finals

15/ A HUGE thank you to @Sportico’s phenomenal analysis on the topic. I need to emphatically state that their valuation numbers are highly nuanced with expert research and I would encourage anyone interested to dive into their methodologies. They are truly top notch!

16/ If you liked this thought experiment throw me a like and I will continue to brighten your timeline with formatted graphs and utter nonsense

Read on Twitter

Read on Twitter