2) Introduction.

Wintermute is a crypto market maker based in London. They are a prop trading firm and do not manage crypto or fiat funds on behalf of investors or customers.

Before digging into WM, let’s first look at why market makers are so important in the crypto industry.

Wintermute is a crypto market maker based in London. They are a prop trading firm and do not manage crypto or fiat funds on behalf of investors or customers.

Before digging into WM, let’s first look at why market makers are so important in the crypto industry.

3) What is a market maker?

3.1) The goal of most crypto projects is to grow large enough (in users, adoption, value and functionality) to become a self-sustaining, autonomous economic ecosystem. Like any economic ecosystem, value drives crypto...

3.1) The goal of most crypto projects is to grow large enough (in users, adoption, value and functionality) to become a self-sustaining, autonomous economic ecosystem. Like any economic ecosystem, value drives crypto...

...ecosystems, usually in the form of project native tokens. In order for any crypto-system to flourish, value must circulate smoothly throughout. This would not be possible without crypto exchanges and market makers.

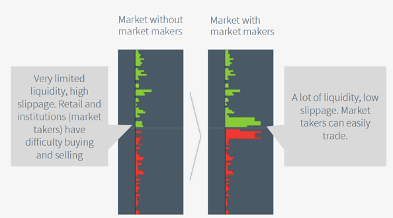

3.2) We all know exchanges provide a platform to match buyers and sellers, but this does not ensure liquidity for any particular coin.

3.3) A market maker is a major participant on an exchange that engages in two sided markets for a given asset, i.e. a MM provides both bids and asks together to a market size for a security. The primary goal...

...of a MM is to profit on the bid-ask spread. These MMs usually have a special agreement with an exchange whereby they receive lower fees in exchange for providing quality liquidity.

3.4) By providing both sides of the market (making the market) for an asset, MMs ensure the asset has a deep orderbook and high liquidity which is beneficial for a number of reasons:

3.4.1) - Deep liquidity reduces wild price swings.

- Large “whale” orders have limited impact on market prices.

- Prices become much harder to manipulate.

- Large “whale” orders have limited impact on market prices.

- Prices become much harder to manipulate.

3.5) By offering both bid and ask in a stable market, MMs quickly profit of bid-ask discrepancy, however, when markets trend and there is high volatility, the risks and rewards increase and sophisticated MMs employ a range of strategies to max. profit.

(Image source: Wintermute)

(Image source: Wintermute)

4) How MMs make money

4.1) A market maker’s primary role is to create a healthy and active market for both buyers and sellers by placing multiple limit orders, on both sides of the market for an asset, in the orderbook of an exchange. These orders...

4.1) A market maker’s primary role is to create a healthy and active market for both buyers and sellers by placing multiple limit orders, on both sides of the market for an asset, in the orderbook of an exchange. These orders...

...will consist of a price and quantity, e.g. Bid: $31,000.50 x 1000, Ask: $31,000.47 x 900. Buyers and sellers fill these trades and a MM profits off the difference.

4.2) How big is this difference? Varies largely on the liquidity of each asset and market. The more illiquid a market, the wider the spread, the more profitable for a MM. At time of writing, Yahoo Finance...

... quoted Alphabet Inc Class C (GOOG) shares @ Bid: 1,726.20 x 800. Ask: 1,726.50 x 1000, a spread, and thus potential market maker profit, of 0.017% (1.7 basis points).

4.3) BTC on the other hand, usually has a spread of 3-5 bps, meaning crypto MMs can earn around twice the profits of a traditional MM dealing in stocks. In fact, during dry trading spells, e.g. following March 12th, BTC spread reached 200-700 basis points on some exchanges.

4.4) Spreads tend to widen during steep market declines like above as sellers hit the bid and buyers stay hold off for lower prices. MMs widen the spread during declines to mitigate the...

...higher risk of loss and disincentive investors from trading (a higher volume of trades during volatile swings increase the risk of a MM being caught on wrong side of a trade)

4.5) Note the spike during the March 13 crash. Under normal conditions most exchanges would rarely exceed a spread of 0.2% with more established exchanges like Coinbase averaging between 0.02-0.04%.

(Data source: https://data.bitcoinity.org/ )

(Data source: https://data.bitcoinity.org/ )

4.6) There are many popular strategies that MMs employ to make money. Examples include:

4.6.1) Delta Neutral Market Making – MMs aim to make a consistent tiny markup in positions on two exchanges, usually one being more illiquid than the other, that cancel each other out and are not affected by small changes in price of underlying. The...

...price the maker would offer on the low liquidity exchange would be the cost of filling the order on the higher liquidity exchange, plus a small profit. The MM achieves a delta neutral state with no directional bias.

4.6.2) High-Frequency Market Making – Key to success is being the first to execute. MMs offer buy and sell orders at the best prices in the market and aim to fill them immediately. This strategy trades as often as possible, as fast as possible (high frequency), constantly...

... filling buy and sell orders around market price and constantly profiting from tighter spreads.

4.6.3) Grid trading – MMs place increasing orders throughout the book around an avg. price. As price moves, MM earns money on spreads. Given that the orders increase as they diverge from avg. price, the MM engages in a sort of Martingale System; doubling down as price diverges.

5) Crypto vs Traditional MM

5.1) In traditional securities markets such as equities, regulatory barriers prevent individuals and small firms from filling the market maker role. Furthermore, competitive barriers like...

... co-location; locating HFT servers physically close to exchange servers for lower latency, also limit access for small firms.

5.2) In crypto, indiv. and firms have direct access to same exchanges, APIs and free data feeds. Co-location is not offered by crypto exch. so usually no indiv. trader can get an unfair advantage over another. In fact, crypto exchange servers are usually a tightly held secret.

5.3) Big names in trad HFT MM include Citadel Securities, Jump Trading, Hudson River, Optiver etc. These are not crypto focused, and those that have recently entered the market lack the idiosyncratic knowledge of crypto, e.g. different APIs, relationships, DeFi intricacies etc)

6) Crypto MM (Orderbook) vs AMM

6.1) DEXs offered a solution to some issues with CEXs like counterparty risk and high fees, however the lack of liquidity on these exchanges ushered in the automated market maker AMM.

6.2) AMMs users to seamlessly swap tokens in a completely decentralized and non-custodial manner, but at the moment are not equipped for institutional level trading.

6.3) Slippage is a major concern for AMMs. For instance, if an order is placed that is greater than half of the liquidity pool, enormous would skyrocket the token price. Such massive slippage would never be acceptable in order book exchanges.

6.4) This risk means sophisticated investors with complex trading strategies and large order sizes will be drawn to toward deep orderbooks.

7) Why Wintermute?

7.1) Wintermute ( https://www.wintermute.com/ ) is “The algorithmic liquidity platform for digital assets”

7.2) Wintermute was founded in July 2017 and is led by Evgeny Gaevoy ( @EvgenyGaevoy) with most of its management team coming from trading and technology at Optiver, other top tier proprietary trading firms and is complemented by DeFi experts (head of DeFi is from Argent).

7.3) Those of you that follow Sino will know, we invest in people. The WM team are veteran traders and have over 70 years of combined experience in market making in the world’s top high-frequency...

...firms in legacy finance, including leading global MM Optiver. They have been providing liquidity in crypto markets for years and trade thousands of pairs on dozens of exchanges.

7.4) We have seen numerous instances in this industry of great projects floundering for lack of a properly experienced team. We believe a crypto market maker should have extensive HFT trading, low latency architecture and DeFi trading experience. Wintermute has it all.

7.5) Wintermute realize that deep liquidity is crucial to the mainstream adoption of crypto and its exponential growth. It ensures fair and transparent prices, market stability, low fees and, importantly, it...

...makes it possible for institutions and professional traders to execute sophisticated strategies e.g. large order execution and hedging.

7.6) While the number of crypto exchanges continues to increase, there is a shortage of sophisticated market makers providing liquidity. This is a major opportunity for pros like WM.

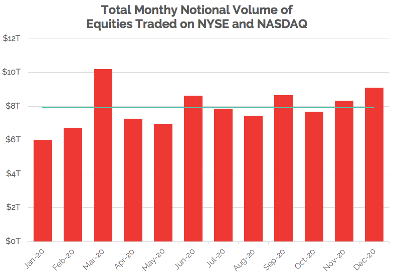

7.7) So how big is this market? For reference, the total notional monthly volume for equities on the NYSE and NASDAQ for September 2020 was approximately $8.7 trillion, with an average of $7.9 trillion per month for 2020.

(Data source: CBOE)

(Data source: CBOE)

7.8) Market makers on established exchanges like NYSE/NASDAQ operate in a very competitive market with tight spreads. Crypto markets are smaller but growing rapidly and have more attractive spreads with a smaller number of professional MMs. So how big is the crypto market?

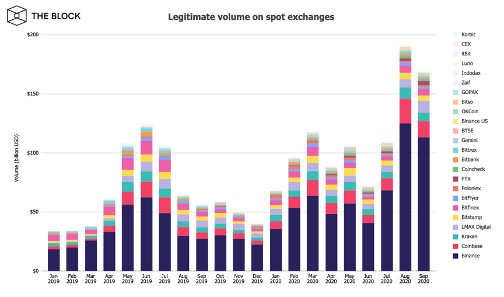

7.9) Estimating reliable crypto market volume is often difficult due to the prevalence of fake volume and wash trading. Luckily, @TheBlock__ and @FTX_Official publish very useful estimates.

7.10) The Block Legitimate Volume Index for September 2020 was over $169 billion (~2% of the $8.7 trillion volume in US equities for September above).

(Image source: The Block)

(Image source: The Block)

7.11) For MM revenues; using the FTX Volume Monitor ( https://ftx.com/volume-monitor ), Wintermute estimates that for the centralized spot and derivatives markets, at a conservative ~$35B daily volume (which matches up with the lower volume months on The Block index) and assuming:

7.11.1) - 90% coverage of CEX

- 30% of DeFi.

- 30% of off-exchange markets.

- Conservative 30% market growth.

- 50% market maker share.

- 3bps (spread) gross MM fee.

- 30% of DeFi.

- 30% of off-exchange markets.

- Conservative 30% market growth.

- 50% market maker share.

- 3bps (spread) gross MM fee.

...the 2021 annual crypto MM market size (as measured by actual MM revenue) is approximately $4.7B.

7.12) Wintermute is a pure crypto, HFT-MM focused operation and in a good position to continue seizing significant MM market share.

7.13) For more info on legitimate volume estimates from the block and FTX see ( https://www.theblockcrypto.com/genesis/50967/introducing-the-block-22-an-extension-of-12-other-exchanges-on-top-of-bitwise-10) and ( https://ftx.com/volume-report-paper.pdf)

7.14) As for the competitive landscape, many other crypto native market makers have shifted focus away from liquidity provision, started concentrating only on high volume pairs and/or have limited HFT expertise in-house.

7.15) A driver of WMs recent success has been the growth of their trading multiple (a key measure of capital usage efficiency). They are trading the same capital...

...more frequently than before and continue to add new exchanges and products to expand market coverage. Recent additions include Curve, Balancer, 1inch, Sushiswap etc. This also highlights WMs plan to dominate the DeFi MM space, solidifying their lead among many competitors.

7.16) In Q1 2021 they are also launching their own RFQ platform that will allow funds, asset managers and various institutional investors to connect through an API and trade with Wintermute directly.

7.17) WM offers institutional OTC desks and aggregators competitive tailor-made prices in spot markets across most major vetted coins by using the same technology and HFT MM algorithms that they use for their own prop trading.

7.18) Wintermute was also an official market maker of some of the most prominent projects that got listed in 2020 helping them achieve liquidity across most exchanges, pairs and liquidity pools.

8) Strategic opportunity for Wintermute in China and how Sino will help

8.1) Wintermute is seeking to expand its Asia exposure to better serve counterparties with a variety demands. China is a major crypto market with a lack of sophisticated market makers. Sino will connect Wintermute with their Chinese audience as a bridge between East and West.

9) Conclusion

9.1) Despite being a crypto focused firm, Wintermute has the security and technology capabilities of a large traditional MM, as well as the HFT experience to execute. Combined this with an aggressive and ongoing expansion plan, including into DeFi, and we believe they have...

...an edge on both current crypto MMs operating in the space as well as any bigger traditional MMs who may enter in the future. As the market grows, we expect Wintermute to become one of the largest liquidity providers in the industry.

Read on Twitter

Read on Twitter