Thread

A lot of people don't seem to grasp the bigger picture of the tanker trade.

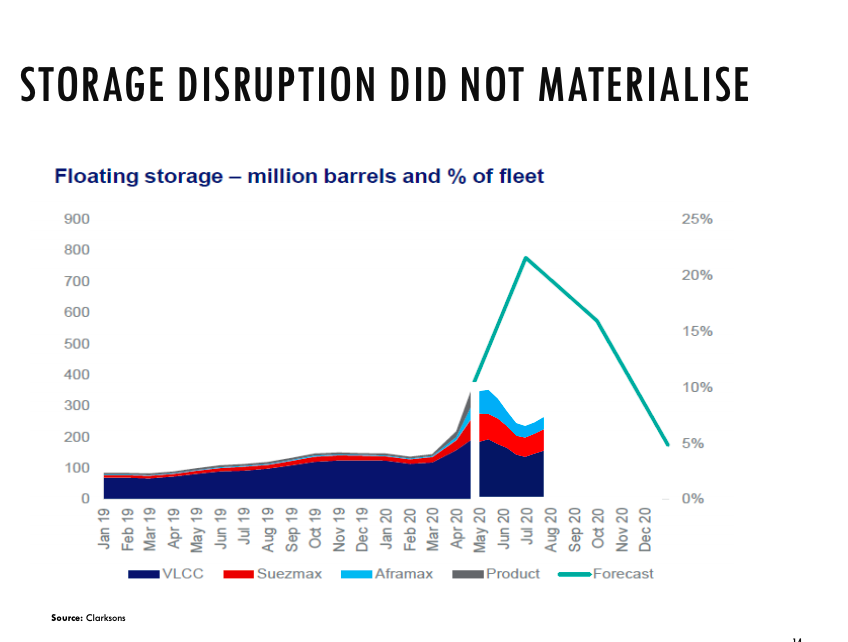

Everyone tried to play the storage story last year and got burned when it didn't materialize (see below chart).

The real story is the recycling rate and empty orderbook.

A lot of people don't seem to grasp the bigger picture of the tanker trade.

Everyone tried to play the storage story last year and got burned when it didn't materialize (see below chart).

The real story is the recycling rate and empty orderbook.

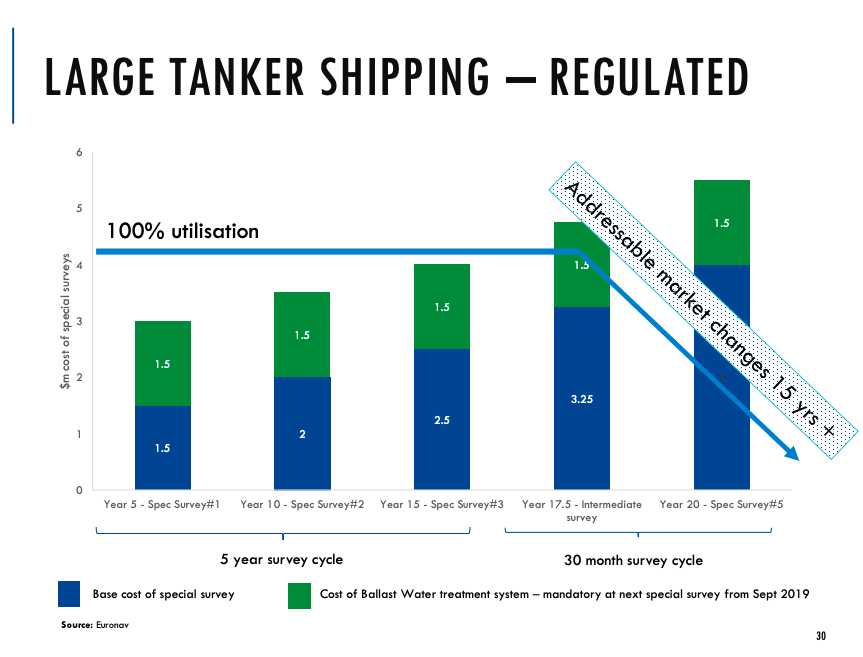

First point to understand is the average life of a VLCC is <20years

Reason being the cost of special surveys at $4m in year 20 makes no economic sense unless the ship is earning high rates

Like getting a $350 warrant of fitness for a $1000 car with a high chance of failing it

Reason being the cost of special surveys at $4m in year 20 makes no economic sense unless the ship is earning high rates

Like getting a $350 warrant of fitness for a $1000 car with a high chance of failing it

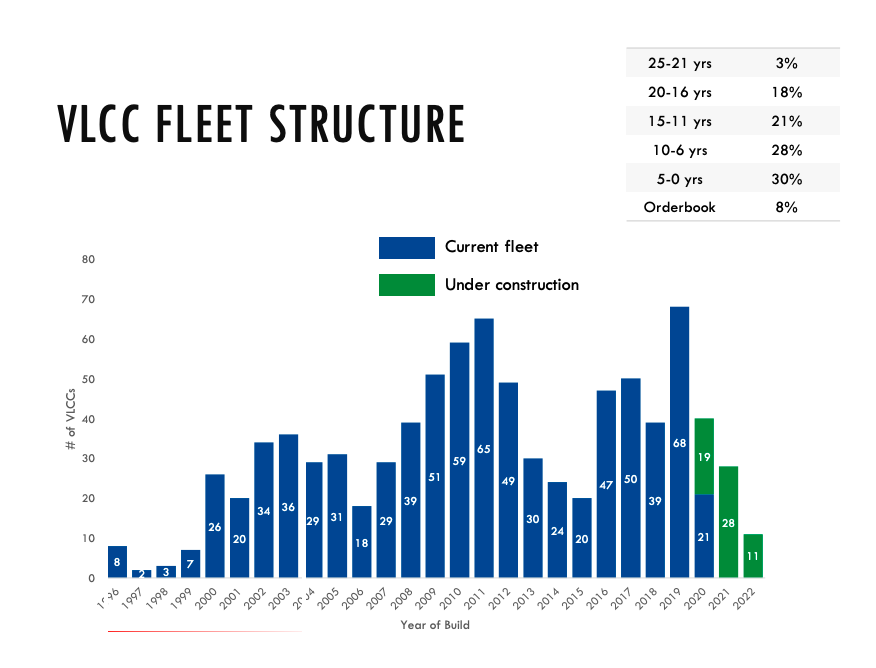

Then need to consider the average age of fleet

21% are due to be recycled in next 4 years at the latest

At a 5% recycling rate =40 VLCCs per year

2020 = +1

2021 = -12

2022 = -29

2023 = -40

21% are due to be recycled in next 4 years at the latest

At a 5% recycling rate =40 VLCCs per year

2020 = +1

2021 = -12

2022 = -29

2023 = -40

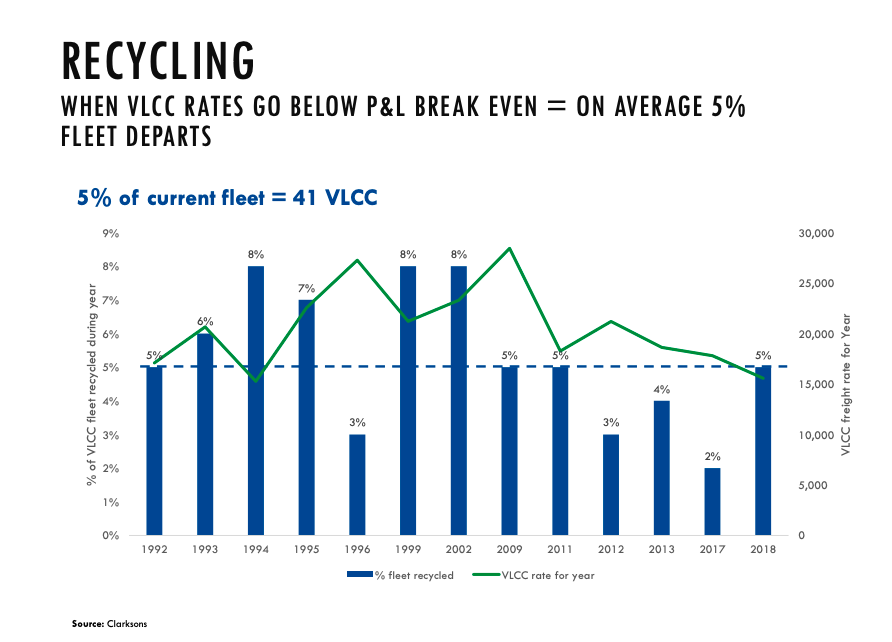

5% is the average recycling rate when P&L goes below breakeven

It can go higher as the early 2000s illustrate with an 8% recycling rate.

This would amount to 64 VLCCs being recycled per year.

It can go higher as the early 2000s illustrate with an 8% recycling rate.

This would amount to 64 VLCCs being recycled per year.

Now the recycling rate is supposed to be offset by the orderbook

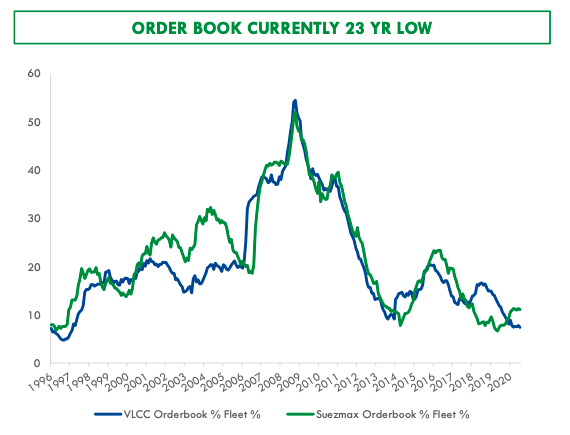

Yet the orderbook is at a 23year low

Why?

Because compliant tankers don't exist

Standard tankers will be obsolete by 2030 under IMO30 rules

IMO30 requires carbon intensity decline by >40% by 2030, & 70% by 2050

Yet the orderbook is at a 23year low

Why?

Because compliant tankers don't exist

Standard tankers will be obsolete by 2030 under IMO30 rules

IMO30 requires carbon intensity decline by >40% by 2030, & 70% by 2050

The fact that there are prototypes for hydrogen and ammonia power ships to be completed by 2023 will be of little assistance to the empty orderbook.

If you're thinking why not run the tankers on LNG, that only reduces ship CO₂ emissions by 9-12% well short of the 40% required.

If you're thinking why not run the tankers on LNG, that only reduces ship CO₂ emissions by 9-12% well short of the 40% required.

Read on Twitter

Read on Twitter