You NEVER really own a piece of property

Try not paying Property Taxes and see what happens.

Property Taxes are not going away.

Let’s look at the Uncommon Way to pay and SAVE!

//Time for a Thread//

Try not paying Property Taxes and see what happens.

Property Taxes are not going away.

Let’s look at the Uncommon Way to pay and SAVE!

//Time for a Thread//

Why is this such a big deal?

Doing some rough estimates the median home property tax is $2,500 a year https://twitter.com/uncommonyield/status/1351901105123438605

Doing some rough estimates the median home property tax is $2,500 a year https://twitter.com/uncommonyield/status/1351901105123438605

Idea 1: Fight the Man

Dispute the value of the property!

I’ve done this twice and saved about $18K over the 10 years in my house

How?

a) Look at recent comparable sales in your area for the last 6-12 months based on number of bedrooms, bathrooms and square footage.

Dispute the value of the property!

I’ve done this twice and saved about $18K over the 10 years in my house

How?

a) Look at recent comparable sales in your area for the last 6-12 months based on number of bedrooms, bathrooms and square footage.

b) If you think your property is worth less than what the govt says pay a few hundred to have a professional appraisal done. It’s easy for them argue against a homeowners analysis. They take a professional appraisal much more seriously.

Do the math to see if this makes sense.

Do the math to see if this makes sense.

Idea 2: Be smart in HOW you Pay

***Disclaimer***

You need a mortgage that DOES NOT escrow Taxes and Insurance. It’s best to do this when you first setup the loan. You can do it afterwards but you may have to pay a fee. You also need a healthy emergency fund.

***Disclaimer***

You need a mortgage that DOES NOT escrow Taxes and Insurance. It’s best to do this when you first setup the loan. You can do it afterwards but you may have to pay a fee. You also need a healthy emergency fund.

a) Instead of saving future payments in a HYSA build an appreciating asset

This could be

-A taxable brokerage account of Index Funds or Dividend stocks

-Real Estate

-Cash Value Life Insurance

I would shy away doing this with volatile assets like

-Crypto

-Growth Stocks

This could be

-A taxable brokerage account of Index Funds or Dividend stocks

-Real Estate

-Cash Value Life Insurance

I would shy away doing this with volatile assets like

-Crypto

-Growth Stocks

b) Take a loan out against the appreciating asset to pay the taxes.

For this to work well the loan should be no more than 5% APY

For this to work well the loan should be no more than 5% APY

c) Look to see how your government takes payments especially the credit and debit card processing fees.

Pick the best payment mechanism for you and pay it!

Pick the best payment mechanism for you and pay it!

d) Pay back the loan over 6 months in full.

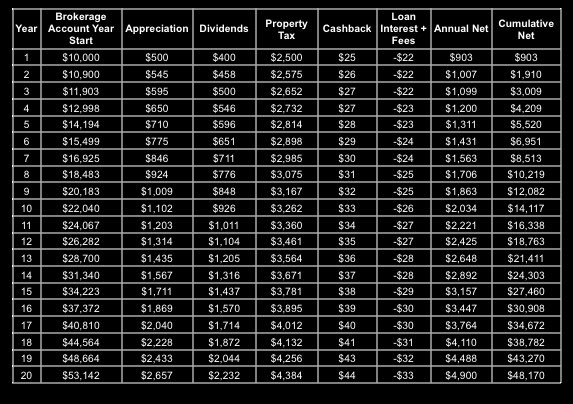

Example

-Annual Property Taxes: $2,500 increase 3% every year

-Asset: $10K Dividend Portfolio 5% asset appreciation, 4% yield 5% dividend growth @M1_Finance

-Payment Mechanism: M1 Spend debit card, 1% cash back, processing fee $3.50

-Loan Terms: 2% APY Margin Loan paid monthly

-Annual Property Taxes: $2,500 increase 3% every year

-Asset: $10K Dividend Portfolio 5% asset appreciation, 4% yield 5% dividend growth @M1_Finance

-Payment Mechanism: M1 Spend debit card, 1% cash back, processing fee $3.50

-Loan Terms: 2% APY Margin Loan paid monthly

The Numbers

Year 1

Interest & Fees Paid -$22

CB $25

Dividends $400

Capital App $500

Net $903

Year 5

Interest & Fees Paid -$22

CB $28

Dividends $596

Capital App $710

Net $1,311

Year 10

Interest & Fees Paid -$26

CB $33

Interest Earned $926

Capital App $1,102

Net $2,034

Year 1

Interest & Fees Paid -$22

CB $25

Dividends $400

Capital App $500

Net $903

Year 5

Interest & Fees Paid -$22

CB $28

Dividends $596

Capital App $710

Net $1,311

Year 10

Interest & Fees Paid -$26

CB $33

Interest Earned $926

Capital App $1,102

Net $2,034

Is this process more complex than having the mortgage company do it for you?

Absolutely.

But whether forced to save monthly through escrow or paying a monthly margin loan payment, you pay monthly!

And in 20 years time I’ll happily take $48K for a little complexity.

Absolutely.

But whether forced to save monthly through escrow or paying a monthly margin loan payment, you pay monthly!

And in 20 years time I’ll happily take $48K for a little complexity.

If this is something you do, @M1_Finance is the best product I’ve found.

You can get $30 in a brokerage account for using my affiliate link below. https://m1.finance/LbIpOpqlpSfb

You can get $30 in a brokerage account for using my affiliate link below. https://m1.finance/LbIpOpqlpSfb

Read on Twitter

Read on Twitter