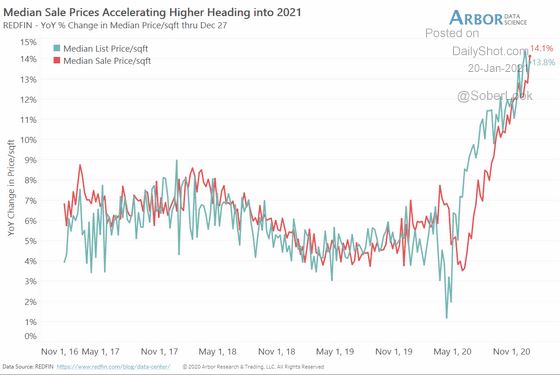

This morning's Daily Shot has the cost of housing in the U.S. up 14%, YOY. The FED says they will keep interest rates at 0% until inflation rises and stays above their 2% inflation target. The problem for fixed income investors, is the FED uses a flawed inflation barometer...

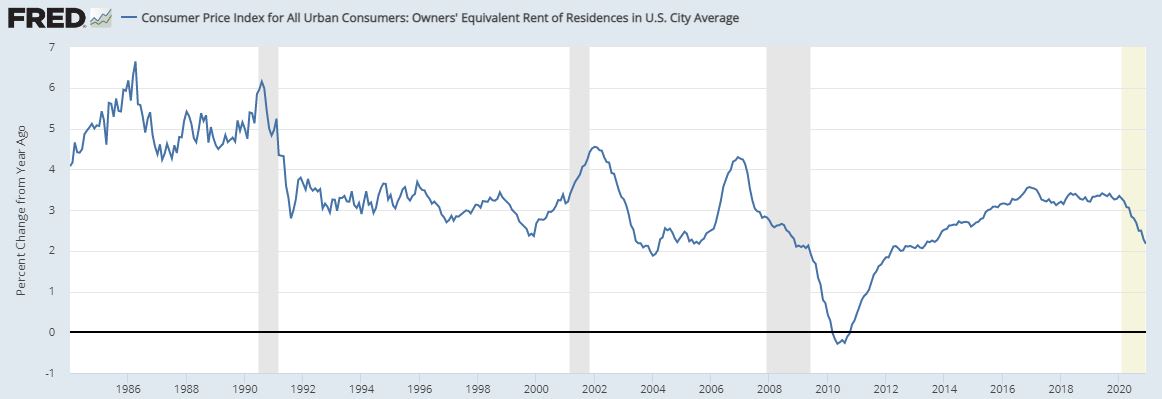

..When computing housing inflation the Bureau of Economic Analysis (BEA) calculates owners equivalent rent. In their latest update, the BEA claims housing costs are up only 2.2%, YOY...

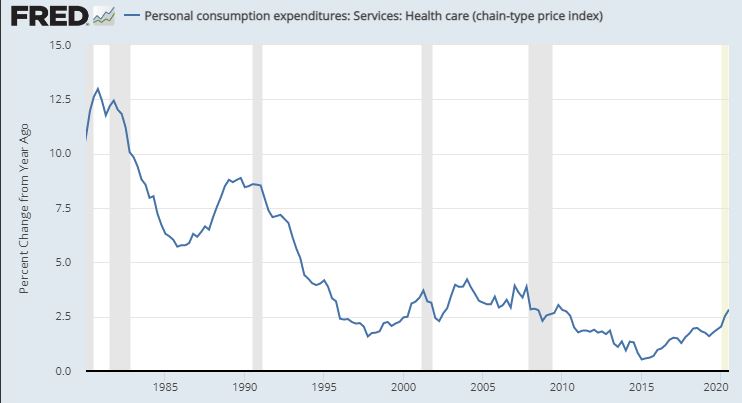

...The BEA claims consumer and small business healthcare costs have only risen 1.5% annually over the past decade..

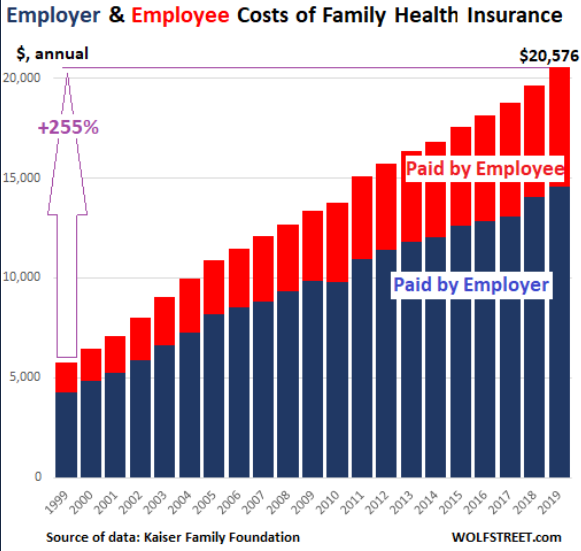

...this real world Kaiser presentation has the cost of healthcare rising at a 7.3% annual rate over the past 20 years. Compounding the problem for fixed income investors is the FED is committed to expanding money supply at whatever rate is necessary to keep financial markets..

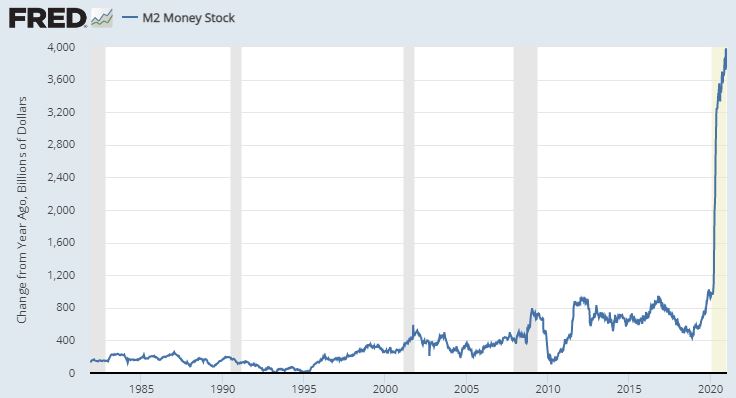

..functioning smoothly. Most fixed income investors have no clue about the history of rapid money expansion. Has your financial advisor run your portfolio through a 1970s style inflation model?

Fixed income investors got decimated in the 70's; money supply is growing faster now

Fixed income investors got decimated in the 70's; money supply is growing faster now

Read on Twitter

Read on Twitter