1/ THREAD: Long ImmunoPrecise Antibodies (IPA- Nasdaq)

$IPA is my largest holding since mid-2020, I haven't sold a share

This thread is just the peak of the iceberg as IPA has made such progress that highlighting all on a thread isn't possible, apologize for lots of omissions

$IPA is my largest holding since mid-2020, I haven't sold a share

This thread is just the peak of the iceberg as IPA has made such progress that highlighting all on a thread isn't possible, apologize for lots of omissions

2/ IPA is composed of 2 businesses:

The CRO (Contract Research Organization) and Talem Therapeutics.

Both the CRO and Talem are on fire. The CRO is growing at +50% with GM of 60% and Talem (drug discovery company) has several programs with some about to start Phase 1.

The CRO (Contract Research Organization) and Talem Therapeutics.

Both the CRO and Talem are on fire. The CRO is growing at +50% with GM of 60% and Talem (drug discovery company) has several programs with some about to start Phase 1.

3/ Current Market CAP 315MCAD /250M USD

SO: ~16M

Rev run rate ~20M CAD- Growth 50%

Cash: 16M CAD

SO: ~16M

Rev run rate ~20M CAD- Growth 50%

Cash: 16M CAD

4/ Let’s start with the CRO. In the antibodies space, IPA is the ONLY CRO that offers a complete end-to-end service from concept to clinical trials

5/CRO's revenues are growing at 50%, with 60% gross margins (the CRO industry has ~12%margins), IPA has more than 70% of the top 20 pharma as clients, more than 500 total clients, EBITDA positive, $16m in cash and run rate revenues of ~ $20M for this fiscal year

6/ IPA's CRO faced an evolution with the arrival of Dr Bath as CEO where it transitioned from the low-value diagnostic market to the high-value therapeutic market, IPA managed to do that with two transformative acquisitions: UPE and Modiquest and the incorporation of a Top team

7/ IPA CRO is able to have ~60% margins as it is the only CRO in the antibodies space that supports pre-clinical drug discovery from concept to IND enabling studies, so IPA's clients don't need to leave IPA until their programs are well advanced & avoid the transport of materials

8/ As of today the CRO managed to onboard 70% of the top 20 pharma companies as clients (and growing) and has already had 2 quarters of Positive (adjusted) EBITDA. Clients start with small projects and with experience give larger projects to IPA (more projects with higher value)

9) How big is the antibody therapeutics market, see below. I expect IPA to capture growth rates well above the industry ones. The CEO started at IPA by bringing a top-class team, developed the strategy of the CRO and launched Talem, which is IPA’s drug discovery company

10/ To finalize the CRO, I expect revenues to grow no less than 30% PA (currently at +50%) maintain margins around 60% & operational leverage will be clear as extra growth should go to the bottom line, (unless it is used to fund Talem). The current MC supports the CRO alone

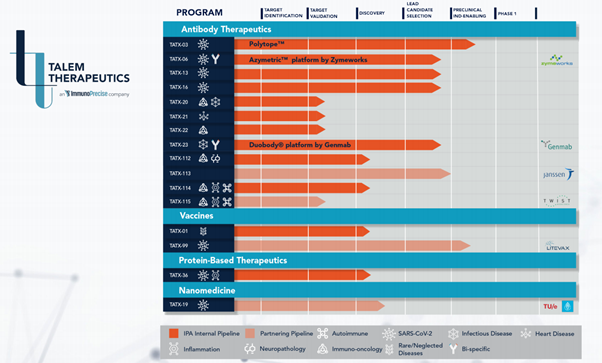

11/ Let me introduce TALEM Therapeutics.

Talem is IPA'S subsidiary focused on the discovery and development of next-generation fully human, monoclonal therapeutic antibodies. Talem is designed to take ownership stakes during the antibody’s discovery and development states.

Talem is IPA'S subsidiary focused on the discovery and development of next-generation fully human, monoclonal therapeutic antibodies. Talem is designed to take ownership stakes during the antibody’s discovery and development states.

12/Talem was founded in 2019 and an internal pipeline was created. TALEM is disease agnostic and uses the CRO's services at cost.

Talem is the most exciting component of IPA. Programs in the pre-clinical pipeline range from immuno-oncology to COVID-19

Talem is the most exciting component of IPA. Programs in the pre-clinical pipeline range from immuno-oncology to COVID-19

13/ I want to show the huge evolution on Talem's pipeline (see both slides below), in only a few months TALEM pipeline moved from 9 programs with only one partner to more than 16 today with several partners and some are about to present pre-clinical trials data, ready to phase 1

14/ It is hard to describe how valuable that pipeline can become, and how impressive it is that Talem's programs have been predominantly funded by the CRO.

I will focus on one now, to show the quality of the company: The COVID Program

I will focus on one now, to show the quality of the company: The COVID Program

15/ IPA's COVID program started in Jan 2020 with the aim to find a therapeutic that is efficacious for the current strains (of the time) & future viral mutations. Remember Regeneron antibody treatment with 1 antibody? IPA is in pre-clinical trials with a cocktail of 4 antibodies

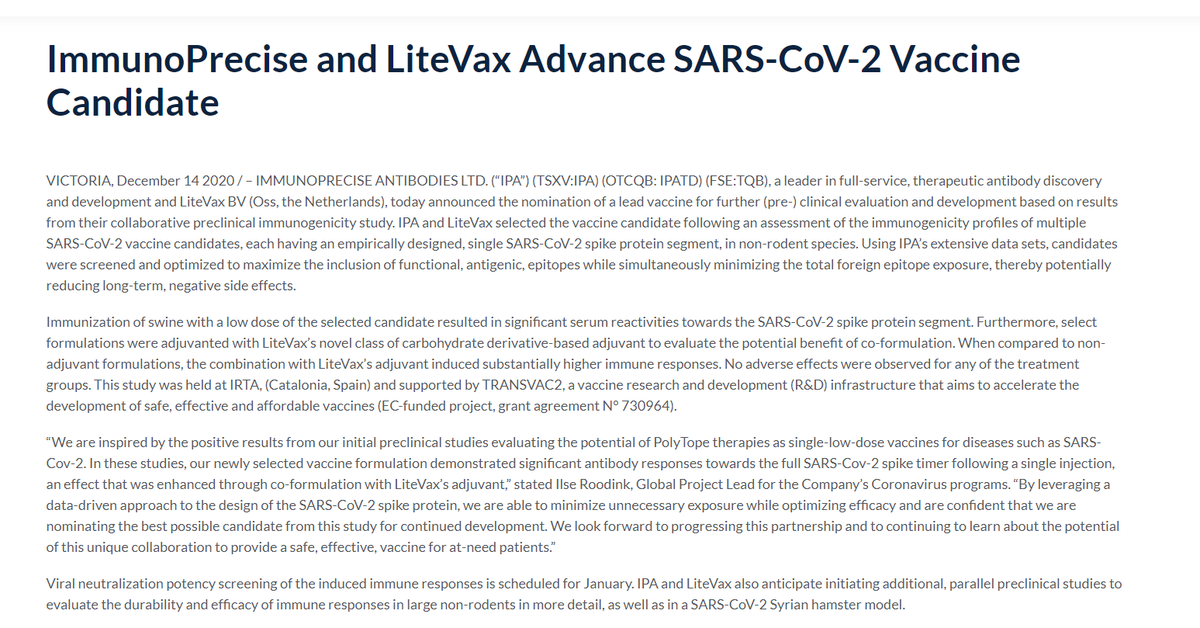

16/ This cocktail is called the Polytope, I encourage to read the explanation in the below link to start understanding the science. Bottom line, if the Polytope works it would be efficacious with future mutations, pre-clinical trials about to be released

https://talemtherapeutics.com/polytope/

https://talemtherapeutics.com/polytope/

17/ IPA’s is also engaged in vaccines (currently in trials-see below) & in the last 5 months has initiated various partnerships, collaborations, etc, all of which are highlighted on the below slide:

Please see for your self the quality of the partners IPA has engaged since SEP

Please see for your self the quality of the partners IPA has engaged since SEP

18/ I have left so much out, and I deliberately made this thread non-scientific, however below I include some sources where you can get a grasp of the science, and they are a must-watch.

1:

2:

3: https://journey.ct.events/view/95414b46-c0ed-420d-a0e4-abdb25cbcdba

1:

2:

3: https://journey.ct.events/view/95414b46-c0ed-420d-a0e4-abdb25cbcdba

19/ On the last conference the CEO mentioned the 1st commercial sale of internal Talem antibodies and announced material revenue from license deals within the next 2 quarters. This validates Talem in a serious way

20/ The industry is after the next-generation sequencing which is designing cocktails by screening ag libraries the companies build, while not apple to apple IPA can be at some extent compared to Abcellera (ABCL has a transgenic animal, IPA does not) but ABCL is priced 50x IPA

21/ We get Talem's potential relatively for free as the current market cap supports only the CRO. IPA just listed on NASDAQ and remains extremely under the radar, I don't think this will be the case for long, as IPA has hired a top IR firm & eventually institutions will become SH

22/ As usual some programs will not work, but some will and many companies with programs in Phase 1 trials already have multi-billion $ valuations, it is hard to not see the potential and most importantly the "OPTIONALITY" of IPA

23/ IPA did a prospectus where they can raise up to $150M, I would like IPA to do a PP in order to bring institutions on board and use that capital either for acquisitions for the CRO or clearly for Talem. With the Nasdaq listing, this makes total sense.

24/ An illustration of what is to come: Yasmina Noubia Abdiche, IPA's Chief Scientific Officer latest patents:

https://patents.justia.com/inventor/yasmina-noubia-abdiche

https://patents.justia.com/inventor/yasmina-noubia-abdiche

END/ As mentioned this thread covers only a portion of what $IPA is, management is outstanding and I am truly excited for IPA's future. DYODD

Find below the latest deck:

https://www.immunoprecise.com/wp-content/uploads/2021/01/IPA_Investor_Deck_Janua2021-WorkingDeck.pdf

Find below the latest deck:

https://www.immunoprecise.com/wp-content/uploads/2021/01/IPA_Investor_Deck_Janua2021-WorkingDeck.pdf

Read on Twitter

Read on Twitter