About the "Greyscale is buying up all the Bitcoin" meme.

(shoutout to @fidelitas_lex for pointing this out).

Most of Greyscale's new subscriptions are in-kind - nobody's buying anything with real cash. People are transferring their Bitcoins to GS, and getting shares in return.

(shoutout to @fidelitas_lex for pointing this out).

Most of Greyscale's new subscriptions are in-kind - nobody's buying anything with real cash. People are transferring their Bitcoins to GS, and getting shares in return.

Why would anyone do that, knowing that GS charges a 2% yearly management fee? What happened to "be your own bank"?

The answer is simple: GS shares are trading at a premium, so by transferring your Bitcoins in exchange for shares you're making an instant paper gain.

The answer is simple: GS shares are trading at a premium, so by transferring your Bitcoins in exchange for shares you're making an instant paper gain.

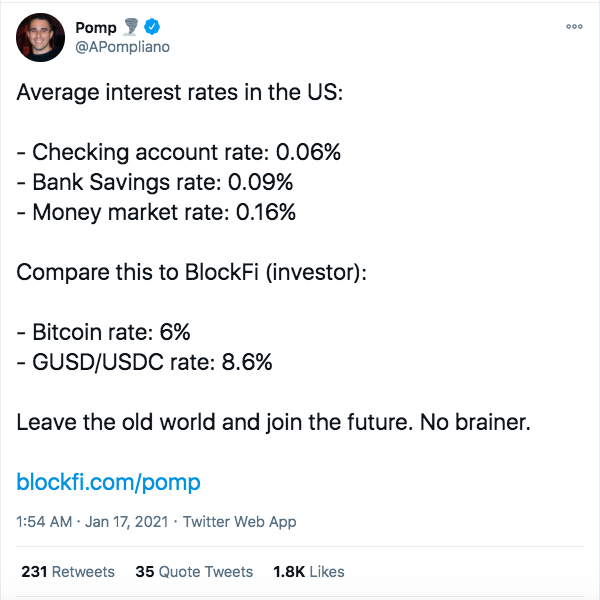

BlockFi is one of the biggest holders of GS shares. BlockFi is also one of the go-to guys if you want to "earn interest on your Bitcoin" - as high as 8%. Where does that 8% interest come from? From the Greyscale share premium. You lend Bitcoin to BF, they exchange for GS shares.

Now if BlockFi were to sell those GS shares in order to collect the premium, they would crush this premium, and kill their business model. So they don't sell the shares. This also contributes to Bitcoin FOMO by pumping Greyscale's AUM, enticing more people to buy Bitcoin.

As long as people deposit Bitcoin with BlockFi to earn interest, it works.

The disadvantage is that BlockFi are sitting on illiquid paper gains that they can't cash out, with mounting liabilities (8% interest on Bitcoin that they'll have to pay one day, when the flows reverse).

The disadvantage is that BlockFi are sitting on illiquid paper gains that they can't cash out, with mounting liabilities (8% interest on Bitcoin that they'll have to pay one day, when the flows reverse).

Read on Twitter

Read on Twitter