So, the ECB is said to make “Spread curve control”...

A few points: https://twitter.com/livesquawk/status/1351700239338639362

A few points: https://twitter.com/livesquawk/status/1351700239338639362

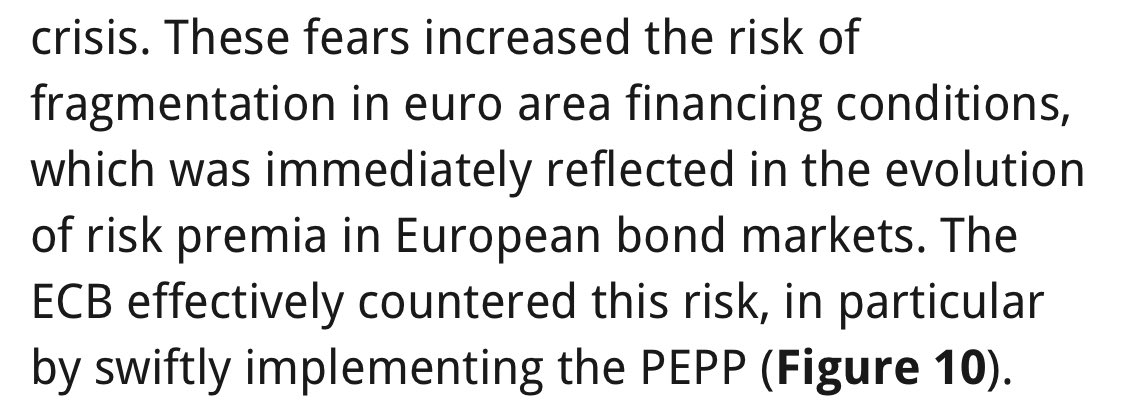

First we all know that the ECB is here to close spreads, all the more than it is quite explicit about it. Eg a recent speech by @Isabel_Schnabel but you can find dozen speeches with the same idea

https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp201216_1~9caf7588cd.en.html

https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp201216_1~9caf7588cd.en.html

Second “the ECB has specific ideas on what spreads are appropriate”. Well, I guess that for the ECB, the appropriate spread level is “lower” right?

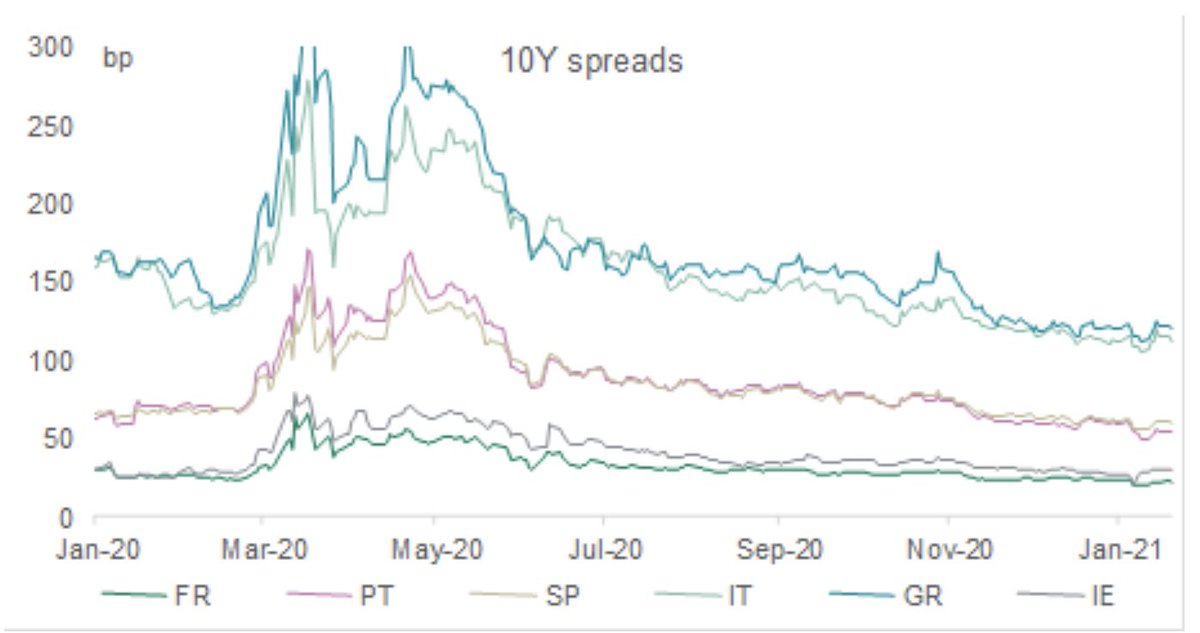

Third since August 2020, the ECB has been respecting strictly the Capital key (except for small countries and supranationals). So no “active” spread control

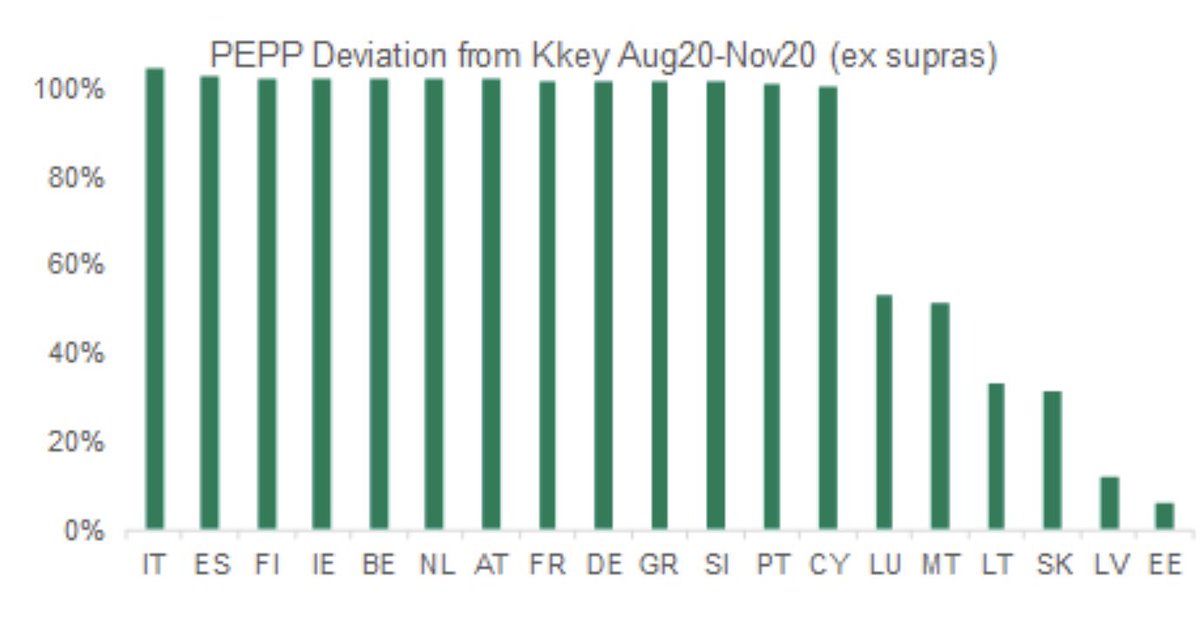

So the only way the ECB is controlling spreads would be via the pace of purchases (higher weekly purchases to tighten spreads)

But I doubt that it’s the case. I think that the ECB simply adapts to net supply and let private investors compress spreads by themselves via hunt for yield and collateral scarcity

Read on Twitter

Read on Twitter