Here's the bull case on Zoom

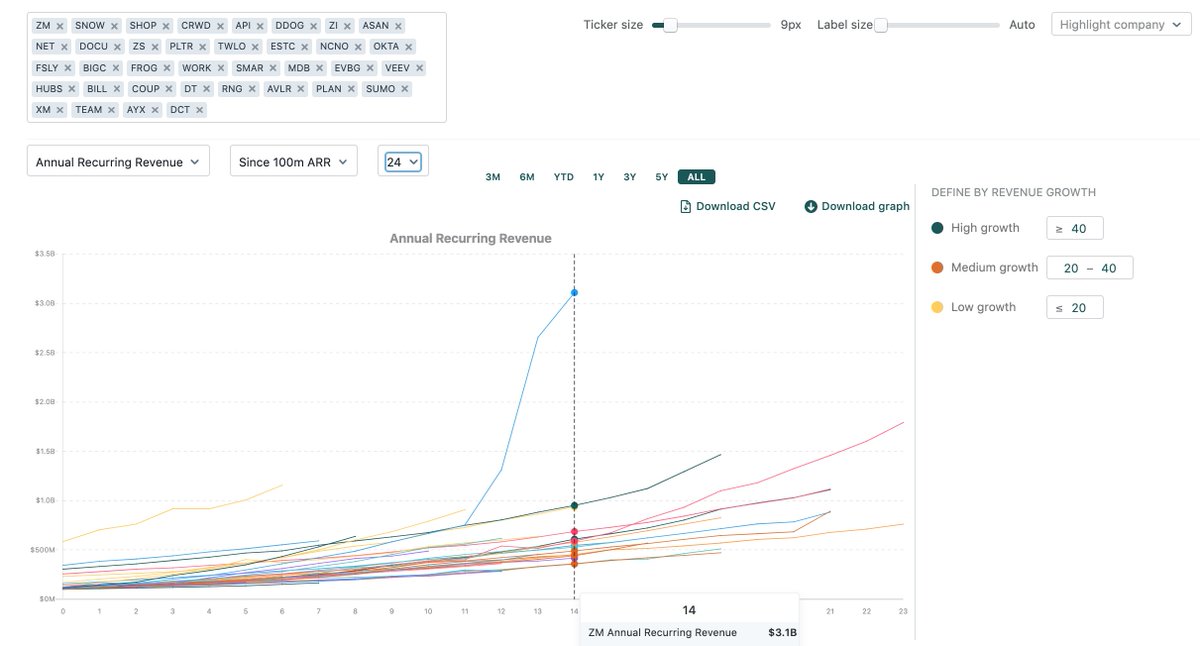

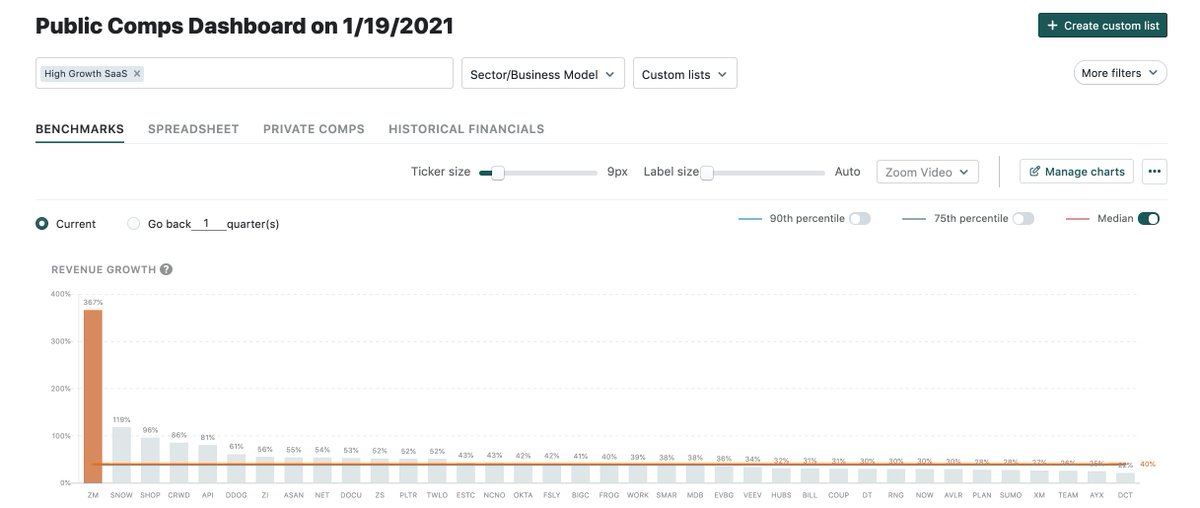

1/ At $3.1b ARR 366% y/y, Zoom is THE fastest growing SaaS company historically and currently

Growth is COVID driven so the question is if growth will persist post-pandemic and how much MSFT Teams will be an impact

Growth is COVID driven so the question is if growth will persist post-pandemic and how much MSFT Teams will be an impact

https://blog.publiccomps.com/the-bull-case-for-zoom-in-2021-2/

1/ At $3.1b ARR 366% y/y, Zoom is THE fastest growing SaaS company historically and currently

Growth is COVID driven so the question is if growth will persist post-pandemic and how much MSFT Teams will be an impact

Growth is COVID driven so the question is if growth will persist post-pandemic and how much MSFT Teams will be an impacthttps://blog.publiccomps.com/the-bull-case-for-zoom-in-2021-2/

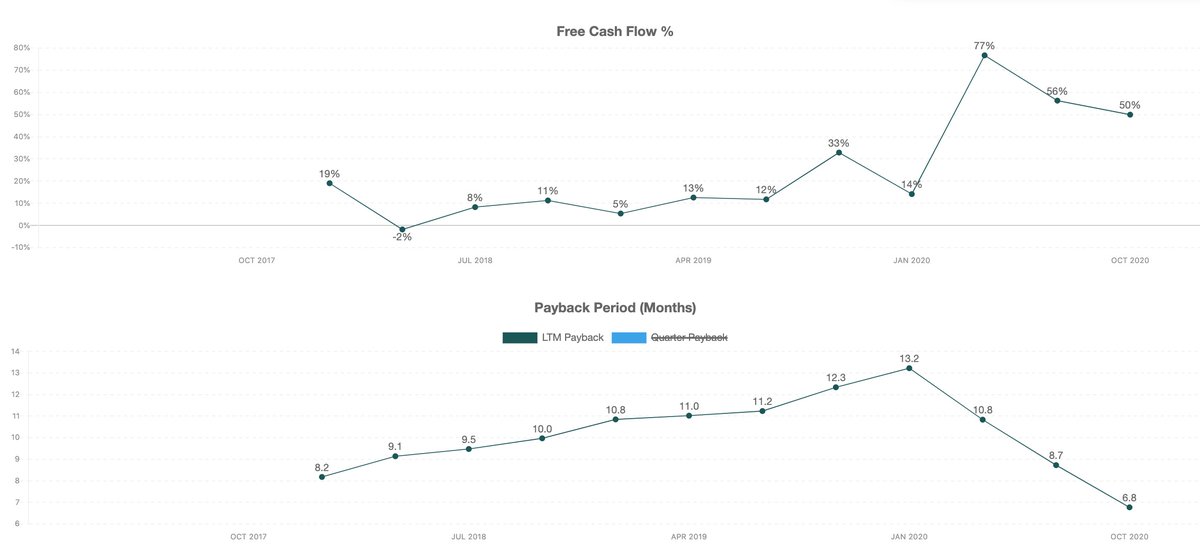

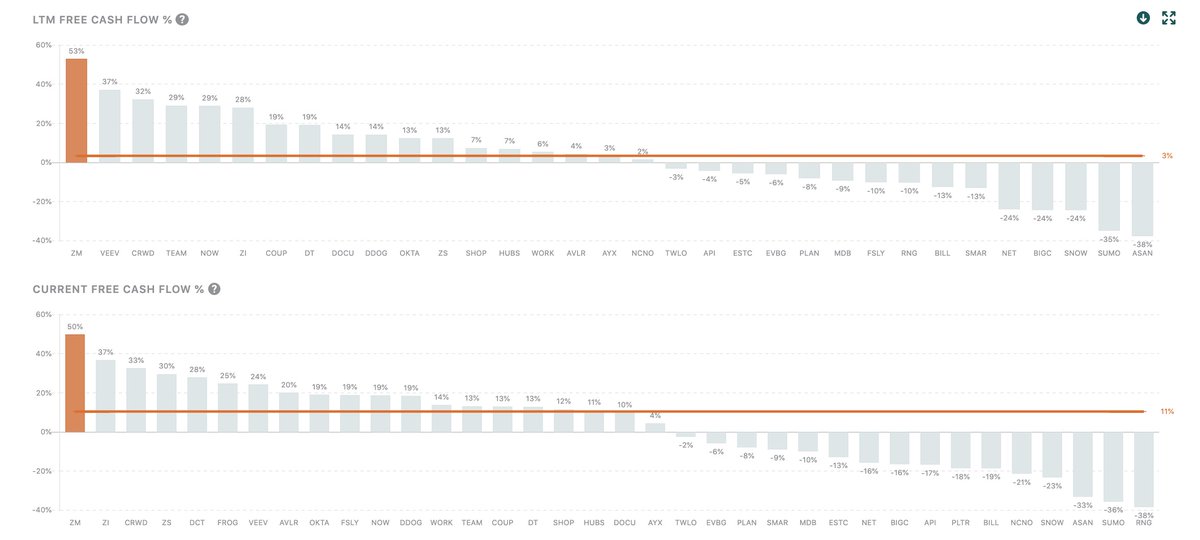

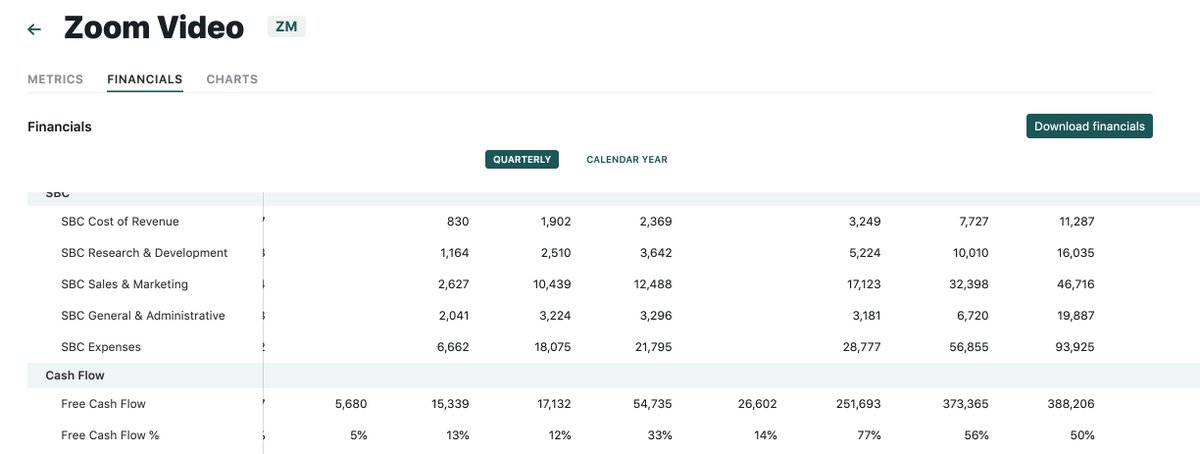

2/ Zoom is a cash machine  with 50%+ Free Cash Flow margins and $1.5b FCF run rate.

with 50%+ Free Cash Flow margins and $1.5b FCF run rate.

This matters because after recent $1.75b public offering, Zoom will have $4b of cash to acquire other players (Frontapp, Superhuman, Calendly?)

This matters because after recent $1.75b public offering, Zoom will have $4b of cash to acquire other players (Frontapp, Superhuman, Calendly?)

with 50%+ Free Cash Flow margins and $1.5b FCF run rate.

with 50%+ Free Cash Flow margins and $1.5b FCF run rate.  This matters because after recent $1.75b public offering, Zoom will have $4b of cash to acquire other players (Frontapp, Superhuman, Calendly?)

This matters because after recent $1.75b public offering, Zoom will have $4b of cash to acquire other players (Frontapp, Superhuman, Calendly?)

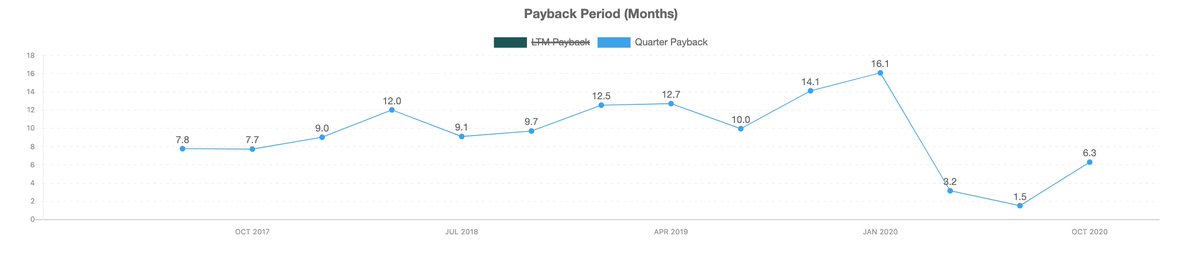

3/ Zoom became a verb in 2020 as the whole world was on lockdown-- payback period dropped to <6 months  as customers came signed up online & swiped credit card to use Zoom to do work.

as customers came signed up online & swiped credit card to use Zoom to do work.

CFO mentioned sales rep productivity coming down to normalized pre-pandemic levels in Q3

CFO mentioned sales rep productivity coming down to normalized pre-pandemic levels in Q3

as customers came signed up online & swiped credit card to use Zoom to do work.

as customers came signed up online & swiped credit card to use Zoom to do work. CFO mentioned sales rep productivity coming down to normalized pre-pandemic levels in Q3

CFO mentioned sales rep productivity coming down to normalized pre-pandemic levels in Q3

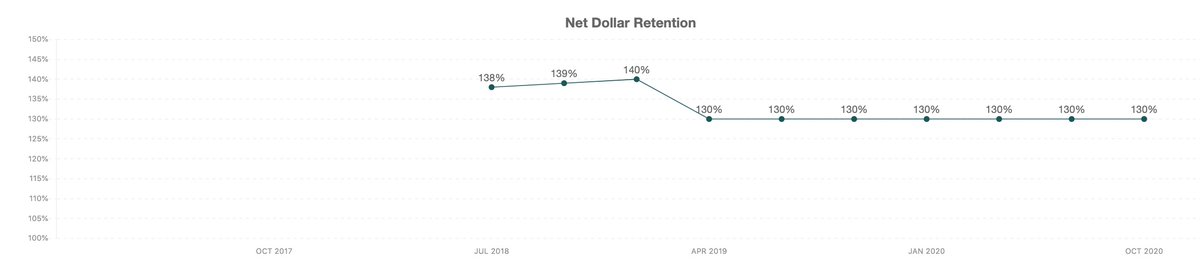

4/ Net Dollar Retention for customers with >10 ees continued to be >130% as customers continued to add more seats, buy more products (e.g Zoom Phone), and more integrated into their workflows.

Will be interesting to see when churn

Will be interesting to see when churn  -- CFO said churn was better than expected

-- CFO said churn was better than expected

Will be interesting to see when churn

Will be interesting to see when churn  -- CFO said churn was better than expected

-- CFO said churn was better than expected

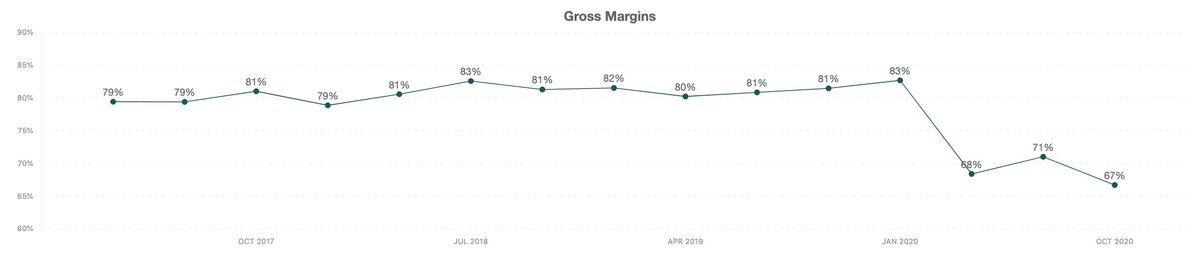

5/ Gross Margins for $ZM went down b/c K12 and school started up in the fall and are free/discounts-- Zoom still has to pay infrastructure to service these users.

Free users could be paying customers down the road. Zoom had

Free users could be paying customers down the road. Zoom had  and lifted 40 min restriction over holidays

and lifted 40 min restriction over holidays

Free users could be paying customers down the road. Zoom had

Free users could be paying customers down the road. Zoom had  and lifted 40 min restriction over holidays

and lifted 40 min restriction over holidays

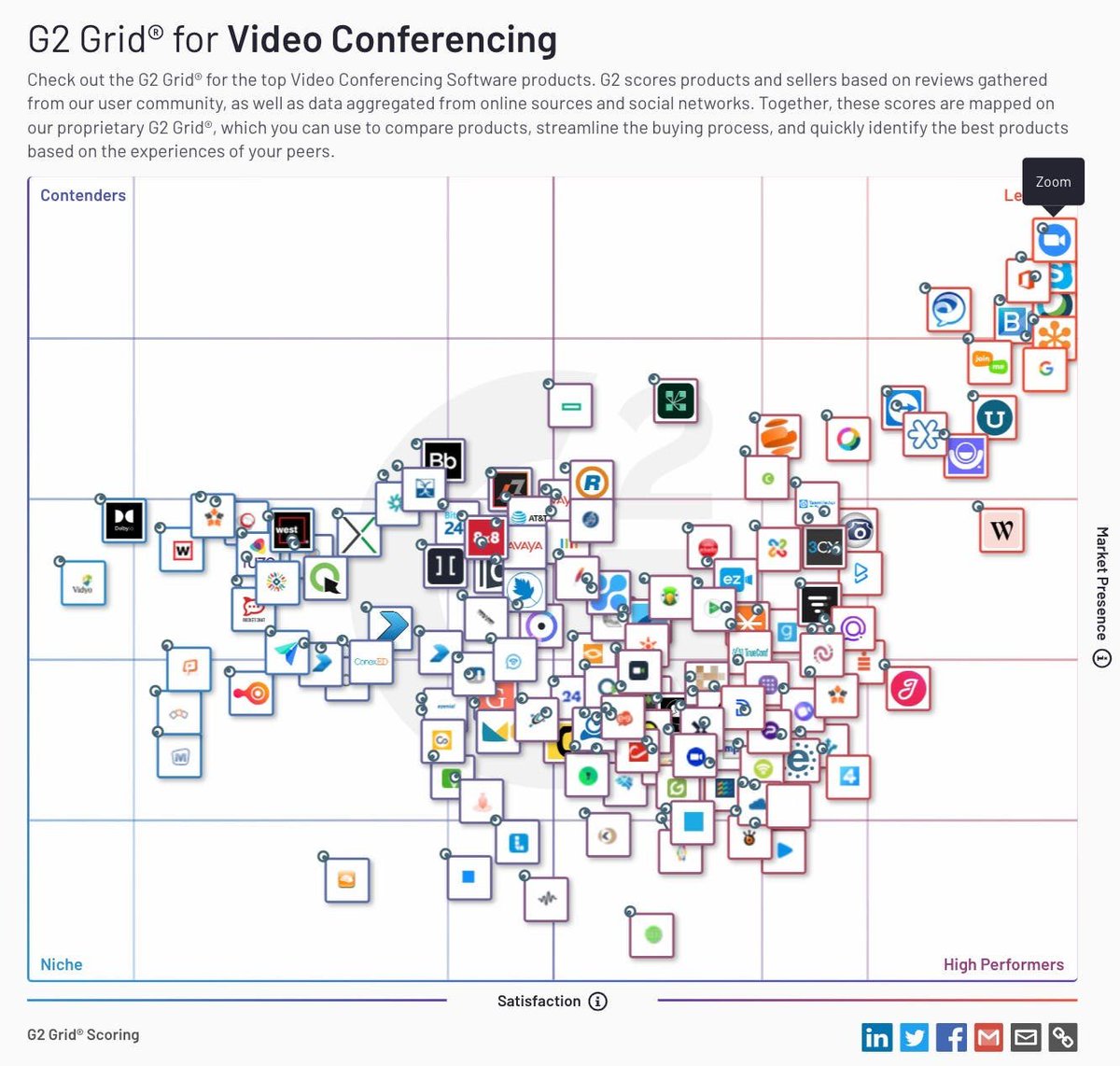

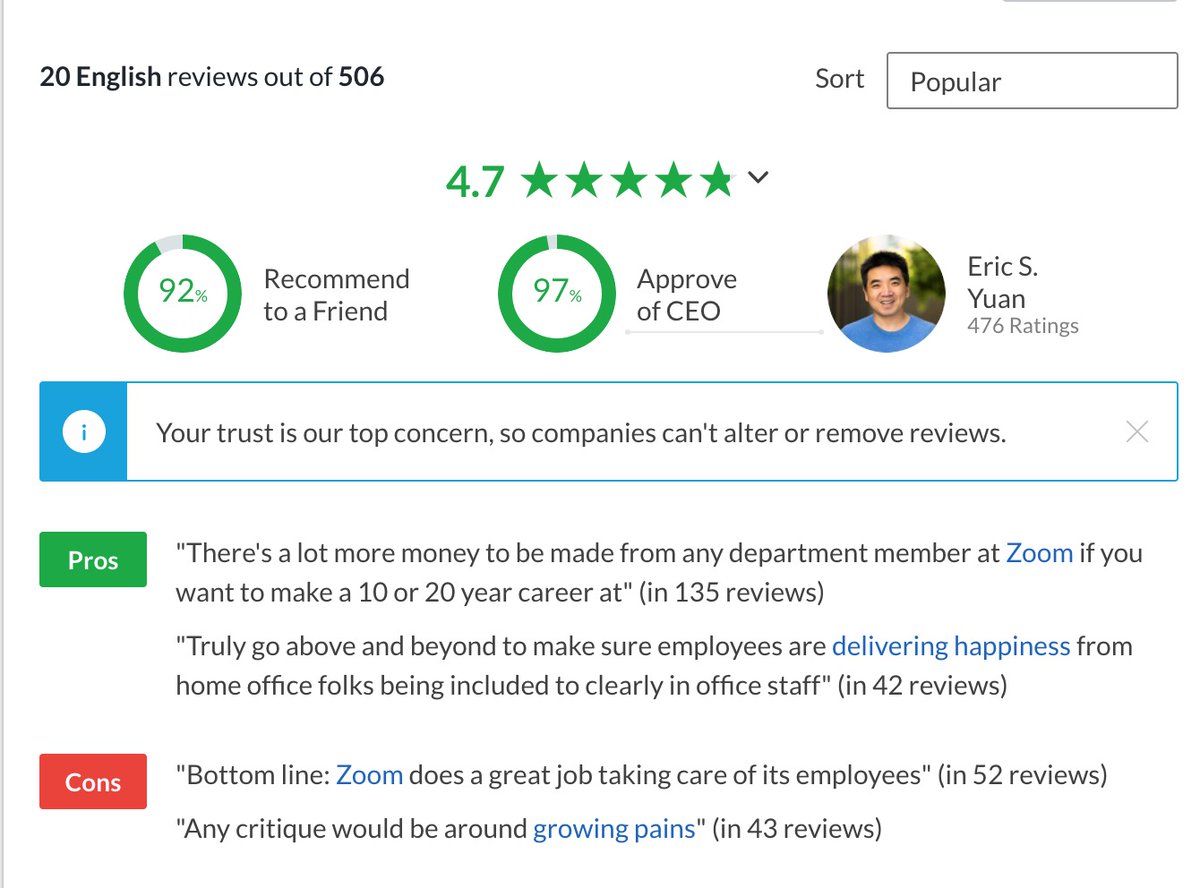

6/ Zoom has the best product compared to Microsoft Teams, Google Hangout, Cisco Webex when looking at ratings on G2Crowd, TrustRadius, Gartner

Question is does Hangout and Teams get to feature parity? Both cos are making a lot of product improvemets:

Question is does Hangout and Teams get to feature parity? Both cos are making a lot of product improvemets:

Question is does Hangout and Teams get to feature parity? Both cos are making a lot of product improvemets:

Question is does Hangout and Teams get to feature parity? Both cos are making a lot of product improvemets:

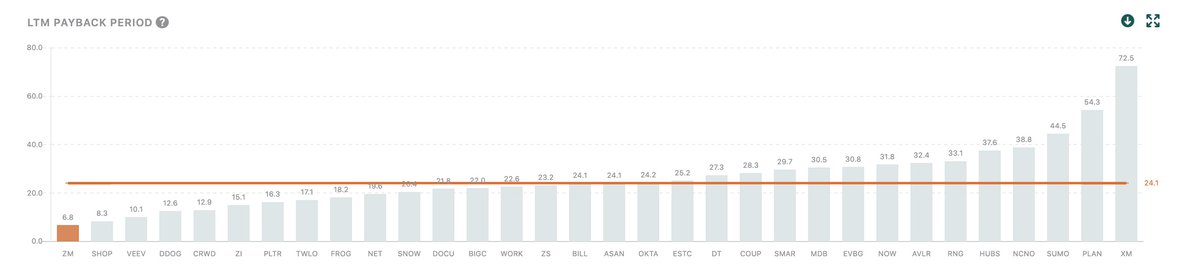

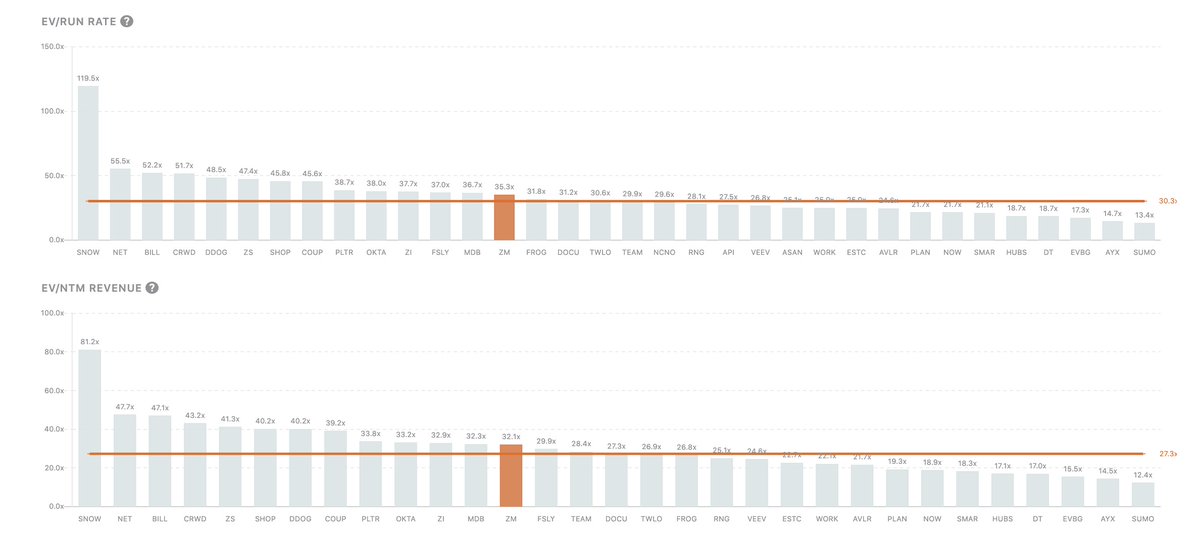

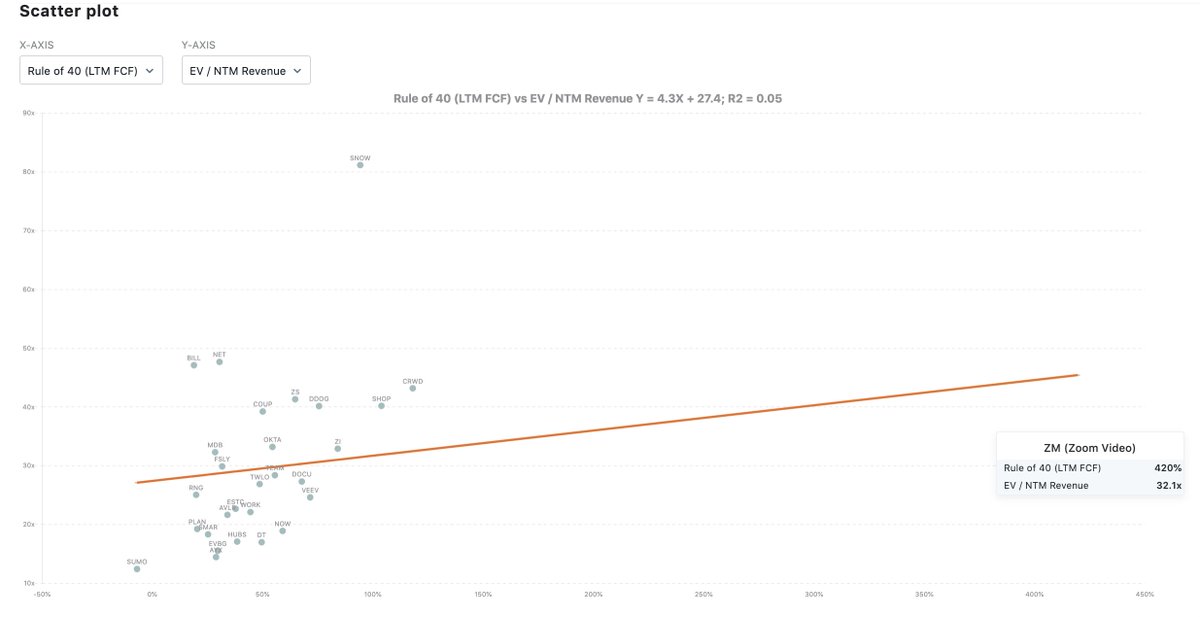

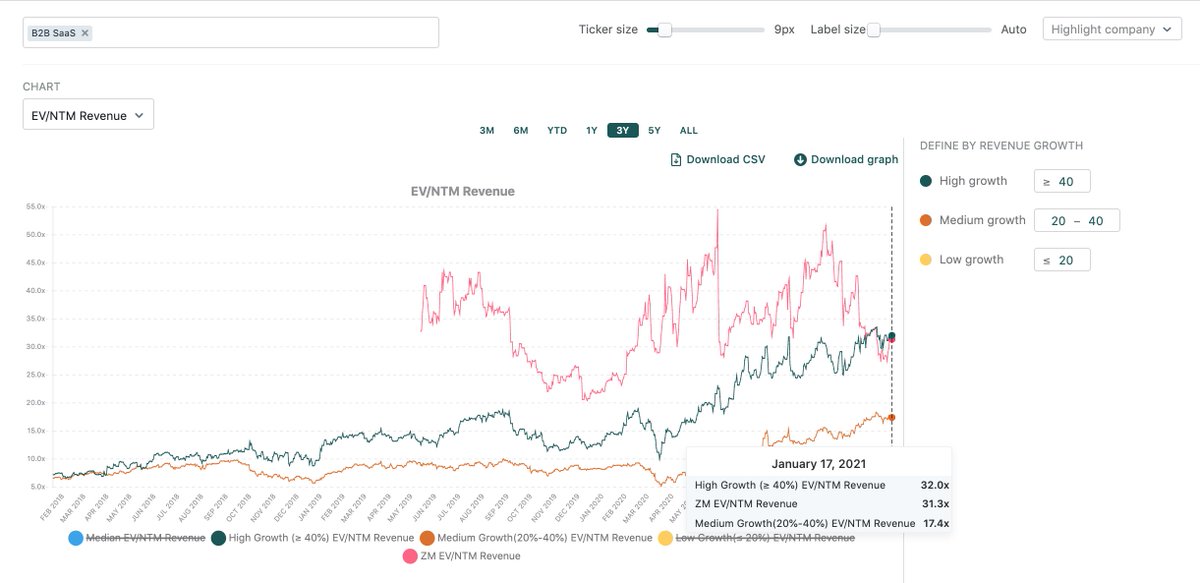

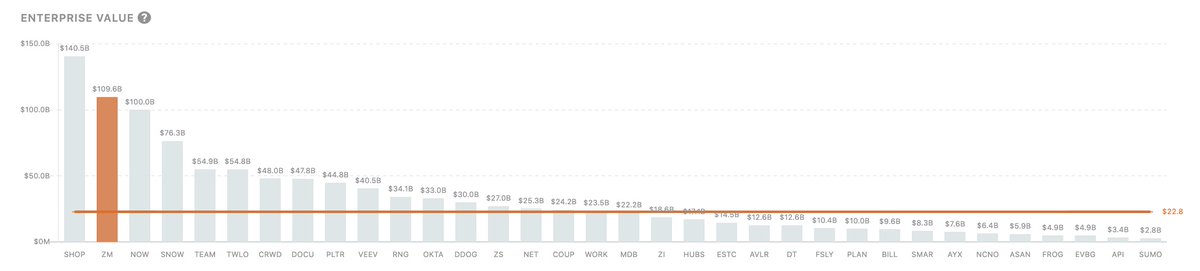

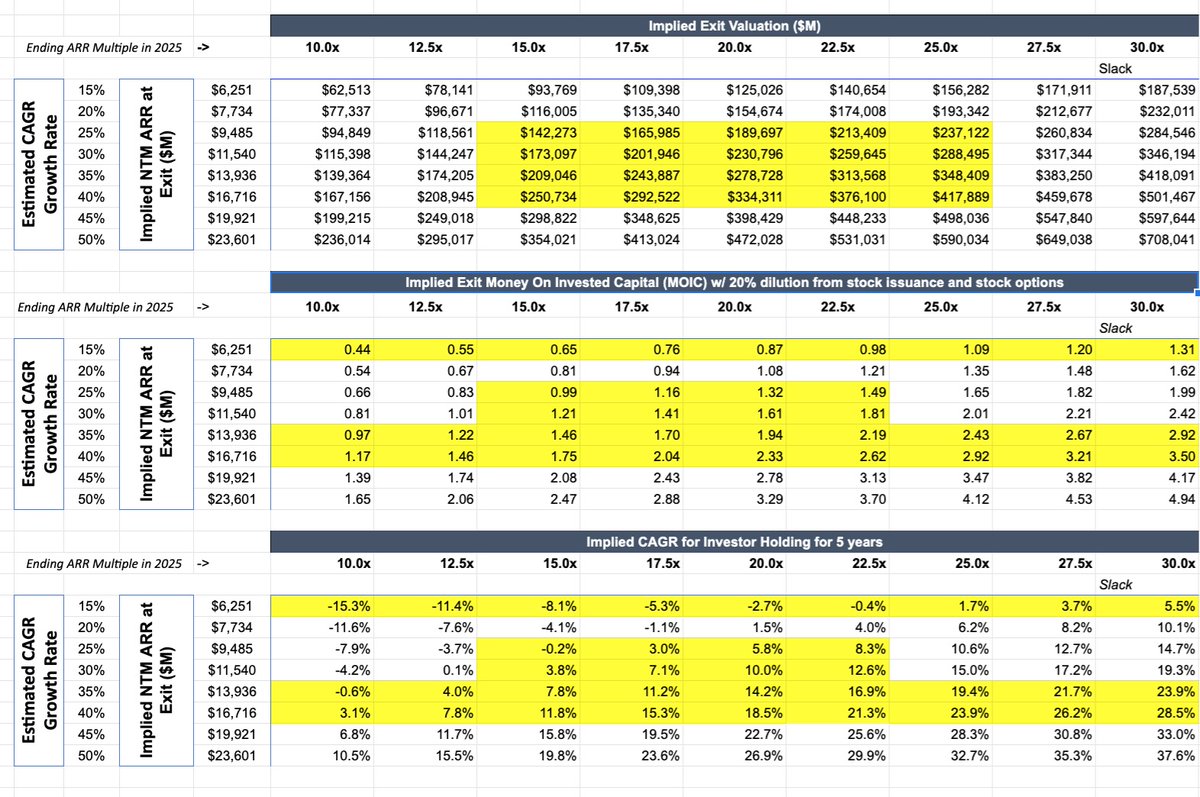

7/ But.. Zoom trades in the middle of the pack at 35x ARR and 32x NTM revenue -- stock is down ~34% from ATH.

Despite growing the fastest and being the most profitable, Zoom trades less than slower growing and less profitable companies!

Despite growing the fastest and being the most profitable, Zoom trades less than slower growing and less profitable companies!

Despite growing the fastest and being the most profitable, Zoom trades less than slower growing and less profitable companies!

Despite growing the fastest and being the most profitable, Zoom trades less than slower growing and less profitable companies!

8/ Remote and hybrid work are here to stay. 90% of HR leaders in Gartner study say they'll let employees work remote post pandemic & <20% of executives so they'll go back to offices like pre-pandemic.

2020 proved teams can work remote and instead of

2020 proved teams can work remote and instead of  you can work over

you can work over

2020 proved teams can work remote and instead of

2020 proved teams can work remote and instead of  you can work over

you can work over

9/ Despite security concerns in early 2020, Zoom put out a 90 day plan and built end to end encryption into the product, added features to prevent Zoombombings, custom data routing.

Zoom seems to be able to move and iterate and bet is will do so even post pandemic

Zoom seems to be able to move and iterate and bet is will do so even post pandemic

Zoom seems to be able to move and iterate and bet is will do so even post pandemic

Zoom seems to be able to move and iterate and bet is will do so even post pandemic

10/ At $20/month & $3.1B ARR, I estimate ~40m paid seats and using 800m knowledge worker mkt size, that's 5% penetration. Still plenty of room to grow among free + new users

Challenge is Microsoft Teams (115m DAU) and Google (235m daily meeting participants) Hangouts are free

Challenge is Microsoft Teams (115m DAU) and Google (235m daily meeting participants) Hangouts are free

Challenge is Microsoft Teams (115m DAU) and Google (235m daily meeting participants) Hangouts are free

Challenge is Microsoft Teams (115m DAU) and Google (235m daily meeting participants) Hangouts are free

11/ Bear case

Post pandemic, churn

Post pandemic, churn  and growth

and growth  as people want to meet in person and are sick of Zoom

as people want to meet in person and are sick of Zoom

Microsoft Teams and Google Hangout are just good enough, cheaper, and own cal/email integrations

Microsoft Teams and Google Hangout are just good enough, cheaper, and own cal/email integrations

High growth SaaS multiples come

High growth SaaS multiples come  from 31x to 15-20x pre-pandemic

from 31x to 15-20x pre-pandemic

Post pandemic, churn

Post pandemic, churn  and growth

and growth  as people want to meet in person and are sick of Zoom

as people want to meet in person and are sick of Zoom Microsoft Teams and Google Hangout are just good enough, cheaper, and own cal/email integrations

Microsoft Teams and Google Hangout are just good enough, cheaper, and own cal/email integrations High growth SaaS multiples come

High growth SaaS multiples come  from 31x to 15-20x pre-pandemic

from 31x to 15-20x pre-pandemic

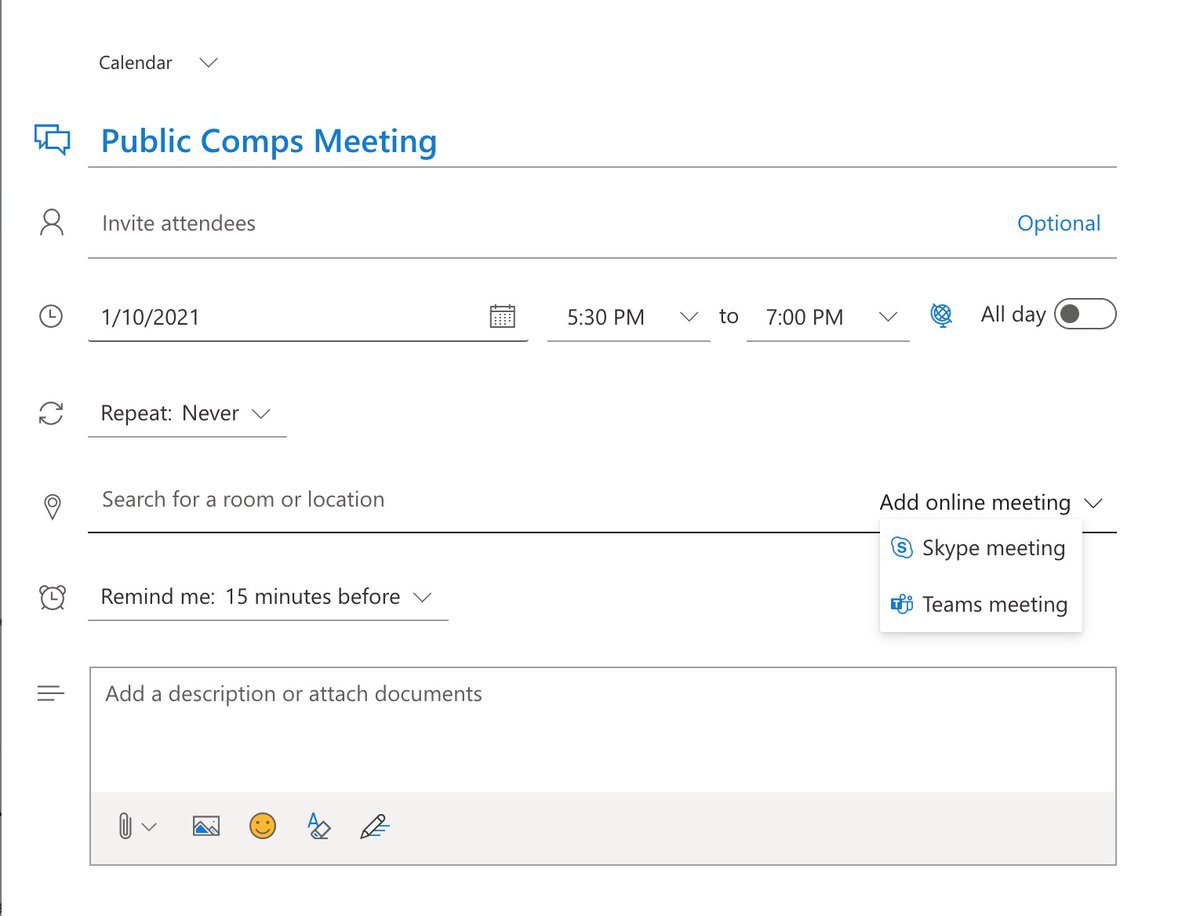

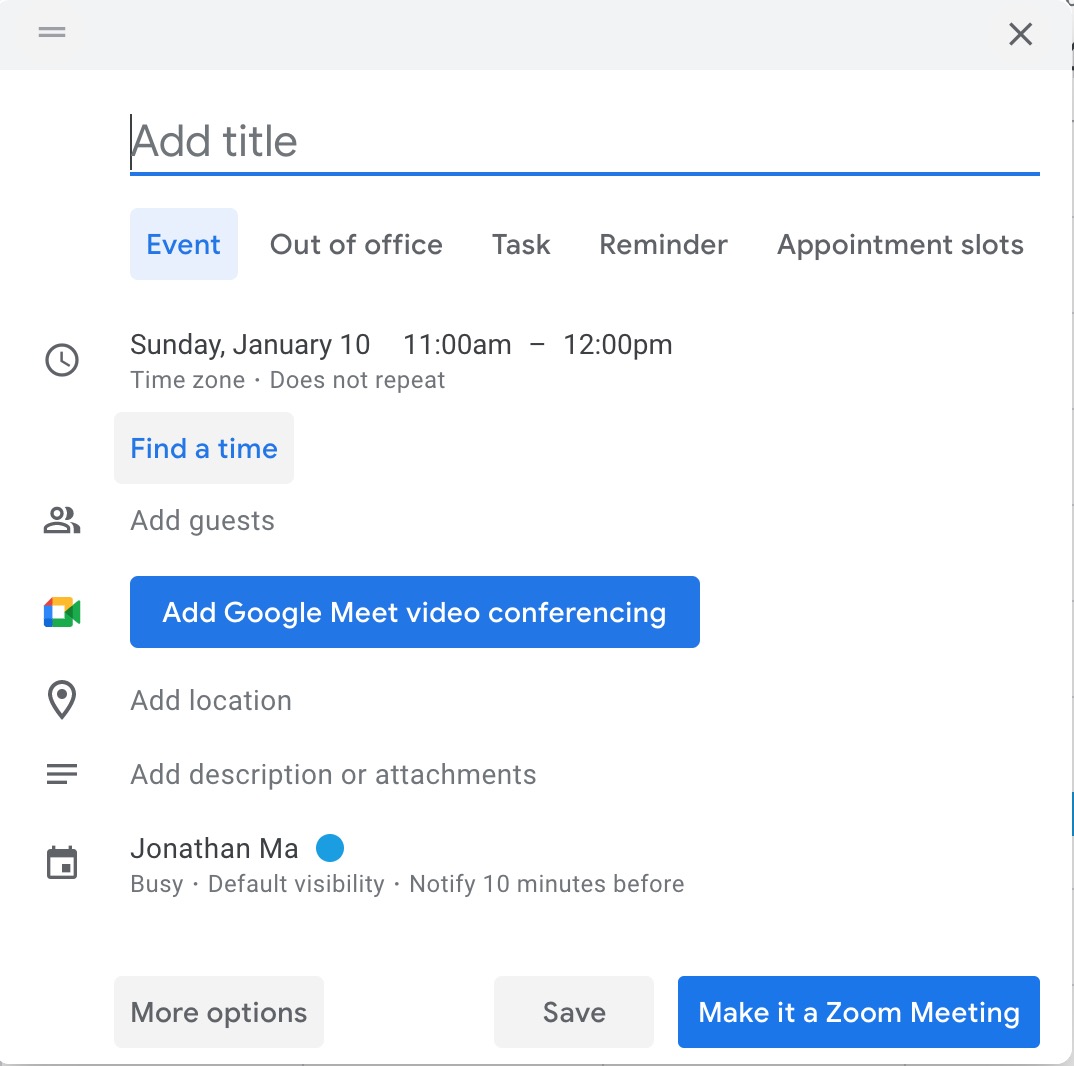

12/ Users schedule Zoom over email + calendar. Microsoft in Outlook making Teams/Skype default and harder to add Zoom. Same with Google Cal + Hangout.

Can Zoom really build an email and calendar client and get adoption? Or buy an upstart (despite how hot the VC market is)?

Can Zoom really build an email and calendar client and get adoption? Or buy an upstart (despite how hot the VC market is)?

Can Zoom really build an email and calendar client and get adoption? Or buy an upstart (despite how hot the VC market is)?

Can Zoom really build an email and calendar client and get adoption? Or buy an upstart (despite how hot the VC market is)?

13/ Encouraging sign that Zoom is able to launch new products and upsell successfully-- Zoom phones hit 1m paid seats and super seamless within Zoom desktop client and mobile app ( @publiccomps pays for it)

https://blog.zoom.us/the-year-in-review-zoom-feature-product-highlights/ https://blog.zoom.us/a-million-reasons-to-celebrate-zoom-phone/

https://blog.zoom.us/the-year-in-review-zoom-feature-product-highlights/ https://blog.zoom.us/a-million-reasons-to-celebrate-zoom-phone/

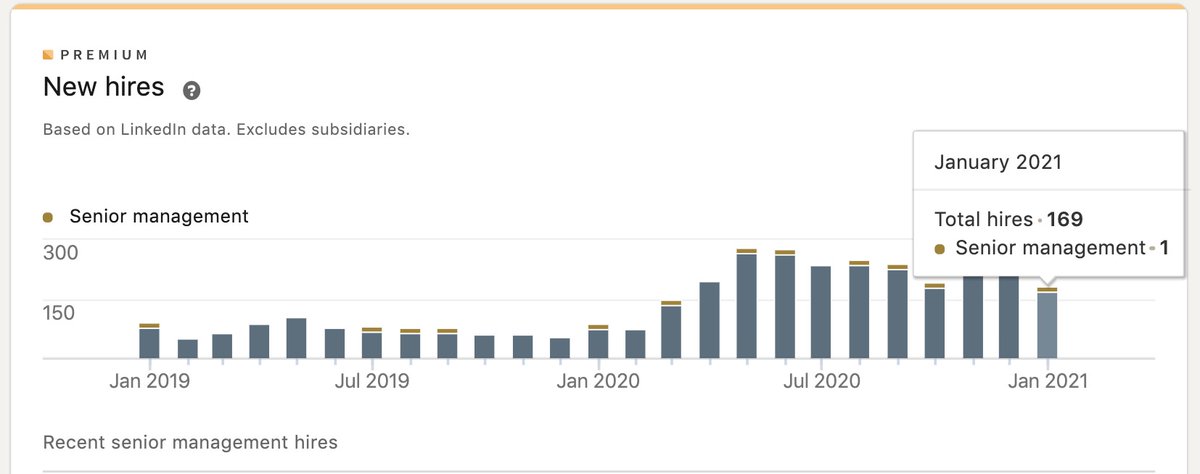

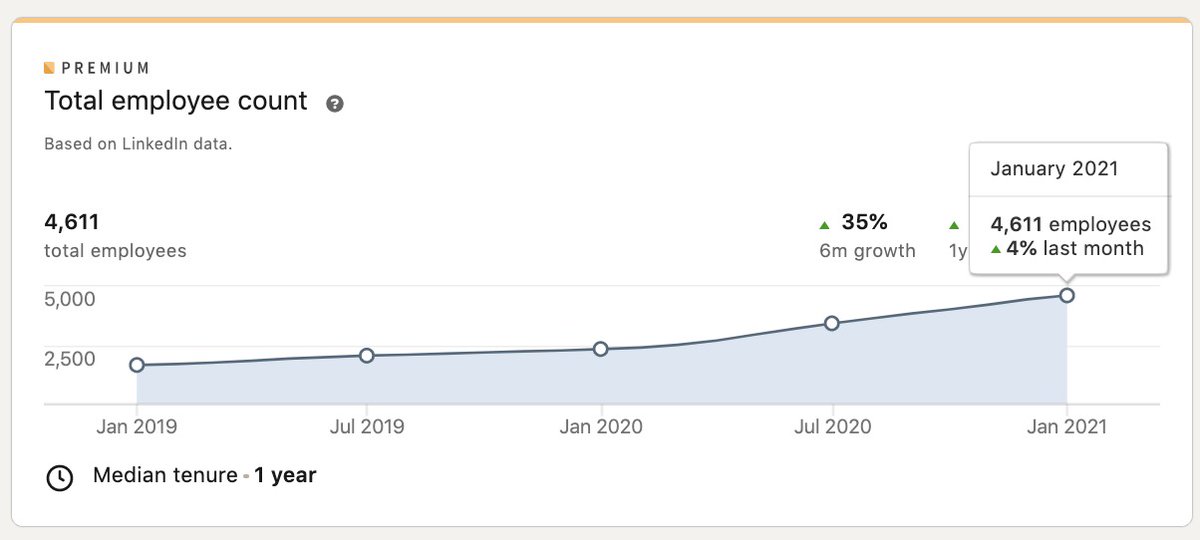

14/ Employees love Eric Yuan and Zoom keeps growing and adding headcount w/ new hires.

Wouldn't bet against the CEO who focuses on delivering happiness to customers, employees, investors

Wouldn't bet against the CEO who focuses on delivering happiness to customers, employees, investors

Read on Twitter

Read on Twitter