1. People are confused right now with what is going on with financial markets. The reason is they are thinking as if the markets are functioning in a traditional market & old economic indicators matter they don’t not in the World of #MMT which is now official. So enjoy the thread

2 #MMT is not modern and not a theory. It has been proven to be wrong time & time again in history. MMT proposes the US Govt which controls the worlds reserve currency can spend freely, as they can always create more money to pay off debts #brrr as Greenspan has said repeatedly

3. It was then tested with Bernanke by starting with $1 trillion being printed in 2009 and upto $4.5 trillion in 2018. He said” $1 trillion did not come from taxpayers. It was printed digitally: The banks have accounts with the Fed, much the same way that you have an account...

in a commercial bank. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It's much more akin to printing money than it is to borrowing.”

4. Since no MAJOR #INFLATION accrued but in financial assets b/c of the brr, the Fed/ #MMT people think we can continue to print any amount we want for the GOVT programs we vote on through our system. this brings up a BIG question, if we can print any amount why do we pay taxes?

5. Taxation in MMT is the new Fed tool of raising interest rates when inflation goes higher which reduces the money supply. We can do #UBI & if inflation goes up you just take it away to bring prices back down. MMT propose that tax policy should be used as an anti inflationary

6. If there is too much money in the economy the govt will tax some of it, thereby taking it out of circulation. (When you pay taxes, the money is literally destroyed,"

The idea of increasing taxes as a deflationary measure is probably one of the most controversial aspects of MMT

The idea of increasing taxes as a deflationary measure is probably one of the most controversial aspects of MMT

7. Critics are highly sceptical that govt would have the courage to increase taxes during a period of inflation. And tax policy is difficult to implement quickly, whereas inflation can move fast. The role of tax, however, goes to the conceptual core of MMT

8. How does it end? Well #Zimbabwe tried out #MMT and failed as soon as they stop producing food and started issuing out $100 trillion dollar bills!

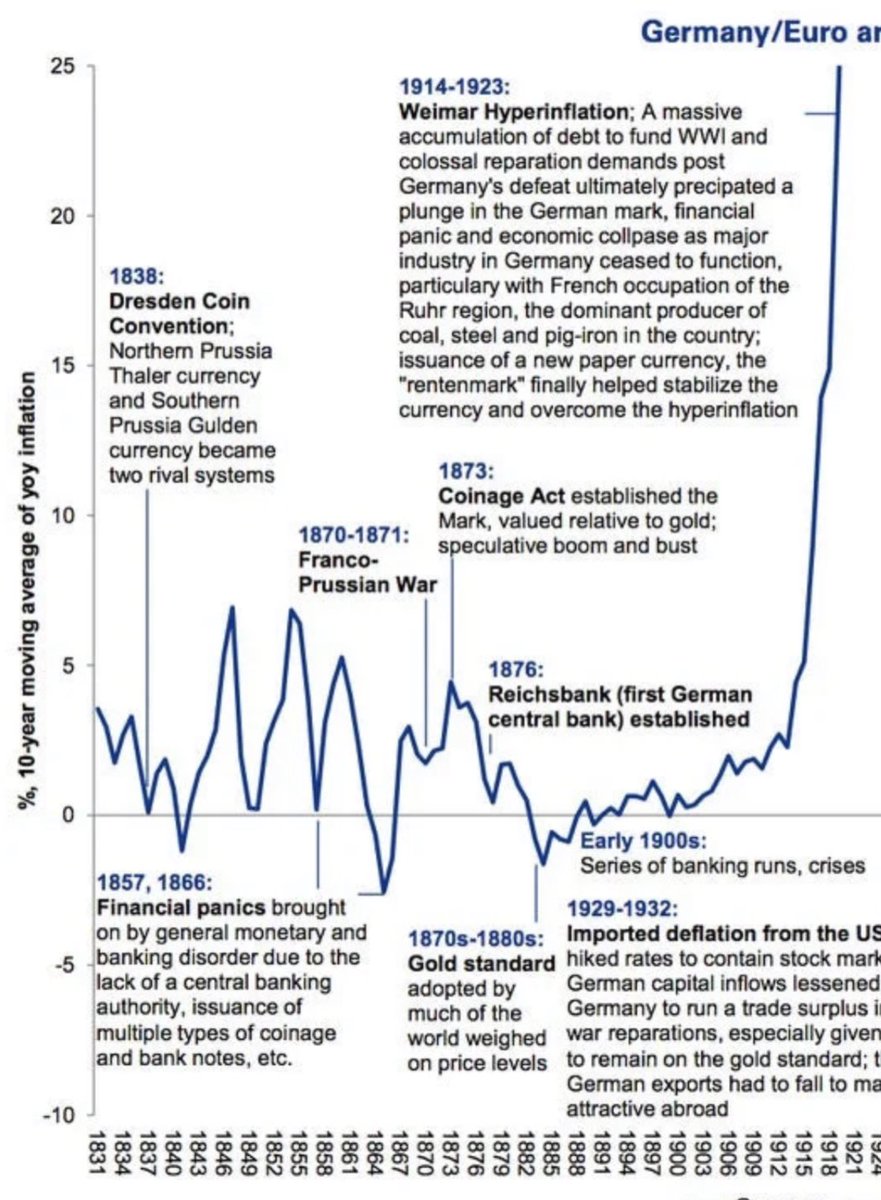

9. There are many more cases of #MMT failing but at first it always seems to work you can go as far back as Weimar Germany 1920s they printed money to pay its bills. Hyperinflation set in and people needed wheelbarrows full of cash just to buy loaves of bread.

The war had destroyed Germany's productive capacity. But the Allies were insisting it pay reparations far in excess of the ability of the shattered German economy to pay. So they printed money. When a lack of productive supply met demand from excess cash, hyperinflation kicked in

With this thread just know that this man @SenSanders who is a FIRM believer in #MMT is NOW in CHARGE OF THE US BUDGET!! Prepare accordingly! @fedupbizowner @sunny051488 @1MarkMoss @quayle_shaun @shaneincle @SahilBloom @tweettruth2me @Ben__Rickert @judyshel @JeromePowellet1

Read on Twitter

Read on Twitter