The most popular narrative surrounding the crypto rally for the past few months has been clear and consistent: U.S. institutional buying is fueling everything. And I agree that this narrative has basically been right!

But ... I also think there's nuance here which can be lost.

But ... I also think there's nuance here which can be lost.

It's easy to make the leap from "U.S. institutions fueling the rally" to "U.S. is buying crypto and fueling the rally." And THEN it's easy to make the leap to "when crypto sells off, Asia is selling." I see people make these leaps all the time!

And sometimes I think claims like this are at least defensible. Like, sure, part of the narrative is that Grayscale has a lot of creations, probably that means U.S. "is buying" to some extent. And when BTC does (sometimes) go up during U.S. hours and down later, sure.

But BTC does *not* have a super consistent time-of-day effect right now. In fact, even if we KNEW someone was gonna buy a ton every U.S. day, this time of day effect would not exist. How come?

Well, let's say that Alameda does a study and determines a time of day effect exists where BTC goes up at 9am Eastern and down at 9pm. Would we just sort of let that exist and gawk at it?

Nope! We'd buy every day ay 8am and sell every day at 8pm. And then the effect would shift earlier and earlier until it's kinda unrecognizably a time-of-day effect anymore! The thing with predictable price effects: they can't exist forever.

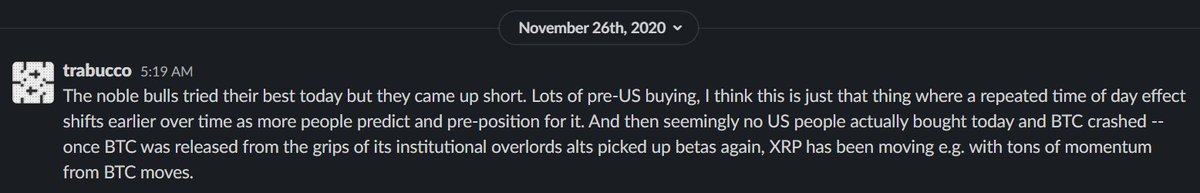

FWIW, crypto *did* have a time-of-day effect for a bit toward the beginning, especially during the $20k dance -- this was before enough of the market by volume was predicting a U.S. narrative, and so there wasn't enough pre-positioning to erode it away. https://twitter.com/AlamedaTrabucco/status/1329154541858656256?s=20

And Alameda *did* trade those, and we *did* notice that the effects were shifting earlier and earlier because of that + others doing the same thing. Also LOL, I found this (facetious :P) post I made from ca. Thanksgiving., enjoy.

So, I'd frame the effect from the narrative here a *little* differently -- it's DRIVEN by U.S. institutions, but the buying is NOT all U.S., and the selling is CERTAINLY not all Asia. And, IDK, this has to be the case anyway because of how leverage works.

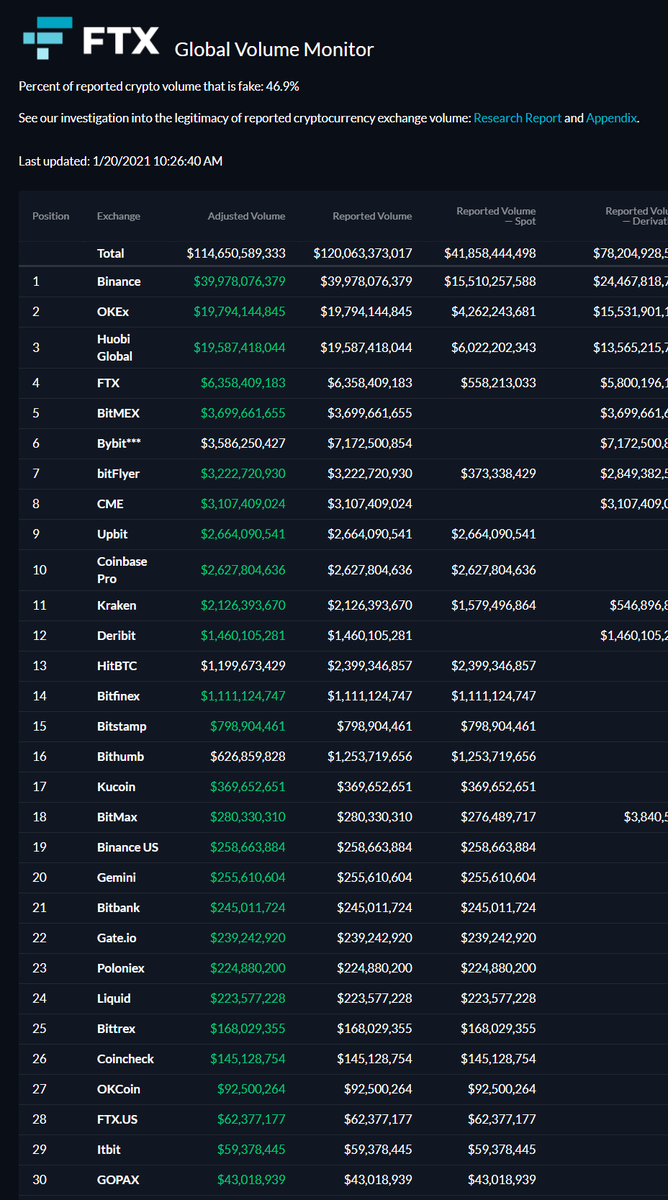

Most U.S. exchanges, due to their regulatory obligations, don't offer anywhere near as high leverage as Asian ones. This is THE reason Asian exchange volumes are so much higher -- just look at volumes from the past day.

https://ftx.com/volume-monitor

https://ftx.com/volume-monitor

How could U.S. exchange flow be having even a *moderate* impact on the net crypto market's moves when the Asian exchanges dwarf their volume with their 100x-levered futures? The answer is: they can't :P

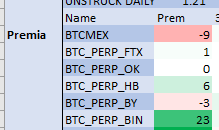

The WAY bigger effects tend to be, like: Binance perps trade at a LARGE premium for a few hours, they're super liquid, BTC goes up as a result and some buying liquidations trigger causing it to go up more. As I type BTC perps there are 23bp rich to spot!

This *doesn't* mean the buying IS from Asia, BTW -- like, OTC exists, maybe all the Binance buying is from OTC desks hedging their trades from U.S. companies, maybe U.S. companies have other entities, etc. But it DOES mean the story is WAY more complex than the one I often hear.

It's dangerous to make simple assumptions about the market -- a large deposit to Coinbase just cannot be a bigger signal than someone buying Coinbase's entire ADV in derivatives in an hour. Always use all the data you've got at your disposal!

Read on Twitter

Read on Twitter