1/n This thread will argue that the unique “triple-dip” nature of the 2014-2020 #Oil Bust has given #energy markets a false sense of security about the ability of #shale to meet any material Supply shortfall. It will also assess what this means for 2022-24. #OOTT #OPEC #Saudi

/2 The explosive growth in US tight oil & gas production from ~2011-14 is not w/out historical precedent: the best analogue is perhaps the famous East TX field coming online circa 1930 & causing a (positive) supply shock just as the country entered the Depression. The comp is

/3 imperfect yet instructive. That is, suddenly there was a “gap up” in US supply. While the latter 2011-14 #shale 1.0 period did not *immediately* crater prices, it did prompt #OPEC in Nov. ‘14 to adopt the ‘pump-at-will’ policy that tanked prices from a high of $115+ WTI to a

/4 low ~$26 in Feb. ‘16.

BUST #1 2014: The 2014-16 Bust was not ‘organic,’ in that specific supply actions exacerbated softness that was emerging in the mkt. Of course, #OPEC would reverse this strategy 2 yrs later w/ the surprise cut of Nov. ‘16. The key difference between 2016

BUST #1 2014: The 2014-16 Bust was not ‘organic,’ in that specific supply actions exacerbated softness that was emerging in the mkt. Of course, #OPEC would reverse this strategy 2 yrs later w/ the surprise cut of Nov. ‘16. The key difference between 2016

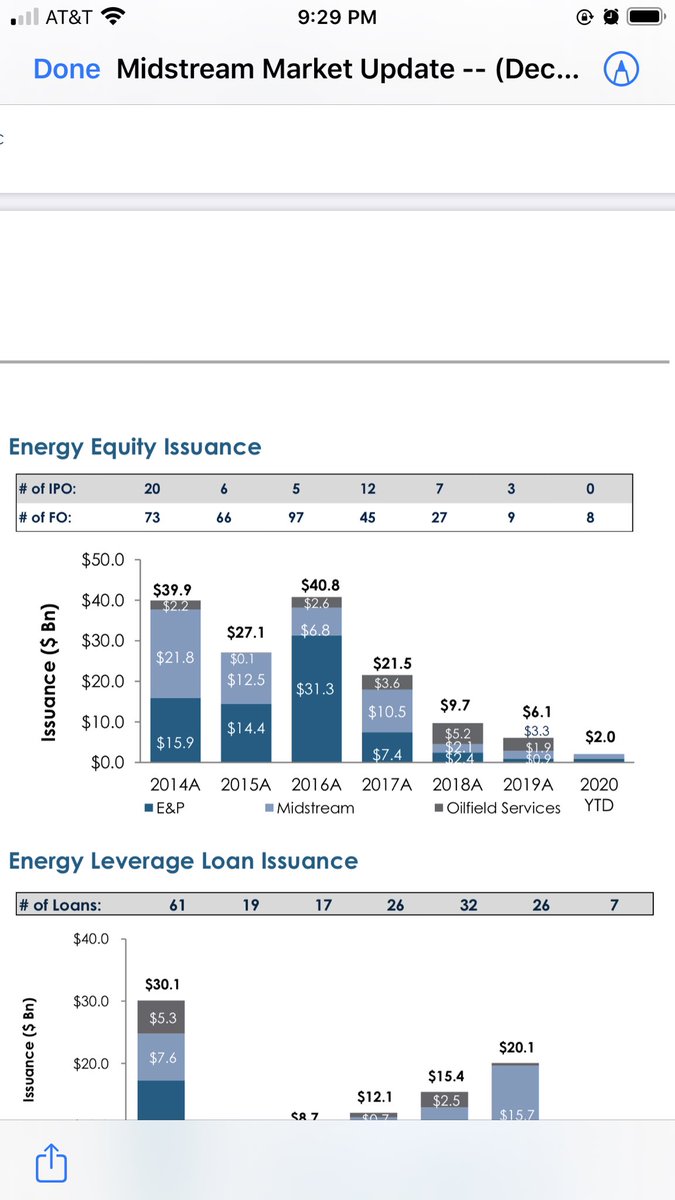

/5 & today, among others, was the ability of E&Ps to tap equity markets. Indeed, 2016 saw nearly $40B of equity issuance, roughly on par w/ 2014. Capital mkts were very much accessible. But look at the figure for 2020, which we’ll come back to.

/6 BUST #2: Oct-Dec. 2018

In the two years between the #OPEC cut in Nov. ‘16 & the price blowout of late 2018, oil prices enjoyed relative stability, w/ TI rising from its 2016 low $26 all the way to $76 in Oct. ‘18. Energy equities, believe it or not, largely fared well during

In the two years between the #OPEC cut in Nov. ‘16 & the price blowout of late 2018, oil prices enjoyed relative stability, w/ TI rising from its 2016 low $26 all the way to $76 in Oct. ‘18. Energy equities, believe it or not, largely fared well during

/7 This interval. Talk even began to percolate of $100 oil. Then, suddenly, the bottom fell out, w/ prices dropping from $76 to ~$42 in a matter of weeks. Energy equities got slaughtered; energy hedge funds blew up & shuttered. Dec. ‘18 was one of the worst months *ever* for

/8 energy equities. What had happened? The combo of nascent Trade War fears (& an attendant Demand hit), coupled w/ Trump’s erratic tweeting & broader equity mkt weakness, obliterated #oil & energy stocks. For the next ~15 months, in fact, energy equities would be weighed on by

/9 Trade War fears & struggle to rise above a narrow band. Eventually, as the Trade War fears abated & a deal was signed last Jan., oil & related equities began to get traction. Then, of course, the Pandemic hit.

BUST #3: 2020: last year’s Bust was sui generis: that is, it

BUST #3: 2020: last year’s Bust was sui generis: that is, it

/10 combined *both* a massive unforeseen Demand hit (Covid) w/ also a sudden burst of Supply when OPEC+ splintered (temporarily). The result, as we know, was cataclysmic for the industry w/ prices even briefly trading negative. Tanks brimmed, bankruptcies mounted. Investors,

/11 predictably, fled. Capital mkt lifelines were unavailable, debt exchanges floundered. But in the wreckage, a silver lining: a much-needed push for consolidation & culling of weak players. More important, a death knell for the ShaleCo ‘growth for growth’s sake’ mantra, & a

/12 renewed emphasis on shareholder returns.

POST-2020

The question now, naturally, is what next? Looking to the past six years for clues is necessary, but I would argue misleading. Specifically, we still don’t know what US tight oil production will look like coming out of a

POST-2020

The question now, naturally, is what next? Looking to the past six years for clues is necessary, but I would argue misleading. Specifically, we still don’t know what US tight oil production will look like coming out of a

/13 bust of this severity. Year-end 2021 production models, e.g., vary widely. Chief among the wildcards is the question of Capex versus FCF. Will investors reward “capital discipline” at the expense of growth? Will equity issuance rebound? How dramatic will base declines get in

/14 the new, ‘lower spend’ world? I would argue that until we see evidence that US #shale production can hold flat—let alone grow—under the new shareholder-friendly paradigm, the broader mkt is too sanguine vis-a-vis the ability of short-cycle bbls to plug any looming

/15 Supply shortfall. That is, in the face of massive stimulus spending & reflation, a weak US $ & structural underinvestment in longer-cycle conventional O&G projects, the mkt is assuming tremendous flexibility in the capacity of shale to ramp, & ramp *quickly*. And while that

/16 trust might end up being justified, if the vagaries of the #oil market the past 6 yrs have taught us anything, it should be the constant necessity of questioning one’s assumptions. To wit: until we see proof that Shale is willing/able to revert to its high-growth past, don’t

/17 assume that such a resumption is automatic or even possible. And if it ends up *not* being possible, the world is going to require significantly higher #Oil prices in 2022-24 to incentivize exploration. Hello, Super Cycle.

Thanks for reading. /end

#OOTT #Oil #EFT #shale

Thanks for reading. /end

#OOTT #Oil #EFT #shale

Read on Twitter

Read on Twitter