$SKLZ Developer adoption of Skillz platform to accelerate, supporting network effects & substantial LT growth

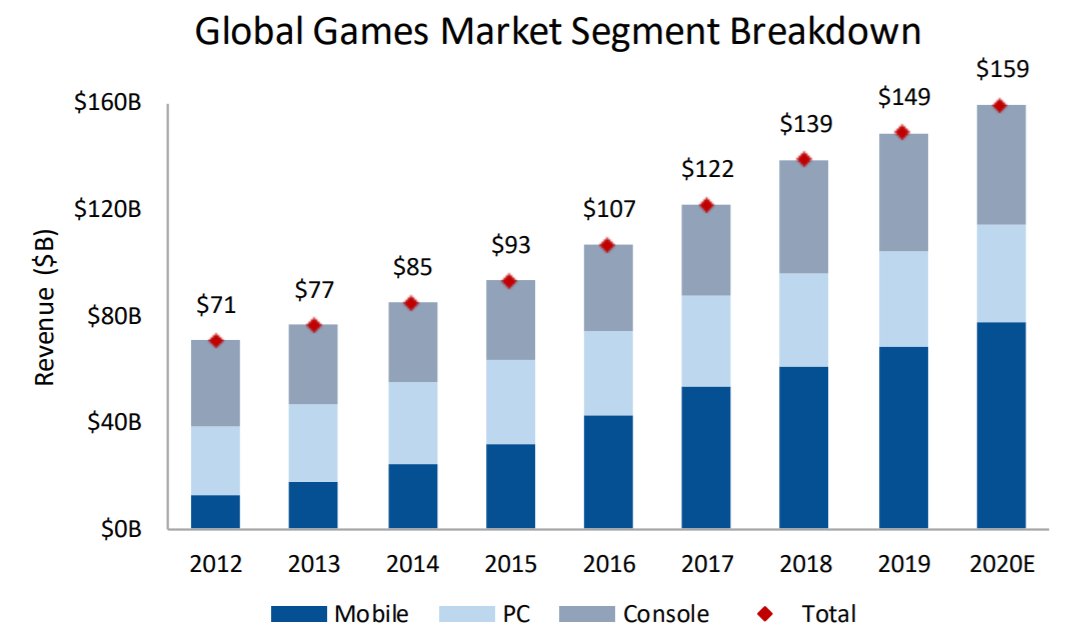

Mobile games revenue has grown at a ~25% CAGR since 2012, compared to just ~4% for both PC and console games during the same period, and mobile now comprises nearly half of the global games market

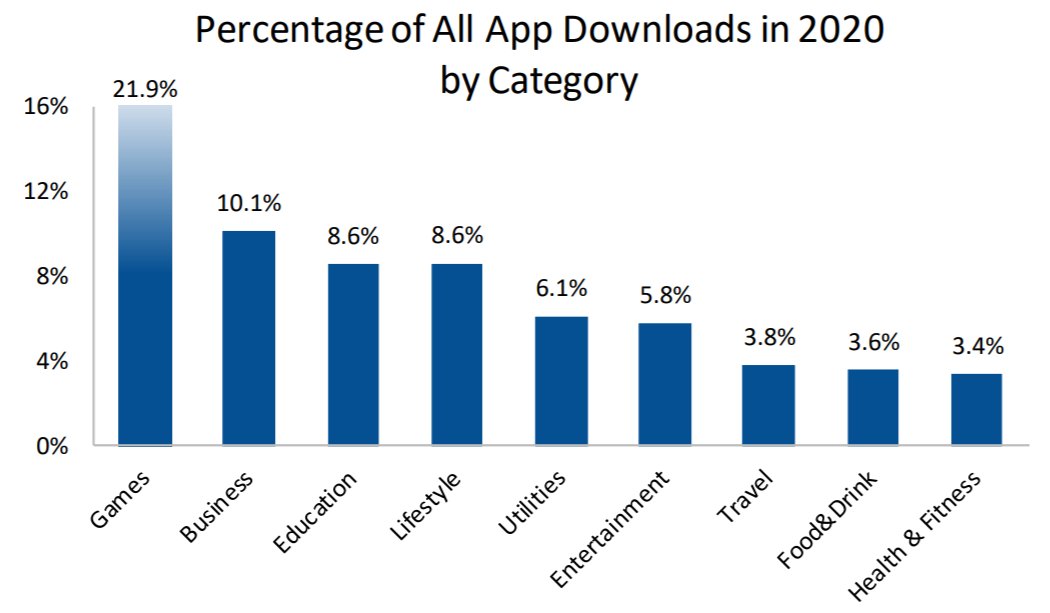

Games were substantially more popular than any other app category in 2020 based on % of downloads, accounting for 21.9% of apps downloaded in the iOS Store, 10% more than the next leading category

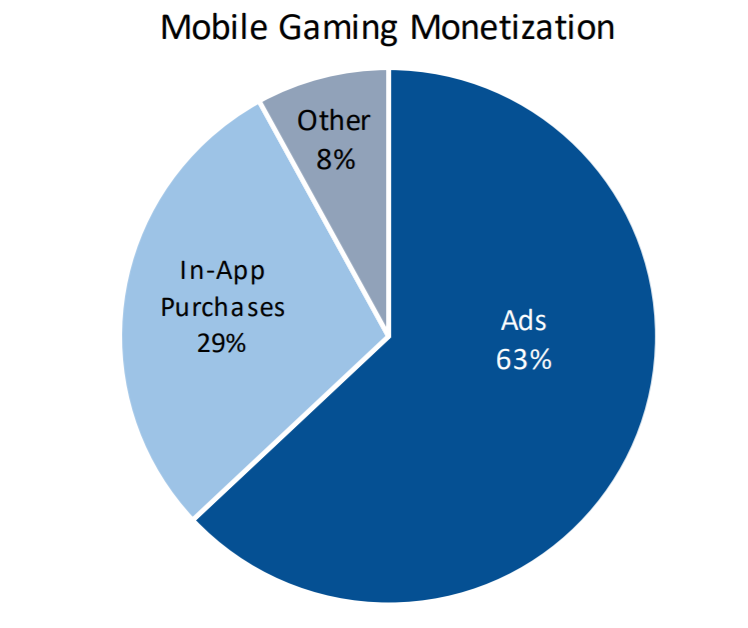

Mobile game monetization has largely been achieved through advertisements, but nearly one-third of mobile gaming revenue is also generated through in-app purchases by users

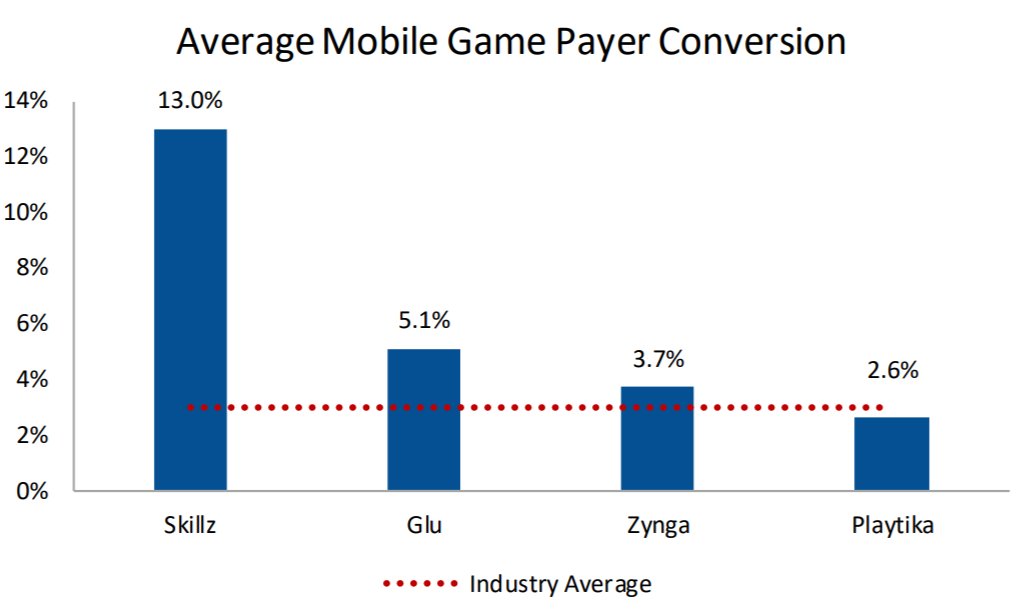

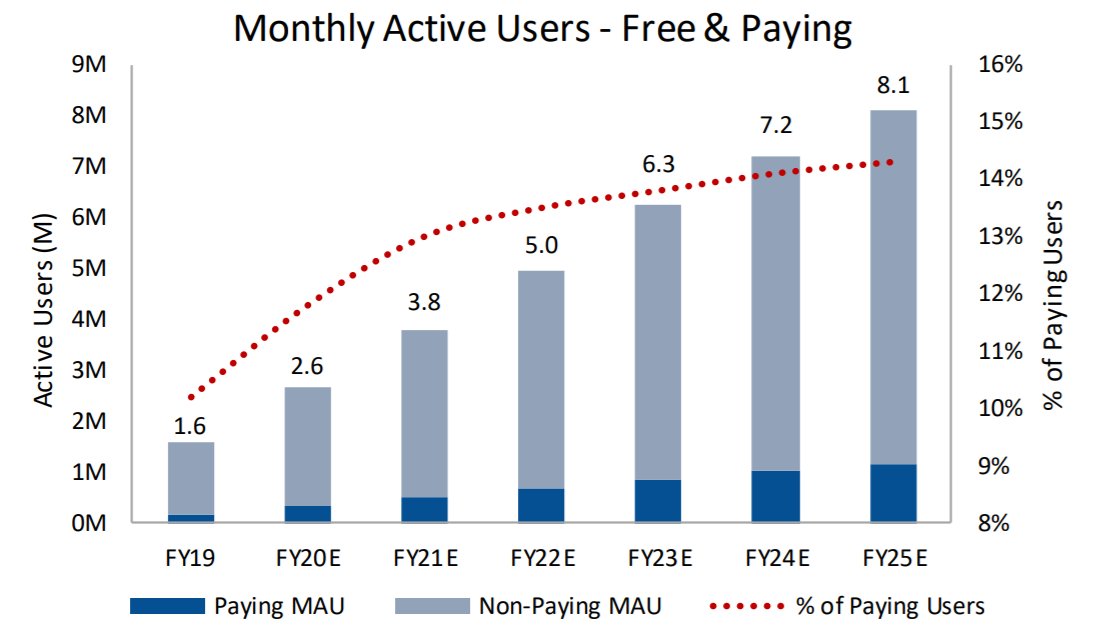

The percentage of users who convert into payers (i.e. make an in-app purchase), is ~3% across legacy mobile gaming; Skillz compares favorably at ~11.5%, although the form of payment is entry fees

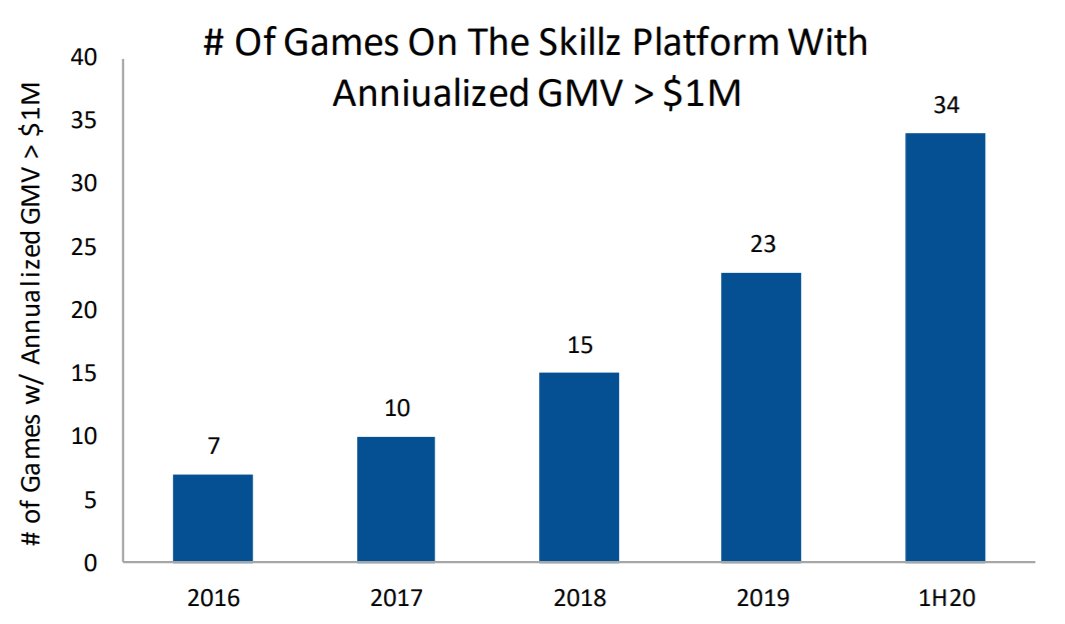

The number of games on the Skillz platform with annualized GMV greater than $1M has increased by ~5x over the past five years

As the number of paying users increases Skillz is better able to match players, improving the user experience; we project paying MAU to grow to ~1.2M, or 14% of total MAU, by 2025

Skillz’s competition-based model drives higher engagement and monetization as compared to more traditional mobile games; we project ARPU will grow ~10% annually through 2025

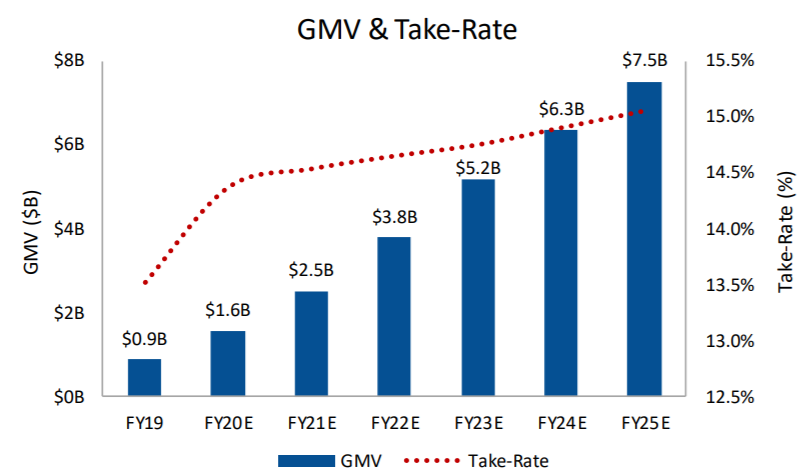

GMV growing at a ~37% CAGR over the next five

years to $7.5B, as increasing conversion to paying users and improved engagement drives total entry fees higher, while take-rate expands through better monetization of non-paying users, such as ads

years to $7.5B, as increasing conversion to paying users and improved engagement drives total entry fees higher, while take-rate expands through better monetization of non-paying users, such as ads

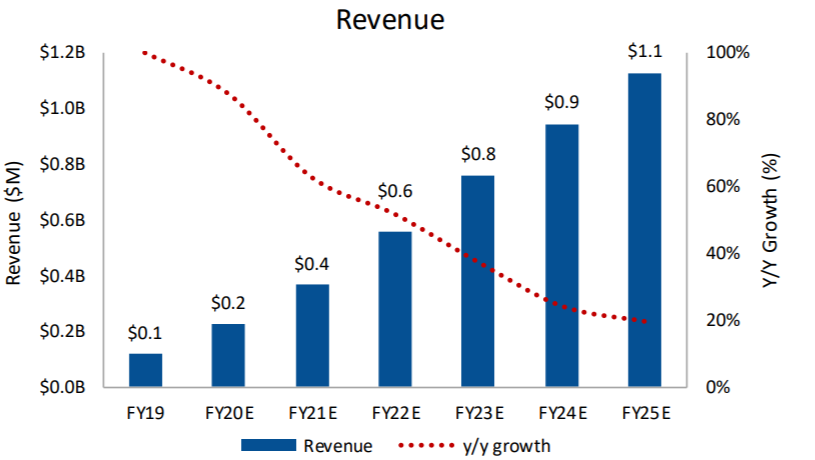

Revenue to grow at a similar pace to GMV and

project a ~38% CAGR over the next five years as Skillz improves monetization through better engagement, bigger contests, and the addition of low-friction advertisements

project a ~38% CAGR over the next five years as Skillz improves monetization through better engagement, bigger contests, and the addition of low-friction advertisements

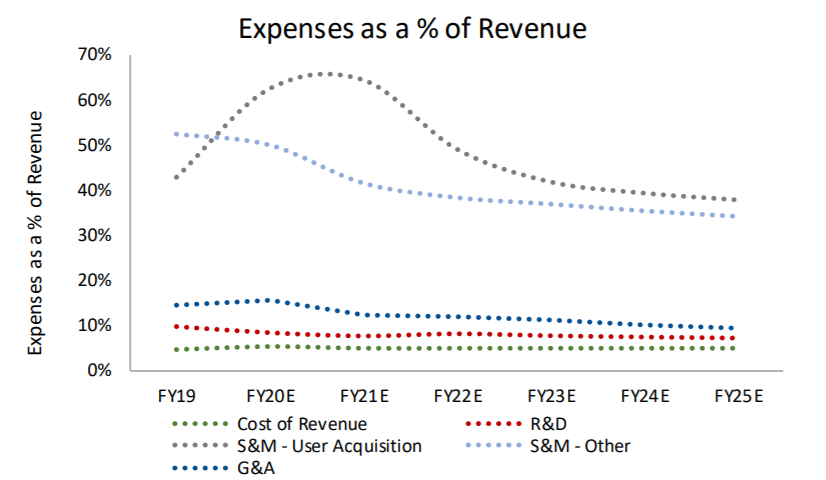

Expect Skillz will continue to invest in its marketing

efforts as it looks to improve player liquidity, and forecast user acquisition expense as a % of revenue to peak at ~65% in 2021, before normalizing at ~40% in 2023-2025

efforts as it looks to improve player liquidity, and forecast user acquisition expense as a % of revenue to peak at ~65% in 2021, before normalizing at ~40% in 2023-2025

Read on Twitter

Read on Twitter