New paper out in @RegGov_journal! With @petr_jansky and @markusmeinzer we develop the Bilateral Financial Secrecy Index and show how secrecy jurisdictions selectively resist automatic information exchange. Thread below

New paper out in @RegGov_journal! With @petr_jansky and @markusmeinzer we develop the Bilateral Financial Secrecy Index and show how secrecy jurisdictions selectively resist automatic information exchange. Thread below  , full paper here: https://onlinelibrary.wiley.com/doi/full/10.1111/rego.12380 1/14

, full paper here: https://onlinelibrary.wiley.com/doi/full/10.1111/rego.12380 1/14

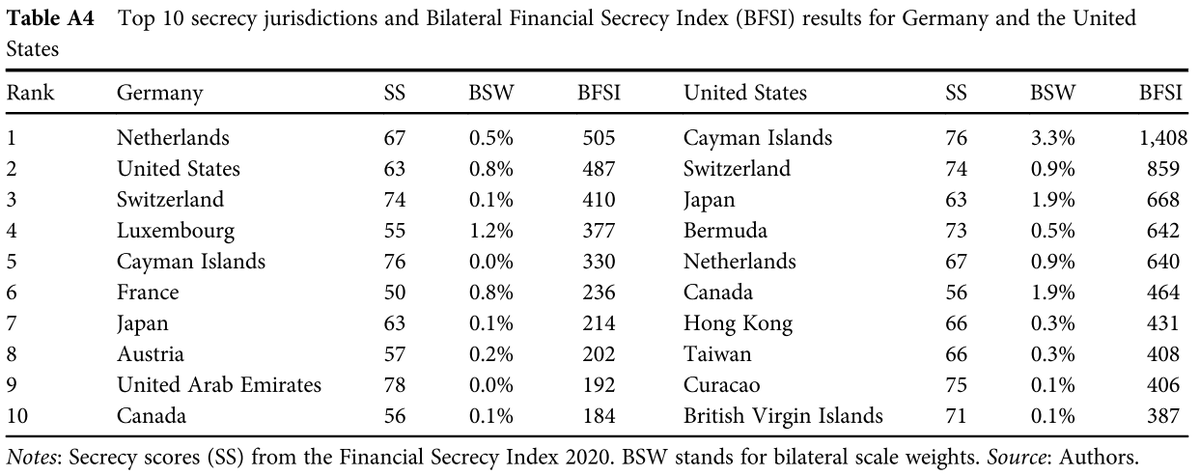

We build on the @FinclSecrecyInd by @TaxJusticeNet and extend it to the bilateral level, allowing for a more nuanced analysis of the world of financial secrecy. Different secrecy jurisdictions service different countries with different intensities. 2/14

For example, Cyprus is important for Russia and some European countries, but not for the US; Mauritius is important for India and South Africa, but not so much for Europe. Caymans, Switzerland and the Netherlands are important for most countries around the world. 3/14

Panama, despite being so prominent in offshore leaks, is actually not as important for most countries as other secrecy jurisdictions. Check out the full results for 86 countries here (incl. data and code)  https://osf.io/kmcyv/ 4/14

https://osf.io/kmcyv/ 4/14

https://osf.io/kmcyv/ 4/14

https://osf.io/kmcyv/ 4/14

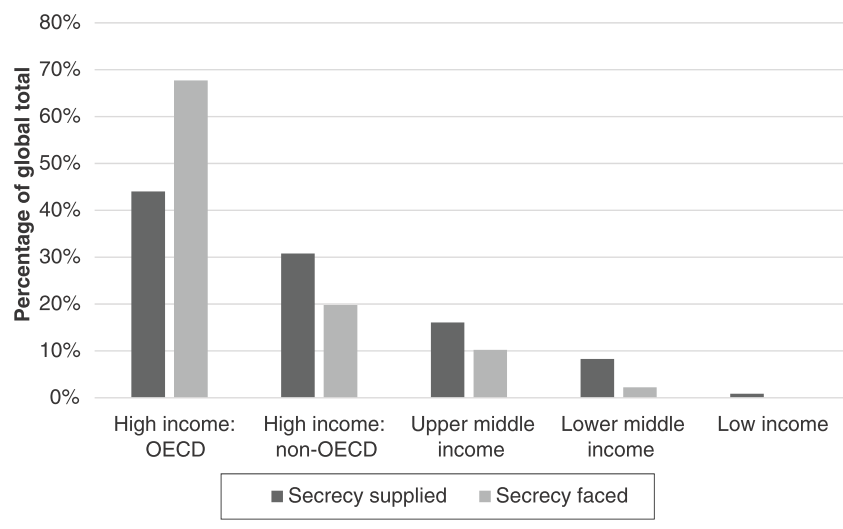

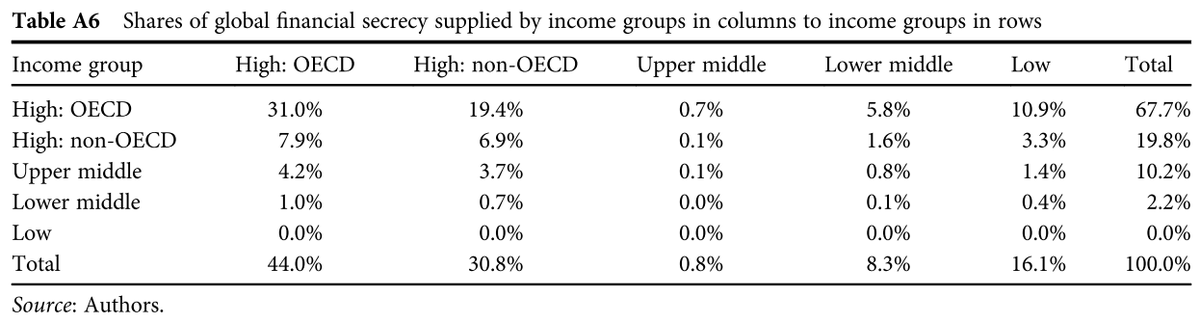

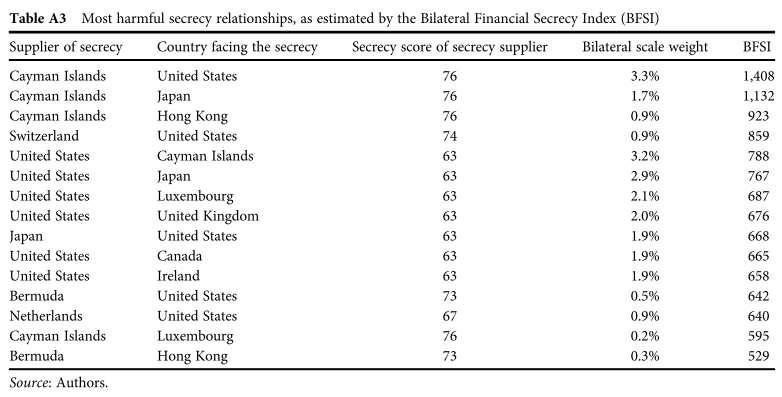

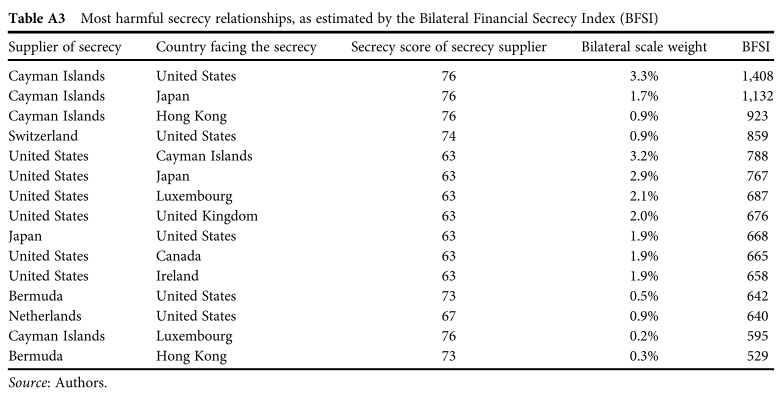

Aggregating the results by income groups, we find that most secrecy is faced by OECD countries, and this secrecy is most disproportionately supplied by non-OECD, high-income countries, including the likes of Caymans, Singapore, or Hong Kong. 5/14

The BFSI results are comparable across relationships. These are the most harmful relationships globally. 6/14

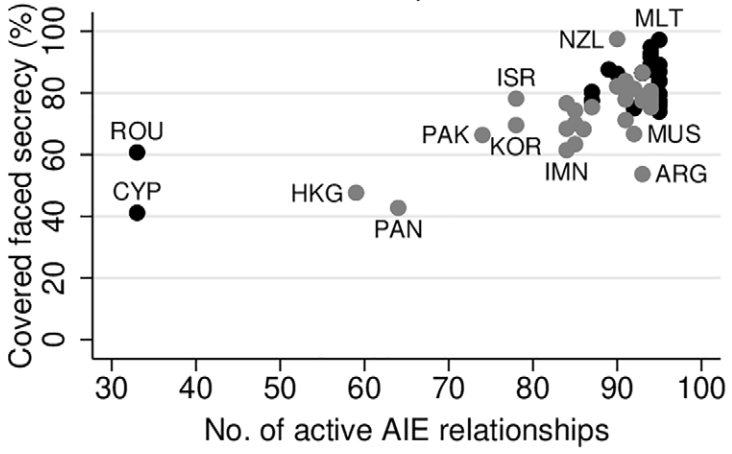

We compare these results to the progress of two recent policies aimed at fighting financial secrecy: OECD's automatic information exchange (AIE) and EU's blacklists of non-cooperative jurisdictions. How much financial secrecy have these policies covered? 7/14

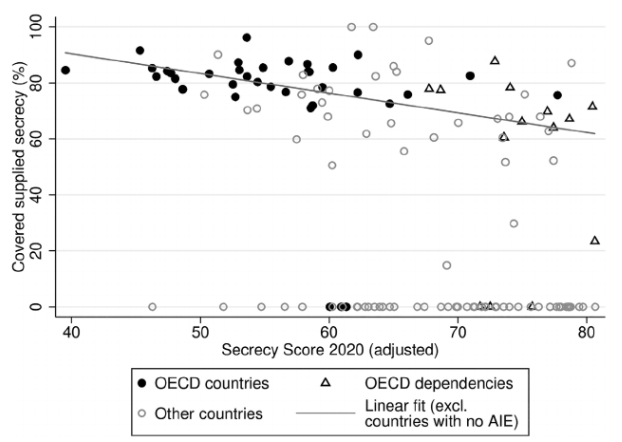

First, we find that secrecy jurisdictions successfully and selectively resist AIE with countries to which they supply most secrecy. 8/14

This is driven mainly by OECD's dependencies, highlighting the hypocrisy of OECD countries in outsourcing secrecy business to their dependencies. 9/14

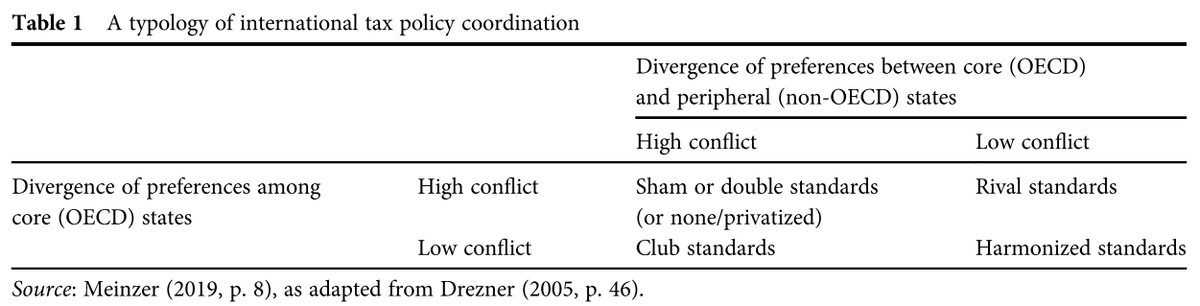

This is consistent with a typology of international tax policy coordination in which the OECD's AIE framework represents a sham standard. 10/14

Second, countries vary in how they target relevant secrecy jurisdictions with AIE, despite signing similar numbers of treaties. We argue that countries should use the BFSI to identify the secrecy jurisdictions to focus on next. 11/14

Third, we find that the @EU_Commission's black and grey lists do not currently cover the most important secrecy jurisdictions for EU countries. They are toothless without stricter criteria, as recently confirmed by the FISC committee. https://www.europarl.europa.eu/news/en/press-room/20201208IPR93318/eu-tax-haven-blacklist-not-catching-worst-offenders 12/14

This paper is part of the @COFFERSEU project. Read it in open access here  https://onlinelibrary.wiley.com/doi/full/10.1111/rego.12380 13/14

https://onlinelibrary.wiley.com/doi/full/10.1111/rego.12380 13/14

https://onlinelibrary.wiley.com/doi/full/10.1111/rego.12380 13/14

https://onlinelibrary.wiley.com/doi/full/10.1111/rego.12380 13/14

Read on Twitter

Read on Twitter