$CDON is the most asymmetric investment I’ve seen in many years

Any student of e-com marketplaces $AMZN, $MELI, $SE, $ALE.WSE, $OZON knows - these are incredible businesses w/ deep moats, no capital required to grow.

7.5 to 15x upside by 2026

I #spinoffs!!!

#spinoffs!!!

Any student of e-com marketplaces $AMZN, $MELI, $SE, $ALE.WSE, $OZON knows - these are incredible businesses w/ deep moats, no capital required to grow.

7.5 to 15x upside by 2026

I

#spinoffs!!!

#spinoffs!!!

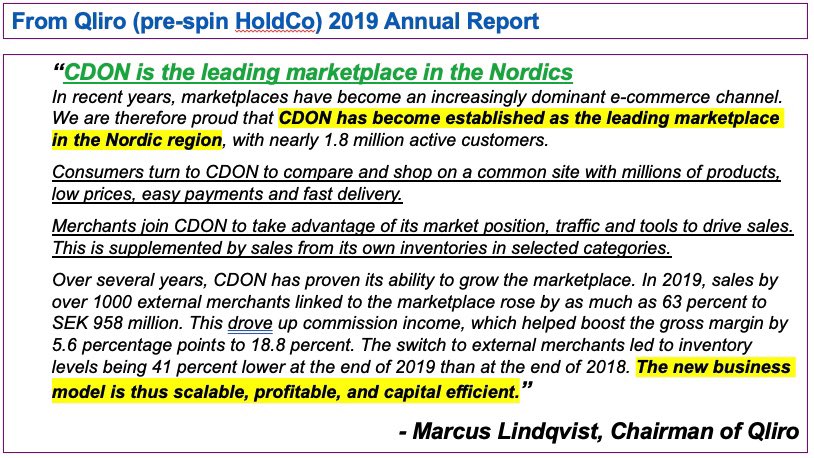

$CDON is the leading Nordic e-com 3P marketplace

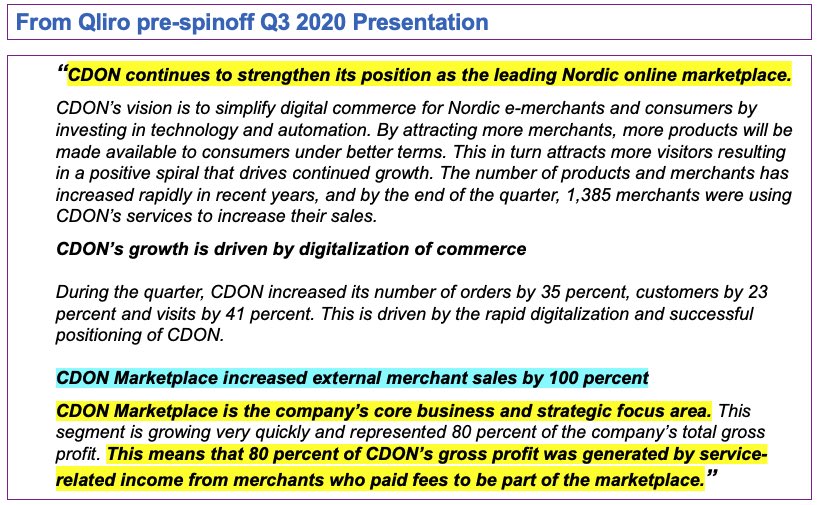

- 80% of $CDON biz is from its 3rd party marketplace ==> going to 100%

- pure play on a hyper growth marketplace with powerful network effects + flywheel

- VERY EARLY stages of a secular shift to marketplaces in the Nordics

- 80% of $CDON biz is from its 3rd party marketplace ==> going to 100%

- pure play on a hyper growth marketplace with powerful network effects + flywheel

- VERY EARLY stages of a secular shift to marketplaces in the Nordics

- GMV for $CDON was ~2bn SEK for 2020, growing 100% YoY (vs. market cap today of 2.4bn SEK, net cash, so EV/GMV ~1.2x)

- Nordic e-commerce is ~250bn SEK (and growing > 10% / yr)

$CDON GMV is ~1% of Nordic e-com (!)

$CDON GMV is ~1% of Nordic e-com (!)

- By 2026, Nordic e-commerce should be over 400bn SEK

- Nordic e-commerce is ~250bn SEK (and growing > 10% / yr)

$CDON GMV is ~1% of Nordic e-com (!)

$CDON GMV is ~1% of Nordic e-com (!)- By 2026, Nordic e-commerce should be over 400bn SEK

- As the leading, largest Nordic marketplace, I think 20bn to 40bn SEK GMV is very realistic by ‘26 for $CDON, this is 5-10% of total e-com

GMV sanity check:

- only 1,385 merchants today vs 100k+ e-com sellers just in Nordics

- Swedish merchants say shift just beginning now

GMV sanity check:

- only 1,385 merchants today vs 100k+ e-com sellers just in Nordics

- Swedish merchants say shift just beginning now

- $MELI has >30% of ecom GMV in mature markets, ~8% in newer ones

- $ALE.WSE is 15%

Q: what does this mean for $CDON earnings power and stock price?

2016 fee revenue of 2.4bn to 4.8bn SEK (take rate of ~12% of GMV, with ads, loyalty, payments)

2016 fee revenue of 2.4bn to 4.8bn SEK (take rate of ~12% of GMV, with ads, loyalty, payments)

- $ALE.WSE is 15%

Q: what does this mean for $CDON earnings power and stock price?

2016 fee revenue of 2.4bn to 4.8bn SEK (take rate of ~12% of GMV, with ads, loyalty, payments)

2016 fee revenue of 2.4bn to 4.8bn SEK (take rate of ~12% of GMV, with ads, loyalty, payments)

EBIT of 1.2bn to 2.4bn SEK (mature marketplaces run @ >50% EBIT margins AFTER marketing spend)

EBIT of 1.2bn to 2.4bn SEK (mature marketplaces run @ >50% EBIT margins AFTER marketing spend)==> at 15x EBIT (eBay at 13x today, only grows revs 10%)

...

... $CDON shares

$CDON shares  to 3,000 SEK to 6,000 SEK vs. 402 SEK today

to 3,000 SEK to 6,000 SEK vs. 402 SEK today 7.5x to 15x today’s stock price by 2026

7.5x to 15x today’s stock price by 2026

Sanity check vs. comps:

- $MELI grew 62% YoY and trades 5x EV/GMV

- $ALE.WSE grew 51% YoY and trades 2.7x EV/GMV

- $OZON grew 61% YoY and trades 4.9x GMV

At 3x EV/’21 GMV, $CDON would be ~1,500 SEK / share

At 3x EV/’21 GMV, $CDON would be ~1,500 SEK / share

At 4x EV/’21 GMV, $CDON = ~2,000 SEK / share ...

At 4x EV/’21 GMV, $CDON = ~2,000 SEK / share ...

... TODAY!

- $MELI grew 62% YoY and trades 5x EV/GMV

- $ALE.WSE grew 51% YoY and trades 2.7x EV/GMV

- $OZON grew 61% YoY and trades 4.9x GMV

At 3x EV/’21 GMV, $CDON would be ~1,500 SEK / share

At 3x EV/’21 GMV, $CDON would be ~1,500 SEK / share At 4x EV/’21 GMV, $CDON = ~2,000 SEK / share ...

At 4x EV/’21 GMV, $CDON = ~2,000 SEK / share ...... TODAY!

Catalysts:

- February 4th is first earnings release as a public company

- Sell-side coverage ($CDON is a prominent Swedish internet company, will be covered)

- IR in English

- Q4 growth should be huge YoY

- Merchant growth accelerating (still relatively few vs. total)

- February 4th is first earnings release as a public company

- Sell-side coverage ($CDON is a prominent Swedish internet company, will be covered)

- IR in English

- Q4 growth should be huge YoY

- Merchant growth accelerating (still relatively few vs. total)

- Spinoff dynamics abate —> no longer an orphaned special sit

- Earlier in its S-curve ==> more upside

- Profitable and generates cash as operating leverage kicks in

- Easy to pencil out multi-year scenario of stock being up 10-20x

- Advertising and subscription fees

- Earlier in its S-curve ==> more upside

- Profitable and generates cash as operating leverage kicks in

- Easy to pencil out multi-year scenario of stock being up 10-20x

- Advertising and subscription fees

Why Does Opportunity Exist?

- Spinoff with no analyst coverage, no roadshow

- Consolidated financials mask the fact that marketplace is 80% of business and will go to ~100% (3P is core focus)

- Spinoff docs in Swedish (will be English going forward)

- Quiet period til Feb 4

- Spinoff with no analyst coverage, no roadshow

- Consolidated financials mask the fact that marketplace is 80% of business and will go to ~100% (3P is core focus)

- Spinoff docs in Swedish (will be English going forward)

- Quiet period til Feb 4

- IR deck: https://www.bequoted.com/bolag/cdon/download/?file=presentation-80841/Presentation-CDON-2020.pdf

Disclosure: I own $CDON

Disclosure: I own $CDON

Do your own work

Do your own work

The above is my analysis

The above is my analysis

Prove me wrong!

Disclosure: I own $CDON

Disclosure: I own $CDON Do your own work

Do your own work The above is my analysis

The above is my analysis Prove me wrong!

Read on Twitter

Read on Twitter